Tactical Solutions: The Evolution of The Trend Indicator

Updated Feb 29, 2024

The aftermath of 2008 ushered in a new era of market dynamics, where manipulation of financial data became pervasive. Traditional notions of free market forces ceased to exist, giving rise to Quantitative Easing (QE) as the primary economic and stock market support. In this paradigm shift, a tactical solution emerged, necessitating a focus on psychological indicators and price action, as fundamentals like EPS succumbed to extreme manipulation.

At Tactical Investor, our ongoing efforts gained newfound urgency after the 2008 financial crisis. The evolving landscape demanded a swift completion of our project, aligning with the recognition that traditional fundamental analysis had lost its relevance in the face of widespread manipulation.

The Trend Indicator: Anticipating Market Shifts

The Trend Indicator stands as a beacon in this transformed landscape, enabling the anticipation of market trends ahead of their occurrence. Its unique capability lies in alerting us to an impending change in market direction. It’s essential to clarify that this isn’t about pinpointing the exact top or bottom—a task fraught with folly—but rather about gauging when a market is on the cusp of a significant trend shift.

In essence, the Trend Indicator represents a tactical solution, steering clear of the pitfalls of attempting precise market timing. Instead, it empowers strategic decision-making by providing advanced insights into evolving market trends. As we navigate the intricate terrain of post-2008 financial dynamics, this indicator stands as a testament to our commitment to adaptability and foresight in the ever-evolving world of finance.

Tactical Solutions: Forging Precision Amidst Market Complexity

In the wake of the 2008 financial crisis, our pursuit of an unassailable indicator led to a revelation: the imperative to harness data impervious to manipulation. Crucial metrics like volume, market internals, new highs or lows, and moving averages had succumbed to distortions, prompting the creation of a tool fortified against such machinations.

Volume, a cornerstone in most technical systems, faced reliability challenges, necessitating a paradigm shift. The answer lay in a tool reliant on price action and essential psychological components—immune to manipulative forces. Thus, the Trend Indicator emerged, a tactical marvel that has consistently identified Major Market Tops or Bottoms since deployment.

Strategic Ingenuity: Unveiling the Trend Indicator’s Precision

Operating beyond the sway of manipulated data, the Trend Indicator epitomizes unwavering accuracy. Backtesting with 50 years’ worth of data has unveiled an astonishing accuracy rate, instilling confidence in its role as a strategic guide through the intricate landscape of financial markets.

As we navigate the complexities of post-2008 financial dynamics, the Trend Indicator stands as a beacon of tactical mastery. Relying on mass psychology and price action, it cuts through the noise, offering unparalleled insights into market trends. Tactical Solutions, in pursuit of adaptability and precision, presents a tool that meets and exceeds the demands of the ever-evolving financial landscape.

Navigating Wall Street: Pigs always get slaughtered.

In the intricate landscape of Wall Street, a timeless adage resonates: “Bears win sometimes, Bulls win sometimes, but pigs always get slaughtered.” The wisdom encapsulated in these words underscores a fundamental principle—we aim not to obsess over pinpointing market extremes but to relish the journey.

Our strategy transcends the fixation on trend lines or the futile quest for exact tops or bottoms. Instead, we derive pleasure from riding the waves of market trends until the signal signals a shift. The essence lies in enjoying the process, whether ascending or descending, with the flexibility to adapt to changing conditions.

It’s crucial to emphasize that tactical investing isn’t about fortuitously timing precise market peaks. If such alignment occurs, we attribute it to fate. At its core, Tactical investing revolves around discerning when an asset class is overlooked or despised by the crowd, operating in the realm of the highly oversold. In embracing this approach, investing becomes a gratifying pursuit guided by strategy rather than the elusive pursuit of market extremes.

Conclusion

One study that highlights the effectiveness of mass psychology in trading is “Market Psychology in the Stock Market: The Role of Investor Sentiment” by Baker and Wurgler (2006). The study found that investor sentiment, which is a measure of mass psychology, has a significant impact on stock returns. Specifically, the study found that high levels of investor sentiment are associated with lower subsequent returns, while low levels are associated with higher following returns.

This research suggests that traders who can gauge market sentiment and use it to inform their investment decisions may be better positioned to generate market profits. Additionally, by understanding the emotional and psychological factors that drive market behaviour, traders can develop strategies that capitalize on market inefficiencies and mispricings.

Another study that underscores the importance of tactical solutions in trading is “Tactical Asset Allocation and Market Efficiency” by DeMiguel, Garlappi, and Uppal (2009). The study found that tactical asset allocation strategies, which involve dynamically adjusting portfolio allocations based on market conditions, can generate significant outperformance compared to a static buy-and-hold strategy.

By leveraging tactical solutions such as mass psychology and tactical asset allocation, traders can gain an edge in the markets and potentially achieve higher returns. Of course, it is essential to note that there are no guarantees when investing. Any strategy should be thoroughly researched and tested before being implemented in real-world trading.

Other Articles of Interest

Yipee Yeah Yipey Yoh: Is Now a Good Time To Buy Bonds

The Perils of Following the Flock: Understanding Sheep Mentality

Psychology of Investing: Escape the Herd, Avoid Financial Destruction

Palladium Metal Price Unveiled: Impact on the Hydrogen Economy

Simplifying the Complex: Understanding Psychology for Dummies

What is Hot Money: Unraveling the Significance and Endurance

Zero to Hero: How to Build Wealth from Nothing

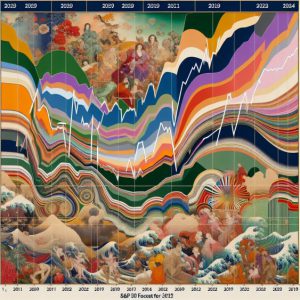

S&P 500 Forecast 2024: Charting Projected Targets

Stock Market Predictions for 2018: Reflecting on Past Insights

Investing for Dummies: Navigating Disasters with Confidence

What is the Bandwagon Effect? Exploring Its Impact

Warren Buffett Economy Unveiled: Mastering Financial Wisdom

Stock Market Predictions 2020: Focus On The Trend

Volatility Trading & Stock Market Trends

Seizing the Copper Shortage Opportunity