The person who lives by hope will die in despair.

Italian Proverb

Currency Wars: The Preferred Trade Weapon

Updated Nov 9, 2023

Exploring the Topic: Merging Current Insights with Historical Wisdom. By delving into the past, we gain insights to avoid repetition, while in real-time, we showcase our strategies, practising what we preach.

Currency wars have emerged as a captivating and high-stakes phenomenon in the global financial landscape. As nations vie for economic dominance and seek competitive advantages, currencies have become the preferred trade weapon. The latest data reveals a complex and dynamic battlefield where countries strategically manipulate currencies to boost exports, stimulate growth, and protect domestic industries. Let’s delve into the exciting world of currency wars and their implications.

In a rapidly interconnected world, currencies are no longer mere mediums of exchange but powerful tools that can shape economic fortunes. Nations engage in currency wars by intentionally devaluing their currencies relative to others, sparking intense competition and potentially unleashing a cascade of consequences across the global economy. The data from recent currency battles reveals a landscape fraught with intrigue and strategic manoeuvring.

One of the primary motivations behind currency wars is to gain an edge in international trade. By devaluing their currency, countries can make their exports more competitive, attracting foreign buyers and boosting their industries. This strategy can deliver short-term benefits, as evidenced by countries like China, which has strategically managed its currency to support its export-oriented economy. However, the data also highlights the risks associated with such tactics, including the potential for retaliation and the destabilization of global markets.

In currency wars, central banks play a pivotal role. Through monetary policy adjustments, interest rate changes, and intervention in currency markets, central banks can influence the value of their currency and its impact on the broader economy. The latest data reveals the delicate balance central banks must strike as they navigate between promoting economic growth and maintaining stability in the face of currency fluctuations.

Moreover, technology has introduced new dimensions to currency wars. The rise of digital currencies, such as Bitcoin and other cryptocurrencies, has created additional opportunities and challenges. While some countries view digital currencies as potential weapons in their arsenal, others are wary of their disruptive nature and the potential risks to traditional financial systems. The data showcases the evolving dynamics of currency wars, where conventional fiat and digital currencies intersect, creating a complex battleground.

Currency wars are not without risks and unintended consequences. The latest data highlights the potential for heightened volatility in financial markets, increased trade tensions between nations, and the erosion of trust in global economic governance. As countries manipulate their currencies to gain short-term advantages, the long-term implications can be far-reaching, affecting global financial stability and the livelihoods of individuals worldwide.

Navigating the intricacies of currency wars requires an astute understanding of the global economic landscape, geopolitical dynamics, and the interplay between monetary policies. Governments, businesses, and investors must carefully analyze the data, anticipate potential outcomes, and develop robust strategies to mitigate risks and capitalize on opportunities.

While currency wars may seem daunting, they also present exciting possibilities. The data-driven realm of currency wars brings an air of anticipation and strategic ingenuity. It challenges policymakers and investors to stay ahead of the curve, adapt to changing dynamics, and leverage insights to make informed decisions.

In this era of rapid globalization and financial interconnectedness, currency wars continue to captivate and shape the global economic landscape. The latest data underscores the significance of currency as a trade weapon and highlights the complexities inherent in this battle for economic supremacy. As we delve deeper into this thrilling arena, we must remain vigilant, agile, and forward-thinking, leveraging the power of data and insights to navigate the twists and turns of the future currency wars.

Battlegrounds of Fortune: Navigating the Intricacies of Global Currency Wars

In the ever-evolving landscape of global finance, currency wars have emerged as highly complex battlegrounds where nations vie for economic advantage. Navigating these intricacies requires a deep understanding of the dynamics at play, as well as the ability to anticipate and respond to the ever-changing strategies employed by countries. Welcome to the thrilling world of global currency wars, where fortunes are made and lost.

