A moment’s insight is sometimes worth a life’s experience

Oliver Wendell Holmes 1809-1894, American Author, Wit, Poet

Oil To Gold Ratio: Unveiling the Story Behind This Powerful Investment Metric

Updated Jan 8, 2024

In the world of investment and finance, myriad metrics and ratios are used to gauge the health of markets and assets. Among the many, the oil to gold ratio stands as a compelling metric. This ratio, as the name suggests, shows how many barrels of oil one can purchase with an ounce of gold. It’s a fascinating tool that highlights the relative value of these two globally significant commodities. But what’s the story behind this ratio, and how can it be harnessed for investing?

The oil to gold ratio has its roots in the economic interplay between these two commodities. Gold, often viewed as a safe haven in economic turbulence, and oil, a fundamental pillar of the global economy, share a complex relationship. Fluctuations in their prices can provide a snapshot of broader economic conditions, making the oil to gold ratio more than just a number.

The ratio works on a simple principle. When the oil to gold ratio drops below a certain point (traditionally 9), the market conditions favor a shift from oil to gold. Conversely, when the ratio trades above a certain threshold (typically 11), the conditions are more favourable for oil. Essentially, it is a switch, guiding investors on when to favour one commodity over the other.

But why is this ratio so crucial? It provides a quick, easily digestible measure of market sentiment towards these two vital commodities. Investors can glean a wealth of information by comparing the value of gold, a stable and secure asset, with oil, a more volatile commodity subject to supply and demand fluctuations. The ratio can indicate economic trends, geopolitical events, and potential investment opportunities.

For example, a high oil to gold ratio suggests that oil is relatively expensive compared to gold. This could be due to increased demand for oil, decreased supply, or a drop in the price of gold. Conversely, a low ratio indicates that gold is expensive compared to oil, perhaps due to increased demand for gold as a safe-haven asset in times of economic uncertainty or a drop in oil prices.

The potential benefits of this ratio are manifold. For one, it offers a simple and direct way to track the relative performance of two essential commodities. Investors can use the ratio to inform their decisions, whether deciding when to buy or sell or identifying broader market trends.

Let’s consider a hypothetical scenario to illustrate its utility. Suppose the oil-to-gold ratio is currently at 13, well above the traditional threshold of 11. This indicates that oil is relatively expensive compared to gold and could signal that shifting investments from gold to oil is time. Investors who act on this information could reap substantial rewards if oil prices continue to rise or gold prices fall.

However, it’s essential to remember that, like any financial metric, the oil-to-gold ratio is not a foolproof indicator. It should be used with other financial indicators and macroeconomic data to inform investment decisions. Moreover, the thresholds (9 and 11) are not set in stone and may vary based on broader economic conditions.

In conclusion, the oil-to-gold ratio is a powerful tool in the investor’s arsenal. It provides a snapshot of the relative value of two critical commodities, guiding investment decisions. However, while it can be a valuable compass, it should not be the only guide. As with all investment strategies, a balanced, informed approach is key to navigating the ever-changing seas of the global economy.

Now, let’s delve further into this narrative against a historical backdrop, recognizing that those who neglect the lessons of history are destined to relive them persistently.

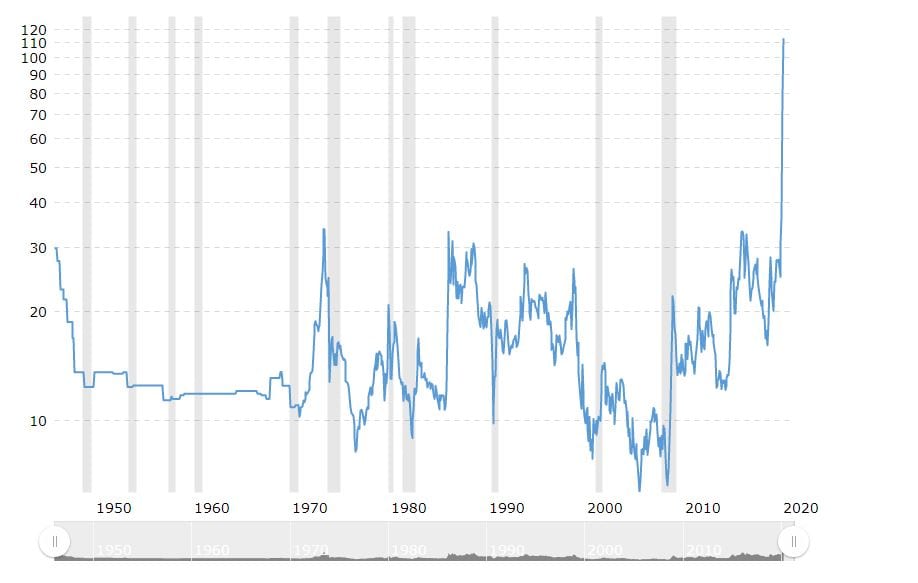

Oil To Gold Ratio

The following chart displays the number of barrels of oil required to purchase an ounce of gold. There is a noteworthy relationship that can be summarized as follows: When the oil-to-gold ratio drops below 9, it is best to sell oil and buy gold. Conversely, when the ratio trades above 11, it is better to sell gold and buy oil.

