Stock Market 2018 to 2024: How Crises Turn into Lucrative Opportunities

Jan 10, 2025

Introduction

Over the past decade, market analysts have repeatedly heralded doom, forecasting crashes that never quite materialized. For a decade, these prophets of catastrophe—despite their dismal accuracy—persisted with their “market crash” rhetoric. Now, as we enter 2024, these same voices oscillate from doom and gloom to sudden bursts of bullish optimism. Yet, when the market inevitably pulls back, the same chorus of experts is back, crying, “The crash is coming.”

But here’s the thing. The trend is your friend. And as much as the financial media would have you believe in the volatile, unpredictable whims of the market, the reality is far more concrete.

Let’s face facts: market predictions are often more about sensationalism than substance. Financial “experts” like to create fear, uncertainty, and doubt—while offering no real strategy to take advantage of the opportunities embedded within these crises. The truth is simple. Over the past several years, significant market corrections have been followed by sharp rebounds, often leading to even greater opportunities for savvy investors who understand market psychology and recognize the hidden resilience beneath the surface.

Market Sentiment: From 2018 to 2024

For much of 2018, the stock market was plagued by uncertainty. As trade wars escalated, geopolitical tensions soared, and social and political divisions deepened, the undeterred market continued to climb, offering opportunities to those who saw beyond the headlines. The so-called “experts” decried every dip as a precursor to a collapse, but the market proved them wrong time and time again.

However, as we moved into 2020, the situation took a sharp turn. The COVID-19 pandemic threw the world into chaos, and the financial markets were no exception. Panic set in as the economy ground to a halt, and stock prices plunged seemingly overnight. Yet, within the very same year, the market staged an incredible recovery, fueled by unprecedented government stimulus packages, vaccine rollouts, and the resilience of the technology sector.

The rapid rebound, as we now know, was not an anomaly. Instead, it was a testament to a fundamental truth many seemingly ignore: markets naturally recover from chaos. This recovery was not just a product of short-term factors like stimulus—it resulted from deep-seated market psychology. When fear grips the market, the long-term investors—those who have learned to read the crowd’s psychological pulse—are able to act decisively and exploit these temporary dips.

Now, as we face the turbulence of 2024, with the looming shadows of inflation, interest rate hikes, and geopolitical instability (particularly in Eastern Europe and China), the same old narratives continue to surface. Yet, once again, savvy investors know the truth. Market declines, while uncomfortable, present some of the greatest growth opportunities.

The Dow Theory: Refined and Tested

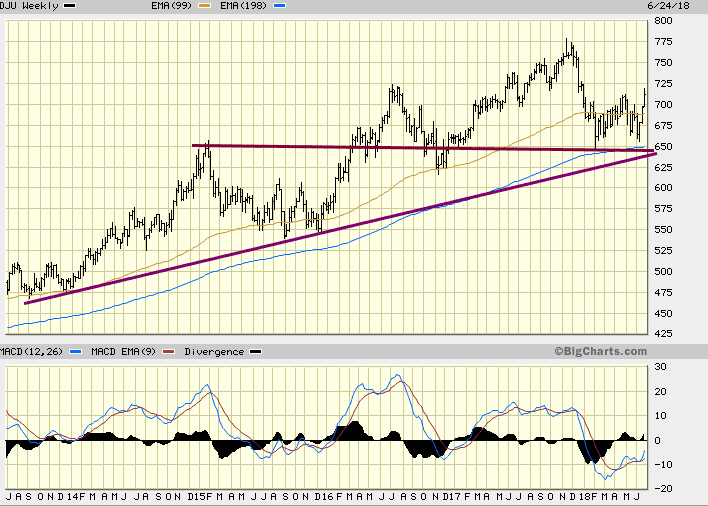

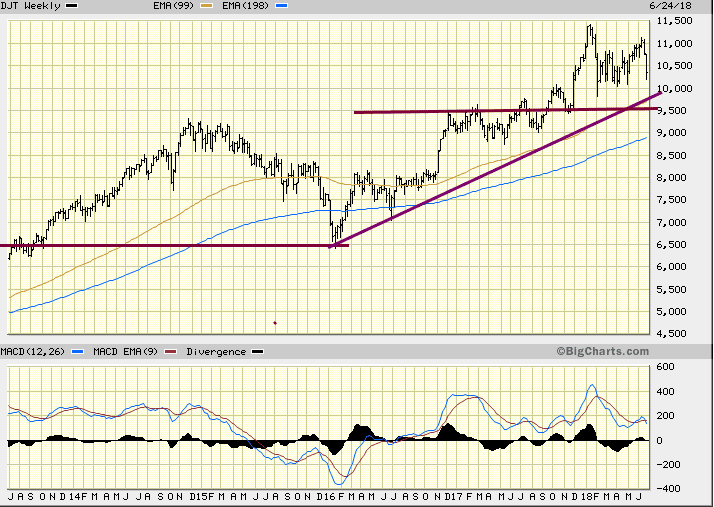

In 2018, the Dow Theory was a key part of the strategy. Today, it continues to offer insight into market direction. However, there’s a subtle shift in its application. Traditionally, the Dow Theory observed the relationship between the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). This relationship still holds, but with a crucial twist.

Since 2018, we’ve seen a divergence in the performance of the industrial and transportation sectors. While industrial stocks have sometimes underperformed, transportation stocks have demonstrated resilience. In fact, despite geopolitical tensions—such as trade disputes, global supply chain issues, and shifts in global manufacturing power—transportation stocks, especially within the logistics and shipping sectors, have continued to perform admirably.

This divergence is a signal. The market is sending a message: there is still underlying strength, and it can be found in the less obvious sectors. Investors who understand this dynamic—who don’t get lost in the noise of pessimism—can position themselves to profit from the strength in less conventional areas of the market.

Even more, the utilities sector remains a key bellwether. If utility stocks continue to hold their ground and don’t hit new lows, the broader market remains favourable. Until then, corrections should be viewed not as reasons to panic but as golden opportunities to add high-quality stocks at discounted prices.

Understanding Market Psychology and Sentiment Shifts

Now, let’s talk about the psychology of the market. One of the most profound insights gained over the past few years is the powerful influence of crowd behavior. From 2018 to the present, market behavior has been a direct reflection of societal sentiment. It’s no surprise that major market crashes have coincided with widespread panic—whether through the fear of trade wars in 2018, the panic caused by the pandemic in 2020, or the current inflation-driven concerns of 2024.

Mass Psychology and Market Trends

There is a key lesson here: understanding the collective psychology of the masses is the real key to successful investing. Market sentiment often swings from extreme optimism to extreme pessimism, and it is the psychological factors that drive these swings.

Think about the market in March 2020. When the pandemic first hit, panic-induced selling gripped the markets, and many investors assumed that the market would crash indefinitely. But those who could see through the mass hysteria—those who understood the nature of mass psychology—were positioned to capitalize on the recovery. They understood that markets are resilient, even in the face of chaos. They understood that fear creates opportunity.

By 2021, the market was back to breaking records, and the same individuals who had proclaimed doom and gloom were suddenly back, crowing about the bull market. It’s a vicious cycle.

Fast forward to 2024, and we are once again in a period of heightened fear exacerbated by geopolitical instability and rising inflation. But once again, we must remind ourselves of an undeniable truth: when fear is high, opportunity is born. The same investors who capitalized on the 2020 recovery are now eyeing the market with a level-headed approach.

The Role of Crisis in Creating Opportunity

We are constantly told that the market is on the brink of collapse—2024 included. Yet, historical precedent teaches us otherwise. Crisis, while a source of immense volatility, also serves as the crucible in which massive wealth is forged. In 2018, fears of a trade war sent markets into a tailspin, but those who bought the dip in high-quality stocks profited handsomely as the economy recovered.

In 2020, COVID-19 caused an economic shutdown, and the market crashed faster than anyone could blink. But for those who took the time to understand the underlying fundamentals, the crisis proved to be a once-in-a-lifetime opportunity. Take a look at the technology sector, which skyrocketed during the pandemic. Those who capitalized on this shift are now sitting on enormous gains.

The lesson here is simple: don’t fear the crisis. Use it. Market crashes and pullbacks are inevitable. But those who understand the market’s true psychology—and how to read the signals—can turn these crises into opportunities for long-term wealth creation.

Tactical Investor Insights: Looking Forward

The market’s recent volatility, particularly in 2024, might seem ominous at first glance. However, a closer look reveals that the principles of market psychology and the Dow Theory continue to point to a bullish outlook, provided you know where to look. This is not to say that challenges don’t exist—indeed, inflation, interest rates, and geopolitical tensions remain very real threats. But fear-based selling is often more damaging than the fundamentals suggest.

There are sectors poised to continue their outperformance—technology, energy, utilities, and healthcare. Even amidst rising costs and geopolitical volatility, these sectors are proving resilient. As always, the key is to identify the trends early and act decisively when others hesitate.

The message for 2024 is clear: The trend is your friend. If you understand how to read market sentiment and psychology, you can position yourself to profit from the inevitable corrections rather than being swept away by the panic-driven noise.

Conclusion: Seize the Opportunity

While the mainstream financial media continues to predict doom and gloom, remember this: markets are unpredictable in the short term, but they follow discernible psychological patterns in the long term. If you want to thrive in the coming years, focus on understanding and using these patterns to your advantage.

The crises we’ve faced from 2018 to 2024—from trade wars to pandemics to inflationary fears—have all been catalysts for both fear and opportunity. The market will continue to present moments of panic, but those moments are the very seeds from which future growth will sprout.

The rewards will be great for those bold enough to act on these insights. Don’t let the noise distract you—focus on the signals, trust the process, and embrace the opportunity. The trend is your friend, and 2024 is ripe for the picking.