Understanding the Significance of the October 24 1929 Stock Market Crash

Updated Sept 28, 2024

Understanding the Significance of Stock Market Crashes: A Long-Term Perspective

When asked about the significance of the October 24, 1929, Stock Market Crash, our response is simple: “Who cares?” As Sir John Templeton wisely noted, “The four most dangerous words in investing are: ‘This time it’s different.'” Every crash has proven to be a buying opportunity from a long-term perspective.

Today’s Federal Reserve is far more reactive than its predecessors. When markets start to tank, they will throw boatloads of money to stabilize the situation, as evidenced by the 2008 financial crisis. As John C. Bogle, founder of Vanguard, once said, “Time is your friend; impulse is your enemy.”

History is replete with naysayers claiming the world is ending. The financial system recovered even after the horrific 1929 crash, and the market soared to new highs. A stock market crash should be viewed as a buying opportunity if fiat currency is in play. The Tactical Investor focuses not on whether the market will crash but on what to do when it does. As Warren Buffett’s business partner, Charlie Munger, advises, “Be fearful when others are greedy, and greedy when others are fearful.”

During a crash, the astute investor backs up the truck and buys top-quality stocks for pennies on the dollar. Templeton’s advice rings true: “To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.”

While short-term volatility can be unnerving, maintaining a long-term perspective is crucial. As Bogle reminds us, “Stay the course. No matter what happens, stick to your program. I’ve said ‘Stay the course’ a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give to you.”

The 1929 Stock Market Crash: Lessons for Today’s Market

The stock market crash of 1929 was triggered by a combination of factors, including rampant speculation, excessive margin buying, and a disconnect between stock prices and economic fundamentals. On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13%, followed by another 12% drop on Black Tuesday.

The crash was not the sole cause of the Great Depression but accelerated the global economic collapse. By 1932, stocks had lost nearly 90% of their value from the 1929 peak.

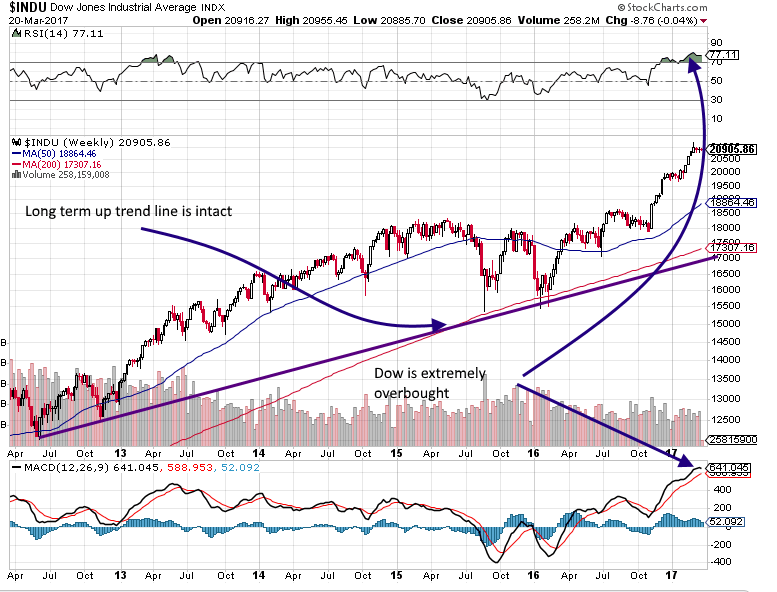

Today, the Dow is overbought on weekly charts but still has room to run on monthly charts. While a correction would be healthy, timing the next crash is impossible. As legendary investor John Templeton noted, “The four most expensive words in the English language are ‘This time it’s different.'”

Mass psychology plays a crucial role in market cycles. In 1929, euphoria among the masses signalled a top, while panic marked a bottom. Contrarian investors like Warren Buffett see crashes as buying opportunities, following his partner Charlie Munger’s advice: “Be fearful when others are greedy, and greedy when others are fearful.”

