What Does Bull Market mean? Focus on Identifying one Instead

From 1994 to the peak of the dot.com bubble in March of 2000, the NASDAQ gained over 1200%. Bitcoin made this bubble appear sane, as in a much shorter period it tacked on over 11,000%. In contrast, since the market bottomed in 2009, the NASDAQ is up roughly 600%. When you look at it from this angle, this run-up appears orderly. We, therefore, think that there is a good possibility that this market could still surge to levels that will seem surreal. In short stock market bull, 2018 is strong, healthy and building up steam for the next leg up.

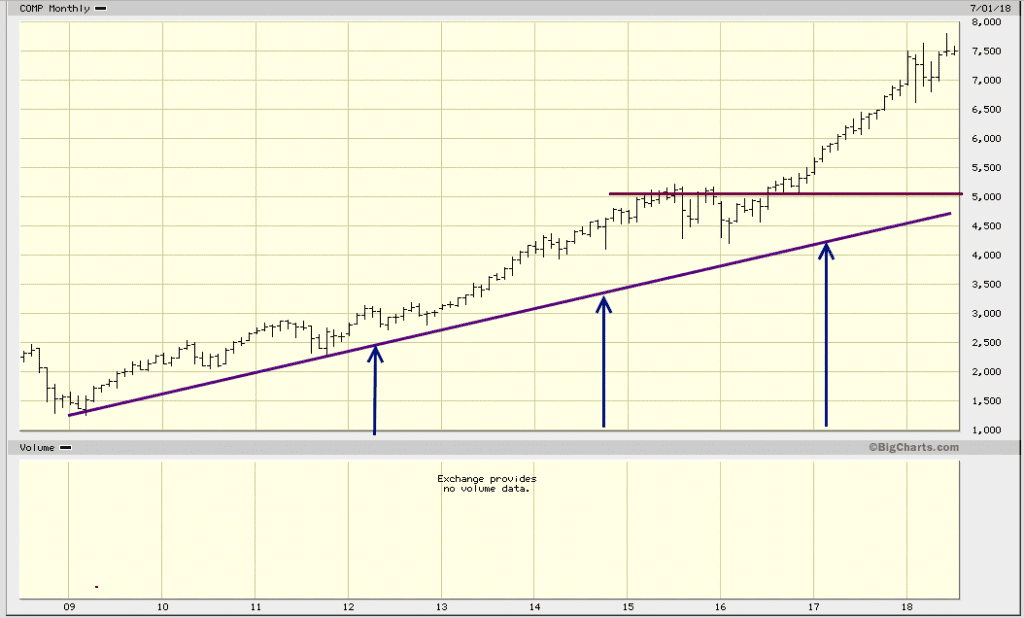

This was the chart we published on April 2017 and that time we stated that the Nasdaq could test its lows but that it was destined to soar higher as former resistance had turned into support. We also went on record to state that the Nasdaq was more likely to trade to 10K then trade below 5K. The Nasdaq bull market is alive and kicking; there are no signs that it’s ready to keel over soon.

What Does Bull Market mean; Experts Are Happy With Defining One

But when it comes to actionable advice, experts are Akin to Jackasses; all noise and no action

What many experts fail to understand is that a bull market starts only after the old high has been taken out. Until that occurs, it’s not a real bull market. In that sense, the NASDAQ bull has just started. For over 15 years the NASDAQ struggled to overcome this hurdle. Jack in the box is what comes to mind; so like a coiled spring, it is ready to trade a lot higher before it breaks down. The NASDAQ has already broken past the psychologically significant 6000 levels, so the odds are fair to high that it should roughly double from its breakout point; a move to the 9000-10,000 ranges might appear insane now. Experts would have felt the same way if someone told them that the Dow would be trading past 21K after it dropped below 7,000 in 2009. What happened to the stock market crash experts were predicting

Nasdaq Is on A Tear

What we stated in April of 2017 still holds true, the odds that the NASDAQ would test 10K before it dropped to or below 5K were much higher. As the markets are trading in the overbought ranges on the monthly charts we expect the consolidation to continue until our indicators move into the oversold ranges; ideally the trade into the extremely oversold ranges. In the interim, the action is expected to be volatile. Furthermore, according to the Tactical Investor Dow theory, the markets are unlikely to trade to new lows unless the utilities put in new lows. The trend is firmly positive, so a stock market crash in 2018 is highly likely. Astute investors should treat all sharp pullbacks have to be viewed through a bullish lens.

Stock Market Bull Game Plan

The stock market is not flashing any signals that an impending crash is in the horizon Market sentiment is far from bullish, and the internal structure of the market is still strong. The trend is positive, and therefore, sharp pullbacks should be viewed through a bullish lens. Mass Psychology clearly states that one should only abandon the ship when the masses are jumping up for Joy. Presently the masses are not jumping up for Joy, in fact, they seem to be concerned that the current trade wars and the extremely polarised political scene could derail this bull market.

When the masses are uncertain one should embrace that development with joy for uncertainty is a very close relative of fear. Uncertain individuals will jump from camp to camp hoping to catch the trend, but with each jump, they get closer to the edge of the cliff. In the end, one should not let emotions do the talking when it comes to the markets but observe what emotion or emotions is driving the masses. Once you identify the emotion, you can quite easily identify the trend. For now ladies and gentleman, stock market bull 2018 is building up momentum for the next upward leg.

Other Stories of Interest

Stock Market Crash 2018 Revisited (July 12)

Uranium Bull Market 2018; The Crowd psychology Outlook Updated (July 2018)

Stock Market 2018 Playbook; Follow The Trend (June 29)

Bear Market Fears-are they overblown? (May 28)

Stock Market Crash: Imminent or does this Stock Market Bull still have legs? (Apr 25)

Good Time To Buy IBM or Should You Wait? (Mar 15)

Is the Bitcoin Bull Market dead or just taking a breather? (Mar 8)

Is this the end for Bitcoin or is this a buying opportunity? (Jan 24)