Are We In A Bear or Bull Market? The Current Situation

Updated March 21, 2023

As we navigate the financial markets in 2023, the question of whether we are in a bear or bull market remains relevant. However, the current situation is vastly different from the years gone by.

The global COVID-19 pandemic has significantly impacted the financial markets, leading to a bear market in the early stages of the pandemic. The subsequent unprecedented stimulus measures implemented by governments and central banks worldwide have led to a sharp recovery, pushing the markets to new all-time highs.

The paradigm shift mentioned in the original text has become even more apparent in recent years, with the rise of digital assets and the increasing influence of social media on market psychology. The traditional tools used to analyze the markets may no longer be as effective in this rapidly changing landscape.

Looking at the markets through the lens of price and market psychology remains crucial, and investors must adapt to the new reality to make informed investment decisions.

Bullish Data Supporting the Market

Despite the unprecedented events of recent years, some bullish data suggests that the market could continue to trend higher. For example, corporate earnings have rebounded strongly since the pandemic lows, and the global economy is showing signs of recovery. The continued low-interest-rate environment has also supported the markets, with investors seeking higher returns than traditional fixed-income investments can offer.

The market’s upward trajectory may not be smooth, as evidenced by the sharp pullbacks experienced in recent years, such as the COVID-19 market crash. However, such pullbacks may present buying opportunities for investors who have a long-term view.

Whether we are in a bear or bull market remains relevant, but the current financial landscape vastly differs from a few years ago. Investors must adapt to this new reality and prioritize transparency, accountability, and adaptability to navigate the markets successfully. They can make informed investment decisions and achieve their financial goals by doing so.

