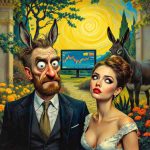

An Unexpected Tip from a Cab Driver

Jan 29, 2025

“When even your taxi driver insists he has found the perfect stock, should that prompt a slight chill down your spine?” This question may seem humorous, but history suggests it deserves serious thought. Whether in 1929, the dot-com boom, or the housing surge leading up to 2008, everyday people have eagerly shared tips and tales of windfall gains just before dramatic downturns. These episodes reflect a well-known pattern: when euphoria reaches dizzying heights, caution tends to be forgotten. The result is often the same—new entrants pour in at inflated prices, only to discover that the bubble was indeed destined to burst. But how might one spot the difference between hype and real momentum? Amid the clamour of bullish calls and panic-driven exits, there is an analytical approach that examines whether price action aligns with whirring signals in the background. That approach includes studying positive and negative divergence.

From a layman’s viewpoint, these terms may sound technical. Yet they serve a practical purpose in spotting when the market’s actual flow departs from the surface-level narrative. A share price heading higher while the underlying indicators weaken hints that buying interest might be inconsistent. Conversely, a price that drifts lower or moves sideways while indicators gain strength hints that buyers might reappear soon. Keep in mind, though, that such signals do not exist in a vacuum. They interact with the emotional see-saw between greed and fear. When mania sets in, red flags can be neglected for far too long, while during bear phases, despair can easily overshadow subtle hints of recovery. This balance of ratio-driven signals and raw human sentiment is what makes trading both endlessly fascinating and risky. For those seeking a steadier compass, positive and negative divergences can offer a helpful check on whether price action is truly supported by the market’s internal shifts, or if it stands on shaky foundations.

The Pull of Mass Psychology

Why do investors flock to stocks that others already hold? One need only recall the housing boom of the mid-2000s: television advertisements and social gatherings emphasised tales of fast-rising property values. Families who had never considered buying a second house jumped into the game, often financed by risky loans. Their fear of missing out on “free money” outweighed any cautionary voices. Soon, mortgages that hinged on impossible repayment plans defaulted, and house prices collapsed in dramatic fashion. This pivot from wild optimism to profound fear happened at lightning speed, leaving countless buyers stunned.

The dot-com bubble displayed a similar story, where newly formed tech companies soared not on sturdy earnings but on grand expectations. At the height of the craze, it seemed that every corner shop and grocery queue featured advice about the next hot internet firm. When a few of these companies revealed weaker-than-hoped earnings or revealed shaky profitability, panic set in. The market tumbled, and businesses once hailed as unstoppable vanished. These cautionary episodes highlight how swiftly group mood can shift from unstoppable bullishness to crippling negativity.

Positive and negative divergences tap into this human tendency. They capture a hidden shift in sentiment: a set of technical indicators might suddenly weaken even though the general price chart looks bullish. This phenomenon, known as negative divergence, alerts watchers that conviction behind the rally is fading. On the other hand, a depressed stock might show growing strength in momentum or volume. That positive divergence suggests that while the price appears feeble to casual observers, deeper interest could be building. In a climate heavily shaped by psychological factors, these divergences can offer a more grounded perspective on whether the crowd still has the stamina to push prices further, or if they are limping toward a reversal.

Understanding Divergences: A Technical Side

Traders frequently plot indicators—such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or other momentum tools—against the main price chart. They then compare the direction of these indicators with that of the asset’s price. If both are going up in harmony, the trend is seen as stable. Yet if the asset continues climbing while the RSI or MACD flattens or declines, that is a sign of negative divergence. It signals that the underlying engine of the rally is losing steam. Traders attuned to such signals often think twice before joining a bullish stampede. They realise that the rally may be built on fewer buyers than it seems.

Conversely, positive divergence reveals itself when the price dips or moves sideways yet the chosen indicator creeps upward, or at least flattens. This suggests that sellers might be exhausted or that new buyers are quietly emerging. In such scenarios, contrarian participants may take an early position, hoping to catch a rebound. Of course, no single signal is absolute, and divergences can persist for a while. However, those who master interpretation can gain a valuable edge, layering technical insights atop their awareness of mass psychology. In times of mania, a negative divergence might confirm that the froth is nearing an end, so it may be time to protect profits. In times of doom, a positive divergence can be the first flicker of renewed interest.

