Avoiding Debt Can Lead to Financial Freedom and Hope.

March 27, 2024

Introduction

In the timeless wisdom of the Book of Proverbs, it is written that “the rich rule over the poor, and the borrower is slave to the lender.” These ancient words carry a profound truth that echoes through the ages as a stark reminder of the enduring principles of financial freedom. As the renowned investor John Templeton sagely observed, “The four most dangerous words in investing are: ‘This time it’s different.'” History has repeatedly shown that the fundamental tenets of sound financial management remain constant, and foremost among them is the crucial importance of avoiding excessive debt and leveraging.

The devastating consequences of disregarding this wisdom were vividly illustrated during the stock market crash of 1929 and the ensuing Great Depression. This dark chapter in economic history serves as a sobering cautionary tale, underscoring the paramount need for prudence, discipline, and foresight in navigating the complex world of finance. By heeding past lessons and embracing the time-honoured principles of financial responsibility, individuals can chart a course towards lasting prosperity and security, even in the face of life’s inevitable challenges and uncertainties.

The Psychological Toll of Debt

In the poignant words of Sigmund Freud, the father of psychoanalysis, “Money is a source of anxiety and stress for many people.” This astute observation encapsulates the profound psychological toll that debt can inflict upon individuals. When mired in debt, our mental well-being suffers as we grapple with feelings of shame, guilt, and hopelessness. These negative emotions can entrap us in a vicious cycle, tempting us to seek solace through further spending, thus exacerbating our financial woes.

Numerous studies have illuminated the vital link between debt and a host of mental health issues, including depression, psychological distress, cognitive disorders, and even suicidal ideation . The social stigma associated with indebtedness can be severe, as highlighted by historical and ethnographic research. Moreover, the strain of debt can erode the very fabric of our relationships, with over half of Americans citing it as a potential catalyst for divorce.

Yet, amidst this bleak landscape, there is a beacon of hope. As the legendary investor John Neff wisely remarked, “The best way to make money is not to lose it.” By embracing a life of financial prudence, living within our means, and saving diligently, we can break free from debt and experience a profound sense of liberation. Even those currently struggling with debt often cling to optimism, with over a third believing they will achieve financial freedom within five years.

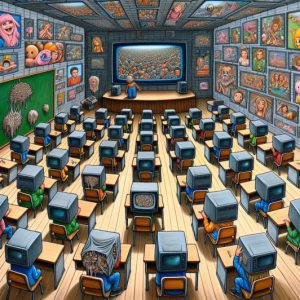

The Herd Mentality and the Cycle of Debt

This hard-hitting subtopic, heavily infused with mass psychology, can be placed after the section “The Psychological Toll of Debt” and before “The Power of Compound Interest.” Here’s how it could be incorporated:

The Herd Mentality and the Cycle of Debt As Gustave Le Bon, the renowned French social psychologist, observed in his groundbreaking work “The Crowd: A Study of the Popular Mind,” “Crowds are always impressed by appearances and by results.” This insight helps explain why so many people fall into debt despite the lessons of history.

The masses, driven by a herd mentality, often make financial decisions based on what they see others doing rather than sound economic principles. They buy houses they can’t afford, cars they don’t need, and gadgets they’ll soon forget, all trying to keep up with the Joneses. As Machiavelli, the Italian Renaissance philosopher, wryly noted, “Men are so simple and so much inclined to obey immediate needs that a deceiver will never lack victims for his deceptions.”

This short-sighted behaviour leads to a vicious cycle of debt, where individuals take on ever-increasing loans to maintain a lifestyle they cannot sustain. They fail to grasp that avoiding debt can lead to financial freedom and hope. Instead, they focus on consumerism’s fleeting pleasures, oblivious to their actions’ long-term consequences.

As John Templeton, the legendary investor, often reminded us, the solution is to “invest at the point of maximum pessimism.” In other words, it’s time to buy when the herd sells in a panic. And when the masses are greedily snapping up assets at inflated prices, it’s time to sell. By living below our means and using market downturns as opportunities to invest, we can break free from the cycle of debt and set ourselves up for long-term financial success.

As Catherine the Great, the visionary Empress of Russia, once declared, “I shall be an autocrat: that’s my trade. And the good Lord will forgive me: that’s his.” While we may not have the power of an empress, we can certainly take control of our financial destiny by rejecting the herd mentality and embracing the timeless principles of wealth-building.

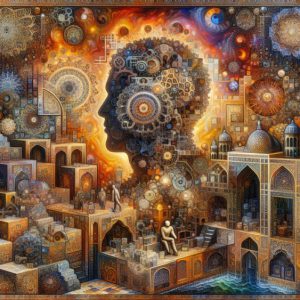

The Power of Compound Interest

Albert Einstein, the legendary physicist, once declared, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it.” This profound statement highlights the immense potential of compound interest to shape our financial destinies. In this article, we’ll explore why avoiding debt and embracing the power of compound interest can lead to a life of economic freedom and prosperity.

