A learned blockhead is a greater blockhead than an ignorant one. Benjamin Franklin

What is a Bullish Market: Follow The Trend, Avoid the Bend

Updated March 2024

A bullish market refers to a financial market in which prices are rising or are expected to rise. Historically, since the recovery began in 2009 after the economic crisis, the stock market has experienced a prolonged bullish phase. Despite numerous predictions of decline, the market has demonstrated resilience and growth.

Many corporations have been enhancing earnings per share (EPS) not through actual growth but through share buyback programs. Often perceived as financial engineering, this strategy presents a facade of growth, allowing companies to improve stock performance without increasing productivity.

The Federal Reserve’s adjustments to interest rates can influence market conditions. Despite rate hikes, there remains scepticism about the Fed’s ability to manage the economy’s underlying issues. The economy’s perceived strength is often attributed to the influx of speculative capital, or ‘hot money,’ which inflates asset prices and can create a disconnect between stock market performance and economic fundamentals.

Unemployment data from the Bureau of Labor Statistics (BLS) and other economic indicators are sometimes criticized for not accurately reflecting economic realities. However, for investors, the primary focus is often on market trends rather than these underlying metrics.

We can understand the market’s behaviour beyond mere economic data by integrating philosophical insights from thinkers like Seneca and Nietzsche. Seneca’s stoicism teaches us the importance of reason and the dangers of emotional reactions to market volatility. Nietzsche’s concept of ‘will to power’ might be analogized to the relentless drive of markets to push boundaries, regardless of the potential for eventual corrections.

While the current trend suggests a continuation of the bullish market, it’s recognized that no trend can persist indefinitely. Markets will inevitably encounter corrections. However, investors should emphasize capitalizing on present conditions rather than speculating on an uncertain future.

The pragmatic approach is to ‘follow the trend and avoid the bend,’ which means investing in alignment with current market trends and remaining vigilant for signs of a shift. This strategy suggests that predicting a market crash is less important than understanding and adapting to the market’s current trajectory.

Bullish Market: Three Charts Back This Assertion

The semiconductor sector needs to be in a strong uptrend for a market to rally on a prolonged basis. A quick look at the above chart (semiconductor index) shows that the index is in an adamant uptrend. It is trading above its primary uptrend line and has continued to trade to new highs over the past five years. It could drop to 650, and the outlook would remain bullish.

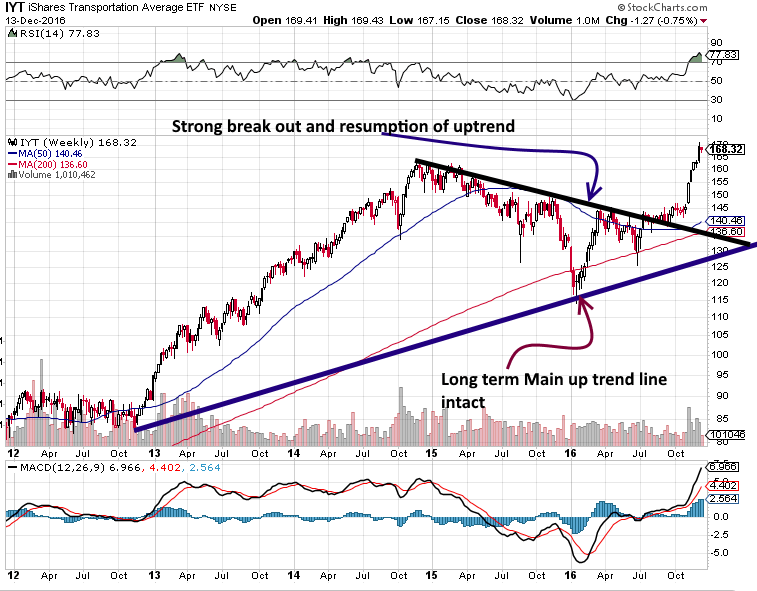

IYT (an ETF that mimics the Transports) is trending upwards again after experiencing a cleansing correction. A monthly close above 165 will pave the way for a test of the 195-205 ranges.

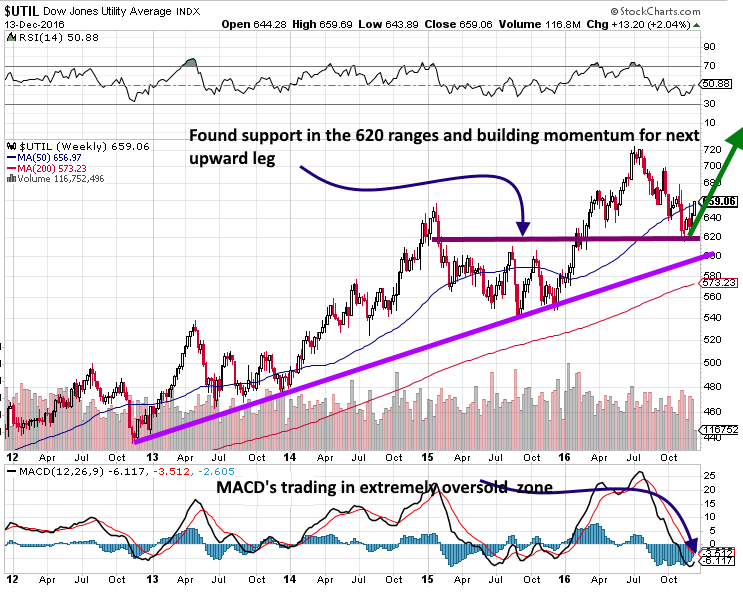

Finally, as we stated in the alternative Dow theory, Utilities appear to be preparing to trend higher.

