Summer Stock market rally: To Be or Not to be?

Updated March 2023

We expected the markets to correct last year, but it was projected/expected to occur in two phases. The sanctions against Russia and not the war have exacerbated the situation. Hence, it appears that the market is experiencing both these corrections simultaneously. Does this mean the markets won’t experience a secondary correction? If the energy crisis in Europe is not resolved, then despite this strong corrective phase, the odds are very high that the markets will experience another correction in the 4th quarter. Stable energy and food prices are essential ingredients for growth and market stability. Market Update June 15, 2022

The stock market rally we expected and projected would occur came to fruition. However, this rally will fizzle out around October unless the picture changes dramatically.

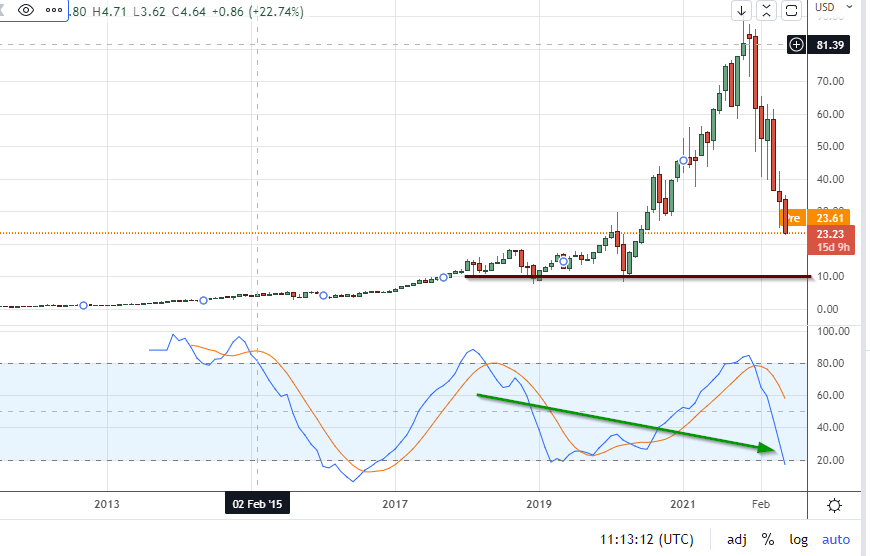

Stock Market Rally Projections: The monthly chart of TQQQ

It’s remarkable that despite all the ups and downs of the stock market rally since 2017, holding onto TQQQ, a highly leveraged ETF (3X), would have still left you in the black. Even with the low point in March 2020 at around 8.50, if you had purchased TQQQ at an average price of 15.00, you would have seen the ETF soar to the 90 range.

As a tactical investor, it’s always wise to take some profits off the table when an investment shows healthy gains. However, we want to emphasize that even a highly leveraged instrument like TQQQ has trended upward over the years, despite the occasional slippages. In bear markets, opportunities for investors can be limited, but in a bull market, the opportunity factor is almost limitless.

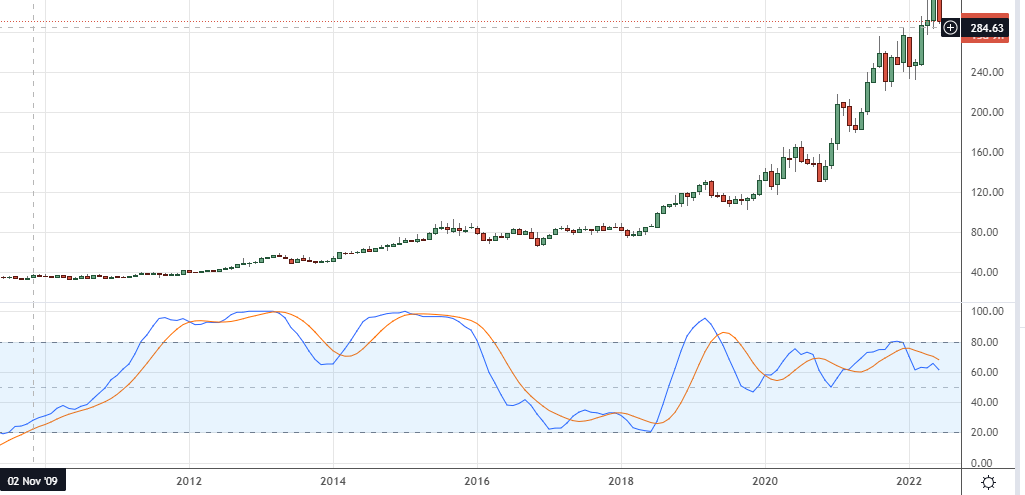

The monthly chart of LLY

While highly leveraged instruments like TQQQ may not be suitable for long-term holdings, some companies, like LLY, can be reliable options. For example, you could have bought LLY for around $60 before the 2008-2009 stock market crash and still made a significant profit. This shows that even in the worst market conditions, there are always companies that can weather the storm.

