The United States Central Bank: A Pivotal Institution

Updated July 2023

The United States Central Bank, often called the Federal Reserve, has long been a pivotal institution in the global financial landscape. Its policies and decisions have far-reaching implications, not just for the American economy but for the world at large. However, a new perspective has emerged, suggesting that the central bank’s actions may be serving as a catalyst for a new form of servitude. This perspective is rooted in the bank’s core objective, which revolves around compelling the global populace to adopt negative interest rates.

The United States Central Bank, with its immense power and influence, has the ability to shape economic policies and trends. Its decisions can stimulate growth, curb inflation, and manage unemployment rates. However, the bank’s influence extends beyond the borders of the United States. As the issuer of the world’s primary reserve currency, the decisions made by the Federal Reserve have a ripple effect on global financial markets.

Yet, this power and influence come with a significant responsibility. The central bank’s policies can have unintended consequences, leading to economic disparities and financial instability. For instance, the push for negative interest rates is a policy that has sparked considerable debate. While it is intended to stimulate economic activity by making borrowing cheaper, it also has the potential to create a cycle of debt and dependency.

This new form of servitude is not one of physical chains but of financial constraints. It is a servitude that arises from the need to navigate an economic landscape shaped by the central bank’s policies. As the global populace grapples with the implications of negative interest rates, the role of the United States Central Bank as a catalyst for this new servitude becomes increasingly apparent. The bank’s core objective, while aimed at economic stability, may inadvertently be fostering a system that diminishes financial freedom and autonomy.

The United States Central Bank and Negative Interest Rates

Negative interest rates, a concept once considered unthinkable, have become a reality in several economies worldwide. The United States Central Bank’s push for negative interest rates is not without reason. Reduced rates are expected to result in an influx of substantial capital into the financial markets. This influx, in turn, encourages companies to undertake more extensive borrowings for share buybacks, thereby perpetuating the facade of stability.

The United States Central Bank’s advocacy for negative interest rates is a strategic move to stimulate economic activity. The central bank hopes to encourage businesses to invest in growth and expansion by making borrowing cheaper. This, in turn, is expected to create jobs, increase consumer spending, and ultimately drive economic growth.

However, introducing negative interest rates also has significant implications for the financial markets. With borrowing costs reduced, companies are incentivized to borrow more. This borrowed capital often finds its way into the financial markets, leading to an influx of substantial capital. This influx of capital can inflate asset prices, creating a sense of stability and prosperity.

Yet, this stability is often a facade. The increased borrowing for share buybacks, while boosting earnings per share and inflating stock prices, does not necessarily reflect the true health of the economy. It does not indicate increased operational efficiency or increased product sales. Instead, it creates an illusion of economic prosperity, masking the underlying issues that may be plaguing the economy.

While intended to stimulate economic activity, the United States Central Bank’s push for negative interest rates may inadvertently perpetuate a deceptive system. A system where the facade of stability masks the true state of the economy and where the influx of borrowed capital into the financial markets creates a cycle of debt and dependency.

The United States Central Bank and the Facade of Stability

Share buybacks have become a popular strategy for companies seeking to boost their earnings per share (EPS). By reducing the number of shares in circulation, companies can increase their EPS without improving operational efficiency or increasing product sales. While beneficial for the companies and their shareholders, this strategy has a darker side. It creates an illusion of economic prosperity, masking the underlying issues that may be plaguing the economy.

The United States Central Bank’s policies, particularly the push for negative interest rates, have inadvertently made share buybacks an attractive option for companies. With borrowing costs at historic lows, companies are incentivized to borrow large sums of money to repurchase their own shares. This strategy boosts the company’s EPS and inflates the stock price, creating a sense of stability and prosperity.

However, this facade of stability can be misleading. The EPS and stock price increase resulting from share buybacks does not reflect an improvement in the company’s operational efficiency or an increase in product sales. It is merely a financial manoeuvre that enhances the company’s financial metrics without contributing to real economic growth.

Moreover, this strategy can mask the underlying issues that may be plaguing the economy. It can hide the fact that companies are not investing in growth and expansion but are instead using borrowed money to inflate their financial metrics. This can create a false sense of economic prosperity, diverting attention away from the real issues that need to be addressed.

The United States Central Bank, in its role as the guardian of the economy, needs to be aware of the potential implications of its policies. While the push for negative interest rates may stimulate economic activity in the short term, it may also be perpetuating a deceptive system. A system where the facade of stability masks the true state of the economy and where the illusion of prosperity hides the reality of financial constraints and economic disparities.

The United States Central Bank: Driving Individuals Towards Speculation

The push for negative interest rates and the subsequent rise in share buybacks have another unintended consequence. They drive fixed-income individuals towards speculative activities. These individuals, who rely on interest income for their livelihood, are forced to seek higher returns in the face of dwindling interest rates. Ironically, these are the individuals least capable of affording such speculation. As they succumb to the lure of the markets, the needs will probably reach their peak, eroding most, if not all, of their savings.

The United States Central Bank’s policies, particularly the push for negative interest rates, have created a challenging environment for fixed-income individuals. These individuals, who rely on the interest income from their savings for their livelihood, find it increasingly difficult to make ends meet. The dwindling interest rates have eroded their income, forcing them to seek alternative sources of revenue.