Ultimately, a long-term perspective is essential. As Vanguard founder John Bogle said, “Time is your friend; impulse is your enemy.” While short-term volatility can be unnerving, staying the course and focusing on quality investments has historically rewarded patient investors.

The 1929 crash offers valuable lessons for navigating today’s market, but blindly drawing parallels can be misleading. As Templeton wisely observed, “The only investors who shouldn’t diversify are those who are right 100% of the time.”

Do not fixate on the crash factor; instead, focus on the opportunity.

Is the stock market going to crash?

Once again, in 1929, the stock market crashed because the masses were jumping up in joy. This is not the case presently, and until this crowd embraces this market with love, this bull market will not end.

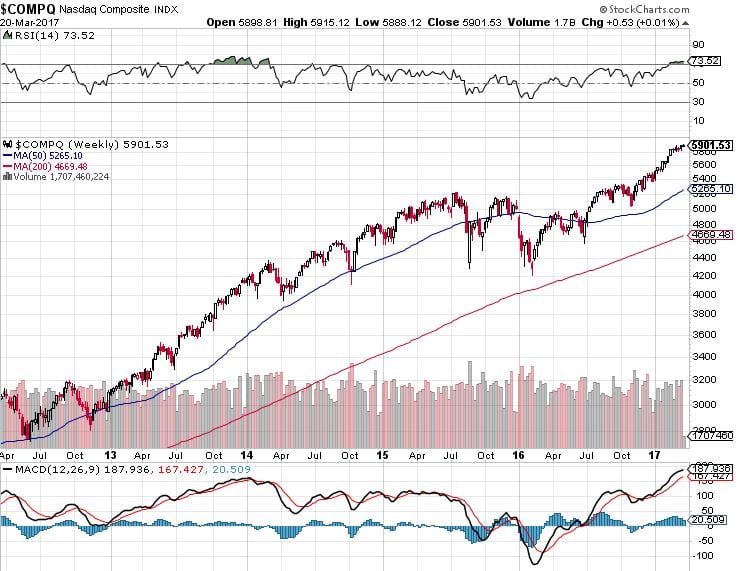

The overall trend is still up (based on our proprietary trend indicator), and thus, all sharp pullbacks need to be viewed through a bullish lens. The Nasdaq is also trading in the extremely overbought ranges on the weekly charts, but what is interesting is that on the monthly charts, there is plenty of room for the Nasdaq to run before it hits the overbought ranges. We could have a friendly tug-of-war here. The NASDAQ could have a limiting effect on any correction, or we could witness a divergence.

The Dow and SPX are correct firmly, while the NASDAQ experiences a minor correction. Until the trend changes, do not focus on the “Will the stock market crash” scenario but on the trend. All sharp corrections have to be viewed through a bullish lens.

Nasdaq is the most robust Index and should outperform Dow and SPX.

A stock market crash is unlikely, at least for the time being. The Nasdaq is in a strong uptrend, and until the trend turns negative, the odds of a stock market crash are not that high. It, therefore, makes no sense to focus on the will the stock market crash scenario. If you are going to do this, you might as well focus on what would happen if you leave the house and get hit by a truck.

The NASDAQ will outperform the Dow, which usually occurs in the last phases of a bull market. However, we could also be witnessing something new here in the era of hot money. The entire world is lowering rates. Despite the misery Brazil is facing, its rates have dropped once again. Can the trend change and favour higher Interest rates? Yes, it can, but until it does, we will not jump on the high-interest rate bandwagon.

For now, the US is the only nation that has raised rates twice. If hot money continues to power this market, we could have a long irrational exuberance phase. It is too early to discuss this topic now; we will save it for another day.

The Nasdaq broke past 5,000 for the first time in 15 years in 2016

Thus, a stock market crash is unlikely at this stage. It took the Nasdaq 15 years to test its old highs and trade past them, but until July 2016, it could not hold above 5K. On an inflation-adjusted basis, it would need to trade to the 6600-6900 ranges to trade on par with its 2000 highs. The bull market for the NASDAQ has just started; it has the potential to trade to 10K. Again, this is a topic for another date.

