Palladium Price Trends: Unveiling the Potential Stealth Bull

August 31, 2024

Introduction

In the precious metals arena, palladium has emerged as a true gem, captivating the attention of investors and industry experts’ attention. With its remarkable price performance and intriguing demand dynamics, palladium is a unique investment opportunity. Precious metals markets endure turmoil as economies recalibrate worldwide. Where some sink with uncertainty, palladium continues confounding forecasts through fundamentals few anticipate. This platinum relative displays resilience against recession through roots in emission reforms rousing consumption counter-cyclically. Discerning eyes discern drivers sustaining gains currency crashes for others. Yet temporary tumult looms – will momentum maintain among macro headwinds?

Palladium: A Precious Metal Poised for a Remarkable Rebound

If we examine the four top precious metals, Gold, Silver, Platinum and Palladium, the only one that falls into the compelling buy category is “Palladium”. However, Gold and Silver make for good long-term investments, but both are likely to consolidate to build up momentum to rally higher. Gold will eventually take out 2400, and Silver could potentially trade to the 39 to 45 range with a possible overshoot all the way to 60. However, for now, 60 is a very extreme target. One should not focus on it until 45 is taken out. Market Update January 15, 2024

As of this week, palladium is the most oversold among the four major precious metals within its class and across all markets. While Gold and Silver are consolidating after significant moves from their September 2022 lows of around $1600 and $17.50, respectively, Palladium is gearing up for a potentially game-changing move. The long-term outlook for Gold and Silver remains optimistic, but investors must exercise patience and discipline in the current market environment.

The weekly charts suggest that Silver is displaying more strength than Gold, with a potential to test the $24-$25 range before a possible pullback. However, until the monthly chart patterns show signs of strengthening, which has not yet occurred, both metals are likely to experience volatility.

Conversely, Palladium is the dark horse that could surprise the market with an extraordinary move. Its thinly traded nature makes it more susceptible to manipulation by large players, unlike the more resilient Gold and Silver markets.

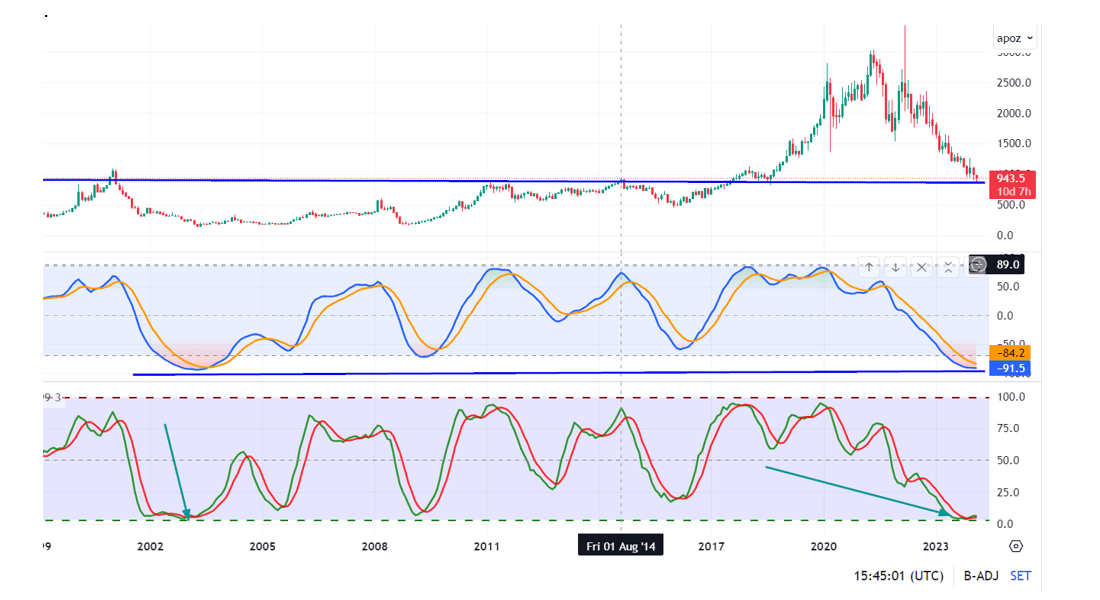

Remarkably, Palladium trades in the highly oversold to insanely oversold range across three-time frames: quarterly, monthly, and weekly. This rare occurrence suggests a potentially explosive outcome shortly.