Yet novices often believe that a single red or green arrow can forecast the future. That is rarely how it works. Positive and negative divergences are best seen as clues rather than guarantees. Price often overshoots fundamentals in both directions, shaped by the ever-swinging moods of traders. Hence, the real skill lies in blending these signals with an understanding of emotional extremes. By combining technical patterns with the knowledge that once-eager crowds might turn fearful at the drop of a hat, the trader can proceed with greater caution and clarity.

Examples from Major Bubbles and Busts

Consider the latter stages of the dot-com bonanza around 1999–2000. Many stock charts soared to staggering peaks, but a closer look at popular momentum indicators suggested that the push upward lacked broad-based commitment. Several technology shares continued to mark fresh highs even as their RSI and MACD faltered. Seasoned observers recognised this negative divergence as a warning that the internet party would not last forever. Of course, the crowd still believed they were heading toward endless gains, and many ridiculed the idea of a looming crash. Yet, when earnings reports underwhelmed or deals collapsed, the imbalance swiftly reversed, and a savage bear market ensued.

A similar tale unfurled during the housing mania in 2008, though the divergences were best spotted in bank stocks and financial derivatives. While the media heralded unstoppable growth in real estate, certain financial institutions posted share prices that kept climbing purely out of habit, even as metrics hinted that mortgage default concerns were growing. Volume studies and momentum indicators revealed sneaking caution. Once the first cracks in subprime mortgages appeared, negativity spread into the entire financial sector. The collapse of institutions seemed to happen overnight, presenting a fierce lesson in how a negative divergence can foretell events that the broader market cheerfully ignores—until it is too late.

Meanwhile, on the flip side, we have also seen battered markets display a foundation for recovery through positive divergence. After the crisis peaked in 2009, several strong companies saw gradually improving fundamentals, but their share prices were still battered by general gloom. Traders who noticed that the indicators began to rise, even as stocks languished near their lows, had the chance to buy at the start of the next long bull run. It was contrarian thinking in action. Rather than waiting for mainstream consensus to declare the storm over, they followed the subtle hints that selling pressure had abated. Those who trusted these signals often reaped rich rewards.

The Psychological Link: Fear, Euphoria, and Divergences

Technical signals do not stand alone; they sit within a human drama again and again. When markets soar, greed makes participants impatient to buy, convinced of unstoppable advances. The possibility of a negative divergence can be overlooked or dismissed as minor. Only with hindsight do many admit that vital clues were visible. Similarly, during a plunge, fear overrides logic. Even if a positive divergence emerges, few are willing to believe that a reversal is near. They have been burned by losses, so the direction of heartbreak seems unshakable. Wait until everything looks perfect again, they say—but by then, the prime entry may have passed.

This interplay of moods confirms why a study of divergences can prove so valuable. It stands in direct contrast to the herd mentality, urging participants to pause and question whether the real momentum has shifted. Looking at an RSI slope, for instance, might highlight that the latest wave of buying is weaker than the prior one. In a fear-laden market, seeing a MACD histogram ticking up despite new price lows might reveal that panic is subsiding. But to act on that knowledge calls for bravery and discipline. Contrarian thinkers use these signals to time moves that others might label foolish. For them, the danger lies in following the majority’s emotional swings too closely.

One might ask: how often do these divergences truly matter? The answer depends on the scale of the move. Minor divergences on a daily chart might reflect short-lived corrections or bounces. More pronounced divergences on weekly or monthly charts can point to deeper trends. A successful approach often involves scanning multiple time frames combined with an assessment of broader sentiment. If a weekly negative divergence forms while the public is enthralled by unstoppable optimism, that might be a particularly potent sign. Equally, if a monthly positive divergence appears while headlines read like chapters from disaster novels, a meaningful rally could be brewing.

Contrarian Tactics and Well-Timed Exits

Why do so many well-known traders swear by contrarian tactics? The answer lies in the pattern of latecomers pouring in near market tops and despairing individuals dumping shares near market bottoms. Divergences function as a beacon to avoid joining the herd at precisely the wrong time. When a widespread mania rages, many chase the last few percentage points of gain, inadvertently ignoring signals that the underlying trend is weakening. Negative divergence suggests that fewer market participants are pushing the price upward. A contrarian who spots this might lock in profits rather than braving the next wave of wild swings. Ultimately, this mindset emphasises survival and consistent gains instead of chasing beloved memes such as “this time it’s different.”

