Religious Tolerance

Update Dec 2023

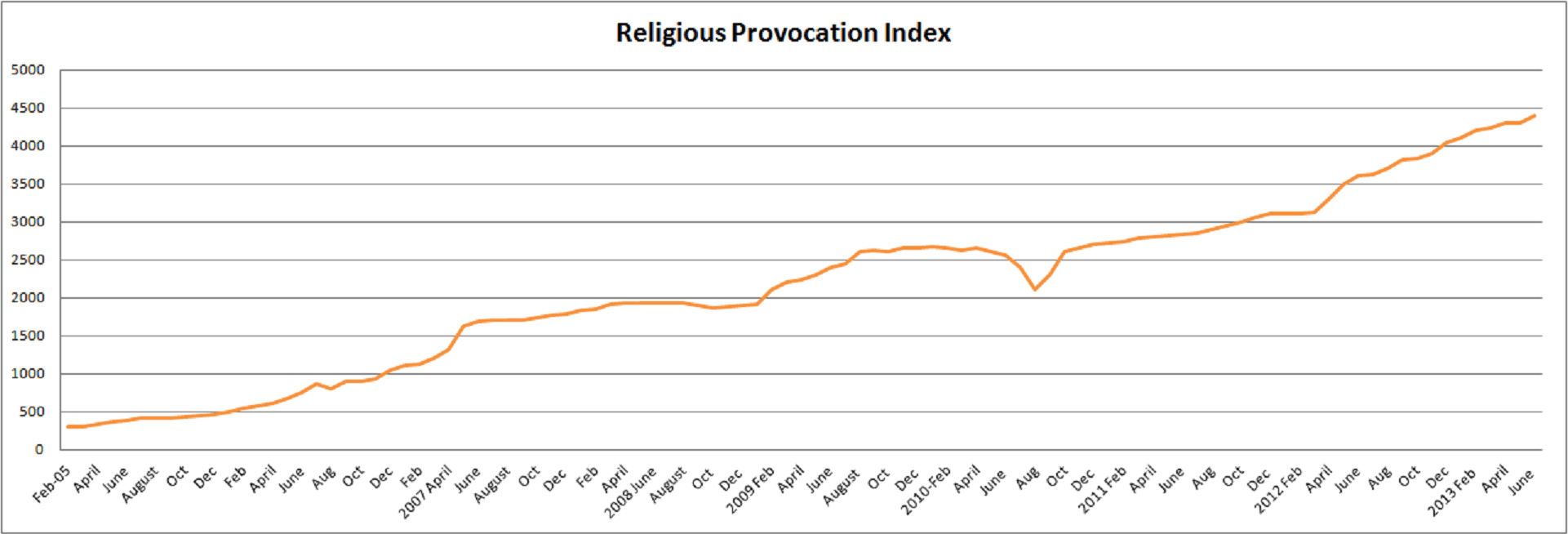

The Religious Tolerance Index continues to soar to new highs and has not experienced a meaningful correction since its inception. This Index accurately predicted that things would get worse In Iraq when the U.S administration was painting a rosy picture. It also accurately predicted that the situation in Afghanistan would turn violent and that we would end up losing the war there. The Index predicted that a new war would erupt in the Middle East towards the end of 2005, and the short war between Hezbollah and Israel followed shortly after that.

In late 2009 and early 2010, the Index predicted that there would be more tensions and conflict in the world, and shortly after that, we had the Arab Spring. This Index has gone on to predict almost every major incident before its occurrence, and the fact that it continues to trend to new highs suggests that the situation will only get worse with time. The Conflict between Russia and Ukraine that has now entangled the USA and Europe is a clear example.

Religious Tolerance: Market Update April 1, 2014

The Religious Tolerance Index is roaring and shows no signs of letting up. Since introducing this index, it has been in a super bull market and has yet to experience a substantial correction. The conclusion is clear: the number of aggressive incidents between different cultures, religions and nations will continue to increase, and we can expect another significant spike soon. When one factors this with the uptick in the Asian index, it provides a longer-term picture of what we can and should expect. Note that a large part of Russia is in Asia, and for all intents and purposes, Russia and the former Soviet Union countries can be considered somewhat part of this index.

The rise in these two indices indicates that new world leaders are emerging, and the increased aggression emanating from Russia and China indicates this. The situation in Ukraine is far from over; what has occurred so far is probably just the tip of the iceberg. Two different things are what our highly biased press is revealing and what is happening. Our associates in the area are providing us with a completely different overview of what is happening.

