Inflation vs Deflation

Whenever people are deceived and form opinions wide of the truth, it is clear that the error has slid into their minds through the medium of certain resemblances to that truth. Socrates BC 469-399, Greek Philosopher of Athens

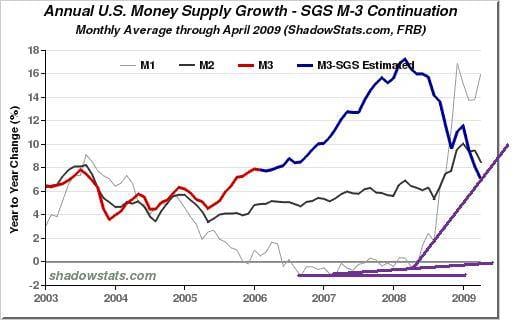

Inflation is defined as an increase in the money supply, and not as many economists falsely refer to it as an increase in the cost of goods. The price increase is a direct result of inflation, but it is not the definition but just a symptom of inflation. Looking at the above two charts, one immediately spots how dramatically the money supply has risen in the last 12 months.

In less than 12 months, the money supply has increased to a level that is double that of 2003. M1 is growing at levels not seen for over 40 years; take a moment to digest this fact, when the economy is broken, when savings are low, when companies are scaling back, we have drug addicts driving the printing press to the breaking point. 1+ one always equals two, and pushing the printing press into overdrive must equate to some form of extreme inflation and, most likely, hyperinflation.

Source:www.shadowstats.com/alternate_data/money-supply

History indicates that inflationary forces advance when the money supply increases, and the more dramatic the growth, the more profound the inflationary effects are. The current expansion rate illustrates that hyperinflation is moving closer to reality with the passage of each day.

Inflation vs Deflation: Which One is Worse

Note that the current administration has many ambitious plans, improve funding for Medicare, improve social security, provide universal health coverage, improve the infrastructure, and increase troop levels in Afghanistan, the future money this administration will be forced to lend banks once the commercial mortgage sector starts to crumble, etc.

All these programs need money this country does not have, and the only way to create this is to print it, as no nation will lend this country the trillions of dollars it will need to fund all these ventures. Therefore, it goes without saying that unless this administration dramatically cuts down on spending or increases taxes by a back-breaking amount, inflation and hyperinflation will soon hit this economy.

Now in the not-so-distant past, the world was busy proclaiming that the US economy no longer had as much of an impact on the rest of the world’s economies as it once used to. Well, that myth has come to an end; when the US housing market tanked, and the credit markets froze, the rest of the world crumbled, also.

Thus the old saying still applies, when the US sneezes, the rest of the world catches the flu and, in some cases, Bronchitis or Pneumonia. Therefore, whatever happens here will have a global effect, and other nations will not be able to come out and say that it’s different this time, for the reality is that it’s not.

Forget the Inflation vs Deflation Argument & Focus on The Dollar Bull

For an extended period, individuals in the Eurozone assumed that they were better off; the reality is that the situation is much more troubling in the Eurozone than in the US. Several countries that make up this zone are in deep trouble, so the long-term prospects for this zone are not very bright, at least not for the next few years. The question now comes down to which location is less ugly, for most nations are in deep trouble. For this reason, we strongly advocate commodities-based investments, for regardless of the currency they trade in, we expect them to trade significantly higher in the coming years.

If we had to choose between the EURO and the Dollar, we would not, but instead, deploy our money into the following currencies, the Canadian Dollar, the Hong Kong Dollar, the Chinese Yuan (probably the main one) and maybe the Australian Dollar. Those investing in currencies should spread their money in at least 2-3 above currencies. Note we are strictly speaking regarding investing in currencies directly or via cash ETFs and not the futures market.

Inflation can be used to your advantage.

Believe it or not, inflation and hyperinflation provide incredible opportunities to make even more money in the stock and Futures markets, provided one holds suitable investments and usually, an excellent advisory service is required to help with the timing of such transactions. Assets always over-inflate to compensate for inflationary pressures, so if the dollar were to lose, say, 20%, certain commodity-based assets could increase in value anywhere from 60%-100%, if not higher.

As we have stated before, the next 6-9 years are going to produce profound changes; these changes will be so extreme and deep that they will stun the unprepared, for the majority have not and will most likely never again be exposed to such dramatic forces again in their lifetimes. Hyperinflation means you go out today to buy a loaf for 3 dollars, and when you return tomorrow, the cost has risen to 4 or 5 dollars. We had a brief taste of this last year when petrol prices kept increasing on a weekly basis.

Reduce debt and use strong Pullbacks To get into Great Stocks

Therefore, we would strongly advise all our subscribers to eliminate all debt, live 1-2 standards below your means, and use strong pullbacks and corrections to open positions in top stocks. Up to 10% of your money can be invested in commodity-based stocks. The time to prepare is when the sun is shining, for once it starts to rain, it’s usually too late.

Not all the currencies we mentioned have ETFs, so one could invest directly in them by opening a bank account (an offshore account that allows you to invest in a basket of currencies) or choosing from the following ETFs.

Canadian Dollar= FXC Australian dollar= FXA

A wild speculative play would be the Russian Ruble

Russian Ruble= XRU

Another means to hedge oneself against the side effects of inflation is to deploy money into commodities and some of the commodity-based ETFs listed below. They should perform well in an inflationary and hyperinflationary environment.

Oil= USO Gold= GDX Silver= SLV

Natural gas= UNG Gold miners= GDX

Dollar Trend

There is a perfect chance that the dollar could go on to test its 2008 Oct-Nov highs and possibly even put in a new high. The testing of its old highs will mark the beginning of the end for the dollar; from there, it could lose up to 60% of its value before it stabilises, which means commodity prices will explode across the board.

