Stock Market Success? It’s All in Your Mindset

March 27, 2025

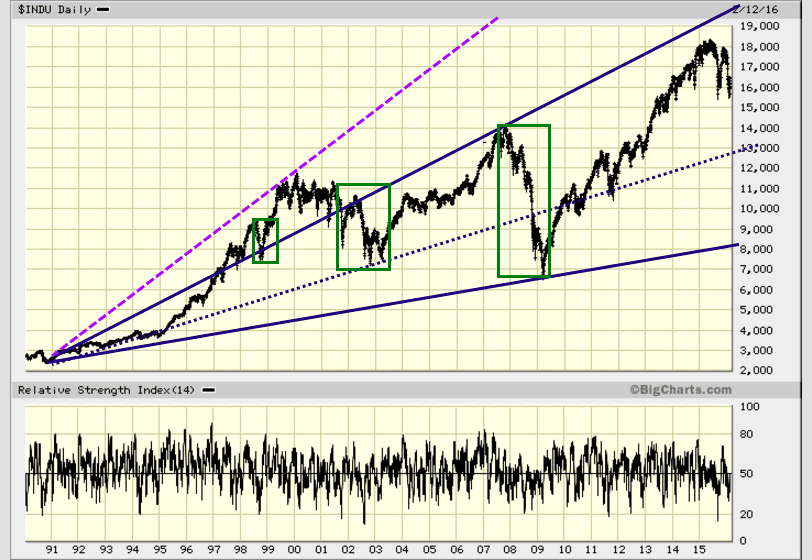

This isn’t just noise—it’s one of the few genuine corrections we’ve seen since 2011. And it might just be the prelude to something bigger on the upside. But it’s not the only one. There are key moments in recent market history where deep corrections turned into rocket fuel for explosive gains—and we will unpack them.

Let’s start with a familiar ghost: 1998. Back then, the dot-com era looked like it was unraveling. Russia defaulted. LTCM imploded. Panic surged. But then—boom. In 1999, the NASDAQ didn’t just rebound—it went vertical, gaining nearly 100% in a single year. The market had flinched… then surged with brutal intensity. The chart below captures this whiplash reversal—a stark reminder that when conviction fades, asymmetry begins.

But that wasn’t the only time fear disguised fortune.

Shakeouts, Snapbacks, and the Silence of the Bold

2016: Amid a commodity meltdown and a Fed tightening cycle, markets stumbled early in the year. Recession chatter reached a fever pitch. Oil hit $26. It felt like a breakdown. Instead, it became a launchpad. Tech led the charge, and the S&P closed the year near all-time highs.

2018’s Q4 Selloff: A violent 20% drop in weeks. The Fed was tightening, volatility was surging, and the bears were pounding the table. But then Powell pivoted—and the market roared back, kicking off a powerful rally that caught almost everyone flat-footed.

March 2020: No need for reminders here. The fastest crash in history… followed by one of the quickest recoveries. If you blinked, you missed a generational buying opportunity. That V-shaped monster was driven by panic first, liquidity second, and sheer disbelief third.

Each of these corrections shared the same psychological signature: fear-driven liquidations followed by disbelief during the rally. Each one rewarded those who could cut through the noise and act with strategic aggression.

This current correction belongs on that same battlefield. Whether it’s a final shakeout or the start of something deeper, it reveals who’s reactive… and who’s ready.

Mindset: The New Psychology of Success — Obey the Trend, Not the Crowd

This bull market has survived assassination attempts for years. Doomsayers have lined up, armed with logic, charts, debt ratios, geopolitics—you name it. And to be fair, many of their reasons made sense. But markets don’t run on reason. They run on emotion, illusion, and misdirection.

Success in the markets has never belonged to the rational observer. It belongs to the predator who understands the emotional climate—who knows when the herd is frothing with euphoria or drowning in fear. Logic screams from the sidelines. Price moves in silence.

The masses? Always late. They chase tops. They sell bottoms. They confuse motion for progress. Their reward is pain—both on the way in and out. The irony? They repeat the cycle, convinced the next time will be different. It never is.

If there’s one mantra worth tattooing into your trading psyche, it’s this: The trend is your only friend. Everything else—news, noise, narrative—is a threat.

The Game Behind the Game

Forget “neutral” Fed policy. That was yesterday’s myth. The Fed is now the world’s most aggressive speculator—not with stocks, but with psychology. And the message is crystal clear: They want you in the game.

Negative interest rates aren’t just policy—they’re psychological warfare. This is financial Darwinism by design. The Fed is engineering a slow panic by punishing savers and distorting risk-free returns. A migration. Capital will flee fixed returns like rats off a sinking ship—and land in risk assets. Equities. Real estate. Anything that moves.

This is not just sa timulus. It’s a paradigm shift.

