When is the Best Time to Buy Stocks: Key Insights

April 24, 2024

Introduction

“Buy when there’s blood in the streets, even if the blood is your own.” These famous words, attributed to 18th-century British nobleman and Rothschild banking family founder Baron Rothschild, encapsulate the contrarian approach to investing championed by some of history’s greatest traders. While the average investor flees the market in panic during crashes and downturns, the astute buyer sees opportunity amidst the chaos.

Nearly a century later, in the early 1900s, Jesse Livermore, one of the most successful stock traders of all time, offered this sage advice: “There is only one side to the stock market, and it is not the bull side or the bear side, but the right side.”. Livermore understood that the key to profitable investing was not mindlessly following the herd but carefully analyzing market conditions and having the conviction to bet against the crowd when warranted.

The philosophies of Rothschild and Livermore ring true to this day. The optimal time to buy stocks is often during periods of maximum pessimism when weak hands are folding, and fear rules the market. History has repeatedly shown that the most significant gains frequently follow on the heels of the darkest times, whether the Great Depression, Black Monday in 1987, or the Global Financial Crisis of 2008-2009.

Of course, having the fortitude to buy when the financial world appears to be crumbling is no easy feat. It requires nerves of steel, a long-term perspective, and an unshakable faith in the resilience of capital markets. Those who can muster the courage to invest when things look bleakest are often handsomely rewarded as stocks inevitably recover and soar to new heights.

So, while it may feel counterintuitive, the most profitable time to put money to work in the market is usually during a gut-wrenching selloff. As Warren Buffett, the most significant investor of the modern era, famously said: “Be fearful when others are greedy, and greedy when others are fearful.” Heed the wisdom of Rothschild, Livermore and Buffett, and you’ll be well on your way to investment success.

The Joy of Contrarianism: Flourishing in Market Turmoil

The 16th-century French philosopher Michel de Montaigne was a master of contrarian thinking. He believed in challenging conventional wisdom and exploring ideas from multiple angles. In his famous Essays, he wrote, “We are, I know not how double in ourselves, so that what we believe we disbelieve, and cannot rid ourselves of what we condemn.”

This spirit of contrarianism is precious for investors navigating turbulent markets. **While the crowd rushes to sell in a panic during crashes, the intrepid contrarian sees an opportunity to buy quality assets at bargain prices.** Some notable examples:

In the depths of the Great Depression in 1932, the Dow Jones Industrial Average had fallen 89% from its 1929 peak. Yet this proved an incredible buying opportunity, as the Dow went on to gain 368% over the next five years.

After Black Monday in 1987, when the Dow plunged 22.6% in a single day, many declared the bull market over. Once again, the contrarians were rewarded. Stocks recovered all their losses within two years, and the Dow climbed over 1100% over the next decade.

– During the Global Financial Crisis, the S&P 500 lost over half its value, bottoming out in March 2009. Investors who had the fortitude to buy during this period of maximum pessimism saw the S&P 500 rise more than 400% over the following decade.

Of course, Montaigne also counselled moderation, noting that “The most extreme and exciting contrarianism is an exercise in self-indulgence rather than a sustainable philosophy.” Investors must not be contrarian simply for the sake of being contrary.

Look for objective signs that fear may be overblown, such as declining volatility, stabilizing credit spreads, and improving economic data. Focus on companies with competitive advantages, healthy balance sheets, and reasonable valuations. Avoid highly speculative stocks or those facing severe secular headwinds. And be patient – wait for authentic signs of stabilization before buying aggressively.

By combining a contrarian mindset with a rational, disciplined approach, investors can take advantage of market dislocations and sow the seeds for handsome long-term returns. In the timeless wisdom of Montaigne, “The great and glorious masterpiece of man is to know how to live to purpose.” For the bold contrarian, volatility is not a risk to be feared but an opportunity to profit and ultimately flourish.

https://youtu.be/A_uB9bdzF0g

Optimal Strategies for Stock Investment Timing

Investing in the stock market is a nuanced activity that requires patience, insight, and strategic acumen. Historical trends and market analysis suggest that the best times to buy stocks are during market corrections or pullbacks. These downturns often scare off less experienced investors, but they can provide golden opportunities for those with a long-term perspective.

Market Dynamics and Investor Psychology

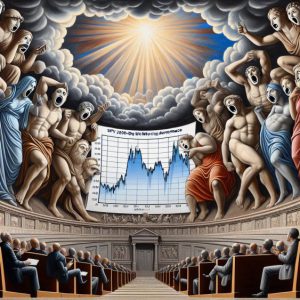

As weekly charts indicate, the stock market often experiences short-term gains that lead to overbought conditions. Such scenarios typically precede pullbacks or corrections. While some may view these corrections as harbingers of a market crash, seasoned investors understand that these moments can offer valuable buying opportunities. The key is to avoid hasty decisions and wait for a significant dip in bullish sentiment, often quantified by sentiment indices falling below certain thresholds, such as 40. This is usually when fear overtakes the market, causing an overcorrection in stock prices relative to their fundamental values.

