Decoding the 2023 Stock Market Outlook

Updated Feb 15, 2024

An Analysis of Bullish Sentiment and Market Fluctuations

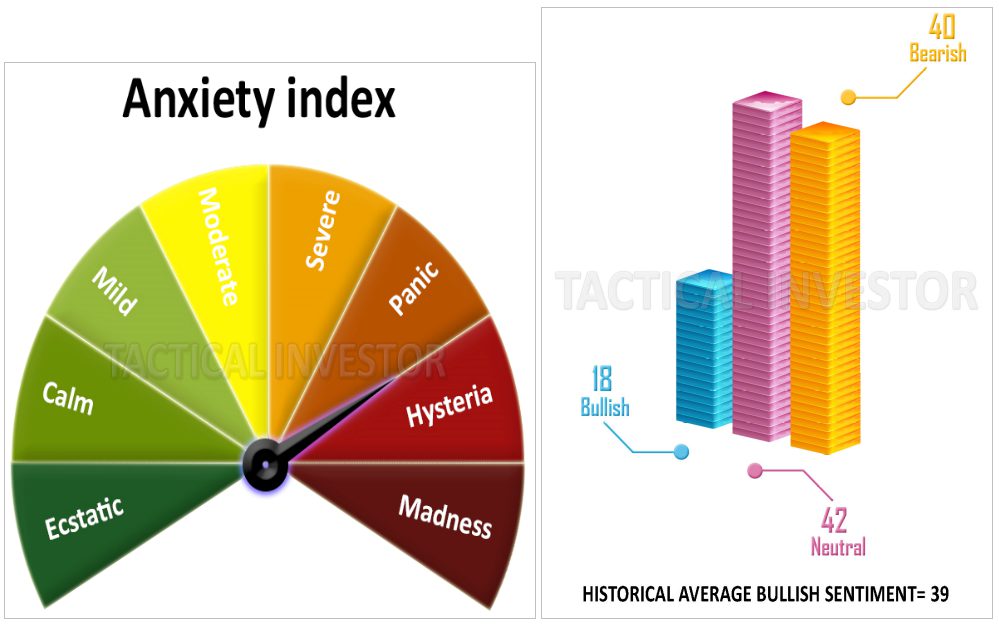

Amid a formidable market ascent that began in October 2022, one cannot help but notice with great curiosity that the bullish sentiment has yet to align with its historical mean, persistently remaining below 39. Under normal circumstances, one would expect the anticipation of a value of at least 45. Alas, only two possible explanations seem plausible at this juncture.

Firstly, the financial multitudes may be reeling from a symbolic blow, experiencing a prolonged period of uncertainty and doubt, as evidenced by subscriber data that reveals trepidation and unease similar to those felt during the turbulent times of October 2008.

Despite a strong market rally since October 2022, it is surprising that bullish sentiment has not matched its historical average, stubbornly remaining below 39. At this point, one would have expected it to be at least in the 45 range. Market update, February 14, 2023

Navigating Uncertainty and Apprehension Among Traders

It is disconcerting to note that the current levels of anxiety and uncertainty among subscribers are now nearly on par with the readings taken during the tumultuous times of October 2008. One cannot help but recall the events that followed in the aftermath of that time.

The financial markets subsequently experienced a singular, conclusive plunge, leading to the market’s nadir and ultimately leaving investors in psychological disarray for nearly a decade. This is a sad reminder that market fluctuations can significantly impact investors’ collective psyche, and one must remain vigilant and cautious during such times.

Should the apprehension amongst T.I. subscribers achieve an unprecedented zenith, it shall be incorporated into the criteria for FOAB. Furthermore, a mere trio of conditions remains; we shall witness the exceedingly elusive FOAB upon their fulfilment. In such an occurrence, the entirety of T.I. would commit all resources at our disposal, and even more through the mechanism of leverage, to the Market. Yet, we vehemently counsel against leverage or margin, save for those prepared to shoulder the accompanying hazards. A duo of criteria teeters on the brink of fulfilment; their realization would, by default, unleash a MOAB.

Prudent Investment Strategies Amidst a Delicate Market Balance

As the market teeters between recovery and further decline, investors grapple with a classic dilemma: to act now or wait for better opportunities. On the one hand, there’s a growing sentiment that current price levels may already reflect favourable valuations, offering a prime chance to enter the market. On the other hand, some traders may choose to wait, convinced that an even deeper correction could present more attractive buying opportunities. This balancing act mirrors the perpetual tension between the fear of missing out (FOMO) and the desire for optimal timing.

Mass psychology plays a significant role in these decisions. When markets approach critical junctures, such as reaching prior support levels or oversold conditions, crowd behaviour often tilts toward hesitation. Investors, driven by uncertainty, may hold back, convinced that the best deals are still on the horizon. This herd mentality can cause markets to stagnate, as a collective pause in buying pressure leads to fewer price movements. An illustrative example of this occurred during the 2018 market correction, where despite several assets appearing undervalued, many traders held back, waiting for prices to drop further. Eventually, those who hesitated missed out on a sharp recovery that followed.

Technical analysis tools can help investors navigate such scenarios. Indicators like the Stochastic Oscillator and the Relative Strength Index (RSI) are invaluable when gauging market momentum and identifying whether an asset is oversold or overbought. For example, when an RSI reading dips below 30, it suggests that a market or stock is oversold and may be primed for a rebound. Investors who understand this dynamic can make informed decisions about when to enter the market, avoiding the paralysis of waiting for “perfect” prices.

Ultimately, it comes down to a delicate balance between patience and action. While waiting for lower prices may sometimes pay off, being overly cautious can lead to missed opportunities. Informed investors should consider the broader market context, including psychological signals and technical patterns, to make prudent decisions rather than rely solely on gut feelings or herd behaviour.

Conclusion: Stock Market Outlook 2023

The market outlook for 2023 presents a nuanced picture that calls for strategic patience and adaptability. Although the bullish momentum has shifted to a more neutral stance, this should not be cause for alarm. Instead, it may signal a much-needed recalibration before the next significant market move. The market’s current position in extremely oversold territory is a key factor supporting this hypothesis, especially on monthly charts. Historically, markets in this condition have often rebounded sharply, suggesting that the present environment could offer long-term buying opportunities.

From a mass psychology perspective, this shift from bullish to neutral sentiment often marks a turning point where panic begins to subside, and rational decision-making takes hold. Investors should resist the temptation to react impulsively to this neutral phase. Instead, they can view it as a reset, potentially setting the stage for a more sustainable uptrend. This psychological shift can be likened to the market’s behaviour in early 2009, when a prolonged bull market followed extreme oversold conditions as fear gave way to cautious optimism.

Technical analysis reinforces this outlook. The FOAB (Force of a Bottom) hypothesis posits that when markets trade within a wide range and show oversold signals, they are likely preparing for a significant move upward. An example of this occurred in 2020 during the COVID-19 crash. Although markets were oversold, technical indicators like the MACD and moving averages signalled that a recovery was imminent, leading to one of the fastest rebounds in stock market history. For the current market, as long as the trend does not deteriorate further, the oversold conditions could act as a powerful catalyst for a reversal.

However, caution is still warranted. While oversold markets present opportunities, they can also stay in this condition longer than expected. Investors should remain conservative, temporarily suspending high-risk purchases and focusing on defensive plays until a clearer recovery signal emerges. By staying attuned to mass psychology and technical trends, savvy investors will be better equipped to navigate the complexities of the 2023 market, positioning themselves for success as the next major trigger unfolds.