Decoding the 2023 Stock Market Outlook

Apr 16, 2023

An Analysis of Bullish Sentiment and Market Fluctuations

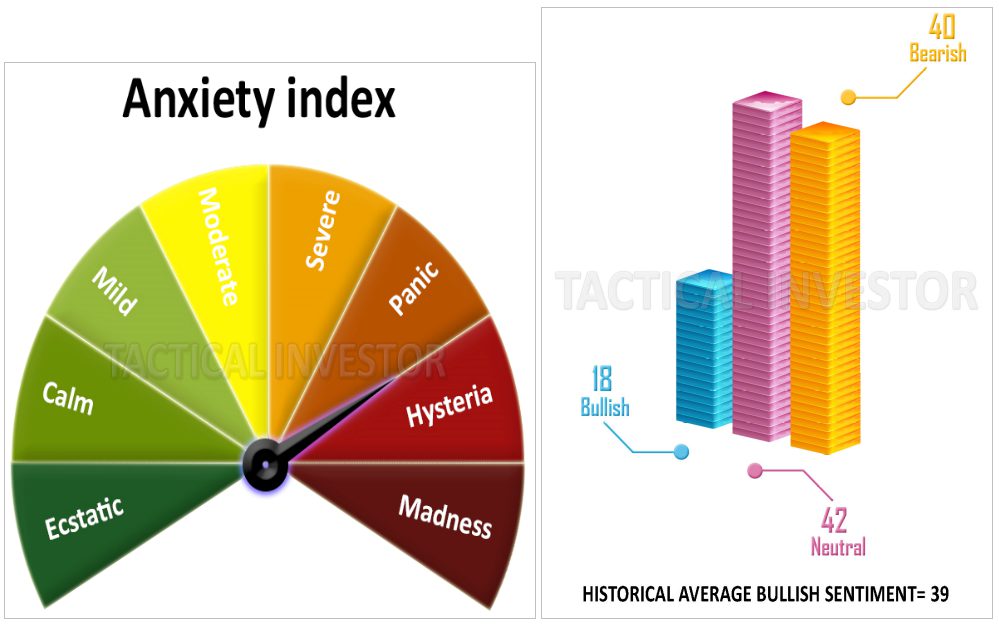

In the midst of a formidable market ascent that began in October of 2022, one cannot help but notice with great curiosity that the bullish sentiment has yet to align with its historical mean, persistently remaining below 39. Under normal circumstances, one would expect the anticipation of a value no less than 45. Alas, only two possible explanations seem plausible at this juncture.

Firstly, the financial multitudes may be reeling from a figurative blow, experiencing a prolonged period of uncertainty and doubt, as evidenced by subscriber data that reveals trepidation and unease similar to those felt during the turbulent times of October 2008.

Despite a strong market rally since October 2022, it is surprising that bullish sentiment has not matched its historical average, stubbornly remaining below 39. At this point, one would have expected it to be at least in the 45 range. Market update, February 14, 2023

Navigating Uncertainty and Apprehension Among Traders

It is disconcerting to note that the current levels of disquietude and uncertainty among subscribers are now nearly on par with the readings taken during the tumultuous times of October 2008. One cannot help but recall the events that followed in the aftermath of that time.

The financial markets subsequently experienced a singular, conclusive plunge, leading to the market’s nadir, and ultimately leaving investors in a state of psychological disarray for nearly a decade. This serves as a sombre reminder that market fluctuations can have a significant impact on the collective psyche of investors, and one must remain vigilant and cautious during such times.

Should the apprehension amongst T.I. subscribers achieve an unprecedented zenith, it shall be incorporated into the criteria for FOAB. Furthermore, a mere trio of conditions remains; upon their fulfilment, we shall bear witness to the exceedingly elusive FOAB. In such an occurrence, the entirety of T.I. would commit all resources at our disposal, and even more through the mechanism of leverage, to the Market. Yet, we vehemently counsel against the employment of leverage or margin, save for those prepared to shoulder the accompanying hazards. A duo of criteria teeters on the brink of fulfilment; their realization would, by default, unleash a MOAB.

