When Will the Next Stock Market Crash Occur: A Fool’s Question

May 16, 2024

The current state of the markets might lead one to anticipate a significant downturn. This is a logical conclusion considering the overstretched nature of the markets. However, we believe there’s more to the story. Let’s start by looking at this situation through the lens of other market analysts. Following that, we’ll present our insights, suggesting there’s more to the problem than what’s initially visible.

If your analysis is primarily based on technical factors and, to some extent, fundamental factors, you could argue that a downturn is imminent.

From a technical standpoint, nearly all major indices, except possibly the Russell 2000, are trading in the highly overbought range on both weekly and long-term monthly charts. This could suggest a less-than-ideal situation, especially considering that the Advance/Decline (A/D) line hasn’t confirmed the recent highs.

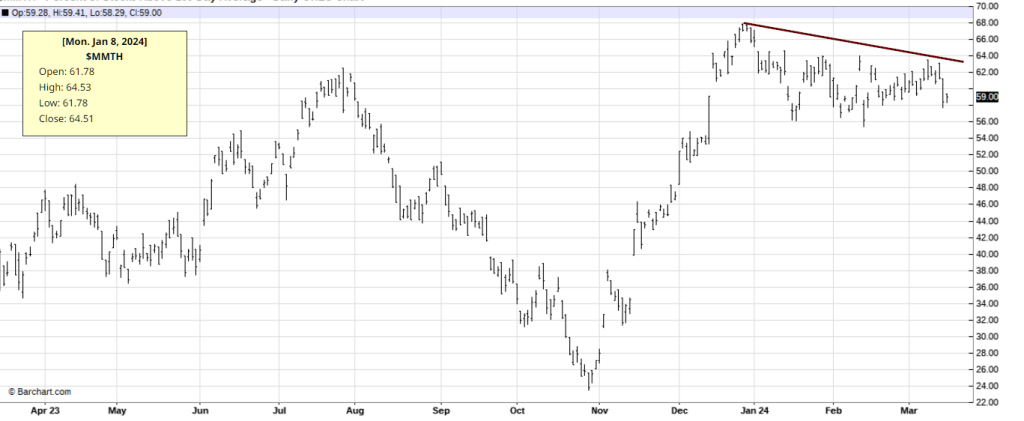

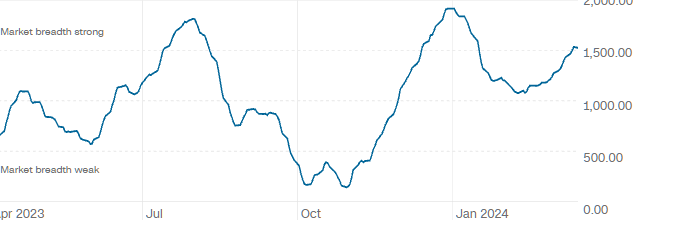

Furthermore, the percentage of stocks trading above their 200-day moving average was higher in December 2023 than at any point in 2024 (1st image below). Coupled with the fact that the McClellan Summation Index peaked in January 2024 (2nd image below), these indicators could support the idea of a sharp pullback shortly.

Courtesy of cnn.com

In short, while the market appears overstretched, various technical and fundamental indicators suggest a potential downturn, but as Machiavelli would advise, a wise investor must look beyond the surface. One must be willing to capitalize on the fears and weaknesses of others, seizing opportunities that arise from market turmoil. Remember, fortune favours the bold and those who adapt swiftly to changing circumstances.

The market fundamentals indeed present a complex picture. The inverted yield curve, where long-term debt instruments have a lower yield than short-term debt instruments, is often seen as a predictor of economic recession. This, coupled with inflationary worries, creates a sense of uncertainty in the market. The mixed bag of inflationary data suggests that the Federal Reserve might delay lowering rates, adding to the uncertainty.

There’s also a noticeable shift of investments into defensive sectors like utilities. This is often interpreted as a sign of impending market trouble, as investors seek safer returns during volatile times.

A group of stocks, the ‘Magnificent Seven,’ significantly influences the tech-heavy Nasdaq. These stocks are closely tied to the AI sector, creating a sense of market euphoria that tends to be associated with speculative bubbles.

