The Trading Range: Masterfully Navigating Volatility

Updated March 14, 2024

Introduction

In the ever-fluctuating world of stock markets, mastering the trading range can be a game-changer for investors. When stock prices oscillate between an upper and lower limit, the trading range offers a wealth of opportunities for tactical investors who can navigate these waters confidently. The key to unlocking this potential lies in understanding market volatility and leveraging it to one’s advantage.

Volatility is essentially a measure of fear in the market. High volatility equals high uncertainty. However, not all volatility is the same. It heavily depends on the asset. For example, Bitcoin’s volatility is usually much lower than a newly-launched meme coin. Generally, the more volatile the asset, the riskier the investment.

Consider the Moving Average Convergence Divergence (MACD), a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. When the MACD dips lower, it often signals a potential buying opportunity within the trading range. Historical data suggests that there is usually one more downward move after a long correction, which can create a lucrative trading range opportunity.

Another effective strategy is shorting the VIX (CBOE Volatility Index), also known as the “fear gauge”. By understanding the VIX, traders can gain valuable insights into market dynamics and make informed trading decisions. A New York money manager netted a 64% gain in 2023 from a strategy riding the big plunge in volatility across the stock market.

The rise of passive investing has significantly changed market dynamics. Big players often target this crowd, which includes mutual funds and ETFs. Bleeding this crowd can generate substantial profits within the trading range.

However, in such a volatile environment, it is crucial to adopt a cautious approach. Numerous good stocks are trading in the extreme to the insanely oversold range, presenting many opportunities. It’s a buyer’s market within the trading range, and investors can afford to be selective.

As the renowned naturalist David Attenborough wisely said, “Trade is a proper and decent relationship, with dignity and respect on both sides.” This principle holds even in the fast-paced world of stock trading.

The ancient Greek philosopher Socrates also offered timeless wisdom for navigating market volatility: “The only true wisdom is knowing you know nothing.” Staying humble, continuously learning, and adapting to changing market conditions are essential for success.

In conclusion, mastering the trading range requires a deep understanding of market volatility, leveraging effective strategies, and the wisdom to approach trading with caution and respect. By combining these elements, investors can skillfully navigate the stock market’s ups and downs and unlock the trading range’s potential.

The Role of Mass Psychology on Rangebound Action

Investor psychology significantly influences range-bound market action. Crowd behaviour, driven by emotional reactions to market fluctuations, often exacerbates price volatility within the trading range. When the range is wide, investors may become skittish, assuming a crash is imminent at the top of the range and panic-selling at the bottom.

However, these emotional responses create opportunities for disciplined investors. As the Dutch philosopher Baruch Spinoza noted in the 17th century, “I have striven not to laugh at human actions, not to weep at them, not to hate them, but to understand them.” Understanding and capitalizing on the crowd’s reactions allows investors to buy low, sell high, and potentially achieve above-average returns in range-bound markets.

Renowned psychologist B.F. Skinner, a pioneer in behaviorism, emphasized the role of reinforcement in shaping behavior. In investing, the intermittent rewards of range-bound markets can reinforce both disciplined and emotional trading behaviours. Investors who maintain a rational approach may be rewarded, while those driven by fear and greed may continue to make suboptimal decisions.

Recognizing the impact of mass psychology on range-bound markets provides a strategic advantage. By understanding and leveraging the crowd’s emotional reactions, investors can make more informed decisions and potentially outperform the market over the long term.

The Role of Technical Analysis and Passive Investing in Range-Bound Markets

Technical analysis is a powerful tool for navigating range-bound markets. Indicators like the Moving Average Convergence Divergence (MACD), Bollinger Bands, and the Relative Strength Index (RSI) help investors identify potential buy and sell signals. The MACD can signal buying opportunities when it dips lower, while Bollinger Bands provide insights into price volatility, with wider bands indicating a more extensive trading range. The RSI helps identify oversold (under 20) and overbought (above 80) conditions, signalling potential reversals.