We do not like discussing extreme targets until specific key turning points are touched. The 1st point to keep your eyes on is 6200. A monthly close above this level will signal a move to the 6900 range and beyond. The Nasdaq indicates that the “Is the stock market going to crash?” question, for now, is a silly question.

October 24 1929 Stock Market Crash and its Resonance in 2019

This week, bullish and Neutral readings came in at 36, which is very telling as it indicates that the masses are still far from embracing this bull market. Secondly, it provides ammunition for our new hypothesis.

One thing stands out sorely regarding market sentiment: bullish readings have hardly traded past their historical averages. This fact forces us to consider another possibility that would make no sense under different conditions.

We hypothesise that when the bears are asleep and the bulls are barely awake (as is the case presently), the market will tend to drift towards the direction of least resistance, and the path of least resistance is up. Therefore, as stated before, while we would like the markets to let out a nice dose of steam, no rule says they must comply with this request. And that is why we continue to issue new plays, as we never put all our eggs in one basket.

If the market pulls back, it’s a bonus, and this is why we also adopt the stance that when the trend is up, the stronger the deviation, the better the opportunity. Extracted from the July 24, 2019, Market Update

Navigating Stock Market Crashes: Strategies Inspired by the October 24, 1929 Crash

June 2023 update

Investing in the stock market during periods of market volatility can be intimidating, especially for newcomers. The feeling of fear is a natural response to uncertainty and rapid market changes, which investors commonly experience. However, it’s essential to recognize that fear often triggers irrational behaviour, causing investors to sell stocks and hastily miss out on substantial growth prospects. Interestingly, some of the most promising investment opportunities tend to arise during these fearful times.

Seizing Opportunities in Market Corrections: The Wisdom of Warren Buffett

Renowned billionaire investor Warren Buffett is credited with one of the most famous quotes in the investing world: “Be greedy when others are fearful.” This statement underscores the significance of investing when stocks are available at discounted prices during market corrections. During market downturns, composed and confident investors can use lower stock prices to acquire high-quality stocks, leading to substantial long-term gains.

The Key to Successful Investing in Turbulent Times: Navigating Market Corrections

Investing during market fear necessitates adopting a long-term investment mindset and the patience to weather volatile conditions. It’s crucial to comprehend that stock market corrections are a normal part of the market cycle and are typically followed by periods of growth. Over the long term, the stock market consistently delivers strong returns, even when accounting for these corrections.

Harnessing the Power of Disciplined Investing: Strategies for Market Corrections

Successful investing during market corrections entails more than just buying low and selling high; it also entails investing in quality. During market fear, investors often sell both high-quality and low-quality stocks, presenting an opportunity to acquire quality stocks at discounted prices. High-quality stocks, with their proven track records of delivering robust returns, tend to be less impacted by market volatility than lower-quality stocks.

To manage risk effectively and capitalize on market opportunities, it’s crucial to maintain a diversified portfolio comprising a blend of stocks, bonds, and other investments. This approach enables investors to benefit from stock market growth while mitigating risk exposure.

In Conclusion: The Art of Navigating Market Corrections

Investing during market corrections demands discipline, patience, and a long-term perspective. By investing in high-quality stocks when fear grips the market, investors can leverage discounted prices and tap into the stock market’s long-term growth potential. Market corrections, a natural part of the market cycle, provide opportunities to purchase quality stocks at lower prices. With a focus on the long term and a diversified portfolio, investors can seize growth prospects while managing risk exposure.

It’s important to note that investing in the stock market carries inherent risks, and seeking professional financial advice before making investment decisions is always prudent. While investing during market corrections can yield significant long-term gains, understanding the associated risks and maintaining a long-term focus are essential factors for successful investing.

Not knowing what has been transacted in former times means always being a child. If no use is made of the labours of past ages, the world must always remain in the infancy of knowledge. Marcus T. Cicero, c. 106-43 BC, Great Roman Orator, Politician

Other stories of interest