Likewise, contrarians aiming to profit from distress watch for positive divergences in an otherwise grim price chart. If shares inch lower while indicators climb or flatten, it may mean that actual selling pressure is ebbing, preparing the ground for a rebound. This perspective goes beyond mere guesswork. Historical examples show that major market turns often begin with subtle improvements in technical indicators, even while news headlines remain dire. A contrarian reaps the advantages of stepping in cautiously before the collective mood improves. Of course, not every divergence guarantees profit. Some signals are false or produce only modest bounces. Still, those who refine their skill can filter out weaker setups and wait for moments when conditions align strongly.

Admittedly, it is easier said than done. Emotional fortitude is crucial. Observing a perfect positive divergence while news warnings continue can feel terrifying. Exiting a beloved stock when negative divergence appears, despite it hitting new highs every day, can stir regret if the rally has more life left. Yet, as repeated booms and busts remind us, no rally lasts, and no downturn persists forever. The beauty of divergences lies in their potential to identify these points of inflexion earlier, balancing risk and reward for the patient investor who reads the clues calmly.

Forging a Path to Steadier Performance

For individuals seeking practical tips, merging a divergence study with a plan is key. One helpful approach is to define thresholds. For instance, decide on a certain magnitude of divergence on the RSI or MACD that prompts a review of priorities. If the indicator strays too far from the price action, evaluate whether it signifies a meaningful shift or if it is merely noise. Another tactic is to introduce partial scaling. Rather than closing or opening an entire position upon a single signal, phase-in or scale out. This strategy allows for flexibility if the market continues in the same direction. Such measures dampen the risk of making drastic moves based on a pattern that might need extra confirmation.

Moreover, the psychological element requires addressing personal triggers. Many traders have a habit of giving in to impulses—buying more once a stock has seen big gains, or selling everything at the first sign of a downturn. Positive and negative divergences can act as a circuit breaker. Before pulling the trigger, consult whether your chosen momentum or volume indicator agrees with your intended action. If there is a mismatch, pause to think. This extra step can reduce knee-jerk decisions that are based on anxiety or FOMO (fear of missing out). Arranging your trades around data is not foolproof, but it encourages a measured style that stands apart from the crowd.

Consistency also matters. Observing divergences once and ignoring them the next time rarely achieves reliable outcomes. Traders who commit to referencing a regularly updated chart, covering multiple time frames, and verifying signals across leading indicators develop an advantage over those who wing it. There is no shortage of cautionary tales about sudden collapses or miraculous reversals that caught casual observers off-guard. It is the disciplined approach to studying both the technical side and the swirling emotions in the market that ultimately fosters more stable, longer-term success.

Final Thoughts: Balancing Confidence and Humility

Many dream of a foolproof strategy: a magic formula that calls the top of every rally and the bottom of every crash. In reality, no such marvel exists. Markets are shaped by sentiment, macro shifts, corporate results, and the intangible factor of crowd impulses. Positive and negative divergences are not a crystal ball, but they do serve as a potent magnifier of subtle signals. They encourage traders to question the narrative rather than simply accept it. Is the market truly unstoppable if the volume or RSI has changed direction? Is the current sell-off unsustainable if momentum shows an upward tilt?

Those who develop confidence in identifying these divergences often find themselves one step ahead, spotting turning points early. Yet humility remains vital. Symptoms of mania are prone to run longer than reason suggests, and severe panic can last until every faint-hearted investor capitulates. Technical signals may fail, or produce whipsaw moves, in especially turbulent conditions. The most successful approach, then, is to maintain balanced expectations, combining divergences with other factors, from basic company analysis to macroeconomic data. By carefully examining the interplay between human emotions and the raw numbers on a price chart, the trader crafts a method that supports prudent decisions.

We return to our opening anecdote: the cab driver confidently recommending shares. In many historical booms, such popular enthusiasm has indeed marked late-stage mania. Yet not every well-timed exit or contrarian buy rests purely on anecdotal clues. Often, a final push upward may appear unstoppable—until negative divergence highlights that the foundations are thinning. Equally, a battered market might look doomed—until positive divergence reveals that resilient buyers are sipping shares at low prices. Time and again, the marriage of technique and psychology stands out as a powerful ally. For those who take the trouble to learn, spot, and trust these signals, the reward can be not merely greater profits but also calmer engagement with markets that otherwise can feel like uncharted waters.