In short, they state that most people in Crimea are happy with the decision to leave Ukraine and that, increasingly, more and more of the Eastern part of Ukraine is viewing a possible alliance/merger with Russia in a favourable light. This is what our associates in the East of Ukraine are stating; the opinion from those in the West is generally the opposite. Thus it would not surprise us after the new elections are held if the East starts to push for a split or even has its referendum to form a stronger alliance with Russia.

Conclusion

In conclusion, the analysis of the Religious Tolerance Index and its accurate predictions of major incidents in the past suggest that mass psychology and the study of crowd behaviour can play a crucial role in positioning oneself on the right side of the market and life in most cases. The index’s ability to anticipate conflicts, such as the wars in Iraq and Afghanistan, the Middle East conflict between Hezbollah and Israel, and the tensions leading up to the Arab Spring, highlights the potential for understanding and predicting societal trends.

By considering sentiment analysis and observing the rise in the Religious Tolerance Index alongside the Asian index, we can gain a longer-term perspective on the emergence of new world leaders and the increasing aggression exhibited by nations such as Russia and China. For example, the ongoing conflict in Ukraine demonstrates the discrepancy between biased media portrayals and the ground reality, emphasizing the need to gather alternative perspectives.

Socioeconomic Factors and Psychology: Navigating Market and Life

Moreover, the impact of socioeconomic factors, such as pension recalculations and higher salaries, on the sentiments and actions of individuals cannot be ignored. The stark disparities in living standards, corruption levels, and wealth distribution contribute to a growing desire for change, potentially leading to regional alliances or even separatist movements. Recognizing these underlying drivers and evaluating sentiment can provide insights into future developments and their potential consequences.

Considering the principles of mass psychology, crowd behaviour, and sentiment analysis can assist individuals in navigating the complexities of the market and life. Understanding the factors that influence societal trends, conflicts, and alliances allows one to make informed decisions and position themselves favourably in an ever-changing world.

Understanding Crowd Behaviour: Theory vs. Experience

While mass psychology books provide valuable insights into crowd behaviour, nothing surpasses the lessons learned from real-life experience. Books offer theories and concepts, but firsthand encounters allow us to understand the intricacies and complexities of human interactions within a crowd. Knowledge gives us a deeper understanding of how individuals’ emotions, opinions, and behaviours spread.

It also exposes us to diverse situations, cultures, and contexts, enhancing our ability to interpret and respond to crowd dynamics effectively. Combining theoretical knowledge and experiential learning sharpens our understanding and equips us to navigate mob mentality with greater skill.

Tactical Investor Free newsletter signup

Previous readings of the Religious Provocation Index

Religious Provocation Index 2007

FAQ

Q: Has the Religious Tolerance Index accurately predicted significant incidents in the past?

A: Yes, it accurately predicted events such as the Iraq conflict, the violence in Afghanistan, the war between Hezbollah and Israel, and the tensions preceding the Arab Spring.

Q: What do the Religious Tolerance Index and the Asian Index indicate?

A: They suggest the emergence of new world leaders and increasing aggression, mainly exhibited by Russia and China.

Q: What factors contribute to the desire for change in Ukraine?

A: Stark disparities in living standards, corruption, and wealth distribution, along with the impact of socioeconomic factors like pension recalculations and higher salaries.

Q: Can crowd behaviour be fully understood through theories alone?

A: No, firsthand experience is essential for a deeper understanding of human interactions within a crowd and the complexities of crowd behaviour.

Q: How can studying mass psychology and crowd behaviour benefit individuals?

A: It enables individuals to make informed decisions, navigate market complexities, and understand societal trends, conflicts, and alliances to better position themselves in a changing world.

Q: What role does sentiment analysis play in understanding future developments?

A: Evaluating sentiment provides insights into potential consequences and helps anticipate societal changes and their impacts.

Originally published on June 4, 2015, this article is continuously updated, with the most recent update completed in Dec 2023.

Feed Your Intellect: Intriguing Articles for Knowledge Seekers

Dow theory no longer relevant-Better Alternative exists

In 1929 the stock market crashed because of

Apple Stock Price Target: Is It Time To Buy AAPL

From GMO Foods To GMO Humans: What’s Next