At the heart of currency wars lies the manipulation of exchange rates to gain a competitive edge in international trade. Countries strategically devalue their currencies to make exports more attractive, stimulating economic growth and protecting domestic industries. The battlegrounds are filled with tactics such as interest rate adjustments, quantitative easing programs, and direct market interventions. Deciphering these moves and their potential impact is crucial for investors, businesses, and policymakers alike.

The intricate dance of currency wars is influenced by a myriad of factors. Geopolitical tensions, economic fundamentals, and monetary policy decisions all shape the strategies employed by nations. The latest data reveals the delicate balance between fostering economic growth and avoiding the destabilizing effects of excessive currency fluctuations. Understanding these nuances is critical to successfully navigating the battlegrounds of fortune.

Technology has also introduced new dimensions to currency wars. The rise of digital currencies, decentralized finance, and blockchain technology has disrupted traditional financial systems and created additional opportunities for countries to exert influence. From exploring central bank digital currencies (CBDCs) to the proliferation of cryptocurrencies, the data showcases a rapidly evolving battlefield where traditional fiat currencies and emerging digital assets coexist.

The consequences of currency wars extend far beyond individual nations. The interconnectedness of the global economy means that actions taken by one country can have ripple effects across the world. The outcomes of these battles influence trade imbalances, capital flows, and investor sentiment. The latest data underscores the need for a holistic approach to understanding the intricate web of global finance and its interplay with currency wars.

Successfully navigating the intricacies of currency wars requires a multi-faceted strategy. It demands a deep analysis of economic indicators, geopolitical developments, and central bank policies. The ability to synthesize and interpret data in real time is crucial, as currency wars are dynamic and ever-changing. With the correct information, market participants can make informed decisions, hedge against risks, and strategically position themselves in the battle for fortune.

However, currency wars are not without risks. The data reveals the potential for heightened market volatility, increased trade tensions, and the erosion of trust in the global financial system. As countries engage in competitive devaluations and protectionist measures, the delicate balance between cooperation and conflict must be carefully navigated.

As the world becomes increasingly interconnected, the battlegrounds of currency wars will continue to shape the global economic landscape. The data-driven era we live in provides a wealth of information and insights to those willing to dive deep into the intricacies of these battles. With knowledge, agility, and a deep understanding of the forces at play, market participants can venture into these battlegrounds of fortune and emerge victorious.

Strategic Safeguards: Navigating Currency Wars for Protection and Profit

Protecting oneself from the impacts of currency wars and potentially benefiting from them requires a thoughtful and strategic approach. Here are some considerations:

1. Diversify Currency Exposure: Holding a diversified portfolio of currencies can help mitigate the risks associated with currency wars. By spreading investments across different currencies, you reduce your exposure to the fluctuations of any single currency. This can help cushion the impact of devaluations or volatility in specific currencies.

2. Hedge Currency Risk: Hedging strategies can be employed to protect against currency fluctuations. This can involve using financial instruments such as currency futures, options, or forward contracts to lock in exchange rates. Hedging can help stabilize cash flows and protect the value of international investments.

3. Invest in Safe-Haven Assets: Investors often seek refuge in safe-haven assets during heightened currency volatility. These include gold, government bonds, or stable foreign currencies with strong fundamentals. These assets tend to hold their value or even appreciate in times of market turmoil, providing protection.

4. Consider Geographical Diversification: Investing in diverse countries and regions can help reduce exposure to any single economy affected by currency wars. By spreading investments across different geographic locations, you can benefit from economic growth in countries with stronger currencies or those less affected by currency manipulation.

5. Monitor Geopolitical Developments: Currency wars are often intertwined with geopolitical tensions. Staying informed about political and policy developments can help anticipate potential currency movements and their impacts on investments. Keeping a close eye on news and analysis from reputable sources can provide valuable insights.

6. Seek Professional Advice: Consulting with financial advisors or experts specialising in currency markets can provide valuable guidance. They can help develop tailored strategies based on your goals, risk tolerance, and investment horizon. Their expertise and market insights can help navigate the complexities of currency wars.

