A Scholarly Examination of Navigating Market Volatility with Volatility Trading Strategies

Mar 30, 2023

Introduction: Embracing Volatility Trading Strategies

The aptitude for identifying opportunity within disorder presents a precious skill that can empower individuals to prosper in tumultuous times, particularly in the mercurial stock market. Although seemingly paradoxical, historical evidence suggests that periods of turbulence often beget monumental advancements. Volatility Trading Strategies can help investors navigate these challenges. Indeed, some of the most distinguished individuals in history have been those who perceived opportunities, whereas others solely observed chaos and desolation.

Exhibiting Equanimity and Adaptability in the Stock Market

Maintaining composure and adaptability in the stock market can be challenging, particularly during market turbulence. However, it is crucial in discovering opportunities and making well-informed decisions that can lead to positive advancement.

Another way to exhibit stability and adaptability is to embrace calculated risks and venture beyond one’s comfort zone. This means being willing to take risks and try new things, even if they seem daunting initially. Investors can reap greater rewards and capitalize on available opportunities by taking calculated risks.

Having a long-term perspective when investing in the stock market is also essential. This means not getting caught up in short-term fluctuations and instead focusing on the bigger picture. With a long-term perspective, investors can make more strategic decisions and avoid making impulsive decisions based on short-term market movements.

Apart from these approaches, it is crucial to establish a system of assistance. This can include a financial advisor, a mentor, or a community of like-minded investors. A support system can provide valuable guidance and support during market turbulence, helping investors stay focused and on track.

Overall, exhibiting poise and adaptability in the stock market requires knowledge, risk-taking, a long-term perspective, and a robust support system. By embracing these strategies, investors can navigate market uncertainties and capitalize on opportunities for success.

A thorough comprehension of the market and its influencing factors can aid in retaining calm and rationality. This includes staying up-to-date with news and trends and having a deep understanding of the companies and industries in which you invest. Investors with a robust knowledge of the market and its influences are better equipped to make sound, calculated decisions and avoid impulsive choices influenced by their emotions.

Staying Composed and Knowledgeable in Volatile Markets.

To maintain composure and clear-headedness amidst stock market turbulence, having a solid understanding of the market and its influencing factors is crucial. This involves staying up-to-date with the latest news and trends and having a deep understanding of the companies and industries in which one invests. With a strong foundation of knowledge, investors can make informed decisions and avoid impulsively acting on emotions.

By staying informed and knowledgeable, investors can also identify emerging opportunities and make strategic moves that will benefit their portfolios in the long run. This requires a level of discipline and patience, as well as the ability to recognise when it is time to exit a position. Volatility trading strategies, such as the straddle or the strangle, can also provide a framework for making calculated moves in a volatile market.

Ultimately, exhibiting stability and adaptability, coupled with a deep understanding of the market, can help investors thrive amidst stock market fluctuations and succeed in their investment endeavours.

Adaptability and Volatility Trading Strategies: Thriving Amidst Stock Market Fluctuations

Adaptability is a crucial trait for investors who seek to thrive amidst the ups and downs of the stock market. It requires the willingness to change course and adjust one’s investment strategies in response to changing market conditions. In particular, adaptability is essential in volatility trading strategies, which rely on taking advantage of market fluctuations.

One of the primary benefits of volatility trading strategies is that they can help investors profit from price movements, regardless of whether the market is going up or down. Using option contracts to buy or sell stocks at a predetermined price, investors can limit their losses and maximise their gains in volatile market conditions. However, effectively doing so requires high adaptability and the ability to adjust to changing market conditions.

To thrive amidst stock market fluctuations, investors must be willing to embrace new experiences and let go of entrenched habits and thought patterns. Adaptability enables them to be proactive and seize emerging opportunities before others do, even in uncertain and rapid changes. By adopting a flexible and adaptive mindset, investors can better navigate the volatile waters of the stock market and emerge victorious.

Transforming Adversity into Opportunity in the Stock Market with Volatility Trading Strategies

Volatility trading strategies can help investors turn adversity into opportunity in the stock market by taking advantage of price fluctuations over time. The word “volatility” refers to the degree of variation in a stock’s price, providing traders with potential opportunities to generate profits. High volatility can present favourable conditions for traders, while low volatility can pose challenges in finding profitable trades.

Volatility trading commonly employs the straddle strategy, where an investor buys a call and a put option on a particular stock or ETF; both options have the same strike and expiration dates. This approach enables the trader to benefit from significant price movements in either direction while limiting potential losses on the unprofitable option.

