How to Navigate the Bull and Bear Market Hyperbole

Updated March 2023

We’ve all heard “bull and bear market.” These two terms refer to trends in the stock market, but what do they mean? Generally, a bull market means stocks are rising, and a bear market means stocks are falling. However, there is more to these terms than just the market’s direction.

The Myth of Bull and Bear Markets

The bull and bear markets are often used to describe the stock market’s overall direction. However, we believe that this is an oversimplification of what is happening in the market. The market moves in cycles, and a variety of factors, such as economic conditions, geopolitical events, and changes in monetary policy, can drive these cycles.

One of the investors’ biggest mistakes is trying to be a “bull” or “bear” and investing accordingly. This strategy is misguided because it assumes that the market is always trending in one direction, which is not the case. The reality is that the market is constantly changing, and it is important to adjust your strategy accordingly.

The Importance of Focusing on the Trend

Instead of trying to be a bull or bear, we suggest focusing on the trend. The trend is your friend, and everything else is your foe. When you focus on the trend, you can avoid getting caught up in the noise of the market and make more informed investment decisions.

There are many ways to determine the trend, but one of the simplest methods is to look at the moving average of the market. The moving average is a line that tracks the market’s average price over a certain period. When the market is above the moving average, it is in an uptrend; when it is below the moving average, it is in a downtrend.

Buying Opportunities in Market Crashes

It is important to note that market crashes are not the end of the world. In fact, market crashes represent some of the best buying opportunities in the market. This is because market crashes are often driven by panic and fear, which can cause prices to drop significantly below their true value.

The saying “bulls win sometimes, bears win sometimes, but pigs always get slaughtered” rings true in this scenario. Trying to time the market and catch the exact bottom is a fool’s errand. Instead, focus on buying good companies at a fair price and holding them for the long term.

Weaponized News and the Stock Market

One of the biggest challenges facing investors today is weaponized news. The media has the power to influence public opinion and the stock market. The problem is that the media is often more interested in generating clicks and views than providing accurate and unbiased information.

In recent years, we’ve seen many instances where old news has been spun into something sinister. The media has a tendency to sensationalize stories and take them out of context, which can cause panic and fear in the market.

The role of social media has only made things worse. Anyone with an internet connection can now become a “news” source, regardless of their qualifications or expertise. The result is a constant stream of information, much of which is inaccurate or misleading.

Bull and bear markets are not as simple as they seem. The market moves in cycles, and it is important to focus on the trend rather than trying to be a bull or bear. Market crashes are buying opportunities, and avoiding getting caught up in the noise of weaponized news is important. By staying focused on the long-term trend and buying good companies at a fair price, investors can build wealth over time.

Other Random thoughts

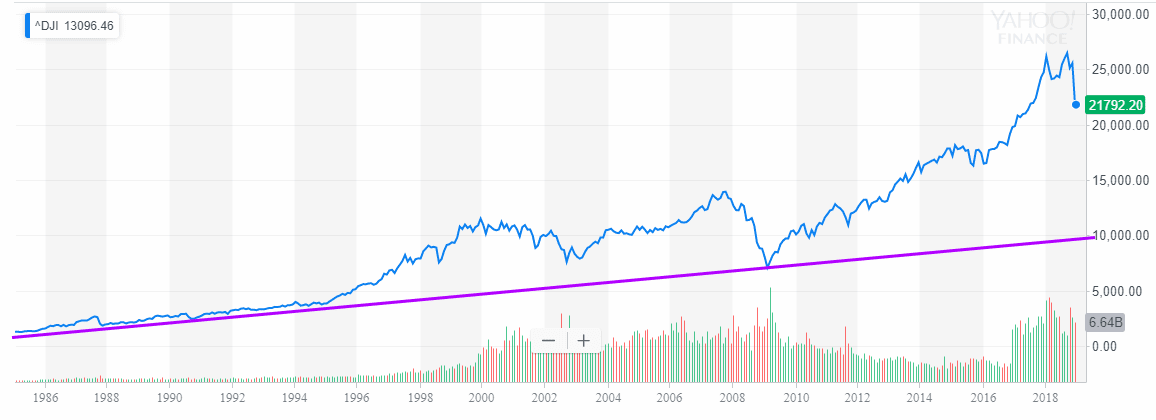

The stronger the deviation, the better the opportunity; markets always revert to the mean. No matter how much one might be tempted to disagree, the above charts state otherwise.

If you look at any long-term chart, the pattern is obvious; all sharp corrections and or crashes represent an opportunity.

The crash of 2008 was one of the most painful in recent history, and yet, despite this vicious pullback, the Dow is still trading well over 200% above its 2009 lows. From a long-term perspective, the Bull And Bear market story is moot. One’s strategy should be to determine the trend and nothing else, for the trend is your friend, and everything else is your foe.

Another myth peddled repeatedly is the issue of how long it takes a market to recoup it has lost gains. Our response is, who cares? What matters is the stocks you buy, not a particular market index. Many stocks had already tacked on gains of several hundred percentage points before the Dow traded above its 2008 highs. The same is going to happen this time around. Strong companies will recoup their gains 2X to 3X faster than the broader markets, so when the Dow trades past 27K, some of these stocks will show gains of over 100%.

Bull and Bear Market Myths Closing thoughts

When blood is flowing in the streets, as is the case right now during this coronavirus pandemic, one should consider nibbling at stocks if one has a long-term perspective. Do not deploy all your funds in one short but deploy them in lots this way if the stock dips lower your average entry price drops.

When we get into plays (at the Tactical investor) we don’t think in terms of days. Under normal market conditions, our minimum holding time is several months. Under the current circumstances, our time frames lengthen as the potential for huge profits surges significantly. In the short term, it’s a bloodbath out there, but in such an environment, one finds outstanding opportunities, leading to the dawn of the next bull market.

It is easy to buy when the sun is shining, but the problem is that almost everything is being sold at a premium. It’s when things appear gloomy that the best bargains are found.

Other stories of Interest

Flow of Funds: Contrarian Opportunities & BTC Market Insights

Long Term Trends Equates to focusing on the trend

Stock Market Euphoria or Stock Market Insanity

Volatile Stock Market

Gold Breakout Imminent: Rally on the Horizon

Tactical Investor: Archives of Past Market Updates

Navigating the Short Dow ETF: Buy, Sell, or Hold for Maximum Returns

Easy Money Environment Fosters Price manipulation

What is deflation? A bigger Problem Than Inflation

Market Opportunity: Embrace crashes like a lost love

Market insights: Fight the Fed & End Up Dead

BBC Global 30 Index Indicates Upward Trend for Dow Industrials

Successful Investing: Dare to Be Different for Unprecedented Success

Russell 2000: Great Buy Signal In the making