A closer look at Palladium’s monthly chart reveals that over 15 of our proprietary indicators are at their most oversold levels since 2002. However, as tactical investors, we must adhere to the principle of diversification and avoid overcommitting funds to a single investment.

As Sir John Templeton wisely stated, “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” Palladium’s current oversold state presents a compelling opportunity for those willing to take a contrarian stance.

In the words of H. L. Mencken, “The men the American public admire most extravagantly are the most daring liars; the men they detest most violently are those who try to tell them the truth.” While the masses may overlook Palladium’s potential, astute investors who recognize the value of truth and independent thinking could benefit greatly.

For those inclined towards speculation, consider reallocating funds from non-essential purchases to speculative ventures. By adjusting your lifestyle to live one or two standards below your means, you can free up additional capital for investment. As the average American tends to live beyond their means, even a modest reduction in living standards can significantly boost your investment portfolio.

Palladium Price Plunge: A Contrarian Opportunity

Despite palladium’s fundamental value, its price has recently plummeted from a peak of around $3,400 per ounce to below $1,000. This sharp decline has piqued the interest of contrarian investors seeking undervalued assets.

Contrarians view the price drop as a temporary correction, an opportunity to invest in a market potentially mispriced due to herd behaviour and emotional trading. They focus on palladium’s long-term supply and demand dynamics, including stricter emission standards and economic growth in developing markets.

The recent price plunge is seen as a chance to buy when others are selling, anticipating a rebound as the market corrects itself over time. Contrarians aim to capitalize on the market’s recovery by taking a disciplined approach to value investing, aligning with Palladium’s underlying fundamentals.

Palladium: The Automotive Catalyst Driving Demand

Palladium’s primary demand driver lies in the automotive industry, where it plays a vital role in catalytic converters. As global emission standards tighten, the demand for palladium as an effective catalyst for reducing harmful pollutants has skyrocketed, contributing significantly to the rise in palladium prices.

Catalytic converters use palladium’s unparalleled ability to convert hydrocarbons and carbon monoxide from exhaust gases into less harmful emissions like carbon dioxide and water vapour. Increasingly rigorous emission regulations under standards like Euro 6 and China 6 have reinforced the trend of increased palladium loading in catalytic converters.

Key factors underpinning the potent demand dynamic include:

– Growing vehicle ownership rates worldwide, especially in large emerging markets like China, which accounted for over 25 million vehicles sold in 2021.

– Even electric and hybrid vehicles rely on palladium-heavy catalytic converters to process trace exhaust emissions.

– The ongoing depletion of the world’s major palladium-rich mines highlights the predicament of tethering demand so closely to one precious metal’s constrained mining output.

For the foreseeable future, global efforts to reduce toxic vehicle emissions and growing auto ownership in emerging markets have solidified palladium’s critical function in the automotive catalyst system, driving its rising price.

Palladium Price Outlook

The demand for palladium is poised to remain strong, particularly in the automotive sector, aligning with the growing trend for environmentally sustainable products. In 2022, palladium demand witnessed a significant increase of 449,000 ounces, primarily driven by the automotive catalyst market’s impressive 20% year-on-year growth.

Factors like the Russia-Ukraine conflict and the post-COVID-19 era are expected to impact the palladium market substantially. However, as industry leaders invest in new products and expand distribution networks, the market is projected to maintain its growth trajectory until 2030.

Regarding price forecasts:

– ANZ Research anticipates palladium trading at $2,048 per ounce in 2023.

– Bank of America sets a 2023 target at $1,740 per ounce.

– By 2024, the palladium surplus is expected to reach 2,339 ounces.

– Long-term projections suggest palladium prices may surge beyond $4,000 per ounce by 2025 and reach between $11,633 and $12,215 by 2030.

Palladium Supply Dynamics: Challenges and Opportunities

Palladium supply is a complex issue, influenced by its status as a byproduct of platinum and nickel mining. This means that palladium production is often at the mercy of the extraction of these other metals, making it susceptible to market fluctuations and mining challenges.

