Navigating the Minds of Investors: Understanding Investor Behaviour

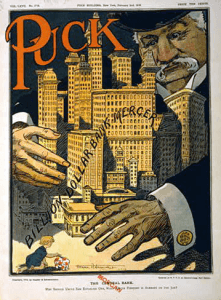

Investor behaviour has long been a topic of discussion among experts in finance, economics, and psychology. Despite the availability of information, individual investors are often prone to making errors in their investment decisions due to a lack of knowledge, an excess of emotion, and a tendency to imitate others. Studies have shown that overconfidence and a tendency to overreact to short-term market fluctuations can result in the purchase of assets at high prices and the sale of the same at low prices, often exacerbated by media and peer influence, leading to herd behaviour and market volatility.

Additionally, the desire to conform and the aversion to loss can result in investors avoiding underperforming assets and missing out on long-term opportunities. This phenomenon, known as the disposition effect, causes individuals to dispose of profitable investments and retain unprofitable ones. Emotional biases, such as fear and greed, also play a significant role in investment decisions and can lead to impulsive actions driven by momentary emotions instead of long-term goals.

Therefore, it is important for aspiring investors to approach investing with a disciplined, long-term perspective so as to minimize the impact of biases and achieve investment success. This counsel is of utmost importance in the present moment, as leading players are known to fashion new narratives and create a false illusion that the Bull market has perished forever. However, if one is able to resist succumbing to panic and maintain a rational state of mind, they may reap abundant profits in the long term. History attests to this truth. Those who do not prepare themselves mentally for such antics risk losing everything.

Mastering Your Emotional Biases: A Key to Successful Investor Behaviour

Investor behavior is a complex subject that continues to fascinate experts in finance, economics, and psychology. Although access to information has never been easier, individual investors often make investment errors due to a lack of knowledge, emotional biases, and a tendency to imitate others. Studies have revealed that overconfidence and a tendency to overreact to short-term market fluctuations can result in buying assets at high prices and selling them at low prices, leading to herd behavior and market volatility. Moreover, investors’ desire to conform and aversion to loss can result in avoiding underperforming assets and missing out on long-term opportunities. This phenomenon, known as the disposition effect, leads individuals to dispose of profitable investments and retain unprofitable ones.

Emotional biases, such as fear and greed, also play a significant role in investment decisions and can lead to impulsive actions driven by momentary emotions instead of long-term goals. Aspiring investors must approach investing with a disciplined, long-term perspective to minimize the impact of biases and achieve investment success. This advice is crucial in the present moment, as leading players are known to fashion new narratives and create a false illusion that the Bull market has perished forever. However, if one can resist succumbing to panic and maintain a rational state of mind, they may reap abundant profits in the long term. History attests to this truth.

Those who do not prepare themselves mentally for such antics risk losing everything. Investment success requires more than just knowledge and rational decision-making. It also requires a deep understanding of one’s own emotional biases and how to overcome them. An investor must be willing to do the hard work of introspection and self-awareness to identify their emotional biases and learn how to manage them effectively. For example, an investor prone to overreacting to short-term market fluctuations may need to develop a long-term investment plan that aligns with their goals and risk tolerance. Another effective way to overcome emotional biases is to work with a professional financial advisor. Financial advisors can provide unbiased advice and help investors develop a long-term investment strategy that aligns with their goals and risk tolerance. They can also provide ongoing support and guidance to help investors stay on track and avoid emotional decision-making.

Conclusion

Investor behavior is a crucial element of investment success. Emotional biases can lead to impulsive decisions that harm investment performance, but with self-awareness and the guidance of a professional financial advisor, investors can overcome these biases and achieve long-term investment success.

Other Articles of Interest

Behavioral Psychology Examples: Secrets of Human Behavior

The Patient Investor: Unveiling the Realm of the Strategist

Ishares robotics and artificial intelligence etf: A Financial Odyssey

Inflation Tax: Stealthy Threat to Middle-Class America

Mastering The Boom and Bust cycle: Buy High, Sell Smart

Unveiling Banking Scams: Deceitful Schemes Targeting the Masses

BIIB Stock Price Analysis: To Bet or to Fold the Cards

Musk Feuds With Coal Company Exec who call him out

AIIB: Paving the Future of Asian Infrastructure!

Super Rich Hoarding Cash: Will the Market Rally or Stall?

Fed Inflation News: Potential Shift in Fed’s Inflation Mandate

House Poor: Navigating the Challenges of Rising Housing Cost

Recession 2023: Defying Expectations

AI advancements: Tomorrow Is Already Here