Difference Between Inflation and Deflation: Soft Touch or Sudden Hit?

“The four most dangerous words in investing: ‘this time it’s different.’” — Sir John Templeton

April 5, 2025

Inflation grabs headlines; deflation rewrites futures. While inflationary fears rise like smoke from economic sparks, deflation is the deeper, slower fire that scorches unnoticed until it reshapes the entire landscape. In the long game, technology, demographics, and psychological inertia tilt the scale toward deflation. The future doesn’t inflate—it innovates.

The Cry of Wolf: A Legacy of Misfires

Time after time, experts have sounded the inflation alarm. Each time, the boom fizzled:

- 2009: “Inflation Scare: Crazy but Real”

- 2010: “My Inflation Nightmare”

- 2011: “A high price to pay”

- 2016: “Inflation will be the biggest economic story”

- 2020: “The Coronavirus Economy Will Bring Inflation”

They cried wolf; the wolf never came. What came instead? Stability—and technological deflation.

Inflation Redefined, Misunderstood, Misused

Once rooted in monetary theory—inflation as an increase in the money supply—modern usage obsesses over rising prices, a symptom, not the disease. This semantic drift fuels confusion, enabling misdiagnosis of economic trends and policy misfires.

Hyperinflation: The Phantom Menace

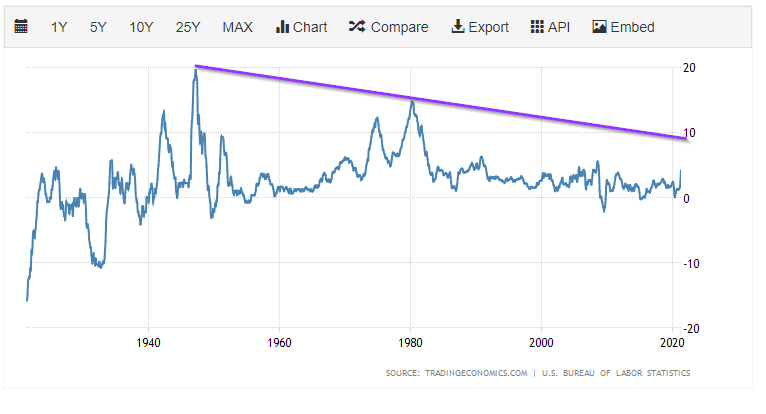

A century-long view of the CPI shatters the hysteria. The feared “runaway” inflation? It was barely a stumble. The index would need to jump severalfold before echoing any true danger. The data paints a picture not of collapse but of friction—grit in the gears, not a system on fire.

Europe’s Low-Burn Inflation

Germany’s inflation in 2021? More echo than explosion—a VAT rollback, not a monetary quake. Across the Eurozone, inflation averaged just 0.9% over five years. If this is the monster, it’s wearing paper claws.

Technology: The Silent Assassin of Prices

AI, automation, digitization—this is deflation by design. Machines don’t just do things faster; they do them cheaper. The more intelligent the system, the less we pay. Kurzweil calls it exponential productivity. We call it the deflationary undertow pulling against every inflationary gust.

Inflation, Illusion, and the Intellectual Collapse of Consensus

This chart dismantles the inflated myth of inflation hysteria. Treating CPI fluctuations as existential threats when the index hasn’t even breached 10 is not just premature—it’s intellectually dishonest. We’re nowhere near the structural pressure that would justify panic, let alone policy overreach.

But here’s the deeper concern: we’re trapped in a binary echo chamber—everything is either crisis or calm, inflationary or deflationary, true or false. This is the death of vector thinking, where context, momentum, and asymmetry matter more than static labels.

We now live in a culture where both youth and adults are equally entitled and uncurious. The real crisis isn’t inflation—it’s intellectual laziness. People worship data without questioning methodology, elevate credentials over competence, and accept editorialized science as unassailable truth.

Less than 10% of the population seems capable—or willing—to interrogate first principles. Much of what parades as “science” is just ideology dressed up in statistical jargon. And many of today’s so-called experts wouldn’t have passed as competent thinkers a few generations ago—they’d be laughed out of the room.

The challenge isn’t just bad theory—it’s a civilization allergic to nuance, allergic to effort, and increasingly hostile to dissent. That’s the real inflation: the overvaluation of consensus and the underpricing of truth.