7. Consider Alternative Investments: Currency wars can create opportunities for alternative investments. For example, commodities like gold, silver, or oil can serve as a hedge against currency devaluations. Similarly, real estate or infrastructure investments in stable economies can provide a tangible asset that holds value despite currency fluctuations.

8. Focus on Export-Oriented Companies: During currency wars, countries with devalued currencies often see their exports become more competitive. Investing in companies with a significant export focus can be advantageous, as they may benefit from increased demand and higher profitability due to currency depreciation. Analyzing the exposure of companies to international markets and understanding their supply chains is vital in identifying potential opportunities.

9. Stay Agile and Opportunistic: Currency wars can create sudden market movements and opportunities. Staying agile and being open to adjusting investment strategies accordingly is essential. Investors can identify potential entry or exit points to capitalize on market dislocations by closely monitoring currency trends, economic indicators, and geopolitical developments.

10. Leverage Currency Trading: For experienced investors, currency trading can provide opportunities to profit from currency wars. Investors can take advantage of short-term fluctuations and trends by actively trading currencies. However, it’s important to note that currency trading carries significant risks and requires a deep understanding of the market dynamics, technical analysis, and risk management strategies.

11. Stay Informed and Educated: Currency wars are complex and ever-evolving. Continuously educating oneself about global economics, monetary policies, and geopolitical events is crucial. Following reputable financial news sources, attending seminars or webinars, and engaging with experts in the field can help deepen your understanding of currency markets and improve decision-making.

12. Seek Long-Term Investments: While currency wars may create short-term opportunities, it’s essential to maintain a long-term perspective when building an investment portfolio. Diversifying across different asset classes, geographies, and currencies can help mitigate risks and provide stability over the long run. Focusing on companies with solid fundamentals, sustainable competitive advantages, and robust business models can help weather the volatility associated with currency wars.

Remembering that currency wars are unpredictable and can significantly impact global markets is essential. Investors should carefully assess their risk tolerance, consult with professionals, and conduct thorough research before making any investment decisions. Maintaining a diversified portfolio and regularly reviewing and adjusting investment strategies based on changing market conditions is crucial for long-term success.

By combining knowledge, adaptability, and a prudent approach to risk management, individuals can position themselves to protect their investments and potentially capitalize on the opportunities that arise during currency wars.

It’s important to note that while potential benefits exist in currency wars, they also carry risks. Currency volatility, market uncertainty, and unintended consequences can impact investments. Therefore, it’s crucial to conduct thorough research, assess risk tolerance, and carefully consider the potential rewards and risks associated with participating in currency-related strategies.

Protecting oneself and potentially benefiting from currency wars requires prudent risk management, diversification, and informed decision-making. By staying informed, being proactive, and seeking professional advice, it is possible to navigate the intricacies of currency wars and position oneself to weather the storm and potentially seize opportunities that arise.

How can one identify the telltale signs of an unfolding currency war?

Identifying the signs of a currency war unfolding requires careful observation of economic and geopolitical developments. While each currency war may have unique characteristics, here are some common signs that may indicate the initiation or escalation of a currency war:

1. Exchange Rate Manipulation: A significant and deliberate devaluation of a country’s currency can be an early indication of a currency war. If multiple countries start competitively devaluing their currencies to gain a trade advantage, a currency war may begin. Monitoring exchange rate movements and central bank interventions can provide insights into potential currency war dynamics.

2. Trade Barriers and Protectionist Measures: The imposition of trade barriers, such as tariffs or import restrictions, can indicate that countries engage in currency wars. These measures are often employed to protect domestic industries from foreign competition and stimulate exports by making them more competitive. Increased trade tensions and disputes between nations can also signify currency war dynamics.

3. Central Bank Policy Shifts: Monitoring central banks’ monetary policies and interventions can provide clues about the potential onset of a currency war. Suppose central banks implement aggressive monetary easing, lower interest rates, or engage in large-scale currency market interventions. In that case, it may indicate that they actively manage their currencies to gain a trade advantage.

