July 28, 2024

How Did Many Banks Fail Consumers in the Stock Market Crash of 1929: Examining the Economic Fallout

Introduction:

As Socrates once said, “The unexamined life is not worth living.” In the context of the 1929 stock market crash, this quote reminds us of the importance of scrutinizing the actions of financial institutions. The crash, which led to the Great Depression, was a pivotal moment in history that exposed the vulnerabilities of the banking system and its failure to protect consumers. Today, we will examine the question, “How did many banks fail consumers in the Stock Market Crash of 1929?” by drawing insights from notable philosophers and successful investors.

The Speculative Frenzy and Lack of Regulation

In the years leading to the 1929 crash, the stock market experienced a speculative frenzy fueled by excessive optimism and a lack of proper regulation. Aristotle noted, “It is not always the same thing to be a good man and citizen.” Banks often prioritized their interests over their customers in pursuit of profits. They encouraged speculative investments and offered loans to investors without adequately assessing the risks involved. This lack of prudence and regulation set the stage for the impending crisis.

The Role of Margin Loans in Amplifying Losses

One of the most significant ways banks failed consumers during the 1929 crash was through the excessive use of margin loans. Jesse Livermore, a renowned investor of the early 20th century, observed, “The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear.” Banks allowed investors to borrow money to purchase stocks, often with only a tiny percentage of the total value as collateral. When stock prices began to plummet, investors could not repay their loans, leading to a cascade of selling that exacerbated the market’s decline. In their eagerness to profit from the bull market, banks failed to assess the risks of margin lending adequately.

The Collapse of Trust and Confidence

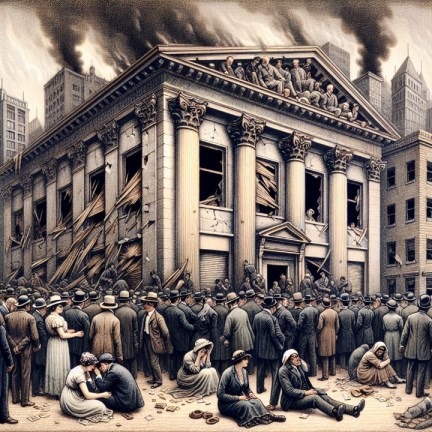

As the stock market crashed and banks struggled to meet the demands of panicked depositors, trust and confidence in the banking system eroded rapidly. The influential German philosopher Friedrich Nietzsche once remarked, “I’m not upset that you lied to me; I’m upset that from now on, I can’t believe you.” The failure of banks to protect their customers’ investments and deposits shattered the trust built over the years. Consumers lost faith in the institutions meant to safeguard their financial well-being, leading to a widespread sense of betrayal and disillusionment.

One striking example of this collapse in trust was the run on the Bank of United States in December 1930. Despite its name, the Bank of United States was a private bank, not affiliated with the government. As rumours spread about the bank’s solvency, panicked depositors lined up to withdraw their money, causing the bank to fail. This failure had a domino effect, leading to the collapse of other banks and further eroding public confidence in the banking system.

The loss of trust was not unfounded. Many banks had engaged in risky lending practices, investing heavily in speculative stocks and offering loans to individuals and businesses without proper due diligence. When the market crashed, these banks found themselves overexposed and unable to meet their obligations to depositors. In fact, by 1933, over 9,000 banks had failed, wiping out the savings of millions of Americans and deepening the economic crisis.

The collapse of trust in the banking system had far-reaching consequences. It led to a contraction in lending as banks became increasingly cautious and unwilling to extend credit. This credit crunch further exacerbated the economic downturn, making it harder for businesses to invest and grow and for consumers to purchase goods and services. The erosion of trust also contributed to cash hoarding, as individuals lost faith in banks and sought to protect their assets by keeping their money at home.

The Importance of Contrarian Thinking

In the aftermath of the 1929 crash, it became clear that many banks had failed to adopt a contrarian approach to investing. John Templeton, a pioneering investor known for his contrarian strategies, famously stated, “To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.” Banks, swept up in the euphoria of the bull market, had neglected to consider the potential for a market downturn. By failing to challenge prevailing market sentiment and advise their customers accordingly, banks had contributed to the severity of the crash.