Fundamental Analysis and Quality Assessment

When considering stock purchases during these downturns, focusing on companies with robust financials, loyal customer bases, and resilient business models is crucial. These attributes often enable companies to withstand market volatility and position them for substantial rebounds once market sentiment improves. For instance, a company trading at a low Price-to-Sales (P/S) ratio compared to its historical averages might be undervalued, presenting a favourable buying opportunity.

Strategic Approaches to Buying Stocks

1. Long-Term Investment Focus: Embracing a long-term investment strategy helps mitigate the impact of volatile short-term market movements. Over extended periods, the stock market has generally provided positive returns, reinforcing the benefit of this approach.

2. Diversification: To effectively manage risk, investors should diversify their portfolios across various sectors and industries. This strategy helps balance the portfolio, offsetting potential losses in one area with gains in another.

3. Dollar-Cost Averaging: Regular investments of fixed sums over time, regardless of the stock price, average out the cost of investments and reduce the risk of market timing.

4. Market Condition Monitoring: The most opportune times to buy stocks are typically after a significant market downturn. It is wise to resist investing during peak market euphoria and focus on periods when pervasive fear provides lower stock prices.

Mastering the Art of Stock Investment Timing

Successful investing in the stock market demands a nuanced approach that harmonizes fundamental analysis with technical insights to seize opportune entry moments. This strategy hinges on identifying companies with robust fundamentals while precisely timing entries to capitalize on market volatility and periods of heightened fear.

Embracing a Long-Term Perspective Amid Market Turbulence

Throughout history, market downturns like the Great Depression and the 2008 financial crisis have tested investors’ resilience. However, these events have also underscored the importance of maintaining a long-term perspective. Investors often reap substantial gains as markets inevitably recover by weathering the storm, avoiding panic-driven sell-offs, and staying the course. Embracing this long-term view enables one to withstand volatility and capitalize on eventual upturns, echoing the wisdom of Jonathan Swift, who might have appreciated the irony in market overreactions. As Swift might suggest, a wise investor looks beyond immediate fears to the underlying realities.

This sentiment resonates with Charlie Munger’s investment philosophy, which emphasizes patience, focusing on long-term value, and resisting the allure of hasty market timing. A disciplined, informed strategy that avoids impulsive decisions is critical to navigating market complexities with composure.

Practical Application and Adaptive Portfolio Management

Effective portfolio management extends beyond selecting promising stocks; it necessitates continuous oversight and adapting to evolving circumstances without compromising long-term objectives. This involves understanding market cycles, mitigating risk through diversification, and employing strategies like dollar-cost averaging to reduce the impact of volatility. By remaining vigilant and proactively managing investments, investors can transform potential downturns into opportunities for growth, steadfastly focused on their financial goals.

Mastering the art of stock investment timing requires a holistic approach that harmonizes fundamental analysis, technical insights, a long-term perspective, and adaptive portfolio management. By embracing the wisdom of figures like Jonathan Swift and Charlie Munger, investors can navigate market complexities with composure, seizing opportune moments while maintaining a disciplined, informed strategy aligned with their long-term aspirations.

Conclusion

The best time to buy stocks is not dictated by a single indicator but by a combination of strategic analysis, market conditions, and personal investment goals. By employing both fundamental and technical analysis, embracing a long-term perspective, and managing investments wisely, individuals can navigate the complexities of the stock market. Drawing on the enduring insights of figures like Jonathan Swift and Charlie Munger, investors are reminded of the virtues of patience, the value of a broad perspective, and the importance of staying informed and prepared, regardless of market conditions. This holistic approach mitigates risks and enhances the potential for significant returns, aligning with the timeless wisdom that true success in investing comes from understanding both the market and oneself.

Drawing on historical wisdom, such as that from the legendary trader Ibn Battuta (1304–1369), we find that the principles of cautious optimism in times of general fear have long been compelling. Battuta, known for his extensive travels and trading insights, often spoke of the virtues of patience and the strategic acquisition of goods during times of abundance or market pessimism.

In conclusion, the best time to buy stocks is not a one-size-fits-all answer but a strategic decision based on market analysis, investor psychology, and a disciplined investment approach. By adhering to these principles, investors can navigate the complexities of the stock market and enhance their chances of long-term success.

Interesting Reads

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

Investor Sentiment in the Stock Market Journal of Economic Perspectives

Mass Psychology of Fascism: Unmasking Bombastic News

Identifying Trends and Buying with Equal Weighted S&P 500 ETF

Real Doppelgangers: The Risks in the Age of AI

The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts

TGB Stock Forecast: Rising or Sinking

Stock Market Crash Date: If Only The Experts Knew When

Reasons Why AI Is Bad: The Dark Truth?

The Inflationary Beast: Understanding What Inflation is and What Causes It

Carnosine Benefits: An Antioxidant for Health, Longevity, and Disease Prevention

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Psychology of Cursing: Why Do People Curse So Much?

Spy 200-Day Moving Average: Covert Financial Indicator Unveiled