4. Escalating Geopolitical Tensions: Currency wars are often intertwined with geopolitical tensions. Heightened political conflicts, trade disputes, or economic rivalries between countries can contribute to initiating or escalating currency wars. Geopolitical developments, such as sanctions, diplomatic battles, or significant policy shifts, can be precursors to currency war dynamics.

5. Currency Intervention Policies: Countries may publicly announce or implement policies to influence their currency’s value. For example, if a country explicitly states its intention to devalue its currency to boost exports or protect domestic industries, it may signify currency war intentions. Monitoring official statements, policy announcements, or communication from relevant authorities can provide valuable insights.

6. Economic Indicators and Competitive Devaluations: A sustained and significant decline in a country’s currency value and similar movements in other currencies can indicate a competitive devaluation scenario characteristic of currency wars. Monitoring economic indicators, such as trade balances, inflation rates, or export levels, can help identify potential signs of currency war dynamics.

7. Media and Expert Analysis: Media reports, expert analysis, and commentary from economists and financial professionals can provide valuable insights into the unfolding of currency wars. Paying attention to discussions on currency manipulation, trade imbalances, or shifts in global economic dynamics can help identify the signs of a currency war.

It’s important to note that the indicators mentioned above are not definitive proof of a currency war, as economic and geopolitical situations can be complex and multifaceted. Therefore, it’s crucial to analyze multiple sources of information, consider the broader context, and seek professional advice to understand the situation comprehensively.

By staying informed, monitoring key indicators and developments, and interpreting the actions of relevant stakeholders, individuals can better identify the signs that a currency war is unfolding and adjust their investment strategies accordingly.

Retracing Currency Wars: Lessons from the Past for Informed Strategies Today

In a recent article, we delved into critical points but tackled the issues left unexplored here. Currency wars are a prime focus, where central bankers intentionally devalue a nation’s currency to spur economic cycles.

Throughout the years, we’ve emphasized a fundamental truth: every primary bull market is bound to face a significant correction, often marked by a 50% pullback from its peak. Applying this to Gold suggests a potential pullback of $960. The precious metal’s captivating journey, commencing in 2003 and concluding with a dazzling peak in 2011, was undeniably remarkable. However, expecting the Gold Bull to persist without interruption is wishful thinking. Regrettably, many Gold enthusiasts clung to this optimism, neglecting the imminent reality—the sector was overdue for a necessary release of pressure.

Gold bugs are losing contact with reality and embracing the illusory.

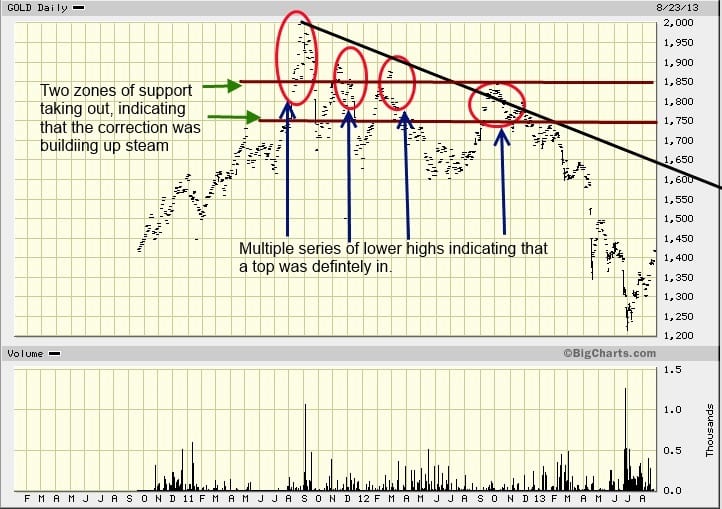

When Gold topped out in 2011 and started to correct, they began to recite “the buy on the dip” mantra. When it appeared to have put a bottom in the middle of 2012, they became Euphoric and started to hum “death to the dollar”. However, this euphoria should have faded when Gold refused to trade to new highs and instead put in a series of lower highs (look at the chart below). After a very long run, a series of lower highs is usually an unfavourable omen. The Gold bugs were unfazed and continued to sing “Kumbaya”, but no one was listening, and the correction gathered steam.