Prudent Investment Strategies Amidst a Delicate Market Balance

On the other hand, an alternative interpretation suggests that traders may be biding their time for more advantageous valuations. However, the quandary lies in the realization that previous price expectations have been met. Suppose the market were to recede once more. In that case, there is uncertainty about whether traders would seize the opportunity or persist in their vigil, speculating that even more favourable prices lie ahead.

It is a delicate balance between seizing opportunities in the market and waiting for even more advantageous valuations, as no one can accurately predict the market’s future movements. Only time will tell which course of action proves to be the most prudent. In any case, it is important to approach these situations with a clear and level head, and to make informed decisions based on a thorough analysis of the market conditions.

Conclusion: Stock Market Outlook 2023

Fear not, dear reader, for the trend has shifted from Bullish to neutral, signalling a potentially auspicious turn of events. While it may be tempting to become agitated over this shift, one must understand that in the present circumstances, it could be a positive development. A promising long-term omen is revealed as we observe the markets trading in an extremely oversold range on the monthly charts. Moreover, as long as the trend does not deteriorate, it may be a significant catalyst for a major trigger, or a FOAB, in due course.

It is difficult to imagine the trend worsening while the markets are trading in an intensely oversold range on the monthly charts. This change in trend could also be perceived as secondary support for our hypothesis that the markets will trade within a wide range for up to 36 months. As a precautionary measure, we have temporarily suspended all high-risk purchases denoted in brick red or bright red text. Only sell orders will remain valid until we re-evaluate the situation.

FAQs – Stock Market Outlook 2023

1. What is bullish sentiment, and why is it important in the stock market?

Bullish sentiment refers to the overall positive outlook of investors towards the stock market. It is essential because it can influence market movements and affect investment decisions.

2. Why is it surprising that bullish sentiment has not matched its historical average despite a strong market rally?

It is surprising because, under normal circumstances, one would expect bullish sentiment to be at least in the 45 range. The persistent below-average bullish sentiment suggests that traders may be experiencing uncertainty and doubt.

3. What are the potential explanations for the persistent below-average bullish sentiment?

One possible explanation is that traders may be experiencing uncertainty and doubt due to market fluctuations. Another possible reason is that traders may be waiting for more advantageous valuations.

4. What is the FOAB, and what conditions must be fulfilled for it to occur?

The FOAB refers to the Father of all buys. Three conditions must be fulfilled for it to occur, and if it does, T.I. would commit all resources at their disposal to the market. However, T.I. strongly advises against the use of leverage or margin.

5. What is the importance of approaching market fluctuations with a clear and level head?

Approaching market fluctuations with a clear and level head is important because it allows for informed decisions based on a thorough analysis of the market conditions. It can also help prevent rash decisions that may lead to losses.

6. What is the stock market outlook for 2023?

The stock market outlook for 2023 appears uncertain, but things are starting to shape up. Shifting from bullish to neutral may signal a potentially auspicious turn of events. It is crucial to approach the situation cautiously and make informed decisions based on a thorough analysis of the market conditions.

Articles That Inspire: Our Collection of Compelling Reads

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Unmasking Deceit: Examples of Yellow Journalism

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Investment Journal: Charting the Course Toward Financial Triumph

Trading Success: From Riches to Rags and the Rise to Wealth Mogul

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology

Herd Mentality: Understanding the Pros and Cons of Conformity

Projected Silver Prices: Setting Sail for Precious Metal Ascension

Which Of The Following Is A Cause Of The Stock Market Crash Of 1929

Stock Bubble: Act Quickly or Lag Behind

The Dow Theory: Does It Still Work?

Tactical Tools: Unleash the Power of Trend Prediction