The surge in passive investing through mutual funds and ETFs has significantly impacted range-bound market dynamics. Passive investors’ mass movements can widen the range of market fluctuations, presenting opportunities for active investors who understand these dynamics. Contrarian investing strategies can be effective in these environments, such as buying at the lower limit and selling at the upper limit of the range.

As legendary trader Jesse Livermore once said, “The big money is not in the buying and selling but in the waiting.” Patience and discipline are key when trading range-bound markets. Investors must wait for the right opportunities and stick to their strategies, even in market volatility.

John Bogle, the father of index investing, also emphasized the importance of staying the course: “Stay the course. No matter what happens, stick to your program. I’ve said ‘Stay the course’ a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give to you.”

By combining technical analysis, an understanding of passive investing’s impact, and the wisdom of market legends like Livermore and Bogle, investors can successfully navigate range-bound markets and achieve long-term success.

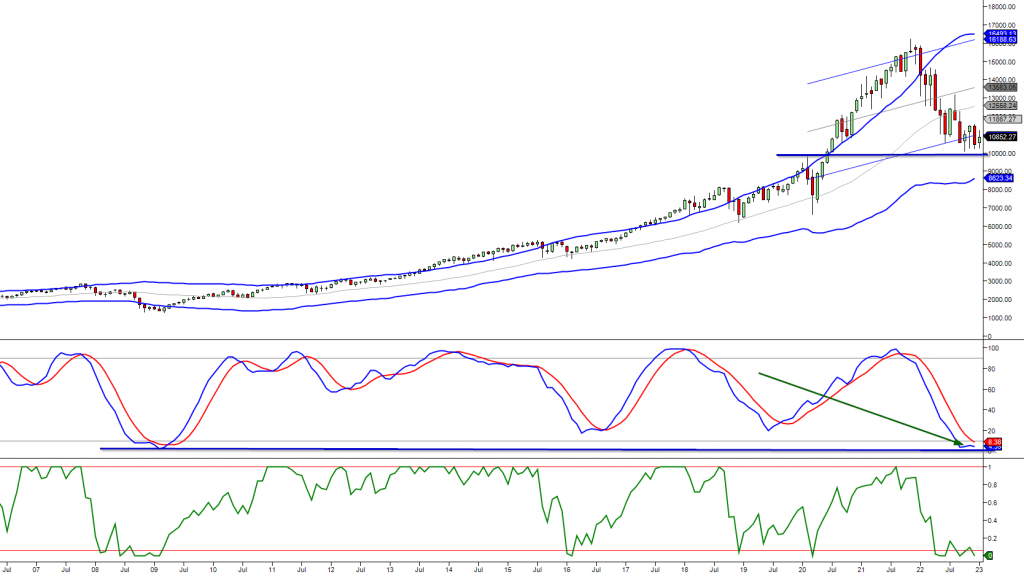

The monthly chart of the Nasdaq

The MACDs are dangerously close to taking out their 2009 lows. If they manage this feat, this event should be treated as a long-term screaming buy within the trading range, even without a MOAB or a FOAB.

While we have sold many positions due to the “Dow trigger” being activated, one should remember that we have many new pending plays. Additionally, in most cases, we sold only half of our holdings.

Adopting a Cautious Approach

It is better to be cautious than unrealistically bold within the trading range in this environment. Why? For one, there are so many good stocks trading in the extreme to the insanely oversold range that we would never be able to get into all of them. In translation, there is a plethora of plays out there. It’s a buyer’s market within the trading range, and we can afford to let the mountain come to Mohammed in such an environment.