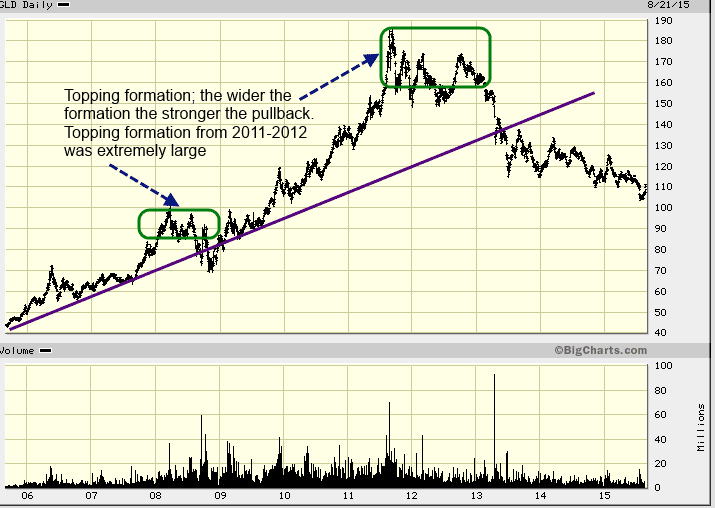

We are using the ETF and GLD for illustrative purposes.

It mimics the price of Gold reasonably well. Note that when a market is bullish, it does not put in a series of lower highs; this is a signal of exhaustion. This occurred twice over the past ten years; the first incidence lasted from 2008 to 2009, resulting in gold shedding 30% of its gains. The topping formation was much more comprehensive the second time, and gold from high to its current low hashed roughly 43%. History tends to repeat, and the pattern (on a much broader scale) from 2008 to 2009 notified the astute investor that all was not well and that it was time to bank some of those profits. We noticed these signals and the many negative divergences that our indicators generated and advised our subscribers to close most of their precious metal positions in 2011.

The term “Gold Bugs” lacks inspiration.

From approximately February 2013 to March 2015, the Gold Bugs discovered religion and prayed for a turnaround. The result is always disastrous when you find religion in an area that does not merit it. The Gold camp was in turmoil, and chaos became the order of the day; how could Gold drop when the Fed was creating money at an insane pace? Unable to explain these strange phenomena, they opted for illusory, magical incantations, looking at tea leaves, skull bones etc., etc. Based on this strange behaviour, it is evident that Gold would continue to trend lower, an assessment with which Jim Rogers seemed to concur.

“There are still too many mystics in the gold market who think gold is holy, so cannot decline. When/if they give up and throw their gold out the window because ‘she lied to me,’ gold will make a firm bottom,” Rogers said.

Hopelessness prevails within the Gold Bug Camp.

Gold traded below $1100 briefly to add pain to misery, and religion was abandoned in favour of fear and desperation. Hopelessness is setting in, for the Gold bugs cannot fathom how, against the backdrop of trillions of new dollars being added to the money supply, Gold continues to take a beating. Embracing the mass mindset is a dangerous affliction, for reason and logic are abandoned in favour of misery and panic. It brings to mind a particular phrase we used recently: “Welcome to my world said the spider to the fly…… to which the fly responded which one.” The Gold bugs have failed to understand and come to grips with the fact that we have two worlds coexisting, the imaginary and the real.

Embracing the Imaginary: Illusion vs. Reality

The masses believe money is created from trees instead of sweat and labour. This means that the Fed can continue debasing the currency, and the masses will be none the wiser. They do not want to or refuse to grasp the concept of “Fiat Money”, and trying to educate them is an endeavour in futility. They idiotically and fallaciously assume that the valueless pieces of paper-backed-up nothing are just as valuable as Gold.

