Market Correction Definition is the wrong topic to focus on; instead, focus on identifying the trend. Sol Palha

Market Correction Definition: Myths vs. Reality

Updated Sept 7, 2023

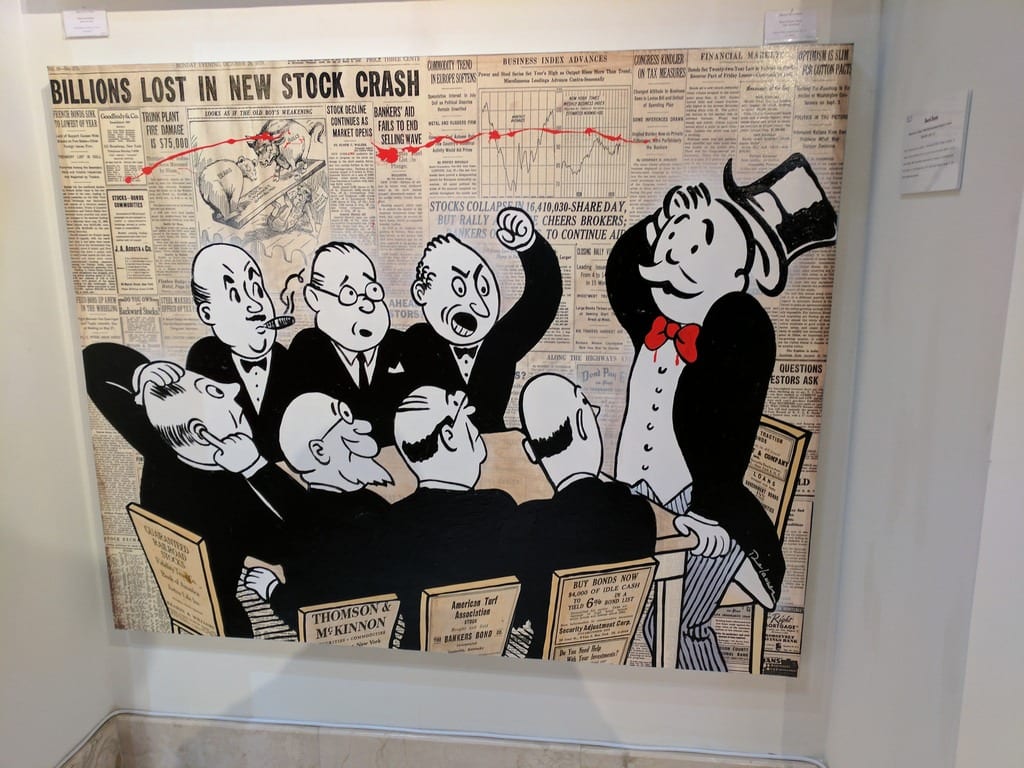

We will delve into this concept within the context of historical events, as history stands as the most insightful teacher in matters concerning the stock market. Learning from history helps us avoid repeating past mistakes. Additionally, we will demonstrate our real-time actions to provide practical insights.

Our overarching philosophy centres on allowing the trend to guide our decisions, particularly in an era where market manipulation prevails. It’s important to acknowledge that today’s markets are not truly free; corrections occur at arbitrary junctures. In simpler terms, the dominant players dictate when and to what extent the markets will correct, both upward and downward.

This is precisely why our focus remains on the trend rather than fixating on absolute price targets, given the removal of nearly all free-market forces. Developing our trend indicator required a substantial investment of time and resources. Consider how much simpler trading becomes when you possess advance knowledge of the prevailing trend. If the trend is upward, each pullback presents an opportunity for purchase, and conversely when the trend is downward.

Don’t fixate on trying to predict the exact top or bottom

Nonetheless, some individuals remain fixated on pinpointing exact entry points rather than embracing the concept of robust pullbacks as prime buying opportunities. This mindset has, unfortunately, caused them to miss out on the remarkable 7-year bull market, leading to regrets and wishes that they had taken action earlier.

