Market Correction 2020: An Excuse For The Fed To Attack

Before this pandemic hit, we stated that central bankers, especially the Fed, were trying to take rates towards zero. Imagine how people would have reacted if the Fed had lowered interest rates by 150 bases two weeks ago. When the Fed cut rates before the coronavirus attack, experts were quick to label them as being reckless, but now after a 150 basis point cut, they say more has to be done. Notice the ploy here; to do that which the masses abhor, one has to create a situation that distracts their attention. Then offer a solution that is three times as damaging as the previous one, and in their desperation to seek safety, they will agree to whatever course of action is laid out.

The system is going to be flooded with so much liquidity that the markets will melt upward when the media starts to report the data more accurately. Right now, they talk about the mortality rate without breaking the data down and informing the masses that older individuals are the ones that fall into the high-risk category. Even then, most of them appear to have some other complications already.

Market Correction 2020 Equates To Incredible Opportunity

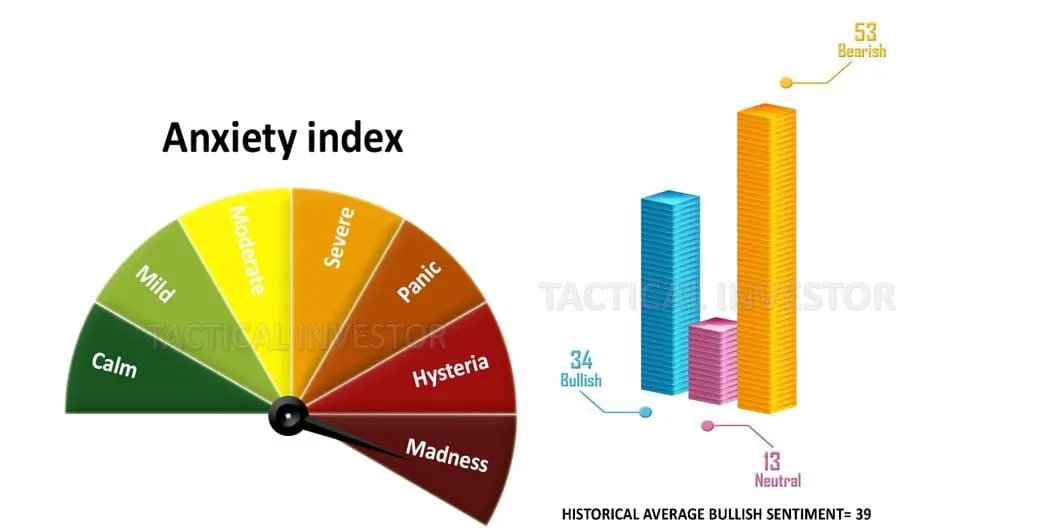

Anticipating an imminent “mother of all buys,” our confidence level is 99%. The anxiety index continues to dwell in the depths of madness, poised on the brink of a potential surge with the next pullback. Notably, the secondary indicators indicate extreme trading ranges, while bullish sentiment remains below its historical average, although surprisingly high amidst the chaos. While neutral sentiment has seen a modest increase, it still falls significantly below its historical average. Activation of this buying scenario hinges on either neutral sentiment testing its recent lows or slight additional movement in our weekly indicators.

Both the 1987 crash and 2008 crashes are considered significant “mother of all buying opportunities.” However, there is a possibility of a setup surpassing even these remarkable occurrences, creating what can be referred to as the “father of all opportunities.” Such an event is exceedingly rare, perhaps transpiring only once in an individual’s lifetime. While the current landscape may appear distressing in the short term, it is essential to avoid fixating solely on immediate timelines, as the chances of achieving substantial profits under such circumstances are pretty slim.

Sharp Pullbacks equate to an Opportunity.

Merely three weeks ago, investors would have eagerly embraced the current prices, but within 15 days, sentiments have shifted dramatically. Volatility is expected to persist until the month’s end, especially considering the astounding surge of 650 points in V readings, reaching an all-time high. It’s worth reflecting on the significance of the Fed’s decision to reduce rates by 150 basis points in just two weeks—a monumental development overshadowed by the prevailing hysteria. Companies are poised to capitalize on this environment with their share buyback programs.

