Dow Theory vs Modern Strategies: Exploring Superior Technical Analysis Tools

Dec 20, 2024

The Evolution of Dow Theory: A Tactical Approach for Modern Markets

The Dow Theory, a cornerstone of technical analysis, has been a trusted guide for investors for over a century. However, this venerable theory faces limitations in today’s complex and dynamic markets. This essay explores an alternative, more adaptive approach, leveraging additional indicators and modern data analysis techniques. We also discuss the benefits of incorporating mass psychology and contrarian investing principles to further enhance our tactical framework’s effectiveness.

The Dow Theory: Limitations and Modern Challenges

Developed by Charles Dow in the late 19th century, the Dow Theory revolves around the movement of the Dow Jones Industrial Average and the Dow Jones Transportation Average. While it has had its successes, the financial world has evolved, and the theory now faces several challenges:

Market Complexity: Today’s markets are influenced by many factors, from global politics to technological innovations, creating intricate market dynamics that the Dow Theory struggles to capture fully.

Investor Sentiment: The theory underestimates the impact of investor sentiment and emotions, which play a significant role in market behaviour, especially during extreme volatility and uncertainty periods.

Lagging Indicators: The price and volume indicators used in the Dow Theory tend to lag behind actual market movements, providing signals that may be too late for investors to act upon effectively.

Past Patterns: The theory assumes that historical market patterns will repeat themselves, but markets are dynamic, and past performance does not always predict future results.

External Events: External Factors:** External factors, such as economic data releases or geopolitical tensions, can significantly influence market directions, yet the Dow Theory does not adequately consider their impact.

Notable examples of the Dow Theory’s failures include the 1987 stock market crash, the dot-com bubble burst in the early 2000s, and the 2008 financial crisis, where its signals lagged or failed to predict major market moves.

An Alternative Approach: The Tactical Investor’s Method

We propose an alternative Dow Theory that addresses these limitations. Our method introduces a greater focus on analyzing Dow utilities. By closely monitoring the behaviour of utility stocks and identifying when they enter oversold ranges and form potential bottoms, we can more accurately predict broader market performance.

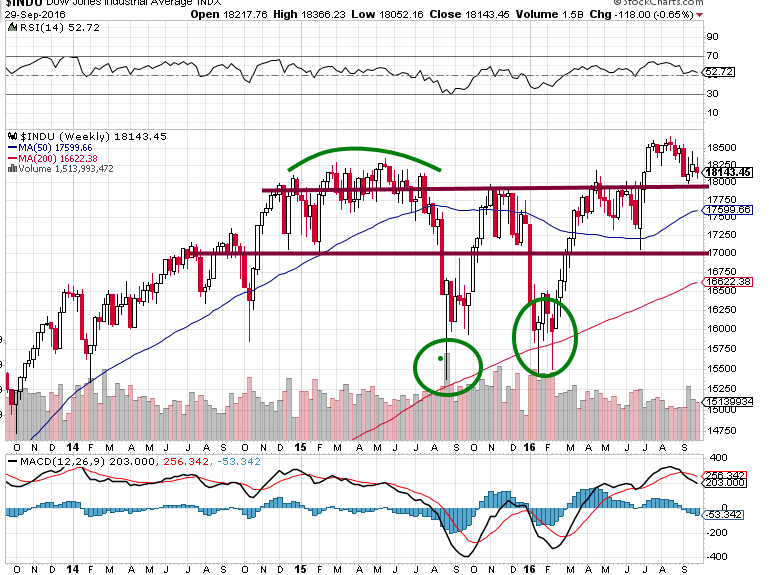

For instance, the chart below shows that the Dow Utilities (blue line) led the Dow Industrials (red line) during the 2014-2016 period. The utilities topped out in early 2015, followed by a similar move in the Industrials, illustrating the predictive power of our alternative approach.

Our alternative theory also leverages the power of modern computing and data science. With access to vast data sets and advanced analytical tools, we can identify complex patterns and market inefficiencies, providing a more nuanced analysis and timely signals for investors.

Enhancing the Tactical Framework: Mass Psychology and Contrarian Investing

While our alternative Dow Theory provides a robust framework, we believe incorporating mass psychology and contrarian investing principles can further enhance its effectiveness.

Mass Psychology: Understanding the behaviour of the masses is crucial in market analysis. Investor sentiment and societal trends can influence market movements. For example, during the COVID-19 pandemic, mass psychology played a significant role. Initial panic drove stock prices down, but as optimism returned, markets rebounded. Recognizing these psychological shifts can provide valuable insights for tactical investors.

Contrarian Investing: This approach involves going against the herd. Legendary investors like Warren Buffett have successfully employed this strategy. By seeking undervalued assets the market has overlooked, contrarian investors position themselves for substantial gains when the market corrects. For instance, during the 2008 financial crisis, Buffett invested in Goldman Sachs and General Electric when their stock prices plummeted, resulting in significant profits as the market recovered.

Contrarian investing also helps mitigate the impact of cognitive biases, such as overconfidence and confirmation bias, leading to more rational and profitable decision-making.

Conclusion: Embracing Tactical Evolution for Robust Market Navigation

In today’s fast-paced and complex markets, a tactical approach is not just beneficial; it’s essential. While the original Dow Theory has carved its place in the annals of financial history, our alternative, enriched with insights from mass psychology and contrarian investing principles, offers a more dynamic and adaptive framework. Tactical investors can navigate market turmoil with increased confidence and make more informed investment decisions by delving deep into market trends, investor sentiment, and the potential for undervalued assets.

The wisdom of H.L. Mencken, who often challenged popular thinking and highlighted the follies of following the crowd, resonates deeply with our approach. Mencken’s critique of the “booboisie,” his term for the unthinking masses, underscores the importance of stepping away from herd mentality—a principle that is at the core of contrarian investing. In line with Peter Lynch’s advice, “Know what you own, and know why you own it,” our methodology emphasizes understanding the underlying factors driving market movements rather than following them blindly.

Our alternative approach leverages historical patterns and the psychological undercurrents that influence market dynamics. It recognizes that “humans drive markets, and humans don’t change,” as Lynch noted. This perspective is crucial, particularly in volatile markets where emotional reactions can overshadow rational decision-making.

Furthermore, Mencken’s views on the limitations of traditional wisdom in facing new challenges are particularly pertinent. He argued that “for every complex problem, there is an answer that is clear, simple, and wrong.” This cautionary stance is vital in financial analysis, where the simplistic assumptions of the Dow Theory often fall short in today’s intricate market environments. Therefore, our approach does not seek simple answers but embraces the complexity and nuance required to understand and capitalize on market opportunities effectively.

In conclusion, by synthesizing the Tactical Investor’s Alternative Dow Theory with an understanding of mass psychology and a contrarian investing approach, we equip investors to survive and thrive in today’s and tomorrow’s markets. This evolution in our analytical approach empowers investors to stay ahead of the curve, leveraging both the wisdom of past financial leaders and the advancements of modern finance to maximize returns and minimize risks.

Epiphanies and Insights: Articles that Spark Wonder