What they tend to overlook is that they are essentially repeating the same pattern today as they did in the past. This is precisely why the market is poised to reach heights far beyond anyone’s expectations. Numerous investors fall into this category, and the unfortunate reality is that they often fail to realize that this mindset could eventually lead them to purchase assets at the market’s peak out of sheer frustration for having missed the entire upward journey, all in pursuit of that elusive “perfect entry point.”

Market Realities: Why PhDs Aren’t Guaranteed Wealth in Investing

If reason governed markets, then all those with PhDs and higher education would be the ones raking in the highest gains; instead, these chaps are the ones that consistently lose. You need to change your mindset now and throw this fear out of the window. Stop waiting for others to give you the push you need to give yourself. You cannot expect someone to dig you out of the hole you dug yourself into. The crowds’ biggest problem is fear; the second one is that they are angry and upset that they missed the ride up so far. Instead of viewing market corrections through a lens of fear and trepidation, the masses would do well to embrace them.

Navigating Investment Choices: Two Paths Ahead

You now stand at a crossroads with two distinct options, each with its own set of consequences. Your choice today could determine whether you secure gains or risk losing more.

Firstly, it’s crucial to dispel the notion of a perfect entry point. While we provide targets, we recognize that, especially with major indices like the Dow and SPX, these targets may or may not be reached. It’s important to understand that in the current market landscape, free market forces have a limited role. Instead, the top players dictate arbitrary correction endpoints, contributing to the extreme market fluctuations we predicted using our V-indicator.

The solution, however, remains straightforward. Create a list of stocks, ETFs, or other investments you’re interested in and patiently await pullbacks to seize opportunities. If you prefer a more hands-off approach, you can consider positions in the stock plays we recommend. Always keep in mind that perfection in timing the market entry is elusive. If such a moment were to occur, it would essentially be attributed to luck. Waiting indefinitely for that ideal entry point could mean missing the ride.

Your second option is to persist with the same strategy, hoping for a different outcome over time. However, it’s essential to remember that the classic definition of insanity is precisely this: repeating the same actions and expecting a new result.

Exciting read: Economy: Exploring Different Economic Systems

Capitalizing on Market Trends: An Opportunistic Approach

The prevailing trends across all three indices continue to point upward. However, it’s worth noting that the markets are trading within overbought ranges, and they have begun releasing some well-deserved pressure. This action will likely sustain volatility for the foreseeable future, a development traders welcome. Volatility often deceives the masses into believing that a market crash is imminent, prompting many to offload their high-quality stocks. Our V-indicator, designed to gauge market volatility and other factors, has surged to a new all-time high, reaffirming our belief in the endurance of this volatility.

In such conditions, the most prudent strategy is to leverage sharp pullbacks as opportunities to initiate positions in robust companies. The more substantial the pullback, the more enticing the opportunity becomes. It’s becoming evident that 2018 holds promise for the markets. Those who wait endlessly for the elusive perfect entry points will find themselves trailing behind. They will look back at today’s entry points with regret, just as they did in 2014, 2015, 2016, and 2017, wishing they had taken the leap. What distinguishes today from yesterday? In essence, nothing. The masses are restrained by fear and uncertainty, embodying the adage that “markets climb a wall of worry and plunge over a cliff of joy.”

Avoiding the Euphoria Trap: A Lesson in Timing

It’s a near certainty that the masses will dive into the markets either at the very top or perilously close to it. When that moment arrives, euphoria will have taken hold, and it will be our cue to exit. What we find both peculiar and amusing is how these individuals will eventually convince themselves to enter the market on some future day when it’s excessively overvalued, yet they hesitate to act now.

If possible, steer clear of this crowd. Despite their claims of seeking change, they continually follow the same repetitive patterns. Closely examining what drove them in the past will reveal that the same set of irrational emotions is steering their actions today. Consequently, they are bound to face losses. You cannot achieve victory by employing a methodology that has previously failed. There’s a term for this: it’s called insanity.

If you are part of this group and want to break free, force yourself to go against your emotions. Do the opposite of what you think you should, especially if it has failed to produce any results in the past. Going forward, view strong pullbacks through a bullish lens; change will not come from standing still.