Negative rates create forced participation. Even the most conservative players—pension funds, retirees, institutions—will have no choice but to speculate. And that speculation will serve as the fuel for the next supercharged rally. This isn’t accidental. It’s engineered.

So what’s the play?

Build Your Arsenal, Strike on Weakness

Create your war chest now. Curate a list of stocks with real muscle—companies with dominant moats, explosive growth, or both. Wait for the fear spikes. The pullbacks. The market tantrums. That’s when you strike—not with hesitation, but with precision.

Here are a few to keep on the radar:

BIDU, TSM, AMD, AMZN, BABA, GOOG, JD, etc — each has weathered storms, and each has the DNA to survive and thrive in a negative-rate world.

This isn’t about catching bottoms or tops. It’s about understanding momentum psychology—getting in while others hesitate and riding the wave others are too scared to see forming.

It appears this market is experiencing one of those rare but inevitable “backbreaking corrections” that every long-term bull run endures at least once. It’s not the first—nor will it be the last. Over the coming weeks, we’ll cover several such moments from the past that were initially mistaken for the end, only to be followed by seismic rallies.

It appears that markets are experiencing the “backbreaking correction” that every bull market experiences at least once and is often mistaken for the end of the bull. In today’s manipulated markets, one cannot tell which correction will morph into a backbreaking correction, as free-market forces have almost been eliminated from today’s markets. While it feels like the end of the world, such corrections always end with a massive reversal. Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course; it could tack on 2200 to 3600 points within ten days. Interim update March 9, 2020

Conviction fades fast in moments like this. The crowd always feels like it’s “different this time.” But the data, the charts, and the patterns keep whispering the same truth: fear distorts, overreaction exaggerates, and opportunities multiply.

Let’s rewind to other critical inflection points—lessons burned into market history:

1998 – The dot-com boom seemed ready to unravel after a harsh selloff. The headlines were drenched in doom. But what followed? A euphoric 1999, where the NASDAQ tacked on nearly 100% in gains—its most explosive year ever.

2009 – The market is forming a pattern that is dangerously similar to 2009, especially in the sentiment arena. We all know what happened after that.

2011 – Another fierce correction triggered by fears of a double-dip recession and Eurozone collapse. But instead of collapse, it lit the fuse on a multi-year rally that would define the post-2008 bull.

2015-2016 – China’s slowdown, Brexit anxiety, and collapsing oil prices fueled panic. Yet the S&P went on to break record after record.

2018 – The fourth quarter meltdown felt brutal—many thought the bull was dead. But once again, a dramatic V-shaped recovery unfolded.

The masses never see the reversal until it’s well underway. That’s the nature of a backbreaking correction—it exists to break emotional conviction, not trend structure.

Stock Market Update Oct 2019

APPL is also forming a fascinating and bullish pattern, which bodes well for this market, as this stock was a laggard. The canary in the mine could signal that the markets might be overreacting to all the negative news.

Copper continues to form a bullish pattern. Once the MACDs on the monthly charts experience a bullish crossover, the markets will get a boost, as copper is a leading economic indicator. Copper Stocks are expected to outperform the market over the next 6-9 months.

The Dow utilities surged to new highs in September. According to the Tactical Investor alternative Dow Theory, it is an early indicator that the Dow industrials and Dow Transports will follow suit.

Everyone is jumping onto the negativity bandwagon, as seen by the enormous amounts of money leaving the markets. Therefore, the only plausible outcome is that the crowd (as always) will get hammered.

Remember, emotional narratives dominate the airwaves during every correction. But when insiders start loading up, it’s not random—it’s signal.

Stock Market Outlook March 2020

To put things into perspective, consider this: If cancer were a virus, it would be one of the most lethal viruses of all time, yet no one blinks that we lose 9.6 million people a year to this insidious disease. Until mass-scale testing is underway and the data is broken down into categories such as age group and other pre-existing conditions, all the massive death projections experts are issuing amount to faulty science.

It appears that the only course of action on the table is to give in to panic and flee for the heels. Well, that’s true if you are part of the herd; such action brings short-term relief at the expense of significant gains for the long-term player. Nobody knows the inner workings of a company better than the insiders, and these chaps are doing something that can only be described as unprecedented, further confirming that this sell-off represents opportunity instead of a disaster. We will finish tabulating the latest batch of sentiment data tomorrow, and another update will be sent within 48 hours, if not sooner.

Final Word: The Market Doesn’t Reward Good Intentions—It Rewards Bold Adaptation

Forget what should be. Focus on what is. The market doesn’t care about fairness or logic. It cares about liquidity, sentiment, and flow. If you’re waiting for everything to “make sense” before acting, you’ve already missed the move.

Master your emotions. Embrace controlled aggression. And above all, submit to the trend—but never to the herd.