Strong Buy stocks: Follow the Insiders

Updated March 2023

Investors have long looked to corporate insiders as a signal for market direction and for a good reason. Insiders, such as executives and officers of a company, have access to information about their own firm that the general public does not, and their buying or selling activity can often provide a clue as to what they believe the future holds for their company. In British English of the 1950s, this practice of following insiders is often referred to as “tailing the big shots” or “tailing the insiders.”

Research has shown that insider activity can strongly predict stock performance. A study by Nejat Seyhun, a finance professor at the University of Michigan, found that insider buying tends to precede a rise in share prices, while insider selling precedes a fall. Other studies have also shown a positive correlation between insider buying and future stock performance.

Moreover, insiders are incentivised to act in the best interest of their company and its shareholders, as their wealth is often tied to the company’s performance. By following insider activity, investors can gain insight into insiders’ confidence in their own company’s prospects.

However, it is essential to note that insider activity alone should not be the sole factor in making investment decisions. It should be used with other analyses, such as financial metrics and overall market trends.

Following insiders can be a valuable tool for investors, as it provides a glimpse into the confidence and expectations of those with the most information about the company. As the British stockbroker of the 1950s would say, tailing the big shots can be a profitable strategy, but it should not be relied upon in isolation.

Following insiders Pays

Following insider buying is a tried and tested approach to investing, based on the premise that corporate executives and officers know their firms better than anyone else. They are privy to information about their companies that is not available to the general public, and their buying activity can signal their confidence in their company’s prospects.

Several studies have been conducted over the years supporting the idea that following insider buying can be profitable. For example, a survey by Nejat Seyhun, a finance professor at the University of Michigan, found that insider buying predicts future stock returns. The study found that over two years, stocks with insider buying outperformed those without insider buying by an average of 4.5%.

Another study by the University of British Columbia found that insider buying is a more reliable signal than insider selling. The study found that insider buying is associated with positive future returns, while insider selling is related to negative future returns.

Investors can use several tools to track insider buying activity, including SEC filings and websites that aggregate insider buying data. For example, Insider Monkey’s website tracks insider buying activity and lists the top stocks with insider buying activity.

Following insider buying can be profitable for investors because insiders know their firms better than anyone else. Several studies have shown that insider buying predicts future stock returns, and investors can use several tools to track insider buying activity. By following insider buying activity, investors can find strong buy stocks and potentially outperform the market.

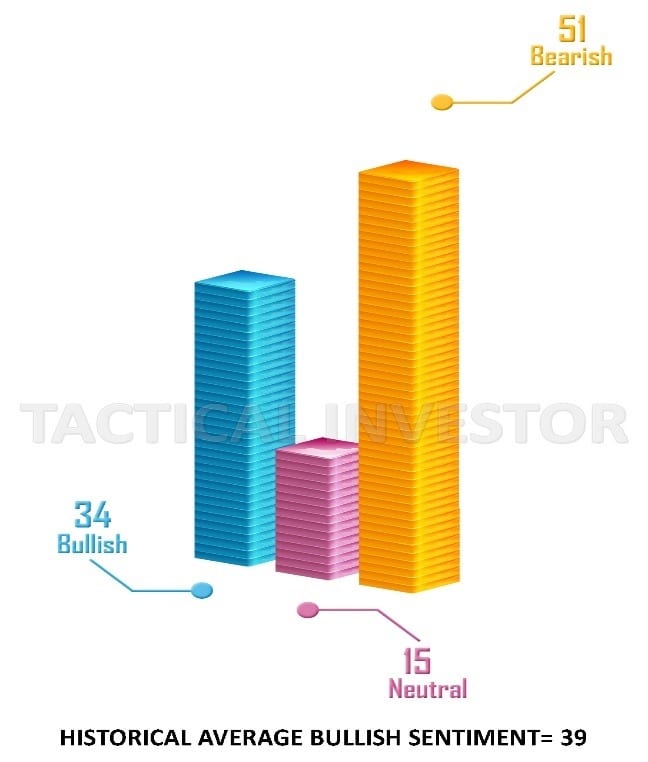

We are almost sure that a “mother of all buys” will be generated shortly; the anxiety index is still entrenched deep in the zone of madness, and the next pullback could push it to the brink. The secondary indicators posted below are trading in the extreme ranges, and bullish sentiment, while surprisingly high given the chaos, is still below its historical average. Neutral sentiment rose but remains well below its historical average. To trigger this buy, we only need neutral sentiment to test its recent lows or for our weekly indicators to move slightly more.

The technical indicators (on the weekly chart of the Dow) are now in the oversold ranges; they need to move a bit more into the oversold zone, and we will have a “mother of all buy” signal. By following insider action or using IBD’s relative strength rating system, one can identify strong stocks smoothly. As for the “father of all buys,” that will take a lot more work, and we will not comment on it for now, as nothing has changed since the last update.

