Unravelling the Mystery: What Is Mass Hysteria and its Impact

Updated March 2024

Mass hysteria, a complex psychological and social phenomenon, emerges when collective anxiety manifests in a community, often leading to irrational behaviours and beliefs. Historically, events like the Salem Witch Trials and the Dancing Plague of 1518 exemplify mass hysteria’s powerful grip on society. In modern times, the COVID-19 pandemic has provided a stark illustration of how fear and uncertainty can fuel widespread panic.

The concept of mass hysteria is not confined to health scares. It can also be observed in financial markets, where the term ‘market crash’ often signifies a sudden, severe downturn. The psychological parallels between societal mass hysteria and market crashes are striking. Both are driven by collective fear, frequently based on rumours or misinformation, leading to irrational decision-making.

Experts in psychology and financial markets have studied these phenomena extensively. Dr Robert Bartholomew, a sociologist, notes that mass hysterias and social panics reflect our collective fears and the imagined causes behind these real symptoms reveal the anxieties of each era. In the context of market crashes, behavioural economists like Dr Robert Shiller have highlighted how psychological factors can create speculative bubbles that eventually burst, resulting in panic selling and market collapses.

Another expert, Dr. Gary Small, a psychiatrist, emphasizes the role of media in exacerbating mass hysteria. During the COVID-19 pandemic, for instance, the relentless news cycle and spreading misinformation on social media platforms contributed to heightened public anxiety. This phenomenon is mirrored in the stock market, where rapid dissemination of information, accurate or not, can lead to significant volatility.

The Federal Reserve’s role in managing economic stability is often scrutinised during market crashes. Historically, central banks have used tools like interest rate adjustments to influence market conditions. However, the timing and scale of these interventions can sometimes lead to unintended consequences, including the worsening of mass hysteria in financial markets.

It is crucial to discern the underlying ploy at play here. To execute actions that counter the masses’ preferences, one must create a situation that effectively diverts their attention. By offering a solution three times more detrimental than its predecessor, cunning manipulators exploit the desperate yearning for safety that pervades the populace. In their desperation, people willingly embrace any course of action laid before them, regardless of the severe repercussions it may entail.

Notice the ploy here; to do that which the masses abhor, one has to create a situation that distracts their attention. Then offer a solution three times as damaging as the previous one, and in their desperation to seek safety, they will agree to whatever course of action is laid out. Tactical Investor March 25, 2020

Preserving Your Investment Portfolio: Shielding Against the Destructive Impact of Panic

The system will be flooded with so much liquidity that the markets will melt upward when the media reports the data more accurately. Right now, they talk about the mortality rate without breaking the data down and informing the masses that older individuals are the ones who fall into the high-risk category. Even then, most of them appear to have some other complications already.

Updated mortality rate by age group

Notice how mild it is for those under 50, but let’s assume it’s 1.3%; no data is provided on whether these individuals had any existing conditions. So far, they are using stats to manipulate the data to suit whatever outcome they want to project onto the masses. A more robust approach (which would be relatively easy) would entail listing any other conditions the patient might have had before becoming infected.

Furthermore, the overall death rate is relatively low when you look at the data from countries with sound health systems. Look at Japan, Germany, Denmark, South Korea, Switzerland, Singapore, Taiwan, etc. The total death rate is well below 1.5 and, in many cases, below one per cent, and that’s accounting for all age groups. For example, Singapore has zero deaths, Taiwan only has one, and so on.

An Alternate Reality or a Distorted Reflection of Our World

The media is pushing theories without all the data, and if you read almost all the stories, you will see experts using words such as may, could, and might, but the masses treat these opinions as facts. Try to google the term, “Is the Coronavirus from the same family as the flu virus: ”

You won’t find any articles directly answering the question in the top 10 search results. Instead, you will find a plethora of pieces that go on to describe how dangerous the new variant of the Coronavirus is. These articles were there before, but now they have been pushed to the bottom pages where no one bothers to look at them.

Narratives are created on the Fly.

The answer is straightforward: yes, it belongs to the same family, but it exhibits a more potent strain. Despite scouring through six pages of search results on Google, I struggled to find a concise explanation solely focusing on the coronavirus’s relation to influenza. Only when I turned to duckduckgo.com did I discover valuable information on the first page? However, I had to scroll down the article to uncover the following details:

According to the CDC, human coronaviruses are relatively common worldwide. There are seven different types, with many of them causing common colds, as explained by infectious disease expert Amesh A. Adalja, M.D., senior scholar at the Johns Hopkins Center for Health Security. However, two more recent types, namely MERS-CoV and SARS-CoV, can potentially cause severe illnesses. . http://bit.ly/2UeuVL5

So why can’t the most popular search engine provide an article in the top 10 results that will answer the question directly? The answer is that high-ranking media sites push many opinion-based articles, replacing articles from lower-ranking sites that would have responded to the question. Most individuals will not sift through data pages looking for the answer; they stop at the first page and usually look at the top results.

The Danger of Mass Hysteria in Investing

This hysteria-based sell-off is producing one of the most significant buying opportunities in decades; more on that later.