One such alternative is the financial markets. With the rise in share buybacks inflating stock prices, the financial markets may seem attractive for these individuals. They are lured by the prospect of higher returns, driven by the illusion of stability and prosperity created by the influx of borrowed capital into the markets.

However, these individuals are often the least capable of affording such speculation. They lack the financial cushion to absorb losses, and their limited understanding of the markets makes them vulnerable to economic shocks. As they succumb to the lure of the markets, they contribute to the inflation of asset prices, increasing the likelihood of a market peak.

When the markets reach their peak and the bubble bursts, these individuals stand to lose most, if not all, of their savings. The United States Central Bank, in its pursuit of economic stability, may inadvertently be driving these individuals towards financial ruin. This highlights the need for the central bank to consider the broader implications of its policies beyond the immediate goal of stimulating economic activity.

The United States Central Bank and the Emergence of a New Servitude

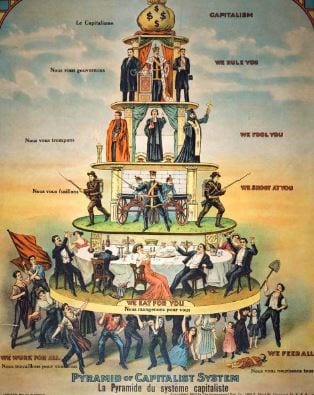

This process creates a fresh class of individuals ensnared by this deceptive system. Instead of resisting the system, they become part of it. The resistance dissipates as servitude prevails. Instead of fostering economic prosperity, the United States Central Bank’s policies end up compelling individuals to rely on the state. This translates to having fewer challengers to the established order.

The United States Central Bank’s policies, particularly the push for negative interest rates, have created a new form of servitude. This servitude is not one of physical chains but of financial constraints. Servitude arises from the need to navigate an economic landscape shaped by the central bank’s policies.

This new class of individuals, trapped by the system, find themselves in a precarious position. They are caught in a cycle of debt and dependency, driven by the need to seek higher returns in the face of dwindling interest rates. Instead of resisting the system, they become part of it. They are lured by the illusion of stability and prosperity, only to find themselves at the mercy of the volatile financial markets.

Instead of fostering economic prosperity, the United States Central Bank’s policies end up compelling these individuals to rely on the state. They are forced to turn to the state for assistance as their savings are eroded, and their financial security is threatened. This reliance on the state translates to having fewer challengers to the established order. The individuals who once could have been a force for change, are now ensnared in a system that perpetuates the status quo.

This new form of servitude, fostered by the United States Central Bank policies, highlights the need to reevaluate these policies. As the guardian of the economy, the central bank needs to consider its policies’ broader implications. It needs to ensure that its policies do not inadvertently create a system that diminishes financial freedom and autonomy but instead fosters a system that promotes economic prosperity for all.

The United States Central Bank: A Catalyst for Servitude

The United States Central Bank, in its pursuit of economic stability, may inadvertently be creating a new form of servitude. While seemingly beneficial in the short term, its policies have far-reaching implications for the global populace. The push for negative interest rates and the rise in share buybacks create an illusion of economic prosperity, masking the underlying issues and driving individuals towards speculative activities. This, in turn, gives rise to a new class of individuals ensnared by the system, leading to a form of servitude where individuals are compelled to rely on the state. In its role as a catalyst, the central bank may be fostering a system where resistance dissipates and servitude prevails.

Conclusion

In conclusion, the role of the United States Central Bank, also known as the Federal Reserve, extends beyond its apparent mission of economic stability. While its policies may appear beneficial in the short term, a deeper examination reveals the potential for unintended consequences. The push for negative interest rates and the surge in share buybacks paint a facade of economic prosperity, masking the underlying challenges that may be lurking within the economy. Moreover, these policies drive fixed-income individuals toward speculative activities, leading to a paradoxical situation where those least equipped to weather market volatility are drawn into it.

Consequently, a new class of individuals emerges—entangled in a system that seems to foster dependence rather than resilience. The central bank’s efforts, aimed at stability, may inadvertently foster a dynamic where resistance fades and servitude gains ground. It is imperative to recognize the implications of these actions and question whether pursuing economic stability inadvertently cultivates a reliance on the state, ultimately altering the dynamics of individual empowerment and societal progress. Critical analysis and awareness are vital in this evolving landscape to shape a future that balances stability with genuine autonomy.

Decoding the Enigma: Gold’s Surprising Crash Instead of a Leap

The unexpected crash of Gold, when it was anticipated to soar, left many baffled. The culprit lies in the Federal Reserve’s actions, which effectively slowed down the velocity of money (M2). This deliberate move ensured that inflation remained in check. Ironically, this explains why Gold experienced a crash precisely when the consensus foresaw a skyrocketing trajectory. Even ardent Gold enthusiasts were taken aback, yet understanding money’s velocity would have indicated Gold’s impending peak. We, in fact, forewarned our subscribers of this scenario—predicting Gold’s peak, the dollar’s ascent, and the subsequent decline of the Euro and Yen. These forecasts were issued as early as 2011, remarkably close to the peak.

Originally published in 2018, this content has undergone periodic updates over the years. The most recent update was carried out in July 2023.

Engrossing Articles That Shed Light on Complex Topics