History is replete with examples clearly illustrating how the masses are forlornly optimally positioned to be used as cannon fodder. The mass mindset refuses to study and learn from the past; secure in their knowledge that the past offers nothing of value, they are doomed to embrace a future which is nothing but a replay of the past they so candidly repudiate. While the masses embrace the paradigm of ignorance and bliss, you can differ.

Gold will not drop to zero, but it’s hardly likely to soar to the Moon.

Gold will not drop to zero, not in the face of the largest currency war the world has ever witnessed. Years ago, we labelled this war as the “race to the bottom”. We stated in early 2003 that nations would be forced to take this path as they sought to maintain a competitive edge. Now, the war has taken on an urgency not seen before as nation after nation joins the battle. China finally embraced this war with open arms and stunned the markets by devaluing its currency twice in two days.

The two devaluations come after a run of weak economic data and have raised suspicions that China is embarking on a longer-term slide in the exchange rate. A cheaper yuan will help Chinese exports by making them less expensive on overseas markets. Full Story

More nations are coming to the “devalue or die party”. Vietnam joined the bandwagon and devalued its currency twice to maintain its competitiveness. Indonesia has been allowing its rupiah to collapse since Jan of 2013.

Currency Wars: The Psychological and Technical Perspective

Gold issued several psychological signals that a top was close at hand in 2011 and was in place in 2012. The first message came in 2011 when Gold put in a series of new highs; instead of exhibiting signs of caution, the sentiment in the Gold camp was filled with Joy and elation. The 2nd signal came in 2012 when Gold failed to put in a new high and pulled back firmly after trading past the $1800 range; the gold bugs exhibited no signs of distress.

From a technical perspective, several technical indicators did not confirm the surge to new highs, and the negative divergences these indicators generated were somewhat significant. It was time to take money off the table when we combined this with the above psychological developments. Many sophisticated investors took this route, or like Jim Rogers, they opted to hedge themselves against the subsequent decline.

The Trend is not Bullish.

One can see the topping formation in progress if we zoom in and examine the period from 2011-2013. Gold continued to put in a series of lower highs for one year. The first zone of support (1820-1850 ranges) was breached around September of 2011, and each attempt to trade past it after that failed. Gold then went on to sell below the second zone of support (1750) and continued to put in lower lows. In August of 2012, when it looked like Gold might have bottomed and was ready to mount a strong rally, it didn’t even trade past 1850; the first zone of former support turned into resistance.

Attempting to Time the Exact Top Is an Exercise in Futility

After failing to trade above 1850, it rapidly switched below the second former zone of support, which now had become another zone of strong resistance. Investors had ample time to bail out from 2011-2012. We are not talking about getting out at the exact top. Trying to time the exact top is a process best reserved for imbeciles with plenty of time and a large capacity for pain. Any exit from 1750-1900 would have made for a great exit point.

Returning to the first chart, we see that Gold has violated its long-term uptrend line, automatically indicating that the bottoming phase will be just as frustrating as the topping phase. In other words, many early bulls will be crushed as every bottom they predicted continues to be violated. A base will take hold, but it will not be smooth.

We could list an overabundance of fundamental data about why Gold should fly. Every Gold analyst and connoisseur has done this continually over the past five years, all to no avail. A simple Google search should yield many results if you are eager to process this regurgitated information. The sentiment readings right now are conducive to market bottoming action; however, the technical outlook indicates that there could be more downside. This downward move will reinforce the imprudent perception that the Gold bull is deceased. Every bull market undergoes a back-breaking correction, and Gold is no exception.