When we are in debt, we become unwitting victims of compound interest. Every dollar we owe multiplies over time as interest charges relentlessly compound, creating a snowball effect that can quickly spiral out of control. The longer we remain in debt, the more we pay in interest, siphoning away our hard-earned money and hindering our ability to build wealth.

Conversely, when we harness the power of compound interest to our advantage, we unlock a world of financial possibilities. By consistently saving and investing a portion of our income, we set in motion a powerful force that works tirelessly in our favour. Over time, our interest in our investments begins to compound, generating even more interest on top of our original principal.

Warren Buffett, the legendary investor, attributes much of his success to the power of compound interest. His authorized biography, aptly titled “The Snowball,” references the snowball effect – the idea that a small snowball, when rolled down a hill, gathers more snow and momentum, growing exponentially. Similarly, when left to compound over time, our investments can snowball into substantial sums, far exceeding our initial contributions.

To grasp the astonishing potential of compound interest, consider the Rule of 72. Given a specific annual return, this simple formula reveals how long it takes for an investment to double in value. By dividing 72 by the annual return percentage, we can estimate the years required for our money to double. For example, at a 10% yearly return, our investment would double every 7.2 years. Over 50 years, that initial investment would multiply by an astounding 117 times.

The key to unlocking the full potential of compound interest lies in patience and discipline. The earlier we start saving and investing, the more time our money has to grow. Even small amounts can yield remarkable results when consistently invested over a long period. For instance, investing just $10 per week for 30 years at a 7% annual return would result in a final balance of over $60,000.

Avoiding Debt: The Path to Financial Freedom and Hope

Cultivating the habit of living below one’s means is crucial in resisting the siren song of consumerism. As Gustave Le Bon, the French social psychologist, observed, “The masses have never thirsted after truth. They turn aside from evidence not to their taste, preferring to deify error if error seduces them.” To build a solid foundation for lasting wealth and happiness, prioritizing long-term financial goals over short-term gratification is essential. Bill Miller, the legendary investor who beat the S&P 500 for 15 consecutive years, emphasized the importance of long-term thinking in business.

Financial literacy plays a vital role in avoiding debt and achieving financial freedom. As Catherine the Great once said, “I shall be an autocrat: that’s my trade. And the good Lord will forgive me: that’s his.” While not everyone is born into royalty, taking charge of one’s financial destiny through education and discipline is possible. By learning about personal finance, investing, and the psychology of money, individuals can make informed decisions that align with their values and goals.

Jerry Buss, the visionary owner of the Los Angeles Lakers, wisely stated, “I don’t worry about what I can’t control. I just try to deal with the things I can.” Focusing on controllable factors such as spending habits, saving and investing strategies, and mindset can help chart a course towards financial freedom and hope. By living below their means and continuously seeking financial education, individuals can break free from the shackles of debt and experience the profound sense of liberation that comes with economic independence.

Conclusion on Avoiding Debt Can Lead to Financial Freedom and Hope.

In the words of Thomas Cromwell, the influential advisor to King Henry VIII, “The world is not run from where he thinks. Not from border fortresses, not even from Whitehall. The world is run from Antwerp, from Florence, from places he has never imagined.” In our modern age, the world is run by the global financial markets, and those who master the art of avoiding debt and investing wisely will shape the future.

As we navigate the complex landscape of personal finance, let us remember the timeless wisdom of those who came before us. By living below our means, harnessing the power of compound interest, and continually educating ourselves, we can break free from the chains of debt and achieve true financial freedom. And in so doing, we will inspire hope not only for ourselves but for future generations.

Tasty Treats

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

Giving Content to Investor Sentiment: The Role of Media in The Stock Market

Considering the impact of inflation, Why Is Investing Important?

Technical Analysis of Stocks and Commodities: Unveiling Insights

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

Investor Sentiment in the Stock Market Journal of Economic Perspectives

Mass Psychology of Fascism: Unmasking Bombastic News

Identifying Trends and Buying with Equal Weighted S&P 500 ETF

Real Doppelgangers: The Risks in the Age of AI

The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts

TGB Stock Forecast: Rising or Sinking

Stock Market Crash Date: If Only The Experts Knew When

Reasons Why AI Is Bad: The Dark Truth?

The Inflationary Beast: Understanding What Inflation is and What Causes It

Carnosine Benefits: An Antioxidant for Health, Longevity, and Disease Prevention

Simplicity: Tax Lien Investing for Dummies: Simplified Success in Property Stakes