On December 5th, the ratio was in the 11 range, so it made sense to invest in oil and sell gold. As it turned out, oil was a better investment during that time than gold.

On October 6th, the ratio dropped below 7, which was a good time to buy gold and sell oil. Since then, gold has held up better than oil. However, we are currently at another inflexion point, with the current ratio standing at 12.5. Therefore, it makes more sense to invest in oil and sell gold. What this pattern illustrates is that oil is now a better investment than gold.

source: www.macrotrends.net

Oil To Gold Ratio: What Is The Story Behind This Metric

In the 10-year oil chart, the primary uptrend line remains unbroken, allowing for potential trading down to the 41.40-42.00 ranges without a breach. Each bar represents a monthly interval, so trading below 40 is feasible as long as oil closes above 40 by month-end to sustain the main uptrend line.

Considering technical analysis and mass psychology, it’s now prudent to consider additional positions in this sector. Despite predictions of lower prices, some pundits who previously anticipated oil surpassing $100 have swiftly changed their outlook.

Let’s bring in other factors, such as the geopolitical situation, terrorism, etc.

The recent rapid decline in oil prices is attributed to Saudi Arabia reportedly flooding the market with oil, a move believed to be influenced by the United States. Despite official statements indicating a reduction in oil production, skepticism persists, as governments, including Saudi Arabia, are known for their less-than-transparent communication.

The driving force behind Saudi Arabia’s strategy lies in its fear of a stronger Iran, which holds a considerable military advantage. Historically, Saudi Arabia has used oil production to curb Iran’s ambitions, hitting them economically when needed. While this tactic has shown success in the short term, several factors suggest that its effects may be temporary:

1. **Instability in Nigeria:** The volatile situation in Nigeria, marked by terrorism and sabotage, has significantly reduced oil production, contributing to the overall decline in global oil availability.

2. **Alaskan Pipeline Issues:** BP’s pipeline problems in Alaska have led to a notable decrease in oil production, adding to the challenges faced by the global market.

In total, these factors have collectively removed nearly one million barrels a day from the market. While Saudi Arabia’s strategy has historically had a short-term impact, the current landscape, marked by geopolitical tensions and production challenges in Nigeria and Alaska, may limit the effectiveness of this approach in the long run.

Russia emerges as another significant player in the current dynamics of the oil market.

Repeatedly highlighted in the past, Russia seems to perceive a strategic opportunity to diminish the influence of the United States and is actively leveraging this situation. Unconcerned about Western opinions, Russia is aligning itself with emerging powers such as China and India while consolidating its dominance in the energy sector. Using the pretext of issues with Belarus, Russia is employing tactics to restrict oil supplies to the markets, preventing oil prices from falling below a certain threshold. Similar strategies may be implemented to manage potential plunges in natural gas prices.

Essentially, Russia has chosen to wield its energy resources as a bargaining chip, signalling a departure from the previous approach. The Western world finds itself with limited means to counteract these moves, as Russia possesses highly advanced weaponry, adding a layer of complexity to the geopolitical landscape.

The final factor is the emergence of China and India

as two new energy-hungry consumers. In the past, they were not a big factor, so when the Saudis flooded the markets with oil, the effects were usually terrible. However, this is no longer the case, and so, at most, the Saudis are simply going to provide the astute investor with a lovely opportunity to load up on extra shares of energy stocks at incredibly low prices. Most of the small-cap stocks in this sector have already priced in 40-dollar oil and are now looking into the future. Another interesting fact is that most of them hardly rallied when oil was putting in new highs on a weekly basis. This suggests that the next time around certain small-cap stocks will experience rather huge explosive gains.

Conclusion on Oil To Gold Ratio Debate

We are not suggesting that Gold is not a good investment. Rather, we are stating that the above ratio clearly illustrates which of the two, Gold or Silver, will provide a better rate of return on capital in the short to intermediate time frames. It is recommended that everyone should have a particular portion of their money invested in either Gold bullion or Silver bullion.

Since we made this information available to our subscribers on January 30, 2007, oil has significantly risen by approximately 18%, from a low of $51 to a high of $60. In the same time frame, Gold has risen by 10%, which is still a commendable gain.

We believe that certain small-cap stocks in the oil sector will see a significant upward trend on the next leg up, as many of these stocks hardly moved the last time oil rallied. In fact, some of these small-cap stocks foresaw the coming correction in oil. It is important to remember that oil is also known as the Black Gold. Thus, it makes sense to own some of this “gold,” and the best way to do this is via certain stocks.

People of humour are always in some degree people of genius

Samuel Taylor Coleridge 1772-1834, British Poet, Critic, Philosopher

Other Articles of Interest

Dow theory no longer relevant-Better Alternative exists

In 1929, the stock market crashed because of