Stock Market Technical Analysis Unleashed: Separating Fact from Fiction

Updated Feb 2023

Stock market technical analysis on its own produces mediocre results. However, when combined with Mass psychology, the results are outstanding. From a long-term perspective, this confirms that the super trend of polarisation, loss of personal freedom and massacre of the middle class will continue for roughly 30 years in the West. If we are lucky, it might end in 18 years, but we would not hold our breath, as the trend to elect super idiots into positions of power is in full swing.

The MACD crossover (on the weekly charts) is a bit more pronounced now, so unless there is a black swan event, the Dow is on course to (at minimum) test the 37,5K to 38K ranges. Between now and the 1st quarter of next year, we expect sudden surges in volatility. The short to intermediate trend won’t change if the Dow does not end the week below 38.8K.

We have a hypothesis regarding market tops. As the market matures and moves closer to putting in a top, the weekly charts have more influence than the monthly charts. When we are in the final stages of the topping game, the daily charts take over and exert more pressure than the weekly charts. At this point, the weekly charts are leading the game, and this pattern usually starts to manifest 3-6 months before a top is in. The count for the weekly charts began in September. It will be interesting to see if this hypothesis pans out.

Our anxiety index is another development confirming that the markets will likely top in the 1st quarter of 2022. The gauge has moved precariously close to the moderate zone for the first time in almost two years. Even more, telling is the speed of this move; in less than ten days, it went from the border (almost) of the hysteria zone towards the perimeter of the Moderate zone.

A Fascinating Read: Does Technical Analysis Work? Unveiling The Truth

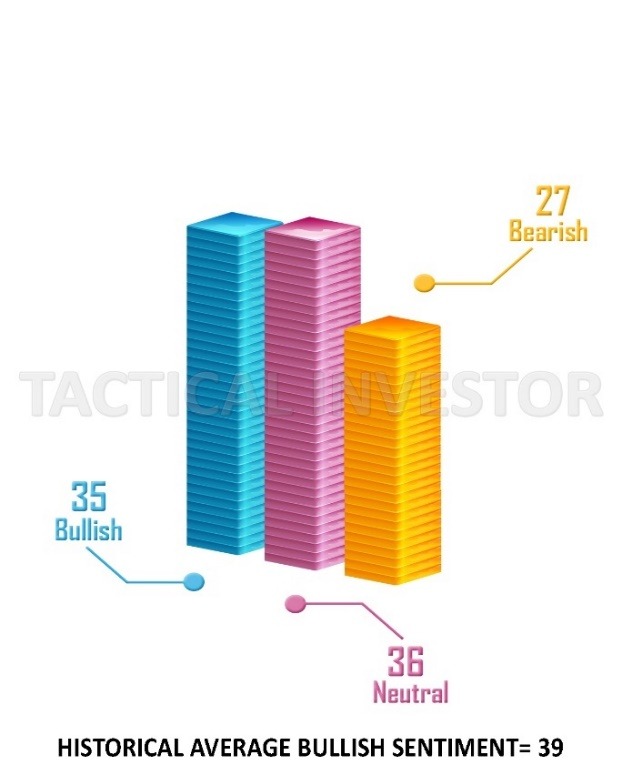

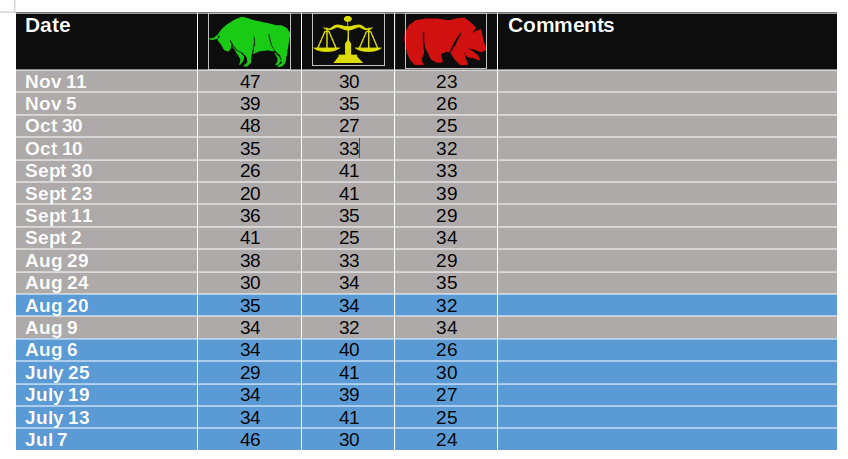

Historical Sentiment values

For the first time this year, we have three back-to-back readings where bullish sentiment is trading above its historical average. The first strong confirmation that the markets are going to put in a multi-week top next year. Market Update Nov 11, 2021

As soon as volatility levels rose, bullish sentiment shed 12 points, signalling that a strong correction may be on the horizon next year. However, this correction is expected to be short, as fear levels will likely spike into the next galaxy. Currently, the market has very few long-term investors, and most are fickle, quickly fleeing to the nearest exit when times get tough.

While many inflation experts have been urging the Fed to raise rates, they may soon be offering “mea culpa’s” and begging the Fed to step in. The Fed is likely to oblige, as “debase or die” may be their new slogan, with the masses, unfortunately, fulfilling the “dying” aspect of the saying. The Fed seems willing to do whatever it takes to achieve its goals, even if it means sacrificing everything in its path.

Conclusion

When combined with mass psychology, stock market technical analysis can yield above-average results. As we stated last year and this year, a lot of our proclamations are coming to pass, with the first part already unfolding. Once the MACDs complete the bullish crossover, we expect a mini-feeding frenzy that will ultimately pave the way for the next top. However, novice traders will likely be caught off guard and “get clobbered,” as the saying goes.

Almost every asset class is expected to suffer next year, with the high-tech sector potentially experiencing bloody carnage if the projected pattern pans out. While certain stocks in this sector have refused to pull back, likely, they will eventually do so, causing many “fake bulls and baby men” to learn a harsh lesson. It’s essential to remain vigilant, conduct thorough research, and make informed investment decisions to successfully navigate these volatile market conditions.

Bulls win some of the time, and bears win some of the time, but pigs always get slaughtered.

Tactical Investors Never Panic

At T.I., we never panic. As Tactical Investors, we are the last to leave the room and the first to enter. We take our time to make informed investment decisions, leaving the running to the fools.

Over the next 45 to 60 months, volatility will become even more critical for traders and investors to understand. However, volatility will take on a whole new meaning starting next year. After the anticipated correction in 2022, we expect the markets to experience massive moves in both directions. While some moves may seem catastrophic, only the astute investor will recognize the opportunities masquerading as disasters.

We wouldn’t be surprised if, after 2022, the Dow routinely experiences round turn moves in the 7K to 12K ranges within 12 months. A round turn move refers to the move from the low to the high, such as shedding 5K points before ending the year 7000 points higher, resulting in a round turn move of 12K points. The key is to remain vigilant, stay calm, and be prepared to capitalize on the opportunities that arise during these turbulent times.