Navigating the Market: A Closer Look at S&P 500 Forecast

Oct 29, 2024

Welcome to the wild side of investing, where ancient wisdom collides with modern market mayhem. It’s time to challenge everything you thought you knew about financial markets and embark on a journey that will make the great Warren Buffett seem like a risk-averse novice. In this chaotic world, we will navigate the intricate dance between mass psychology, behavioural finance, and technical analysis to uncover the secrets of predicting market movements. Brace yourself, for we are about to disrupt conventional wisdom and rewrite the rules of the investment game.

The financial markets are a battlefield; we must understand the ancient art of war to conquer it. The legendary Chinese general Sun Tzu once said, “Know your enemy and know yourself, and you shall win a hundred battles.” In the context of investing, our enemy is not solely the unpredictable nature of the markets but also our human nature, which often leads us astray. Thus, we must master the art of understanding mass psychology and use it to our advantage.

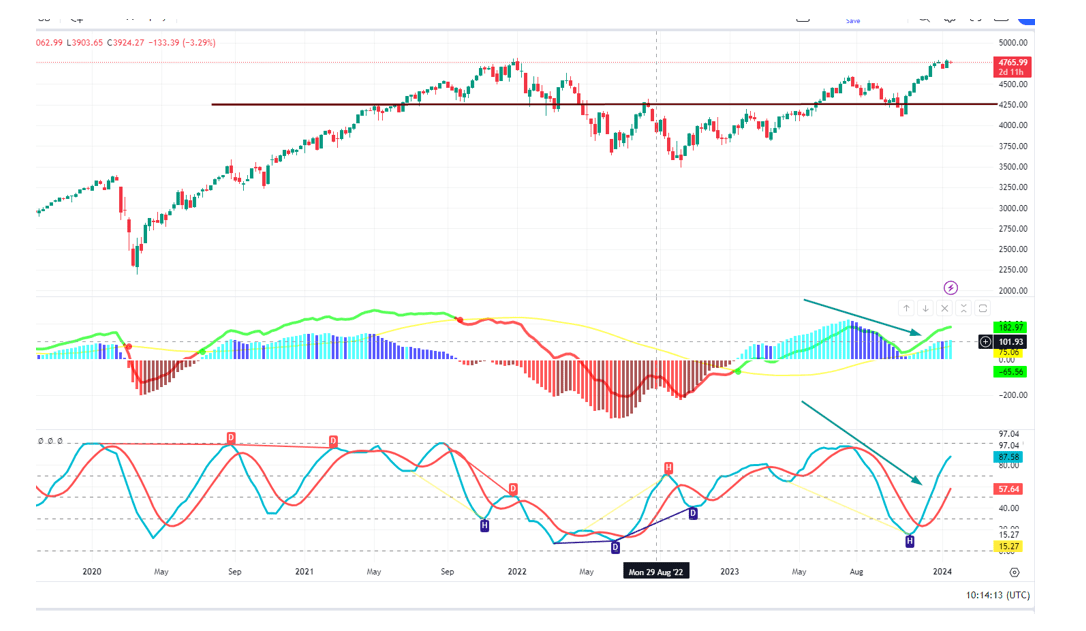

The key to predicting market movements lies in understanding sentiment. Several weeks ago, bullish sentiment soared to 56 but took a step back, forming a base instead of maintaining its upward trajectory. To avoid a situation reminiscent of 2022-2023, where bullish sentiment lingered unusually low, we must see it surge to 60 multiple times. Failure to do so might indicate a minor pullback to the 40-45 range, followed by a potential rally. Tactical Investor Jan 2024

Today, we find ourselves at a critical juncture, with the S&P 500 (SPX) hovering around the 4800 mark. As we contemplate the possibility of a potential correction, it is crucial to recognize that the key to success lies in analyzing charts and data and comprehending the sentiment and behaviour of the investing populace. Are we poised for a bullish surge, or is a minor pullback on the horizon? The answer lies in the intricate balance between market sentiment and mass psychology.

The Market’s Martial Art: Dancing with Mass Psychology

Imagine a vast ballroom, its polished floor gleaming under the glow of crystal chandeliers. In this grand setting, the market participants are not mere investors but graceful dancers, each with their unique style and rhythm. The music, a symphony of news headlines, economic indicators, and whispered rumours, set the tempo for their intricate steps. Yet, amidst the elegance, a fierce competition unfolds as each dancer strives to anticipate the crowd’s next move, their eyes fixed not on their partners but on the subtle cues and subtle shifts in momentum.

The S&P 500, often called the “belle of the ball,” commands the room’s attention. The eager crowd scrutinizes, analyzes, and interprets every twirl and turn. As it gracefully surpasses the 4800 mark, the atmosphere buzzes with anticipation. Is it poised for a graceful ascent, or will it stumble, causing a ripple of corrections across the market?