As they are coming out of a correction, they will likely play around the 625-640 ranges before breaking out. The utilities lead the way up, so a breakout to new highs should be observed. If they break out to new highs, it would indicate that after a correction that could range from mild to intense, the Dow industrials should follow the same path.

Stock Market Crash will have to be put off for another day.

Data indicates that we are in a bullish market phase. Despite the pessimistic forecasts by some analysts, the market has not only survived but thrived since the 2009 financial crisis. This trend suggests that the market’s resilience is stronger than the so-called “Drs of doom” have anticipated.

Experts who have consistently predicted a market crash have often been proven wrong. Following their advice could have led to significant financial losses. The market’s endurance illustrates the complexity and unpredictability of economic systems, which can defy even the most confident of forecasts.

The influx of ‘hot money’—liquid capital that moves across borders in search of high returns—has been a significant factor in sustaining the bullish market. The Federal Reserve’s monetary policy, particularly the use of interest rate adjustments, profoundly impacts this flow of capital. Despite recent rate hikes, the market has not shown signs of an immediate downturn.

It’s important to distinguish between a market correction and a crash. Corrections are typically short-term adjustments following overvaluations, while crashes are more severe downturns indicating deeper economic issues. Experts often conflate the two, leading to unnecessary alarmism.

For a market to reach its peak, widespread investor participation is often necessary. Currently, there is a sense that not all potential investors have fully embraced the bullish market, which could mean there is room for growth before any significant downturn.

Incorporating philosophical perspectives, such as those from Seneca, can provide a stoic approach to market fluctuations, advocating for rational decision-making over emotional reactions. Nietzsche’s philosophy might suggest that the market’s drive to expand is akin to a natural expression of the ‘will to power,’ which can lead to overreach and eventual corrections.

While no market trend is eternal, the current data and expert analysis do not indicate an imminent market crash. Instead, investors are advised to focus on the present market conditions, favouring a bullish outlook. Monitoring the market for signs of change and adjusting strategies accordingly is essential.

Investors should base their decisions on trends and solid data rather than speculative fear. A balanced and diversified portfolio remains a prudent approach to mitigate risks during market volatility.

Strong Pullbacks are Opportunities

Financial experts often view market pullbacks as natural and healthy corrections within a broader uptrend. These dips are seen not as the harbingers of doom but as opportunities for investors to enter the market at more favourable prices. The adage “buy the dip” reflects this sentiment, suggesting that pullbacks can be strategic entry points for long-term investors.

Seasoned market analysts caution against the panic induced by short-term market declines. They advise that solid pullbacks should be assessed within the larger market context. If a company or the economy’s fundamentals remain solid, a pullback might not signal a reversal but rather a temporary setback.

Experts in market psychology understand that emotional reactions can drive market behaviour in the short term. However, they also recognize that these reactions often do not align with the underlying economic conditions. The fear generated by a pullback can lead to overreactions, creating buying opportunities for the more rational, disciplined investors.

Technical analysts and strategists often emphasize the importance of trend analysis. The phrase “the trend is your friend” expresses that aligning with the market’s prevailing direction tends to be a more successful strategy than trying to predict reversals. This approach involves identifying the trend’s strength and using tools like moving averages, Bollinger Bands, and Parabolic SAR to find optimal entry and exit points.

Looking at historical market data, pullbacks have repeatedly served as pauses in a continuing trend rather than the start of a downturn. This pattern suggests that pullbacks can be disconcerting. They are a normal part of market cycles.

Trading pullbacks effectively requires distinguishing between a genuine opportunity and a potential trap. This involves understanding the difference between a pullback and a reversal, recognizing the strength of the underlying trend, and having clear criteria for entry and exit points.

Experts stress the importance of risk management when trading pullbacks. This includes setting stop-loss orders to protect against the possibility that a pullback turns into a more significant decline and having a clear plan for taking profits during rebounds.

In summary, expert analysis suggests that solid pullbacks are not necessarily indicative of an impending market crash but can be seen as opportunities for strategic investment. The key is understanding the market context, managing risk appropriately, and maintaining a disciplined approach to trading.

Other Stories of Interest

List at Least One Factor That Contributed to the Stock Market Crash and the Great Depression

Thank you for commenting 🙂 . Most experts are fashion contrarians which equates to all talk and no action