However, for this short-term scenario to remain valid, the dollar cannot trade below 78 for more than 3-4 days in a row; if it does, the chances of it rallying to new highs will have diminished significantly. The dollar traded as low as 78.35 and then immediately rallied from these levels; this is an excellent initial sign that the 78 price point level is a zone of strong support.

The rally we expect in the dollar coincides very nicely with the rally that is set to occur in the bond markets; when individuals purchase bonds, they are indirectly opening up long positions in the dollar (in other words, they are buying the dollar).

USD Pattern

If the Dollar does not close below 78 for more than three days in a row, the outlook will remain bullish; ideally, it should not trade below its June lows of 78.35. It initially mounted a rally but then shed most of those gains and is now attempting to rally again. It needs to trade past 82.50 for roughly three days in a row and penetrate the downtrend line in the 1-year chart; a break past this level for three days in a row should be enough to propel the dollar to the 85.50-86.00 range.

If the dollar breaks below 78.00, the next target becomes 74, and it will also suggest that the downward slide in the dollar is occurring at a faster rate than was initially projected. The current pattern calls for a rally that should lead to a test of its recent highs or potentially to a new 52-week high before it embarks on a long downward journey.

The 2-year chart

Confirms the outlook of the 1-year chart. To move higher, the dollar needs to trade past its main downtrend line, which falls roughly in the 82.50-83.00 range, and a break below 78 would take it at the very least, down to the 74 range. In the 2-year chart, we notice how important the 78 price point level is; it’s a zone of support that stretches back almost two years, and thus, a break below this level would be a very decisive move.

The dollar still has time to move higher, and the action in the bond markets is suggesting that it should move higher as the bond markets appear to have put in an intermediate bottom that could result in them rallying for up to 9 months and, thus a rally in the bond markets should drive the dollar higher.

If the dollar can remain above 78, the picture will remain somewhat bullish; a close above 82.50 for three days in a row or a weekly close above 83 will turn the hourly, daily, and maybe even the weekly trends bullish.

Bullish Dollar Factor

One relatively bullish solid factor for the dollar is the fact that when it traded to new 6-month lows, gold did not respond by trading to new highs; this is a rather intra-market solid negative divergence signal, and usually, such signs indicate that the weaker market (in this instance, the weaker demand is the dollar) is going to mount a rally.

Risk-takers could now deploy funds into the dollar to close these positions out the moment the dollar tests its old highs and then redeploy this money back into their original currencies.

The current pattern indicates that the Dollar could trade to the 90-92 range; this represents roughly a 15% gain from current levels; in currency markets, such moves are considered massive.

‘Tis but an hour ago since it was nine, and after one hour more, twill be eleven. And so from hour to hour we ripe and ripe, and then from hour to hour we rot and rot. and thereby hangs a tale. William Shakespeare 1564-1616, British Poet, Playwright, Actor

Overview Of Inflation and Deflation

Inflation and deflation are two opposing forces in the economy that affect both consumers and investors. Inflation occurs when the general price level of goods and services increases over time, while deflation occurs when the price level decreases. Both inflation and deflation can significantly impact the economy, and investors must know the risks and opportunities associated with each scenario.

During inflationary periods, investors can benefit from owning assets that appreciate, such as real estate, stocks, and commodities like gold. These assets can serve as a hedge against inflation, as their values tend to rise with inflationary pressures. Additionally, investors can consider investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), which provide a guaranteed return that adjusts for inflation.

In contrast, during deflationary periods, investors may benefit from holding cash and other liquid assets that retain their value. In deflationary periods, the purchasing power of money increases as prices decrease, making cash and other liquid assets more valuable. Additionally, investors can consider investing in bonds, particularly those with fixed interest rates, as their values tend to rise during deflationary periods.

However, it’s important to note that inflation and deflation can be unpredictable, and investors should diversify their portfolios to mitigate risk. A balanced portfolio that includes a mix of assets, such as stocks, bonds, commodities, and real estate, can hedge against inflation and deflation and protect against market volatility.

In summary, inflation and deflation are two economic forces that can significantly impact investors’ portfolios. By understanding the risks and opportunities associated with each scenario and diversifying their portfolios, investors can benefit from either inflation or deflation.

Research

- “Inflation vs Deflation: What’s the Difference?” by Investopedia: https://www.investopedia.com/articles/personal-finance/032415/inflation-vs-deflation-whats-difference.asp

- “Inflation and Deflation: What Investors Need to Know” by The Motley Fool: https://www.fool.com/investing/2017/03/02/inflation-and-deflation-what-investors-need-to-know.aspx

- “How to Invest in Inflationary Times” by Forbes: https://www.forbes.com/advisor/investing/inflation-investing/

- “How to Invest During Deflationary Times” by The Balance: https://www.thebalance.com/how-to-invest-during-deflationary-times-2466498

- “Deflation: How to Survive and Thrive” by Morningstar: https://www.morningstar.com/articles/626712/deflation-how-to-survive-and-thrive

- “Inflation-Protected Bonds: A Beginner’s Guide” by The Balance: https://www.thebalance.com/inflation-protected-bonds-4162337

Other Articles Of Interest

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)

Popular Media Lies To You: Don’t Listen To Experts As They Know Nothing (March 3)

Fiat Money; The main driver behind boom & Bust Cycles (March 1)

Permabear; It Takes A Special Kind Of Stupid To Be One (Feb 21)

US Debt To GDP Means Nothing To Bonds & Stocks (Feb 12)

Technology-Driven Deflation Will Kill The Inflation Monster (Feb 7)