Stock Market as an Example of Control Group Psychology

Nov 24, 2024

The stock market is the ultimate theatre of mass manipulation. The formula is simple yet potent: propagate a grand narrative—claim a revolutionary trend, sprinkle it with half-truths and fabricated data, and watch the masses flock. Research and statistics are twisted, stretched, and dressed to suit the agenda. Few question the narrative or verify its foundation; the mere appearance of legitimacy is enough. A polished lie sells better than the truth, and if the packaging is convincing, you could sell sewage labelled as coffee. Eventually, the crowd realizes the bitter truth—that they’ve been sold a fantasy, not fortune—and that’s when the facade crumbles.

This gambling ground masquerading as an investment arena (and only those rare, astute players who master the psychology and technical nuances of the market rise above the chaos) is a breathtaking demonstration of crowd psychology. Fear, greed, and the illusion of certainty are the strings pulled by those who understand human nature better than the crowd understands itself. As H.L. Mencken observed, “The whole aim of practical politics is to keep the populace alarmed… by an endless series of hobgoblins, most of them imaginary.” Substitute “politics” with “markets,” and the truth rings just as clear.

Mark Twain’s piercing insight, “Whenever you find yourself on the side of the majority, it is time to pause and reflect,” cuts to the heart of market dynamics. The herd mentality is a surefire path to ruin, yet it’s the contrarian. This thinker moves against the tide of fear or greed and discovers the opportunities buried in the wreckage of mass delusion. In this game, those who think differently aren’t just players but the architects of their fortune.

The Mechanics of Control Group Psychology in the Stock Market

Market crashes often serve as prime examples of control group psychology at work. The crowd becomes nervous when the market experiences extreme volatility, with wild swings from day to day. This nervousness is demonstrated by erratic buying and selling patterns. One day, positive economic data might spur a buying frenzy, while the next day, fears of a recession lead to massive sell-offs. This uncertainty creates a fertile ground for contrarian investors who see opportunity where others see chaos.

Consider the 2008 financial crisis. As markets around the world plummeted, fear gripped the masses. However, astute investors like Warren Buffett saw this as a golden opportunity. Buffett famously invested in Goldman Sachs and General Electric during the height of the crisis, capitalizing on panic-driven low prices. His actions exemplify the principle of buying when others are selling, a cornerstone of control group psychology.

The Role of Volatility and Sentiment Indicators

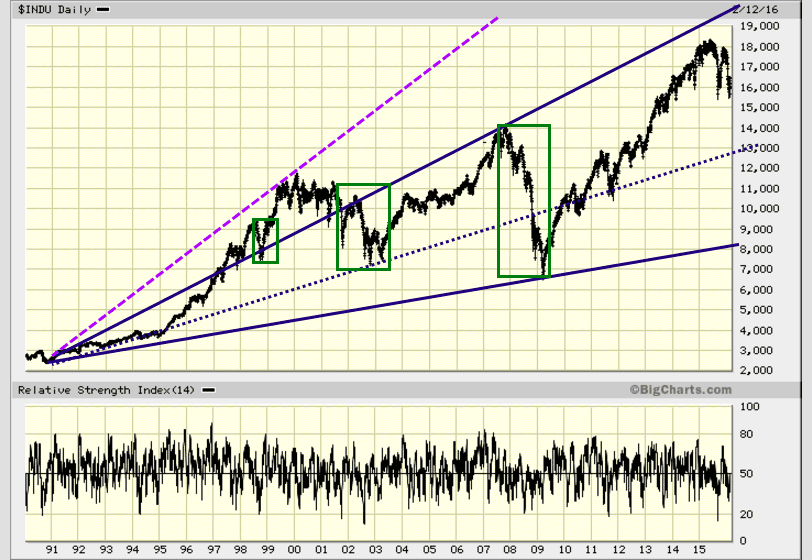

Volatility levels and sentiment indicators are crucial for understanding control group psychology in the stock market. High volatility often indicates heightened fear and uncertainty among investors. Sentiment indicators, such as the Relative Strength Index (RSI), can provide insights into whether the market is oversold or overbought.

For instance, during the 2016 market fluctuations, Tactical Investor’s proprietary sentiment indicators showed extreme ranges, signalling panic among the masses. Astute investors used these signals to identify buying opportunities, as the crowd was selling in fear. This contrarian approach, supported by sentiment analysis, allowed smart money to profit from the subsequent market recovery.

Historical Perspectives on Market Psychology

The principles of control group psychology are not new. Sun Tzu, the ancient Chinese military strategist, understood the importance of exploiting the enemy’s weaknesses. In his seminal work, “The Art of War,” Sun Tzu emphasized the value of deception and psychological manipulation. These principles apply equally to the stock market, where savvy investors exploit the crowd’s emotional responses to market events.

The Tulip Mania of the 17th Century

One of the earliest documented examples of market psychology at work is the Tulip Mania of the 17th century. During this period, the price of tulip bulbs in the Netherlands skyrocketed due to speculative buying. The crowd, driven by greed and the fear of missing out, pushed prices to unsustainable levels. When the bubble burst, prices plummeted, leaving many investors with worthless bulbs. This episode highlights the dangers of herd behaviour and the importance of contrarian thinking.

Modern Examples of Control Group Psychology in Action

The Dot-Com Bubble: A Lesson in Hysteria

Modern examples of control group psychology are the late 1990s and early 2000s dot-com bubble. As internet-related stocks soared, the crowd became euphoric, driving prices to astronomical levels. Companies with little to no revenue were valued in the billions. However, when the bubble burst, the market crashed, wiping out trillions of dollars in market value. Savvy investors who recognized the irrational exuberance of the crowd were able to avoid significant losses and, in some cases, profit from the downturn.