The Need for Transparency and Accountability

The 1929 crash exposed the banking system’s lack of transparency and accountability. Immanuel Kant, the renowned Enlightenment philosopher, argued, “All our knowledge begins with the senses, proceeds to the understanding, and ends with reason. There is nothing higher than reason.” In banking, this highlights the importance of transparent practices and the use of reason to guide decision-making. Many banks had engaged in opaque and unethical practices, such as manipulating stock prices and misleading investors. The absence of accountability allowed these practices to go unchecked, ultimately harming consumers and contributing to the market’s collapse.

Lessons Learned and the Path Forward

The stock market crash of 1929 served as a painful reminder of the importance of prudent investing and the need for robust financial regulation. Benjamin Graham, the father of value investing, emphasized the importance of thorough analysis and a margin of safety in investment decisions. He stated, “The intelligent investor is a realist who sells to optimists and buys from pessimists.” In the wake of the stock market crash, it became clear that banks needed to adopt a more disciplined and conservative approach to investing, prioritizing the interests of their customers over short-term profits.

Opportunity Amidst Crisis: Contrarian Investors Profiting from the 1929 Crash

The 1929 stock market crash and the subsequent failure of many banks undoubtedly caused immense financial hardship for countless consumers. However, amidst the chaos and despair, a few astute investors recognized the opportunity hidden beneath the surface. Armed with a long-term perspective and a keen eye for value, these contrarian thinkers capitalized on the crisis that brought others to their knees.

One such investor was Jesse Livermore, a legendary figure in the world of finance. Livermore, who had already made and lost fortunes in the stock market, saw the crash and positioned himself accordingly. He began short-selling stocks in the months leading up to the collision, effectively betting against the market. When the stock market crash finally arrived, Livermore’s trades paid off handsomely, and he emerged as one of the few individuals to profit from the downturn.

Livermore’s success was rooted in his understanding of market psychology and his willingness to go against the crowd. He famously quipped, “The real money made in speculating has been in commitments in a stock or commodity showing a profit right from the start.” By recognizing the speculative frenzy that had gripped the market and the rally’s unsustainable nature, Livermore could anticipate the impending crash and position himself to benefit from it.

Another notable investor who thrived in the aftermath of the 1929 crash was Benjamin Graham, the father of value investing. Graham, who had already established himself as a successful investor, saw the market downturn as an opportunity to acquire quality companies at bargain prices. He understood that the indiscriminate selling that followed the crash had created a disconnect between many businesses’ intrinsic value and market prices.

Graham’s approach, which involved thorough fundamental analysis and a focus on the margin of safety, allowed him to identify undervalued stocks that could potentially deliver significant returns over the long term. By investing in these companies when others fled the market, Graham laid the foundation for his fortune and the success of his many disciples, including Warren Buffett.

The experiences of Jesse Livermore and Benjamin Graham during the 1929 crash serve as powerful reminders of the importance of independent thinking and the potential for opportunity in even the darkest of times. While the majority of investors succumbed to panic and despair, these contrarian thinkers were able to see beyond the short-term chaos and position themselves for long-term success. Their stories underscore the value of discipline, patience, and a willingness to go against the crowd in the face of market turmoil.

Conclusion: How Did Many Banks Fail Consumers in the Stock Market Crash 1929

The stock market crash 1929 exposed the myriad ways many banks failed consumers. From encouraging speculative investments to offering risky margin loans and lacking transparency, banks prioritized their interests at the expense of their customers. The collapse of trust and confidence in the banking system had far-reaching consequences, contributing to the depth and duration of the Great Depression.

As we reflect on this historic event, it is crucial to draw lessons from the past and work towards building a more resilient, transparent, and accountable financial system that truly serves consumers’ needs. By embracing the wisdom of notable philosophers and successful investors, we can navigate the complexities of the modern economic landscape with greater insight and integrity.

Other Interesting Mental Treats

US Rising Food Prices: Analyzing FOMO and Other Market Dynamics