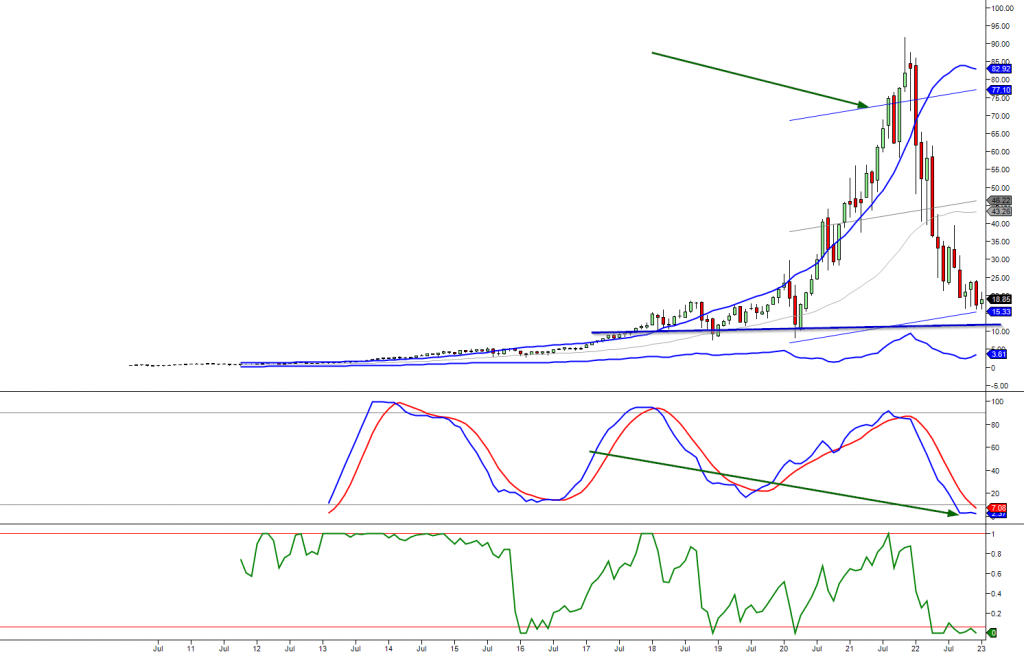

The Monthly Chart of TQQQ

While nothing is set in stone, we can confidently assert that TQQQ will likely trade north of $72 much sooner than many anticipate. The primary reason for taking partial profits lies in our strategic plan to re-enter the market at a lower price point.

However, no matter what angle you look from, it seems highly unlikely that its sister fund SQQQ (a fund that shorts the Naddaq 100) will ever test its highs of 2000 unless you smoke a combo of crack and coke.