The COVID-19 Pandemic: Fear and Opportunity

The COVID-19 pandemic triggered another wave of fear and uncertainty in the stock market. In March 2020, global markets experienced a sharp decline as investors panicked about the economic impact of the pandemic. However, those who understood control group psychology saw this as an opportunity. Investors like Cathie Wood of ARK Invest capitalized on the downturn by investing heavily in technology and innovation-driven companies. As the market rebounded, these investments yielded substantial returns.

Insights from Notable Figures

Benjamin Graham: The Father of Value Investing

Benjamin Graham, the father of value investing, emphasized the importance of buying undervalued stocks and ignoring market noise. In his seminal work, “The Intelligent Investor,” Graham highlighted the market’s irrational behaviour and the importance of a disciplined, contrarian approach. His teachings have influenced generations of investors, including Warren Buffett, who famously described “Mr Market” as a manic-depressive figure whose mood swings should be exploited rather than followed.

John Maynard Keynes: The Importance of Behavioral Economics

John Maynard Keynes, a renowned economist, understood the psychological underpinnings of market behaviour. Keynes introduced the concept of “animal spirits” to describe the emotional factors that drive economic decisions. He recognized that investor behaviour is often irrational and influenced by emotions such as fear and greed. Keynes’ insights laid the groundwork for behavioural economics, a field that explores the impact of psychological factors on economic decisions.

When Control Group Psychology Fails

Overvaluation and the Limits of Contrarian Investing

While control group psychology can provide valuable insights, it is not foolproof. There are times when the market’s behaviour is driven by fundamental economic factors rather than irrational emotions. For example, during periods of extreme overvaluation, even contrarian investors may struggle to find undervalued opportunities.

The Japanese asset price bubble of the 1980s is a case in point. Driven by speculative frenzy and easy credit, property and stock prices in Japan soared to unsustainable levels. The bubble burst in the early 1990s led to a prolonged economic stagnation known as the “Lost Decade.” Investors who bought into the market during the bubble faced significant losses, highlighting the risks of ignoring fundamental valuation metrics.

Structural Economic Issues

Structural economic issues can also undermine the effectiveness of contrarian investing. In regions heavily dependent on a single industry, such as oil-dependent economies, a downturn in that industry can lead to prolonged economic challenges. For example, the collapse of oil prices in the 1980s led to a severe real estate crash in Houston, Texas. Investors who bought into the market during the downturn faced significant challenges due to the prolonged economic recovery.

The Future of Control Group Psychology in the Stock Market

Technology and data analytics advancements are transforming how investors understand and exploit control group psychology. Machine learning algorithms and artificial intelligence can analyze vast amounts of data to identify patterns in market behaviour. These tools can help investors better understand the psychological drivers of market movements and make more informed decisions.

For example, sentiment analysis tools can analyze social media posts, news articles, and other sources of information to gauge investor sentiment. By identifying shifts in sentiment, investors can anticipate market movements and capitalize on opportunities created by the crowd’s emotional responses.

The Growing Importance of Behavioral Finance

Behavioural finance, a field that combines psychology and finance, is gaining prominence as investors recognize the importance of understanding human behaviour. Researchers in this field study how cognitive biases, emotions, and social factors influence investment decisions. By understanding these factors, investors can make more informed decisions and avoid common pitfalls.

Daniel Kahneman, a Nobel laureate in economics, has significantly contributed to behavioural finance. His research on cognitive biases and decision-making processes has provided valuable insights into how investors can overcome irrational behaviour and make better investment decisions.

And finally, let’s a bit of historical perspective before we conclude this topic. Those who learn from history are saved from repeating terrible mistakes. Time is the greatest teacher and the most efficient killer at the same time. It’s the only teacher that kills all its students without fail

Stock Market Predictions 2016- take expert advice with a grain of salt

Fear is in the air, and the masses have just moved to the border of the Hysteria zone. The trend is still up on the NASDAQ and the Dow, so the outlook remains bullish. As high volatility levels, strong pullbacks are viewed as buying opportunities. A test of the August lows is likely, with a possible overshoot to the 14,800-15,000 ranges to destroy the last of the ardent bulls. The RSI has generated a lovely series of positive divergence signals, too.

All our proprietary sentiment indicators are trading in the extreme ranges, indicating that panic is in the air and opportunity is waiting to give you a big hug if you welcome into your domain. Do not become one with the crowd; crowd psychology states that you should buy when the group sells and vice versa. Smart money is buying the dip instead of selling into strength; the crowd, on the other hand, is selling the fall and will scream when the markets mount a stunning rally in the months to come. Tactical Investor Feb 2016

Conclusion

The stock market is a compelling example of control group psychology, where savvy investors who understand human psychology manipulate the crowd’s behaviour. Historical and contemporary examples, from the Tulip Mania to the dot-com bubble and the COVID-19 pandemic crash, illustrate the impact of herd behaviour on market movements. Insights from notable figures such as Benjamin Graham, John Maynard Keynes, and Daniel Kahneman underscore the importance of understanding psychological factors in investing.

While control group psychology can provide valuable insights, it has limitations. Overvaluation and structural economic issues can undermine the effectiveness of contrarian investing. However, technological advancements and the growing field of behavioural finance offer new tools and insights for understanding and exploiting market psychology.

In conclusion, by recognizing and understanding the principles of control group psychology, investors can navigate the complexities of the stock market and capitalize on opportunities created by the crowd’s emotional responses. As the saying goes, “Be fearful when others are greedy, and greedy when others are fearful.” This timeless wisdom, rooted in understanding human behaviour, continues to guide successful investors in pursuing market opportunities.

Other articles of interest:

Mob Psychology: Breaking Free to Secure Financial Success