Furthermore, the rapid rise of Bitcoin over the past year has been pointed out as another sign of rampant speculation. Bitcoin’s value has been known to fluctuate wildly, and its recent surge could be another bubble waiting to burst.

However, while valid, these technical and fundamental factors do not provide a complete picture. This analysis is missing a crucial component, which we will address shortly. If you’d like to skip ahead to that component, feel free to scroll to the end. However, let’s first examine some of the factors mentioned above.

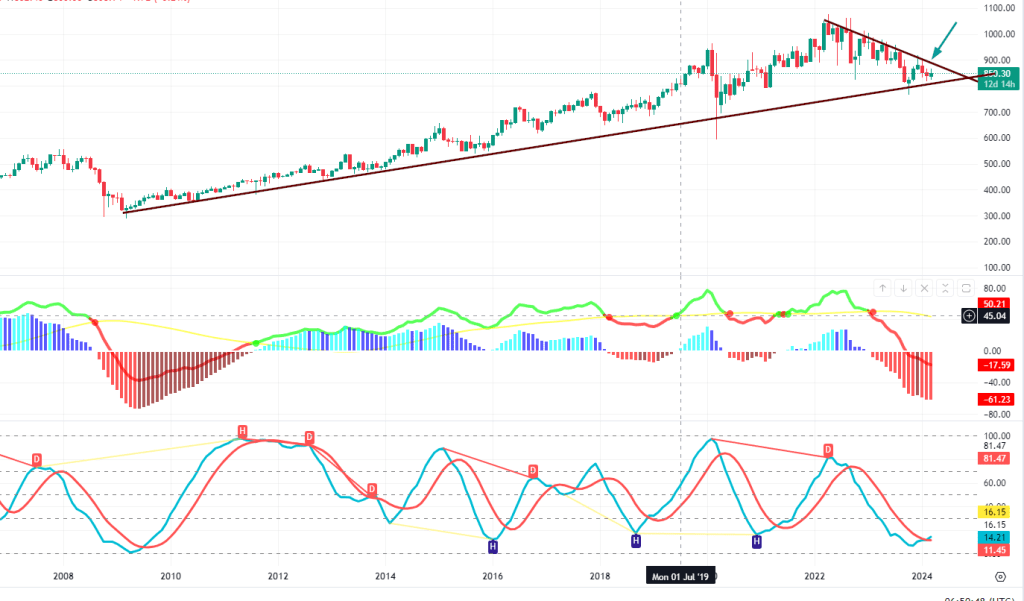

The Monthly Chart of the Dow Jones Utility Index

This monthly chart illustrates the Utilities sector, showing an upward trend that has yet to break past the downtrend line. A monthly close at or above 879 is needed for a bullish outlook. However, the notion that a market crash would ensue if utilities rise is unfounded. According to the Tactical Investor-modified Dow theory, a breakout by the DJU signals bullishness, albeit with a delay. Hence, while markets may experience pullbacks, a crash is unlikely until the missing element is in place.

As for concerns about higher rates and an inverted yield curve, this narrative has been circulated for too long without validation. In short, it’s not yet substantiated. Regarding euphoria, the masses are not exhibiting signs of widespread exuberance, though sectors like AI and Bitcoin may show some enthusiasm. However, this doesn’t justify a market crash. In the worst-case scenario, these sectors could face a more substantial pullback, with other sectors stepping in to fill the gap, as observed throughout history.

So, what is the missing element?

Recall that bullish sentiment remained below its historical average throughout most of 2022 and a significant portion of 2023. Despite the current excitement, bullish sentiment has not been able to sustain at or above 55 for two consecutive weeks. It briefly touched this level in December 2023 but hasn’t revisited it since. Last week, it briefly touched 54 before dropping below 50 again this week, with the current reading at 49.

If you haven’t deduced it yet, the missing element is rooted in Mass Psychology. Mass psychology indicates that the crowd is not experiencing euphoria. This means that the markets will not crash regardless of other factors until the masses are ecstatic. For this to occur, bullish sentiment readings must remain at or above 56 for an extended period. Additionally, there should be at least two instances where they surge to or above 60. Further confirmations will be sought from our anxiety index, trend indicator, and other sources. Until then, all corrections must be viewed through a bullish lens regardless of intensity.

Delve Deeper: Explore Exciting Topics

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity