Russian Economy On the mend

Updated March 2023

We will delve into this topic from a historical standpoint for two significant reasons. Firstly, individuals who fail to learn from history are destined to repeat its mistakes. Secondly, it provides a real-time reflection of our past actions. Please write in the English language.

For a long time, we have been stating that the Sell-off in both the Ruble and the Russian stock market provided astute investors with an excellent long-term buying opportunity as the long-term prospects for the Russian Economy remain favourable. Well, This chart proves that things are getting better and that the Sanctions that the West imposed on Russia at the behest of America were ill-thought, but more importantly, it has made Russia even stronger. The chart below is proof of this; inflation is down over 50% year over year. Translation things must be getting better.

Understanding RSX: Tracking the Market Vectors Russia Index

This investment aims to closely mimic the price and yield performance of the Market Vectors Russia Index, excluding fees and expenses, to the greatest extent possible. Typically, the fund allocates at least 80% of its total assets to securities that form the foundation of the fund’s benchmark index. The Russia Index primarily consists of securities from Russian companies.

A company is classified as a Russian company if it is incorporated either in Russia or, in specific circumstances, outside of Russia but generates at least 50% of its revenues (or possesses at least 50% of its assets) in Russia. It’s important to note that this investment is non-diversified.

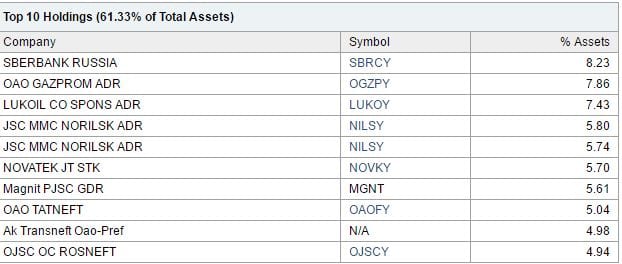

Top 10 Holdings of RSX

Technical Outlook

Strategic Approach for Investing in Russian Stocks

Anticipate resistance within the 16.00-16.50 price range, suggesting that it would be wise to await a pullback to the 13.50-14.00 range before committing to new investments. Alternatively, you can consider selling puts at a specific target price. If the stock trades below the strike price, the shares will be assigned to your account. Selling puts allows you to place a limit order and potentially get filled at a more favourable price due to the premium, which reduces the cost of initiating a position. Another stock worth considering is MBT.

For prudent investors now is an opportune time to seek out promising opportunities in the Russian market and allocate a portion of their capital to these stocks. A strategic approach to benefit from the potential rebound in the Russian market is establishing positions in the RSX ETF.

Other Related Stories

Perfect Scam; Central Banks Print Money & buy bullion with it (March 10)

Achieve Financial Independence & retire Young by not being a Lemming (March 9)

Fed Will Shock Markets; Expect Monstrous rally in 2016 (March 6)

How to Profit from Misery & Stupidity (March 4)

Religious wars set to Rip Europe Apart (March 4)

Oil prices: bottomed out or oil prices heading lower (Feb 28)

China targets corruption: strikes zombie companies hard (Feb 27)