Another popular strategy for trading volatility is the strangle. This approach is similar to the straddle, but instead of buying a call and put option at the same strike price, the trader buys options at different strike prices. The goal is to profit from the option in the money while minimizing losses on the other option if the stock price moves significantly in either direction.

Volatility trading strategies require careful analysis and risk management. Traders must be able to identify stocks with high volatility and determine the appropriate strike prices and expiration dates for their options. They must also be prepared to adjust their positions as market conditions change.

In addition to volatility trading strategies, traders can transform adversity into opportunity by diversifying their portfolios, staying informed about market trends and news, and maintaining a long-term perspective. By remaining composed, adaptable, and strategically focused, traders can navigate market uncertainties and capitalize on opportunities for success.

Conclusion

In conclusion, mastering the art of recognizing opportunities within chaotic circumstances and market volatility constitutes a crucial skill that enables investors to flourish during challenging times. By maintaining equanimity, exhibiting adaptability, and incorporating the Contrarian Strategy into their investment approach, investors can effectively harness market volatility to yield higher long-term returns.

Acknowledging the significant role of Mass Psychology in market volatility is imperative.

As collective panic and elevated fear levels permeate the masses, markets become increasingly volatile. By amalgamating an understanding of Mass Psychology with market volatility, investors can seize opportunities at more favourable prices and capitalize on prospects others might disregard.

In essence, numerous successful investors have employed this approach to their advantage, purchasing when others are divesting and liquidating when others are acquiring. These investors have consistently generated substantial returns over extended periods by deviating from the consensus.

Ultimately, embracing chaos and volatility as opportunities for growth rather than obstacles is key to thriving in the capricious stock market.

By fostering mental resilience, adaptability, and strategic thinking, investors can transform adversity into a springboard for success, positioning themselves advantageously in the ever-evolving financial landscape.

FAQs

| Question | Answer |

|---|---|

| What are volatility trading strategies? | Volatility trading strategies are approaches that help investors navigate the stock market by taking advantage of price fluctuations over time. These strategies involve buying or selling options contracts to limit losses and maximize gains in volatile market conditions. |

| What is the importance of adaptability in the stock market? | Adaptability is crucial for investors who seek to thrive amidst the ups and downs of the stock market. It requires the willingness to change course and adjust one’s investment strategies in response to changing market conditions. In particular, adaptability is essential in volatility trading strategies, which rely on taking advantage of market fluctuations. |

| What is the Contrarian Strategy? | The Contrarian Strategy involves buying when others are selling and selling when others are buying. This approach enables investors to capitalize on market volatility and generate substantial returns over extended periods by deviating from the consensus. |

| What is Mass Psychology? | Mass Psychology refers to the collective emotions and behaviours of individuals in a group. Mass Psychology can influence market volatility in the stock market as collective panic and fear levels permeate the masses. |

| How can investors transform adversity into opportunity in the stock market? | Investors can transform adversity into opportunity in the stock market by using volatility trading strategies, diversifying their portfolios, staying informed about market trends and news, and maintaining a long-term perspective. By remaining composed, adaptable, and strategically focused, investors can navigate market uncertainties and capitalize on opportunities for success. |

Expand Your Mind: A Selection of Intriguing Articles

Unveiling the VIX Fear Indicator: A Case Study in Market Volatility

Mind Games: Unmasking Brainwashing Techniques in Institutions & Media

Brain Control: Domination via Pleasure

Yipee Yeah Yipey Yoh: Is Now a Good Time To Buy Bonds

The Perils of Following the Flock: Understanding Sheep Mentality

Psychology of Investing: Escape the Herd, Avoid Financial Destruction

Palladium Metal Price Unveiled: Impact on the Hydrogen Economy

Simplifying the Complex: Understanding Psychology for Dummies

What is Hot Money: Unraveling the Significance and Endurance

Zero to Hero: How to Build Wealth from Nothing

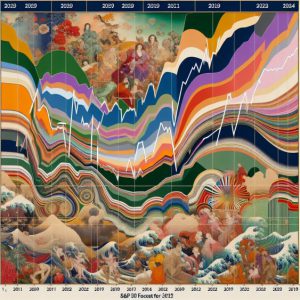

S&P 500 Forecast 2024: Charting Projected Targets

Stock Market Predictions for 2018: Reflecting on Past Insights

Investing for Dummies: Navigating Disasters with Confidence

What is the Bandwagon Effect? Exploring Its Impact