Gold Market Outlook: Exploring Support Levels

We are going to revert to the chart of GLD. If Gold cannot rally and stay above $1180 weekly, then the next level of support that comes into play is around 100, which correlates to a group of roughly $1000 for Gold bullion. A weekly close below this level should take the price of Gold down to the $960 range, completing a back-breaking pullback of 50%. In this age of extreme volatility, there is always a chance that Gold could overshoot this mark. On the other hand, it could hold steadfast above $1000. The point is not to fixate on absolute prices; if it’s a good deal, jump in and buy instead of trying to save a penny and lose a pound. The wise investor will use this phase to open up new positions instead of complaining. The Idiotic investor complains/whines that they would have done things differently given the opportunity. Of course, the truth is that they will react in the same manner. It’s a real-life example of the movie Groundhog Day.

Suggestions Offered To Premium Subscribers

The drug pushers in the media are giving the news junkies their daily fix, catering to the twaddle scenario that the world will end. Step back and reflect on how lucky you are that individuals of such calibre exist who seem to feed and thrive on this rubbish. Every time you run into an idiot be grateful for it’s those idiots who make your life infinitely easier. Most do not see this part of the equation or story; they focus on the false premise that idiots make their lives harder when, in fact, the opposite is true. Market Update July 17, 2015

Our trading methodology focuses extensively on mass psychology and technical analysis. From the mass psychology perspective, Gold is close to putting in a bottom. Sentiment investors, contrarian investors and investors familiar with mass psychology should consider taking a closer look at the precious metal sector now. From the Technical analysis perspective, the potential for more downsides remains.

Nibbling at Gold is Okay with profits only.

We have been advising our subscribers to deploy small amounts of money into Gold because we sold close to the top, so we are using profits to get back in. Starting nibbling at this sector might be prudent now if you sold Gold in the 1700-1900 ranges. On the other hand, if you were dreaming of better prices when Gold was trading north of 1800, you don’t have to dream anymore. Incidentally, we did warn our subscribers to close the bulk of their positions in Gold, Silver and their entire Palladium bullion positions in 2011. For the record, selling close to the top was not something we were attempting, and we attribute that more to lady luck than anything else.

Deciphering Today’s Overleveraged Markets

The markets are incredibly leveraged today, and this leverage does not refer to money only but emotions such as stupidity, fear, greed, etc. There is a lot more in terms of useless emotions involved in today’s trading than in yesteryear. The fixation should not be on trying to spot the exact bottom; looking for the precise bottom is like finding a needle in a mound of cow dung, a malicious and stinky process where the odds of success are rather low. If you adored Gold at $1800 or $1600 or even $1200, you should be mad now that it is trading well below $1200. Do not impersonate the horde (mass mindset), whose sole role is to sell when it’s time to buy and buy when it’s time to sell. These people always say, “I wish I bought when the markets were falling apart,” but they are the first to head for the exit when that situation finally presents itself.

Incredulous Gold Targets from Individuals Posing as Experts

Some analysts offer haughty targets of $10,000 or $15,000, and some even over $20,000. While we are at, why not suggest $100,000? We are sure some analyst will come out and issue such an inane target, as was the case with the lofty target of Dow 30,000 being issued years ago. This begs the following question. How many generations would have to pass before Gold ever hits those targets? Those guys waiting for the haughty predictions issued on Gold in the 1980s are still waiting for those high-end targets to be hit. Why the focus on high-ceilinged targets when Gold has not even touched the $2000 level?

The targets we issued years ago still stand. Our first target of 1500-1800 has been hit. The next stage is for Gold to trade to $2000; once $2,000 is taken, the next phase of the actual bull will begin. Our high target is in the $ 5,000-$5500 range, with a possible overshoot of $6,000. The focus now should be ensuring you are in the market and not gossiping about how high Gold will trade. As the saying goes, “You need to be in it to win it.” The trend is your friend; everything else is your foe.

A man’s doubts and fears are his worst enemies.

William Wrigley Jr.

The content was first published on August 4, 2020, and has undergone several updates. The most recent update was completed in Nov 2023.

Beyond Basics: Engaging Stories Await

Mind Control Techniques: Mastering Market Dynamics for Success

Elixir for Vitality: Embrace Better Health with Non-Hydrogenated Oil