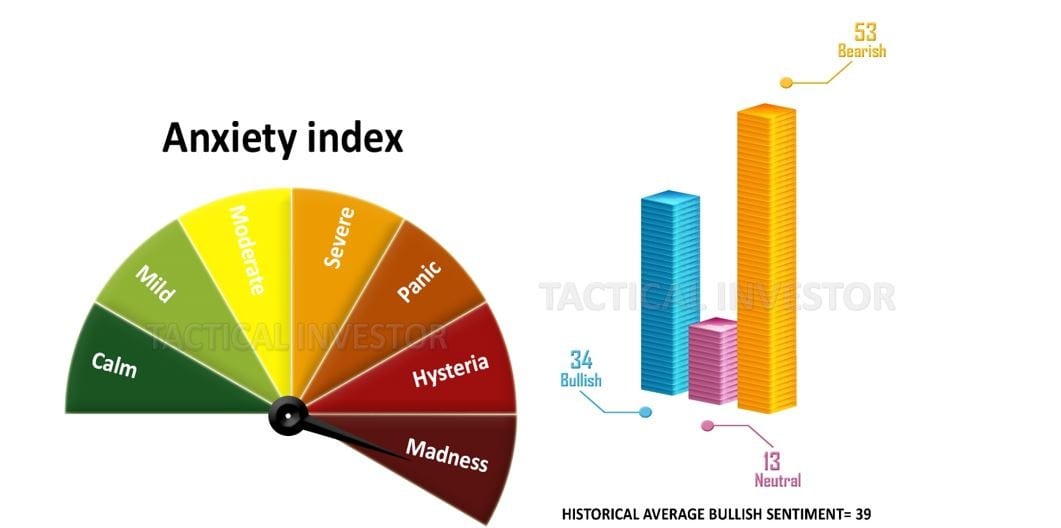

The short-term technical analysis cannot identify support levels because we are dealing with madness, so we added the new standard to the anxiety index. What exacerbates the situation is that there is very little liquidity; look at the bid and ask for prices on some options. They are unreal, for example, an offer of 1.40 and an ask of 5.00. This allows a few big players to move the markets in whatever direction.

Factors That Can Help Stabilize the Situation

- The Fed throws the Kitchen and Kitchen sink at this market, unveiling a vast Stimulus package.

- The press starts to report the news accurately; all they have to do is go to worldmeters.info to get a better take on what is happening.

- A new rapid detection test has been announced.

- The US has come up with concrete measures to test many individuals rapidly. This would be seen as good news because the average death rate is 1.39%, considering all groups. This is significantly lower than in China and many other nations.

- A vaccine works in clinical trials. The FDA is going to approve the use of this vaccine extremely quickly. However, data has to show that it works even with minor problems.

- A treatment that has a 90% cure rate.,

Rational Investing: Staying Calm Amid Mass Hysteria

when you add in stupidity and ineptitude by the elected officials, what should have been a mild situation turned into a nightmare-type scenario. We are supposedly the most advanced nation on earth, but after the current debacle, one would be hard-pressed to call the US progressive, at least in the medical arena.

We know that a vaccine and a better treatment will be found; it is just a matter of time. As for the press and politicians acting sensibly, that’s a hard call.

This chart from the 1940s clearly illustrates that every so-called crash has proved to be a buying opportunity, and in the long run, bears are always killed, but the same cannot be said of bulls. Hence, when the trend is up, and it is up right now, every strong correction has to be viewed through a bullish lens.

Mass Hysteria is A Contrarian Investor’s Best Friend

Still, the long-term outlook is given, as this crash started on a note of uncertainty, unlike every previous market crash.

“the time to buy is when there’s blood in the streets.” Baron Rothschild

Losing your head in a crisis is a good way to become the crisis. – C.J. Redwine

Sooner or later comes a crisis in our affairs, and how we meet it determines our future happiness and success. Since the beginning of time, every form of life has been called upon to meet such a crisis. – Robert Collier

Successful people recognise crisis as a time for change – from lesser to greater, smaller to bigger. – Edwin Louis Cole

It’s not always easy to do what’s not popular, but that’s where you make your money. Buy stocks that look bad to less careful investors and hang on until their real value is recognized. I’ve never bought a stock unless, in my view, it was on sale. Buy on the cannons and sell on the trumpets John Neff

In order to win as a contrarian, you need the right timing and you have to put on a position in the appropriate size. If you do it too small, it’s not meaningful. If you do it too big, you can get wiped out if your timing is slightly off. The process requires courage, commitment and an understanding of your own psychology Michael Steinhardt

Mass Hysteria: More Quotes From Great Minds

I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful. Warren Buffett

To succeed as a contrarian, you must recognize what the crowd believes, have concrete justification for why the majority is wrong, and have the patience and conviction to stick with what is, by definition, an unpopular bet. Whitney Tilson

Humans are prone to herd because it is always warmer and safer in the middle of the herd. Indeed, our brains are wired to make us social animals. We feel the pain of social exclusion in the same parts of the brain where we feel real physical pain. So being a contrarian is a little bit like having your arm broken on a regular basis. James Montier

There are many who give advice, but few that offer guidance. Anonymous

Our all-time favourite

To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage but provides the greatest profit. Bull markets are born in pessimism, grow on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell. If you want to have a better performance than the crowd, you must do things differently from the crowd. Sir John Templeton

Insight into the Future: A Look at the Stock Market’s Outlook

We have moved deeper into the madness zone, and neutral sentiment has dropped to levels not seen for years. It is trading at 13, but bullish sentiment, while below its historical average, is still relatively high; it would be ideal to drop below 24. Bearish sentiment continues to trend higher, and that’s a good sign. As things stand now, we are close to another “mother of all buy signals” that would match 1987 and 2008. Our indicators need to dip slightly lower into the oversold range.

Our trend indicator is positive, suggesting that every pullback, from mild to wild, should be embraced.

Originally disseminated on March 25, 2020, this piece remains in a state of perpetual refinement, with the most recent update undertaken in March 2024.

Other Articles of Interest

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?