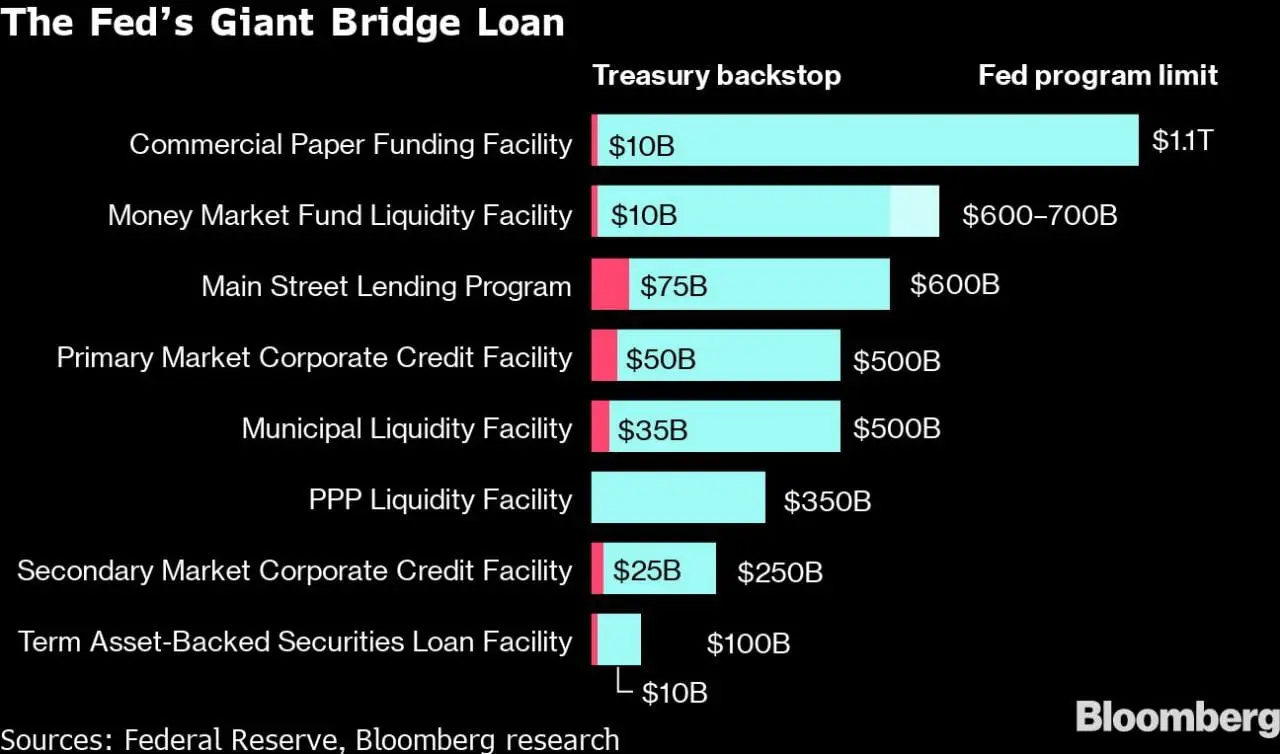

Once the panic subsides, a frenzy unlike any witnessed before is likely to ensue. The combination of near-zero interest rates, massive injections of two trillion dollars by the Federal Reserve, and several additional billion-dollar stimulus packages to revitalise the economy will propel the market to unprecedented heights by today’s standards. Moreover, zero rates will prompt many individuals with fixed incomes to engage in speculation, particularly as they possess significant cash reserves on the sidelines.

Stock Market Correction 2020; Just another Buying Opportunity in Disguise

The Trump administration has disbursed approximately $881 billion from the critical components of the pandemic relief package enacted into law a month ago. Furthermore, an additional half a trillion dollars is set to be injected into the economy shortly.

The distribution of nearly half of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act was the responsibility of the Treasury Department, utilizing various channels. While one significant portion, specifically the aid designated for small businesses, depleted its funds within two weeks, a significant amount of money is still available for allocation.

During a recent interview with Bloomberg News, Treasury Secretary Steven Mnuchin highlighted the unprecedented fiscal and monetary response that has been witnessed.

In alignment with this response, President Donald Trump is set to sign a new law on Friday, which will allocate an additional $484 billion in rescue funds. These funds will replenish small business assistance, support hospitals, and allocate resources for virus testing. Here is a summary of the current expenditures and commitments made under the critical programs established by the enacted law. Yahoo

This kind of liquidity is like throwing gasoline on a raging fire. While the short-term pullback has been vicious, the counter rally will be even stronger. The first stages of the counter-rally indicate what lies in store for these markets years ago. Now is the time to back the truck up and buy quality stocks.

Other Stories of Interest

Stock Trends & The Corona Virus Factor (March 14)

Misdirection And Upcoming Trends For 2020 And Beyond (March 13)

Trading The Markets & Investor Sentiment (March 3)

Brain Control: Absolute Control Via Pleasure (Jan 20)

Indoctrination: The Good, The Bad and the Ugly (Jan 15)

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)