Furthermore, inflation has been a persistent concern throughout history, but the stock market has proven to be an effective hedge against it. While real estate is another option, it may not be accessible to the average person due to its high cost. On the other hand, the stock market provides an excellent opportunity for the masses to hedge against inflation. Despite some experts’ claims that the end of everything is near, it should be encouraging to know that the stock market has historically overcome even the worst situations.

As evidence of this, some hedge funds have recently been selling their shares, which may indicate an opportunity for investors to purchase stocks at a discount.

Smart Money Dumping stocks?

Hedge funds tracked by Goldman Sachs Group Inc. have been selling off U.S. equities for the past seven days, with the dollar amount of selling over the last two sessions reaching levels not seen since April 2008, when the firm’s prime broker began tracking the data.

This unprecedented exodus occurred as the equity market continued its sharp decline, fuelled by concerns that the Federal Reserve may have to accelerate its inflation-fighting campaign, which could lead to an economic recession. As a result, fast money investors rushed to double down on their bearish wagers while stocks tumbled and Treasury yields spiked. It’s clear that the smart money is selling stocks at a record pace, signalling a bearish sentiment in the market.. https://cutt.ly/YJ6NNWA

Hedge funds are not smart money; some are better positioned than the average joe, but by far and large, they fall under the umbrella of dumb money. Hence by far and large, they will miss out on the summer rally of 2022.

Geopolitics

The Geopolitical situation is on turbocharge now as the dumbest humans alive happen to be the Western world’s leaders. Calling it a recipe for disaster would almost sound quaint. The situation could change on the fly but never forget this slogan. The larger the deviation (from the norm), the better the opportunity. The top players are greedy, and the end game is always to make more money, and there is no way they can make more money if the markets crash permanently. They will create the illusion of a permanent crash, but it will only be an illusion, and those that fall prey to it will cry for years to come. You can bank on that. Market Update May 30, 2022

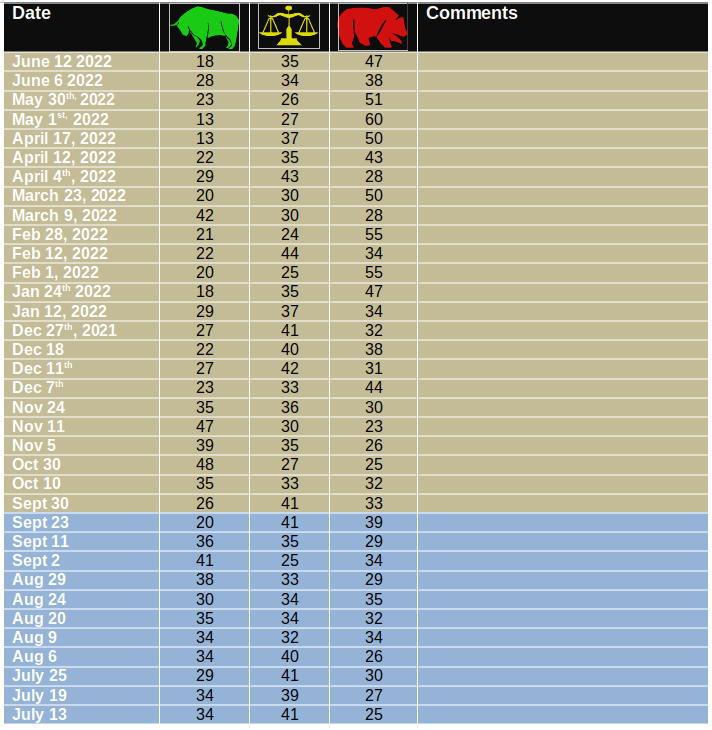

Historical Sentiment values

It’s essential to question the reliability of sentiment data when bearish sentiment is reported to be lower on May 1 than today or when bullish sentiment is reported to be higher today than on April 17 and May 30. This discrepancy suggests that data manipulation may be occurring on multiple fronts. However, this manipulation could be seen as a silver lining. It indicates that big money may be resorting to shenanigans to deploy all the capital they accumulated after the COVID crash.

We estimate that each prominent family at least doubled their net worth during that short phase by deploying massive amounts of money. They may need to create a boom cycle that lasts three times longer than the previous bust cycle to exit these positions. They may even extend the next cycle by a factor of six. Therefore, it’s crucial to remain vigilant and conduct thorough research before making any investment decisions.

A final selling wave will set the bedrock for the next massive rally. Investors don’t understand that the best time to buy is when everything looks bleak; instead, they wait for things to look bright before jumping in and feel very grim when the bottom falls out. Market Update May 30, 2022

Selling Climax will indicate a tradable bottom is close at hand.

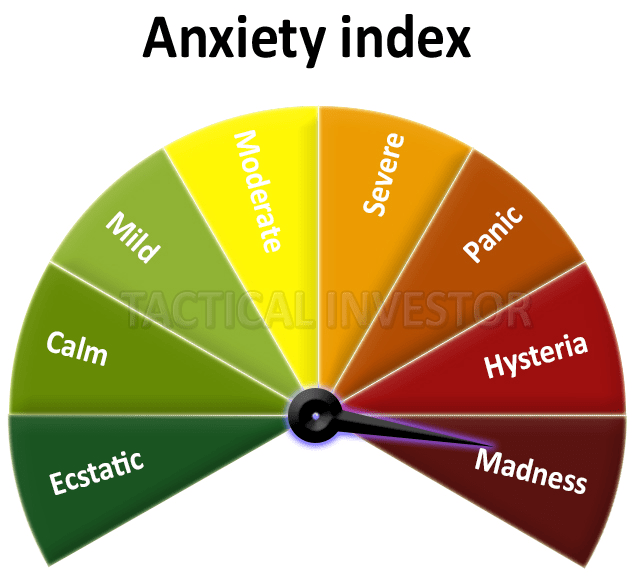

The strong selling wave that has hit the markets over the past week may culminate in a selling climax, as everyone and their grandmother appear to be in a panic phase, full of doubt. However, this could lead to a sharp reversal and a furious stock market rally. It’s worth remembering that just nine months ago; many investors were waiting for a pullback to jump in, complaining that prices were too high and hoping that high flyers like AMD, NVDA, TSLA, GOOGL, APPL, WMT, TGT, etc. would let out some steam. But now, the mantra has changed, and the focus has shifted from how high stocks can go to how low they will trade.

When opportunity knocks, it’s crucial not to shy away. While the outlook may remain volatile in the short term, history has shown that the best time to buy is when you and everyone you know are scared to press the buy button.

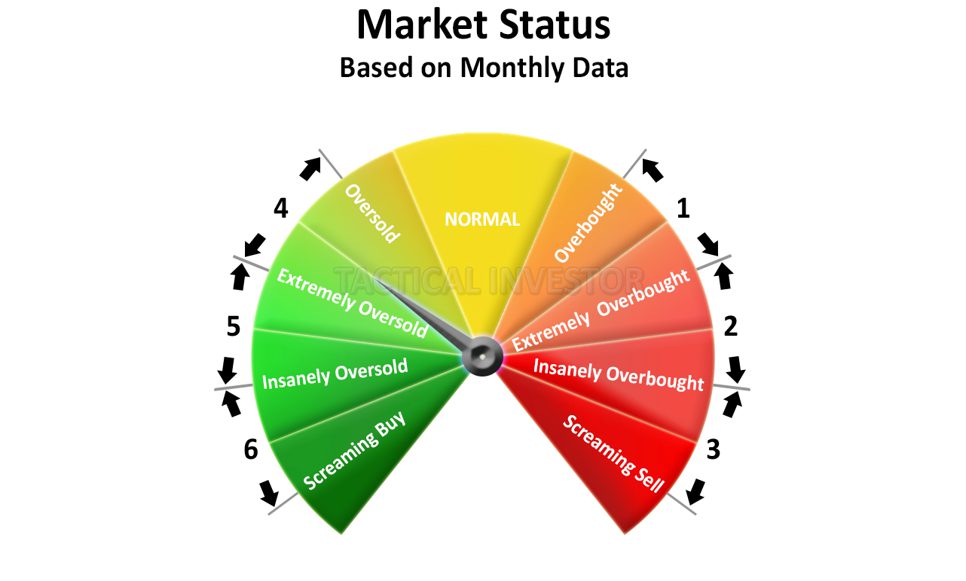

Instructions on how to utilize the above gauge are reserved for paying subscribers. The markets are trading in the oversold zone, and the risk-to-reward ratio is now in the buyers’ favour.

You Need to be in it to win it.

Investing in the stock market can be risky, and timing is crucial. As the saying goes, “You have to be in it to win it or out of it to lose it.” The masses are notorious for buying and selling at precisely the wrong time, and it’s important to remember that “nothing ventured, nothing gained.” While history does not repeat itself, it often rhymes.

The Summer Stock Market Rally 2022 is becoming a reality, but it’s important not to be overly enamoured by it. Unless the trajectory changes dramatically, the rally may fizzle out around October. However, plenty of time remains to book serious gains between now and October. It’s crucial to remain vigilant, conduct thorough research, and make informed investment decisions to maximize your gains and minimize your risks.

Stock Market Rally 2023 Outlook

Here’s a revision that smoothly incorporates the keyword “stock market rally” twice into the text:

Investors tend to be jittery and overreact to even the slightest bit of negative news. While the markets still have room to pull back on the daily timelines, the Dow could test the 32.5K range before bottoming out. Long-term investors, especially those in the low to a medium-risk category, should have been using recent stock market rallies, as we stated over the past few weeks, to lighten up their long positions. Only short-term traders, who can tolerate more risk, should attempt to capitalize on any potential upside.

Following a recent stock market rally that pushed almost all indices above their 2022 highs, the market outlook has turned positive, with expectations of continued gains until March, potentially extending to the end of the month. However, caution is still necessary, especially for the Nasdaq index, which has emerged as the strongest performer during the recent stock market rally.

Nasdaq Outlook

To maintain this positive momentum, the index should avoid closing below the critical support level of 11,400 on a monthly basis. The index came perilously close to breaching this level in February. On the other hand, if it can instead close above 12,000, it may quickly surge to the 12,300 to 12,600 range, with the potential for an overshoot to 12,900.

The markets will likely experience another selling wave before settling into a rangebound pattern for the next 18 to 36 months. While it’s possible that one index could momentarily trade at new highs during the next stock market rally, traders should be prepared for wide-range bound action. At T.I., we view rangebound markets as a trader’s delight and plan to make calculated moves to capitalize on this market condition. It’s important to remember that those who act in haste are usually laid to waste.

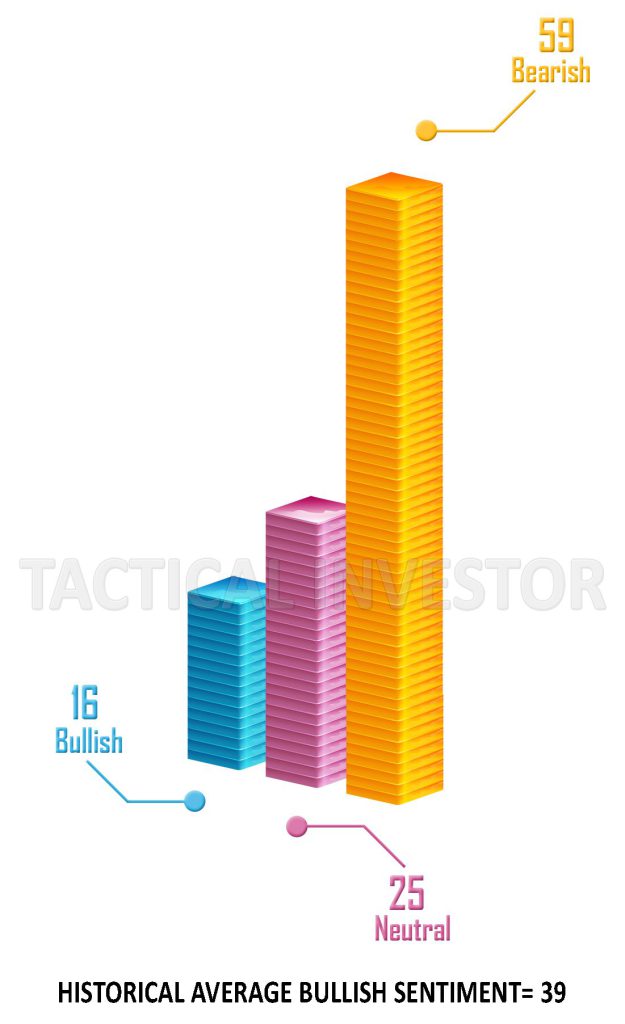

Sentiment Outlook

Despite a strong market rally since October 2022, it is surprising that bullish sentiment has not matched its historical average, stubbornly remaining below 39. At this point, one would have expected it to be at least in the 45 range. Market update, February 14, 2023

One thing that could potentially break the cycle of erratic market movements is a healthy dose of fear among investors. In other words, the crowd needs to be shellacked to eradicate the current yo-yo market behaviour. This would require bearish sentiment to surge above 63 or neutral readings to climb to 55 or higher. While it may seem counterintuitive, such a development could be what the markets need to regain their footing and move towards a more stable trajectory.