Why Is Critical Thinking Important?

Mar 22, 2023

The importance of critical thinking as a fundamental skill cannot be overstated, particularly in areas such as mass psychology and investing. This paper shall examine the concept of critical thinking, including its definition and significance in the context of mass psychology and contrarian investing.

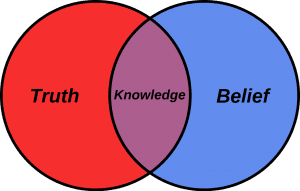

Defining Critical Thinking: Critical thinking is a systematic and logical approach to analyzing and evaluating information. It is a process that involves questioning assumptions, considering alternative perspectives, and applying reason to arrive at a well-informed conclusion. The value of critical thinking as a life skill cannot be overemphasized, as it plays a vital role in decision-making, problem-solving, and evaluating information.

Mass Psychology and Critical Thinking:

Mass psychology studies how chaps behave in groups, and it’s a valuable tool for analyzing consumer behaviour and market trends. In marketing and advertising, it’s essential to understand groups’ motivations to target marketing efforts effectively.

However, mass psychology can also be used to manipulate chaps for political or economic gain. Without critical thinking, chaps may be more susceptible to propaganda and other forms of manipulation. Critical thinking can help individuals evaluate information objectively and make informed decisions based on their own analysis.

The Role of Mass Psychology in Investing: Mass psychology studies how individuals behave in groups. It is a fundamental aspect of investing, as the crowd’s behaviour can impact market trends and financial decisions. However, critical thinking is necessary to evaluate the motivations behind the group’s behaviour and avoid falling prey to groupthink.

Contrarian Investing and Critical Thinking:

Contrarian investing is a strategy that involves investing against the crowd. Such investors look for opportunities in markets that are undervalued or overlooked by other investors. This approach requires a willingness to go against the herd mentality and to think critically about market trends.

Critical thinking is essential for successful contrarian investing. Contrarian investors must be able to evaluate market trends and identify opportunities that others may overlook. They must also be able to question their own assumptions and consider alternative perspectives.

Using Critical Thinking in Mass Psychology and Contrarian Investing:

To apply critical thinking in mass psychology and contrarian investing, individuals should follow these steps:

- Question assumptions: Individuals should question their own assumptions and consider alternative perspectives. This can help them avoid biases and make more informed decisions.

- Evaluate information: Individuals should evaluate information objectively and consider the credibility of sources. This can help them avoid misinformation and propaganda.

- Consider alternative perspectives: Individuals should consider alternative perspectives and challenge their own assumptions. This can help them identify opportunities that others may overlook.

- Apply reason: Individuals should apply reason to arrive at a logical conclusion. This can help them make informed decisions based on their own analysis.

Conclusion:

Why Is Critical Thinking Important? This is a fundamental question, and we hope the information provided helps provide insights into why critical thinkers excel in life.

In conclusion, critical thinking is vital in areas such as mass psychology and investing. By questioning assumptions, evaluating information objectively, considering alternative perspectives, and applying reason, individuals can make more informed decisions and avoid the pitfalls of herd mentality. Critical thinkers have a better chance of identifying overlooked opportunities and making successful contrarian investments. With an understanding of mass psychology, critical thinkers can maximize the benefits of their analysis and make well-informed decisions.

Other Articles of Interest

NKE Stock Price Projections and Long Term Targets

Huge Risk to US Economy: Fact or Fiction?

Mass Hysteria Definition Unraveled: Exploring the Enigma

Inflation News: Real Inflation Set to Surge

Resource Wars: Navigating a Shifting Global Landscape

Stock Market Sell-Off: Embrace Fear & Seize Opportunities

Crisis Investing: Turning Market Crashes into Opportunities

Yuan Vs Yen: Yuan On course to Challenge Yen

ASAN Stock Price Trends: Poised for Takeoff or Set to Decline

Ultimate Oscillator: The Volatility Indicator

Navigating Success: Top Stocks of 2016

Is The Stock Market Crashing: Separating Signal from Noise

Greenspan Put: Why the Maestro has it Wrong?

Financial Insights: Cutting Through the Noise