Thriving with Financial Psychology Mastery: A Counter-Cyclical Discourse

“The wise man looks ahead; the fool attempts to fool himself and won’t face facts.” – King Solomon (circa 970-931 BC)

June 16, 2024

Step into the electrifying realm of financial psychology, where market sentiment ebbs and flows, creating a tapestry of golden opportunities. This counter-cyclical discourse will illuminate the intricate dance between historical events and financial markets, revealing hidden treasures for the astute investor.

Consider the tumultuous political landscape of recent elections. Politics, at its core, may seem like a battlefield for the power-hungry, a realm where chaos reigns supreme. Yet, beneath this turbulent surface lies a treasure trove of financial opportunities for those with the wisdom to see beyond the immediate turmoil.

As the ancient Chinese philosopher Confucius (551-479 BC) wisely observed, “The superior man understands what is right; the inferior man understands what will sell.” This profound insight reminds us that true financial mastery comes from understanding underlying principles rather than following fleeting trends.

When political battles reach their zenith, they send shockwaves of uncertainty through financial markets. But remember the words of the Roman philosopher Seneca (4 BC – 65 AD): “It is not because things are difficult that we do not dare; it is because we do not dare that they are difficult.” In this very uncertainty, the daring investor finds a silver lining – a golden opportunity to buy low and sell high once the dust settles.

History, in its infinite wisdom, offers us invaluable lessons. By examining past events through the lens of financial psychology, we can uncover patterns and strategies to capitalize on future market fluctuations. Whether you’re a seasoned investor or a novice, understanding the psychology behind financial markets can equip you with the insight to navigate uncertainties and transform them into profitable ventures.

Embark on this thrilling journey with us as we harness the power of financial psychology to thrive in the ever-evolving economic landscape. Let’s decode the market’s pulse together, turning periods of turmoil into fountains of opportunity. The path to financial mastery awaits – are you ready to seize it?

Capitalizing on Election Debate Volatility: A Market Perspective

Contrary to popular belief, the recent election debate is not just a political affair but a market-moving event. Despite initial optimism surrounding Donald Trump’s presence, the markets quickly turned downward. Regardless of personal opinions on the former president, his impact on the market is reminiscent of the Brexit fallout—albeit on a smaller scale.

However, the market reaction would be much larger if Trump were to win the election. The positive market response to Hillary Clinton’s performance in the first debate further solidifies our long-standing argument that pullbacks should be viewed as opportunities for savvy investors.

It’s time to challenge conventional wisdom and embrace the reality of the market’s reaction to political events. The market’s response to the election is a testament to the power of polarizing individuals and their impact on the financial world. The smart move is to embrace the volatility and turn it into a profitable opportunity.

Enhancing Your Understanding of Stock Market Psychology: A Contrarian Perspective

From a contrarian perspective, a Trump victory in the election could be seen as a positive development. While non-contrarians may question this stance, the principles of mass psychology suggest that the majority is often misguided.

In the event of a Trump win, uncertainty would likely arise, causing the masses to panic and sell off their investments. This, in turn, could present a buying opportunity for those who can maintain a level head and see past the fear.

Conversely, if Hillary were to win, markets would initially rally before pulling back due to the “buy the rumour, sell the news” effect. On the other hand, a Trump victory would elicit a strong reaction, which could be interpreted as a chance to buy.

According to mass psychology, the key to successful investing is to sell when the masses are overly optimistic and buy when they are pessimistic. With a Trump win, widespread pessimism may present an investment opportunity.

Please note that this perspective does not represent any political stance but rather a viewpoint on market behaviour.

Financial Psychology and Market Trends: Unraveling Charts and Contrarian Outlook in the Stock Market

Charting the Ebb and Flow of Market Action

Please permit me to present a different perspective on the current market trend and the impact of the upcoming election. It has been observed that, in the eyes of a contrarian, a potential victory for Mr Trump could be viewed as a positive development. According to the principles of mass psychology, the masses are often found to be on the wrong side of the equation.

In a Trump win, uncertainty would be anticipated to grip the market, leading to a sharp pullback. However, this presents a buying opportunity for those who do not allow their emotions to govern their actions. On the other hand, if Mrs Clinton were to win, the market would likely rally initially, only to pull back subsequently due to the “buy the rumour, sell the news” effect.