Most of the world’s palladium comes from Russia and South Africa, which account for about 75% of the global supply. This concentration of production means that any operational issues or geopolitical tensions in these countries can significantly impact palladium’s availability.

Mining difficulties, such as labour disputes and safety incidents in South Africa, can disrupt production. In Russia, government policies, including increased taxes and regulations, can also affect the mining industry. As primary mines become depleted, the challenge of finding new orebodies in more remote and deeper locations increases costs and complicates extraction.

Environmental concerns are another factor that mining companies must contend with, as there is growing pressure to mine responsibly and sustainably. These ecological considerations can influence the cost and feasibility of mining operations.

Recycling is a potential avenue to supplement the primary supply of palladium, but it has limitations. Most recycled palladium comes from autocatalysts, and there is a significant time lag between the metal’s initial use and its eventual recovery and return to the market.

The geographical concentration of palladium reserves adds another layer of complexity, as it limits the options for diversification should supply disruptions occur. Efforts to develop new mines in different regions could help mitigate this risk in the long term.

Contrarian Opportunities Amidst Palladium’s Psychological Investment Landscape

Investing in palladium extends beyond traditional supply and demand dynamics, including psychological factors influencing investor behaviour. Recent fluctuations in palladium prices have highlighted the impact of investor psychology, particularly the fear of missing out (FOMO) and anchoring bias.

As palladium prices soared to record highs, investors were anchored to these peak prices, setting expectations for future valuations. The subsequent price pullback has created a perception of relative affordability, enticing some investors despite ongoing supply constraints.

This shift in sentiment has opened the door for contrarian investors, who seek to profit from the market’s emotional volatility. These investors can identify mispriced opportunities by resisting the urge to follow the crowd and instead focusing on the long-term fundamentals of palladium demand and supply.

Palladium’s essential role in the automotive industry, particularly in catalytic converters, underpins its enduring demand. Despite the rise of electric vehicles, palladium remains crucial for gasoline-electric hybrids and other industrial applications. Supply-side challenges further support the metal’s long-term value proposition.

Contrarian investors view temporary price dips as strategic entry points, allowing them to accumulate palladium at discounted prices. They understand that while short-term market sentiment can drive price volatility, the underlying supply and demand trends will ultimately reassert themselves.

Conclusion: Palladium’s Enduring Appeal in a Dynamic Market

Its fundamental strengths and psychological allure drive palladium’s unique position among precious metals. Its critical role in the automotive industry, especially in catalytic converters, ensures sustained demand. Even as electric vehicles (EVs) rise, palladium remains essential for gasoline-electric hybrids and other industrial applications. The supply-side challenges—primarily due to its production being concentrated in Russia and South Africa—only enhance its appeal. Given these complexities and that palladium is typically mined as a byproduct of platinum and nickel, supply constraints further support its long-term value proposition.

For contrarian investors like Warren Buffett, markets that experience temporary volatility—such as palladium—often present valuable opportunities. Buffett has frequently preferred investing when markets are in an overselling or irrational fear. This mindset aligns perfectly with Palladium’s periodic price dips, which contrarian investors can view as strategic entry points. In markets driven by mass psychology, Buffett’s approach focuses on the long-term fundamentals of supply and demand rather than succumbing to short-term sentiment swings. This philosophy underlines the metal’s intrinsic value when applied to palladium, regardless of its price fluctuations.

Regarding demand, palladium is forecasted to remain relevant at least through 2030, driven by the increasing regulations on emissions worldwide. As hybrid vehicles transition significantly from traditional gas-powered cars to full EVs, palladium’s non-substitutability ensures that it remains in high demand. On the supply side, production disruptions in Russia and South Africa (which together control over 70% of global palladium supply) further heighten the metal’s attractiveness as a hedge against geopolitical risks.

The numbers speak for themselves: as of 2024, demand for palladium in catalytic converters alone was projected to remain steady due to stricter emission regulations globally. At the same time, supply remains tight, with some analysts estimating annual production shortfalls, which could exceed 1 million ounces by 2027. The ongoing supply constraints, particularly from Russian sanctions and South Africa’s production challenges—exemplified by SBSW’s stated potential limitations due to pricing—underscore the likelihood of continued price volatility. This makes palladium a particularly attractive asset for those willing to invest with a long-term outlook.