The Fed’s Money-Printing Scheme: Don’t be Fooled by the Popular Narrative

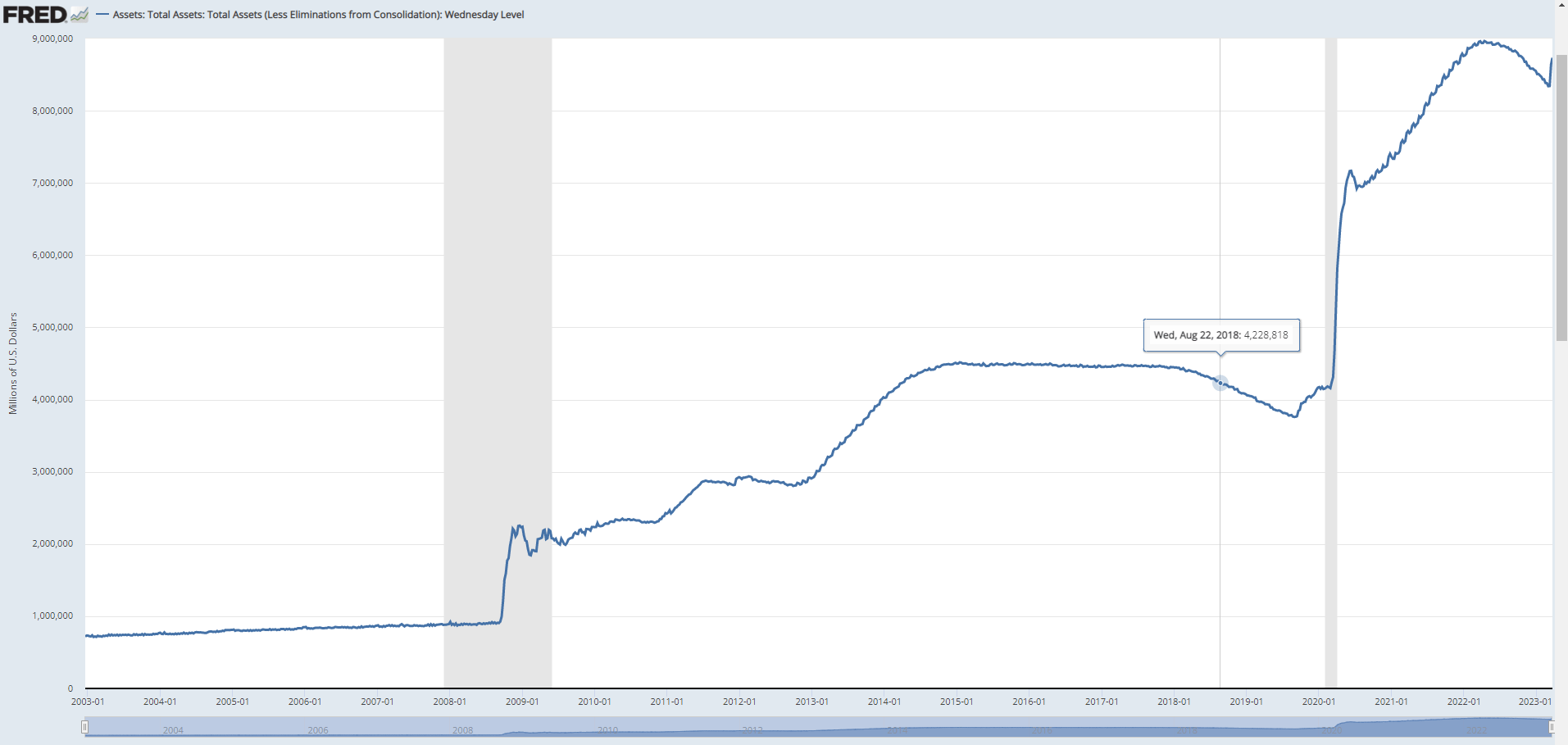

The chart many are quick to point to as evidence of the Fed’s dire straits is a case of the masses following the herd. Don’t be fooled by the popular narrative – it’s a classic case of groupthink leading to flawed analysis. The Fed is taking a breather before it unleashes another wave of money into the markets. And make no mistake, the longer the track, the bigger the boom. Expect a flood of epic proportions.

Those who cry wolf, insisting that this cannot go on, are the same ones who said the same thing when the Fed’s assets doubled from $800 billion to $1.6 trillion and then again when they doubled to $3.2 trillion. With assets nearing $9 trillion, they continue to sound the alarm, but the masses remain asleep.

The number itself is irrelevant – what matters is whether the masses have woken up. And in this case, they have not. Therefore, we predict the Fed’s assets will quickly surge to $8 trillion. The Fed’s printing money and buying treasuries, known as debt monetization, may seem like a giant Ponzi scheme, but the masses aren’t revolting. And as long as they remain silent, this process will continue unabated.

Don’t be swayed by the popular narrative or the naysayers who cry wolf. Take a closer look at the charts, and you’ll see that the Fed is far from being in deep trouble. As long as the masses remain silent, the Fed’s money-printing scheme will continue to fuel the markets.

Current Market Outlook

In investing, demonstrating patience and discipline does not mean waiting indefinitely. Instead, it means possessing the forbearance to wait for the most opportune moment to strike and having the discipline to follow through. Are we in a bear or bull market? That’s a question on many investors’ minds. However, one thing is clear: success requires patience and discipline.

We are in a stage of capitulation and despondency, similar to what the markets experienced during the 2008-2009 financial crisis. Many investors mistakenly assumed that the Market had bottomed in June-July 08, only to be taken aback when it continued to plummet until March 2009, when pessimism peaked. At that juncture, most investors gave up and did not venture back into the Market until 2018, almost a decade later. This unfortunate example highlights the importance of possessing both patience and discipline.

While our latest update didn’t feature targets for the SPX, let’s examine the NDX first, an extension of the Nasdaq. The NDX (Nasdaq 100) could potentially test the range of 13,600 to 13,800, possibly overshooting to 14,160. However, to maintain this outlook’s validity, it must not close below 11,960 on a daily basis. Should the NDX achieve this, the other indices will likely follow suit, rallying for two to three weeks, with rallying for up to four weeks.

Conclusion

Many investors lack a long-term perspective when it comes to the stock market. However, from this perspective, every crash or strong correction should be viewed through a bullish lens.

Mass psychology is obvious – the current situation is dangerously close to triggering a mother of all buys (MOAB), and history has shown that this can lead to huge gains. Having the patience and discipline to wait for the right moment to strike is essential.

As investors, it’s easy to get caught up in the short-term ups and downs of the market. However, it’s important to remember that the stock market is a long-term investment. By focusing on the big picture and maintaining a long-term perspective, we can better weather the storms and take advantage of opportunities when they arise.

So, while the current situation may be uncertain and even volatile, it’s essential to keep in mind the potential for a MOAB and the opportunities it may present. By taking a long-term perspective, we can make informed decisions and position ourselves for success in future years.

Other articles of Interest

Dow’s Ascendance: Monthly Stock Trends Unveiled

Sentiment Trader: March to Your Own Beat

Becoming a Better Investor: Key Strategic Moves

Investing in a Bear Market: Ignore the Naysayers

Buy the Dip: Dive into Wealth with this Thrilling Strategy

Resource Wars: Navigating a Shifting Global Landscape

Stock Market Sell-Off: Embrace Fear & Seize Opportunities

The Prudent Investor: Prioritizing Trends Over Speculation

Optimal Strategies for The Best Stocks To Invest Long Term

Market Correction Definition: Myths and Realities

Seizing Dominance: The Relentless Rise of Mental Warfare

Stock Market Predictions Today: Americans Fear The Market

Investor Sentiment Survey Defies Stock Market Crash Outlook

What is Inflation? Unveiling Effects and Strategies for Mastery