Two distinct styles emerge among the dancers: the bullish waltz and the bearish tango. The bullish dancers, full of optimism and confidence, sweep across the floor with graceful arcs and soaring lifts. Their steps echo the sentiment of hope, reflecting a belief in the market’s endless upward trajectory. In contrast, the bearish dancers move with calculated precision, their steps marked by caution and strategic retreats. They anticipate the music’s shifts, ready to pivot and adapt at the first sign of a changing tide.

Yet, amidst the elegance and strategy, a crucial element remains hidden—the subtle force of mass psychology. The unseen conductor influences the dancers’ every move, shaping the very rhythm and tempo of the ballroom. This force harnesses the power of sentiment, the collective emotions and beliefs that drive human behaviour. The invisible thread connects each dancer, guiding their steps in harmony or discord.

The Bullish Waltz and the Bearish Tango

Within the grand ballroom of the market, the bullish waltz and the bearish tango represent the opposing forces that shape the investing dance. These contrasting styles reflect the ebb and flow of market sentiment, with each step and turn influencing the direction of asset prices.

The bullish waltz, a graceful and uplifting dance, signifies investors’ collective optimism and confidence. It is characterized by smooth, upward movements, with dancers gliding across the floor in harmonious steps. This waltz embodies the belief in endless growth and prosperity, where each upward arc reflects the market’s ascent to new heights. The bullish dancers swept up in a tide of positive sentiment and moved in unison, their steps fueled by a shared vision of success.

In contrast, the bearish tango is a more cautious and strategic dance. Sharp, downward movements and calculated pauses mark it. The bearish dancers move with a sense of tre, anticipating potential pitfalls and market corrections. Their steps are deliberate, reflecting a cautious approach to the market’s uncertainties. While the bullish waltz soars enthusiastically, the bearish tango grounds itself in realism, always prepared for the unexpected.

The transition between these two dances is not always clear-cut. At times, the market may sway gently, with investors cautiously optimistic, resulting in a delicate balance between the bullish and bearish styles. Other times, the dance may become frenzied, with wild swings and abrupt changes in sentiment. During these volatile periods, the true nature of mass psychology becomes apparent as investors’ emotions run high, influencing their decision-making processes.

As investors, it is crucial to recognize the nuances of these contrasting dances.

Our approach involves plans A, B, and C (not discussed now).

Plan A: The Standard Approach

The standard plan is to wait for the markets to release substantial steam.

Plan B: Adapting to Market Sentiment

If the sentiment doesn’t follow the expected trajectory, markets may release less steam. For instance, the SPX might test the 4200 to 4300 range, possibly overshooting to 4020 to 4050. This move could push the markets into the oversold range, prompting a strategic re-entry based on the evolving sentiment scenario.

Understanding sentiment and mass psychology and having adaptable plans is crucial for navigating the dynamic landscape of financial markets, especially in the context of the S&P 500 forecast.

Right off the bat, we employ various technical indicators, cycling through them, including some undisclosed ones. This emphasizes our primary focus on market psychology; technical analysis, while applicable, takes a secondary role. From a purely technical standpoint, one could argue that the SPX might hold at 4250. While a 500-point pullback is substantial, it’s not serious in this context. A severe pullback for the SPX would involve shedding 840 to 1020 points, presenting a potential monumental buying opportunity if it occurs.

The equivalent of a 500-point pullback in the SPX for the Dow would roughly translate into a move to the 34,500 to 35,100 range, give or take 200 points in either direction. If bullish sentiment doesn’t soar as outlined, we’ll shift our focus to the technical picture. The overall breadth of the market has improved, providing broad support for the current rally—a positive development. However, we’ll closely monitor the situation during a pullback, especially in tech stocks, as they might experience more significant percentage losses.

Conclusion

We avoid fixation on a specific outcome, prioritizing the determination of the psychological state of the crowd. If there’s no extreme euphoria, a market crash, in our view, is nothing more than a sharp correction. We’ll focus on technicals if bullish sentiment doesn’t follow the projected trajectory, indicating that the subsequent correction won’t be significant until the masses are highly optimistic. In short, we’re adaptable, and the moment the SPX pulls back by 200-250 points, we’ll fine-tune our buying list.

While it’s early now, we issue an advanced warning that when we make a move, expect a flurry of up to 18 new buys. This includes buys for all portfolios, not just the Main AI portfolio. In the interim, patience and discipline are essential. We might issue an unofficial short on NVDA or a similar stock via puts for more aggressive players. Note that while we’ll monitor it, there’s a high probability it’ll be an unofficial play.

Articles That Offer In-Depth Analysis