The Madness of Crowds: Where Mass Psychology Hijacks Reality

Keynes didn’t miss—he fired a warning shot. Markets stay irrational not just longer than you stay solvent but longer than most can stay sane. The crowd doesn’t calculate; it mimics. It doesn’t discern; it echoes. Emotional contagion, narrative inertia, and dopamine-fueled feedback loops hijack price action with zero regard for underlying structure.

Forget fundamentals. In a herd, perception is reality—until it isn’t. And when the illusion breaks, it breaks fast.

Media: The Megaphone of Mass Delusion

Today’s hysteria isn’t organic—it’s syndicated. The media doesn’t just report sentiment—it manufactures it, amplifies it, sells it in 30-second cycles. Inflation panic makes great content. Doomscrolling drives clicks. Repetition becomes belief. Belief becomes “consensus.” And consensus, no matter how unfounded, becomes policy.

We’re not in an information age—we’re in an amplification age. And volume is not the same as truth.

Dot-Com to GameStop: Echoes of the Irrational

We’ve seen this movie. The faces change; the plot doesn’t. In ’99, it was fiber optics and vaporware. In 2021, it was short squeezes and Reddit rage. Fundamentals got laughed out of the room. In their place: conviction—raw, unvetted, and viral.

What moved markets wasn’t cash flow or margin expansion. It was belief, weaponized by community. Narrative became capital. Hype became liquidity. Price became a poll—not a valuation, but a vibe.

And still, people act surprised when gravity returns.

Cognitive Tripwires: Biases That Derail Judgment

- Availability Heuristic: If it’s vivid, it’s real—regardless of probability.

- Recency Bias: Last week’s panic becomes tomorrow’s forecast.

- Loss Aversion: Fear of pain overwhelms logic. Traders cling to losses and bail on gains.

- Confirmation Bias: We don’t seek truth—we seek comfort in agreement.

Technical Analysis: Trading Against the Tide

While psychology fuels the frenzy, technical analysis offers structure amid chaos.

- Support & Resistance: Battle lines of buyer and seller conviction.

- Moving Averages: Momentum made visible—50-day and 200-day are trend sentinels.

- Volume Spikes: Panic is loud. Smart money is quiet.

- RSI Extremes: Oversold doesn’t mean worthless. It often means overlooked.

Case in Point: March 2020 — While media screamed apocalypse, RSI signaled blood in the streets. Those watching charts, not headlines, saw opportunity before the rebound roared.

Commodities, Money Velocity, and the Illusion of Correlation

Take Nickel: 25 years of price stagnation despite ballooning money supply. Why? Because the velocity of money—the true driver—is at generational lows. Money’s not chasing goods; it’s stuck in dead zones of debt and hoarding.

Deflation in tech, inflation in healthcare. Prices down for code, up for care. We live in a bifurcated economy. And yet, central banks peddle one-size-fits-all narratives.

The Fed’s Narrative Machine

The Fed isn’t blind—it’s strategic. Admitting the coexistence of inflation and deflation wrecks its binary models. It needs inflation expectations to stay tame, so it manages perceptions, not outcomes—monetary theatre, not monetary policy.

Here’s a sharpened, more forceful version of the conclusion. It keeps your tone, adds weight, and makes the final punch land with more velocity:

Fear as Fuel: The Contrarian’s Edge

Buffett wasn’t being poetic—he was laying out a playbook. Fear isn’t a warning sign; it’s raw material. It distorts prices, fractures narratives, and creates blind spots wide enough to drive alpha through. When the herd bolts, the contrarian doesn’t just stay put—they press forward with intent.

The hyped and headline-hungry inflation is often just noise—amplified by media and misunderstood by the masses. The real threat is quieter. Deflation doesn’t scream; it erodes. It rewrites the script without asking permission.

So ignore the volume. Watch the slope. Vectors matter more than velocity. Structures matter more than stories. And truth rarely travels in packs.

The edge isn’t found where everyone’s looking. It’s in the dissonance—between signal and story, between fear and fundamentals. Bet against the crowd not because it’s popular but because the crowd forgot how to think.

That’s the edge. And in markets like this, it’s everything.