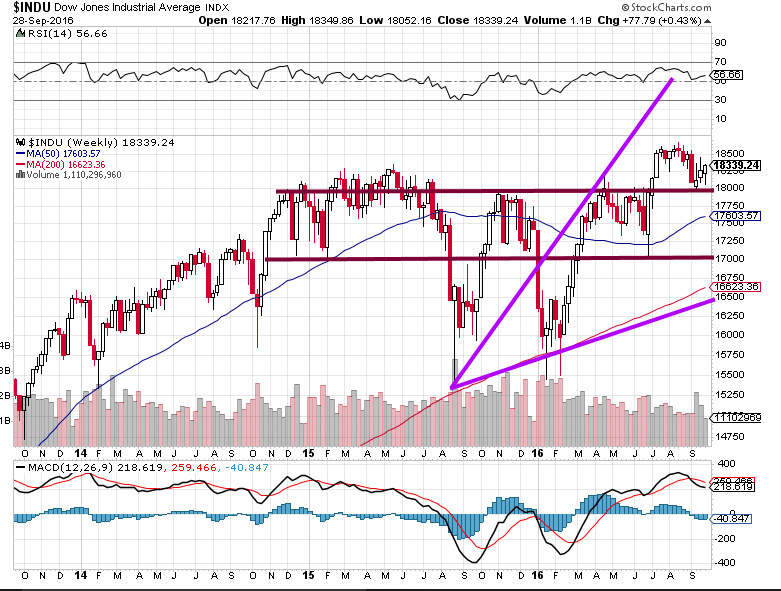

It is worth noting that before the current pullback, we had predicted that the Dow was more likely to test the 18,000 range than reach 20,000, as the media had become overly bullish. This came to pass as the Dow traded briefly below 18,000. Subsequently, we expected the market to rally towards the 19,000 range. Still, the uncertainty generated by Mr Trump’s recent resurgence has acted as a new VIX factor, causing the market to trend in that direction. However, trading significantly beyond 19,000 may be limited until the election outcome is determined.

If Mr Trump’s numbers improve, expect intense market volatility. Conversely, if his numbers decrease, the market will be less volatile.

Market Outlook in the Wake of a Hillary Victory:

We must delve into the contrarian realm and consider the election’s potential outcomes. Before the recent market pullback, it was noted that the Dow Jones was likely to touch the 18,000 range rather than reach the highly-touted 20,000 mark, as the media was becoming overly optimistic. Indeed, the Dow briefly dipped below 18,000, leading us to anticipate a rally towards 19,000.

However, with Mr. Trump’s resurgence, uncertainty has once again gripped the masses, and, in a sense, he has become the new VIX factor. The trend should continue in this direction, though it may be difficult for the Dow to surpass 19,000 until the elections have come and gone. If Mr. Trump’s numbers improve, we can expect great market volatility. If, on the other hand, his numbers decline, market volatility will be less pronounced.

In the event of a victory for Mrs Clinton, we expect the Dow to rally initially, followed by profit-taking and a modest pullback. However, if Mr Trump wins, there is a strong likelihood that the Dow will break through the first layer of support in the 17,800 to 18,000 range, leading to a drop as low as 17,000. This would present a fantastic buying opportunity for the astute investor.

It has been some time since this market has undergone a significant correction, and a Trump victory would provide the perfect backdrop for the market to release pent-up steam. And, if the masses were to panic, the Dow could drop even further, to the 16,500 to 16,800 range, presenting a “screaming buy” scenario from a contrarian perspective.

Political Divisiveness & its Negative Impact on Markets and Investors

dance when the crowd panics and standstill when they jump up with joy. Sol Palha

From a contrarian standpoint, a Trump victory in the elections may be viewed as a positive development in the financial market. Mass psychology clearly illustrates that the masses are misguided and on the wrong side of the equation. Thus, a win for Trump, who represents uncertainty, may result in a sharp sell-off. However, this will be an opportunity for those who can control their emotions.

On the other hand, a win for Hillary, who is as corrupt as sin, could lead to an initial rally followed by a pullback as traders bank their profits. The reaction may not be as strong as it would be in case of a Trump victory. However, the overreaction to a Trump win will prove to be a buying opportunity.

If Trump does win, the market may likely drop to the 17,000 range, providing an attractive buying opportunity for contrarian traders. However, in a panic, the market may overshoot to the 16,500-16,800 range, creating an even better buying opportunity.

It would be wise to heed the advice of market experts and embrace corrections, whether in the wake of Brexit or a Trump victory, as buying opportunities. The naysayers may loudly predict doom and gloom. History has shown us that such predictions are often misguided. Ultimately, the decision on who makes a better candidate is left to the individual reader.

if Trump wins. All the Naysayers from every crack and crevice will emerge screaming the end of the world and when the world does not end they will be forced to crawl under the rock again. Sol Palha

The Complex Relationship Between Politics and the Stock Market

It is widely acknowledged that election outcomes can impact the stock market, but the relationship between political events and market performance can be complex. Some experts believe that President Biden’s election and the Democrats’ control of Congress brought stability to the policy environment. However, others argue that the stock market has performed poorly and inflation has been high under the Biden administration. The facts seem to support the latter, with 2022 being one of the worst years in market performance and inflation at a multi-decade high.

The ongoing political polarization in the United States is causing uncertainty and instability in the stock market, contributing to a toxic and divisive public discourse that has eroded public trust and reduced social cohesion. This, in turn, is causing investors to become increasingly risk-averse. While many factors influence the stock market, including economic conditions, geopolitical events, and investor sentiment, political events and policies can play a significant role in the market, especially when they are not in line with the desires and expectations of the nation’s citizens.

The Impact of Political Divisiveness on Investor Confidence

As a man handles his troubles during the day, so he goes to bed at night as a General, Captain, or Private. Edgar Watson Howe

Political polarization has reached new heights recently, with politicians and citizens becoming increasingly entrenched in their beliefs. While this may benefit political parties, it is unsuitable for the financial markets and investors. Political divisiveness can lead to increased volatility in the stock market, decreasing investor confidence and making it difficult for businesses to secure funding and for individuals to plan for their financial future.

The French Renaissance philosopher and writer Michel de Montaigne believed that the key to wisdom was to question one’s beliefs and consider alternative perspectives. If he were alive today, he would likely argue that ongoing political divisiveness harms society, including the financial markets. In the context of political divisiveness, politicians and citizens should consider the impact their actions and beliefs have on the financial markets and the economy.

Bad times have a scientific value. These are occasions a good learner would not miss.

Ralph Waldo Emerson

Other Articles of Interest