Embracing the Trading Range: Opportunities for Tactical Investors

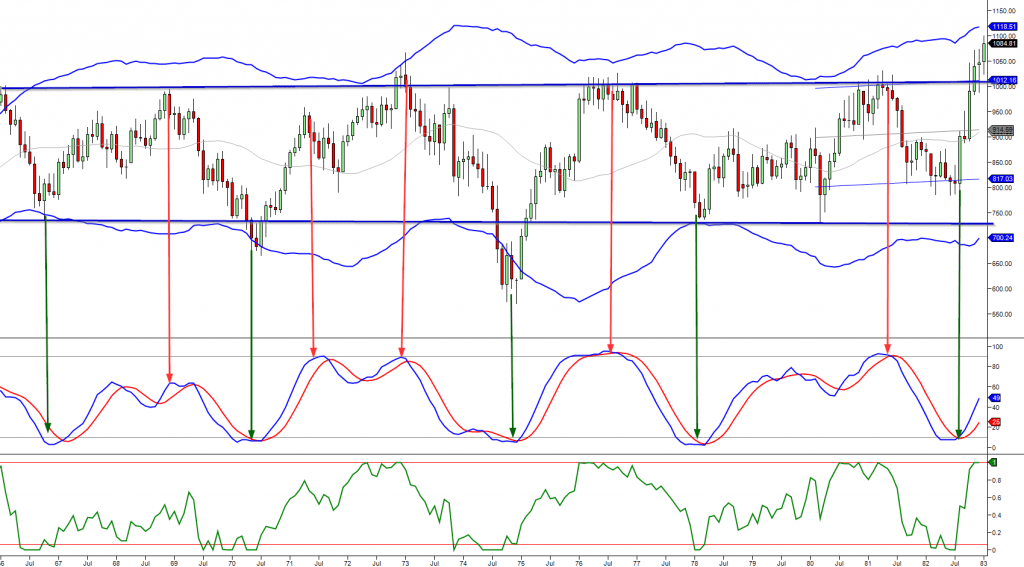

Historical Monthly Chart of the Dow

As Tactical investors, we must remain open to wide-range bound or trading range action in the markets for years to come. This market condition presents an excellent opportunity for traders but can be detrimental to passive investors. However, we are not passive players, so we have nothing to fear.

Historical Perspective and Capitalizing on Range-Bound Markets

The Dow Jones Industrial Average (DJIA) provides a rich history of range-bound market action. One notable period occurred from 1966 to 1982 when the DJIA oscillated within a broad range. However, range-bound markets don’t necessarily mean mediocre returns. Technical analysis can be particularly effective in these environments, with indicators like moving averages, RSI, and Bollinger Bands helping to pinpoint market bottoms and tops.

More recently, during the early 2000s dot-com bubble burst, the DJIA entered another period of range-bound action with high volatility. Investors who understood market psychology and technical analysis could have capitalized on this volatility, buying at the lower end of the range during panic selling and selling at a profit when the market rebounded.

Astute investors can find massive opportunities within the trading range. By selling when markets are extremely overbought and buying when highly oversold, investors can profit from the market’s cyclical nature. Significant deviations above or below the trading range can also present opportunities for long or short positions.

Big players often make money by targeting the “whales” that serve the masses, such as mutual funds, ETFs, and most hedge funds. Many average investors suffering from “Post Financial Stress Disorder” after events like the 2008-2009 crash may sit on the sidelines for years, missing out on solid bull markets.

As legendary investor Peter Lynch once said, “The key to making money in stocks is not to get scared out of them.” Tactical investors can achieve strong returns over the long term by staying invested and capitalising on range-bound markets.

Conclusion: The Trading Range and Market Conditions

The financial market presents various opportunities for tactical investors who remain open to the possibility of comprehensive trading range action for years to come. This market condition offers excellent opportunities for traders while potentially detrimental to passive investors. By closely monitoring MACD dips and the historical context of range-bound action, investors can strategically position themselves to take advantage of market fluctuations.

For example, the MACDs, nearing their 2009 lows, signalled a long-term screaming buy within the trading range. The prominent players in the market are targeting the passive investing crowd, which includes mutual funds and ETFs, making it crucial for tactical investors to adopt a cautious approach. By selling and buying stocks when markets reach extreme overbought and oversold ranges, investors can capitalize on opportunities presented by the trading range.

**Historically, range-bound action has lasted for years, but under current market conditions, a more likely scenario is a duration of 36 to 60 months.** Technical analysis works exceptionally well in such environments, and strong companies will continue to put in new all-time highs even if the indices don’t.

It’s important to note that trading involves risks and extra costs that must be considered. As the risk-return tradeoff principle states, potential return rises with increased risk. Investors should assess their risk tolerance and available capital before trading strategies.

The renowned investor Warren Buffett once said, “Be fearful when others are greedy and greedy when others are fearful.” This wisdom applies well to navigating the trading range – investors can find opportunities others miss by staying level-headed and contrarian.

The ancient Roman philosopher Seneca also offered timeless advice: “Luck is what happens when preparation meets opportunity.” Tactical investors who diligently study the market and prepare their strategies will be best positioned to seize opportunities within the trading range.

In conclusion, tactical investors can benefit from comprehensive trading range action by remaining open to market fluctuations and adapting their strategies accordingly. By closely monitoring indicators and historical trends, investors can pinpoint market bottoms and tops and capitalize on the opportunities presented by range-bound action. With careful planning and a cautious approach, tactical investors can successfully navigate the trading range and achieve above-average market returns, ensuring long-term financial success.