Editor: Draco Copper | Tactical Investor

Are We In A Bull Or Bear Market; Bull Is The Obvious Answer

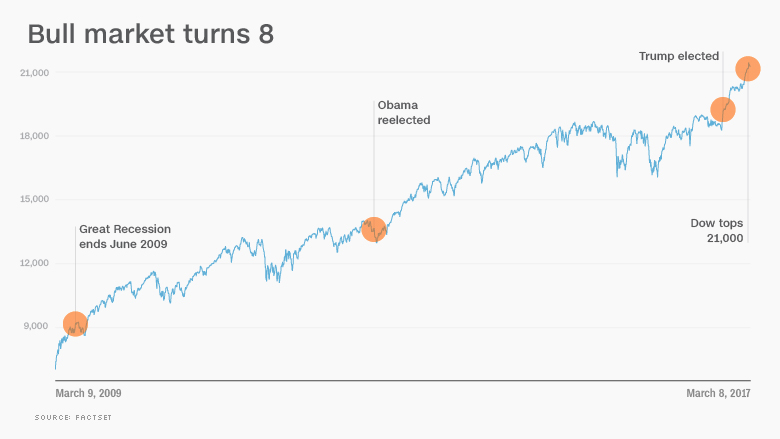

It comes amid a series of market milestones following President Trump’s election. The Dow blew past the 20,000 thresholds in late January and then climbed above 21,000 just a month later.

All told, the bull market in stocks has lifted the Dow an incredible 14,300 points, while the S&P 500 has more than tripled (249% to be exact).

The best part is that regular Americans are partaking of this latest run-up by buying stocks. This is in sharp contrast to earlier years, when mom-and-pop investors barely benefited during most of the market upswing that began in March 2009 during the Great Recession.

“The mood today versus eight years ago is quite dramatic. It’s polar-opposite. Back then, nobody wanted to buy stocks,” said Joe Quinlan, chief investment strategist at U.S. Trust.

“You are starting to see the return of the retail investor, but nothing that suggests we’re near a peak,” said Quinlan. Full Story

Are We In A Bull Or Bear Market & When Will It End

Some, on the other hand, remember it all too well. And many who retreated from the stock-indexed funds into the “safety” of the treasury securities G fund missed out on some, or all, of the dramatic rise in stocks.

We asked Arthur Stein, CFP, of Arthur Stein Financial LLC in Bethesda, Maryland, to comment on the bull market and what comes next. Many of his clients are federal workers or retirees and few are even self-made TSP millionaires. So what’s his message: “Well, happy birthday to the bull market, now nine years old. Blow out the candles, cut the cake, let’s enjoy it while we can.”

“Bull market” and “bear market” are common financial terms. A bull market is a 20 per cent or greater gain from a previous stock market low. A bear market is a 20 per cent or greater loss from a previous stock market high. Full Story

Tactical Investor Take on Bull Bear Market Debate

Financial experts continue to state that the markets are going to crash, even though their record since this bull market started back in 2009 has been dismal to the say the least. To complicate matters, some of these same experts suddenly jump ship and start to paint a bullish picture until the markets start to pull back. Then they falsely assume that the markets are going to crash and start singing the “market is going to crash” song again.

Market sentiment is not extremely bullish, though the bullish sentiment has been trending upwards since Feb of this year. Crowd psychology states that one should only abandon the ship when the masses are euphoric. As that’s not the case, there is no reason to abandon the ship.

The Market has shed some weight, but given the massive run-up, this market has experienced this falls well within the normal ranges of an acceptable correction. In fact, the Dow could drop all the way to 21,500 without having any effect on the trend. Stock Market 2018 Playbook; Follow The Trend

Tactical Investor Aug 2019 Update

A very interesting development is that for the most part of 2019, bullish sentiment has traded well below the historical average of 39. Now let this sink in, we are in one of the longest bull markets in history, and instead of soaring to the moon, bullish sentiment is trading well below its historical average. Contrast this to the sentiment in bitcoin; currently, the sentiment is close to the euphoric stage, and this latest Bull Run is only two months in the making.

As shown in the above two gauges the masses have not embraced this market and until they do, all strong corrections have to be viewed through a bullish lens.

Other Articles of interest

Could Trump’s economic Policies Propel Hated Stock Market Bull Higher (Feb 27)

Stock Market Crashes-Is Panic Warranted (Feb 25)

Stock Market Crash 2017 Video -reality or All Hype (Feb 19)

Stock Market Crash 2017-reality or all Hype (Feb 16)

Gold Market Finally ready to breakout video-Very Interesting Pattern (Feb 2)

Gold Market Finally ready to breakout? Possibly it’s putting in a very interesting pattern (Jan 30)

Will the stock Market Bull Continue to Trend higher or crash video (Jan 18)

Stock Market Bull destined to charge higher or is it time to bail out (Jan 13)

Feds Interest Rate Stance equates to Rubbish-Video article (Dec 27)

Feds Interest Rate stance equates to Rubbish-Economic recovery is illusory (Dec 24)

Stock Market Bulls-Stock Market fools-Market Crash next video? (Dec 22)

Stock Market Bulls, Stock Market fools-Market Crash next or is this just an Illusion (Dec 21)

Trump Effect Rally-Useless Dow Theory and Stock Market Crash (Dec 17)

Gold fools-dollar bulls and the long-term outlook for both Markets (Dec 9)