According to Sundial Capital Research, corporate executives and officers have been buying shares of their firms at an unprecedented pace in recent weeks, indicating a higher degree of bullishness than seen in the past decade. While this trend coincides with a significant bull market, historical data suggests that peak episodes of insider buying have been a positive indicator for stocks, with the S&P 500 up a median of 20% over the next year. https://yhoo.it/2wmO3P6

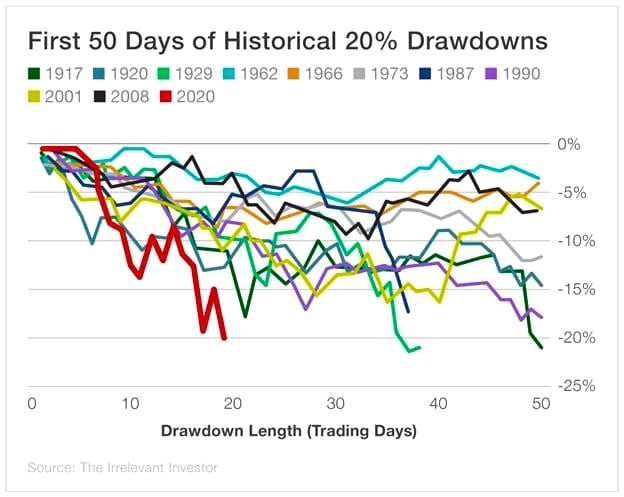

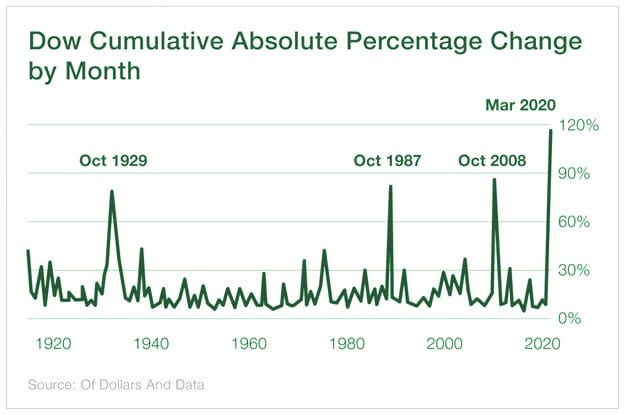

The current market conditions are intense, and the charts indicate that the present action is even more extreme than that of 1929. However, there is a significant difference between then and now – an aggressive Fed willing to do anything to support the markets, even if it means burning the middle class. Previous market crashes started on a note of euphoria, but the current one is an exception.

The extreme ranges of almost every market metric suggest this is a spectacular long-term opportunity. The insiders know what they are doing, as evidenced by their aggressive buying of stocks. Therefore, following the leaders is the best course of action if you want a list of strong buy stocks.

While the current market surge is spectacular, it is essential to remember that a crash is inevitable. The Dow could potentially lose 50% or more of its value, and those celebrating now will likely be caught off guard when the crash occurs. The next crash will probably start on a note of Euphoria, which is the opposite of the current situation.

Therefore, investors must remain vigilant and not get carried away by the current market momentum. Following the insiders can be a good strategy for identifying strong buy stocks, but it is important to also consider the long-term prospects and fundamentals of the company before making any investment decisions. Ultimately, the key to successful investing is to remain disciplined and not let emotions dictate one’s actions.

Overview of The Strong Stocks topic: Update March 2023

Following insiders can be an excellent strategy if you’re looking for a reliable way to identify strong buy stocks. Insiders, such as corporate executives and officers, can access private information about their companies. When insiders start buying shares of their firms, it’s often a sign that they have confidence in the company’s prospects.

Studies have shown that insider buying can strongly predict future stock performance. According to a study published in the Journal of Finance, insider purchases tend to be followed by positive abnormal returns, which suggests that following insider buying activity can be a profitable investment strategy.

Furthermore, as mentioned earlier, peak episodes of insider buying have been a good sign for stocks, with the S&P 500 up a median of 20% over the next year. This indicates that insider buying can not only identify strong buy stocks but can also be a signal for significant future gains.

Insider buying is the best indicator for small players.

So, if you’re looking for solid buy stocks, following insider activity is an excellent place to start. You can find this information on various financial websites, such as Yahoo Finance and MarketWatch, or through subscription services specialising in insider activity data.

Following insiders is a proven investment strategy to help you identify strong buy stocks. By paying attention to insider buying activity, you can gain valuable insight into a company’s prospects and potentially reap significant financial rewards.

Other Articles of Interest

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?