Russian Response to SU-24 Downing Sets Stage for Escalation: Syrian War Profiteers Eye Arms Race

In a reckless move, Turkey’s downing of the Russian SU-24 has unleashed a furious response from Putin, intensifying the already volatile Syrian conflict. The deployment of S-400 units by Russia signals a drastic shift, with specific orders to shoot down any foreign aircraft violating Syria’s airspace. The Syrian War Profiteers, a term aptly describing those benefiting from the turmoil, now face a reckoning.

Despite the cowardly act by Turkey in downing the Su-24, Russia’s retaliation has been swift and severe, targeting Turkmen and rebels in the region. The next phase involves systematically dismantling these rebels, cutting supply lines from Turkey, and arming the Kurds and Houthis as strategic moves against Erdogan and the Saudis. The House of Saud’s gamble supporting Syrian rebels might backfire as Russia gains support domestically and strategically.

The escalating tensions may push Russia to deliver a strong message to those crossing the red line, potentially targeting Turkey or Saudi Arabia. The Religious Provocation Index suggests Russia is determined to counter any interference in Syria. As power dynamics shift, Iran and Russia emerge as dominant players, challenging the aspirations of Turkey and Saudi Arabia.

Amidst the geopolitical turmoil, an arms race looms in the Middle East, presenting lucrative opportunities for defense companies. While the Syrian War Profiteers strategize their next moves, the intricate dance of power in the region unfolds, with Russia and Iran poised to reshape the Middle East’s future. This turbulent landscape prompts our financial insights, expecting significant market movements as geopolitical tensions rise.

Religious Provocations Unleash Russian Fury: Middle East Faces Geopolitical Shifts and Arms Race

With our Religious Provocation Index at unprecedented levels, it’s undeniable that Russia is gearing up for a significant escalation, targeting Turkey, NATO, and anyone hindering its mission in Syria. Erdogan and Saudi Arabia’s dreams of regional dominance are fading; the era of Iran and Russia as top players is dawning. While skeptics may resist this geopolitical shift, our analysis is grounded in trends that favor Russia over the U.S and its questionable allies.

This impending shift towards Russia and Iran as dominant powers in the Middle East carries profound implications. As Erdogan and Saudi Arabia grapple with the reality of their waning influence, an unavoidable consequence is the initiation of a massive arms race in the region. This geopolitical turmoil becomes a boon for defence companies, capitalizing on the heightened demand for military capabilities.

In response to this forecast, we are set to release three strategic plays today. However, our entry prices will be contingent on stock pullbacks, given the prevalent overbought conditions. As the Middle East braces for transformative changes, the intersection of geopolitics and financial markets becomes a focal point for investors seeking opportunities amidst uncertainty.

Navigating Geopolitical Turbulence: Investing Strategies Amidst Syrian War Escalation

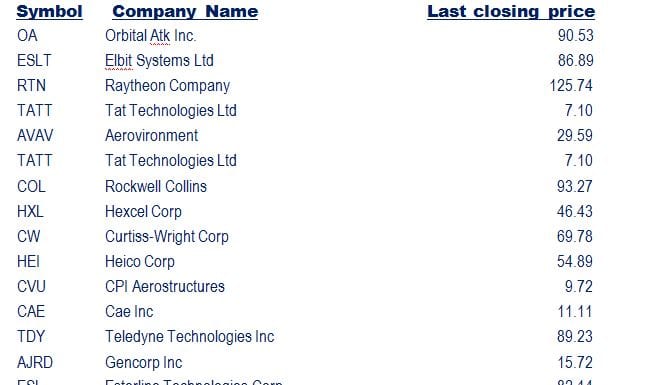

As geopolitical tensions rise in the Syrian conflict, savvy investors may consider playing the “Syrian war card” by strategically positioning themselves in the defence sector. Opening positions in top defence companies can be prudent to capitalize on heightened global security concerns. The following table presents a list of some leading players in the defence industry.

Our recommended approach involves patience and strategic timing. Waiting for strong pullbacks in the market before deploying new capital ensures entry at favorable price points. Utilizing our trend indicator will guide the decision-making process, allowing investors to navigate the complexities of geopolitical turbulence while optimizing their investment strategies. As global dynamics continue to shift, staying informed and agile in the financial markets becomes paramount for investors seeking to capitalize on emerging opportunities.

We need to add that all wars are terrible, and the innocent and helpless are the ones that always pay the heaviest price. We are not advocating war, nor do we support or condone the way most wars are conducted. However, as trend players who follow the principles of mass psychology, we are putting our personal feelings aside and focusing on the trend.