Electric Vehicles: Revolution to Disrupt Crude Oil Market

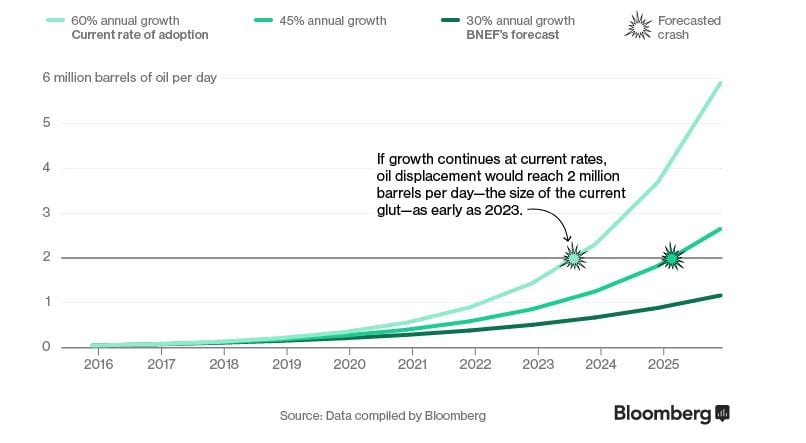

Technical analysis and trend analysis reveals that Crude oil appears to have peaked forever; it is unlikely that we will see prices of $140 a barrel for a long time, if ever. The chart below also seems to somewhat cement this view illustrating that by 2023, the electric vehicle market could displace another 2 million barrels of oil daily.

The inflexion point was hit in 2013 when 143 gigawatts of renewable energy were added versus 141 gigawatts from traditional power plants that burn fossil fuels. Solar energy costs are usually on par, if not cheaper, than grid electricity. This is perhaps why the Saudis are panicking and want to destroy competition to push prices back up and try to lock in as much money as possible before they are knocked out of the game. They are even planning on selling shares in Aramco.

Must read: Peak oil theory debunked: Just another price gouging Scam

“If you look at reports like what OPEC puts out, what Exxon puts out, they put adoption at like 2 per cent,” said Salim Morsy, BNEF analyst.“Whether the end number by 2040 is 25 or 50 per cent doesn’t matter as much as making the binary call that there will be mass adoption of Electric Vehicles

Other stories of interest

Perception Wars; You see what you are directed to see (April 12)

Federal Reserve Existence based on Deception & Fraud (April 12)

Central Bankers use Monetary Policy as Weapons of Mass Destruction (April 11)

Treacherous Ukraine Govt Accepted Toxic Monsanto For 17 Billion IMF Loan (April 8)

Russia Bans Monsanto & Takes strong stance against all GMO Products (April 8)

F-35 Flying Rust Bucket No match for Russia T-50 (April 8)

The Hidden Agenda, Rob, Poison, & Control the Masses (April 7)

Oh, hum, someone extrapolating data from a VERY low base – with low gas prices and limited range electrics (plus more creature comforts and safety with bigger vehicles), don’t expect fast growth. Your money in an oil company should be safe. When I worked with one, I unwisely put all my money in company stock. Now our IRA’s are all in diversified mutual funds – so I am not taking chances with any one sector including oil.