Do not wait for ideal circumstances nor for the best opportunities; they will never come. Anonymous

October 1987 Stock Market Crash Equals Opportunity

Updated as of May 1, 2024

We couldn’t resist including the term “stock market crash” in the title, as it seems to be on everyone’s lips. Many voices want you to believe that we’re teetering on the edge of a Black Monday redux. However, these same individuals often overlook a crucial point: astute investors who focused on recovery following the 1987 stock market crash are the ones who reaped substantial rewards.

Fears are growing, with some expressing concerns about a recurrence of the 2008 crash, prompting investors to seek refuge. This sentiment has been echoed in articles like “The Guardian.”

Headlines like “A Stock-Market Crash of 50%+ Would Not Be a Surprise” on Yahoo Finance and “Stock Market Crash 2016: This Is The Worst Start To A Year For Stocks Ever” on rightsidenews.com only add to the apprehension.

The naysayers are busy listing several factors that could trigger another crash. Still, it’s important to remember that stock market crashes like the one in 1987 are often viewed as buying opportunities from a mass psychology perspective.

Navigating the Lessons of the October 1987 Stock Market Crash

Amid market uncertainties, naysayers tirelessly enumerate various factors that do not augur well for the market’s future.

One of these factors is ultra-low oil prices. It’s worth pondering this: not too long ago, experts warned us about the detrimental effects of high oil prices on the economy. So, which narrative holds true? Many oil companies may face bankruptcy, but those that weather the storm will emerge stronger, poised for the next bullish phase. Interestingly, the current low oil prices have driven a surge in car sales, setting a record with 17.5 million vehicles sold. Consumers are now embracing gas guzzlers they previously avoided due to high fuel costs. Ultra-low oil prices can be likened to a financial stimulus of nearly $1 trillion injected into the global economy, as this is the amount the world economy stands to save under these conditions.

The Monumental Buying Opportunity of the October 1987 Market Crash

One factor causing concern is the state of China’s economy, which is showing signs of slowing down. The fear is that this slowdown could substantially impact our economy.

It’s essential to keep things in perspective regarding China’s economic growth. Even though significant attention is paid to this issue, the reality is that China’s growth is something every developed economy can only dream of achieving. U.S. corporations export approximately $500 billion worth of goods to China annually. Considering our $18 trillion economy, this export figure is relatively small and not a cause for panic; it’s more like a drop in the bucket.

Another source of uncertainty stems from the Federal Reserve’s decision to raise interest rates. It’s worth noting that the Fed only increased rates by a modest 0.25%, and they can reverse this position if necessary. In our perspective, even if they implement another 2-3 rate hikes, it’s unlikely to disrupt our economy significantly, as these are starting from a historically low level.

Is This Time Any Different?

Let’s pause to consider the current financial landscape. This narrative might seem familiar: looming catastrophe, imminent stock market crash warnings, and advice to take cover. Although recent market movements have been volatile, historical trends show that markets eventually rebound and trend upwards. It is essential to highlight that those who persevered through the 1987 crash ultimately realized significant gains.

You might point to Japan as an exception, a market still trying to catch up decades later. However, it’s essential to recognize that the circumstances in Japan occurred in a different era. Today, we’re characterized by a choice between devaluation or decline. Traditional economic principles are set aside as significant economies tend to devalue their currencies voluntarily or due to external pressures. Central banks often counter these shifts by increasing market liquidity.

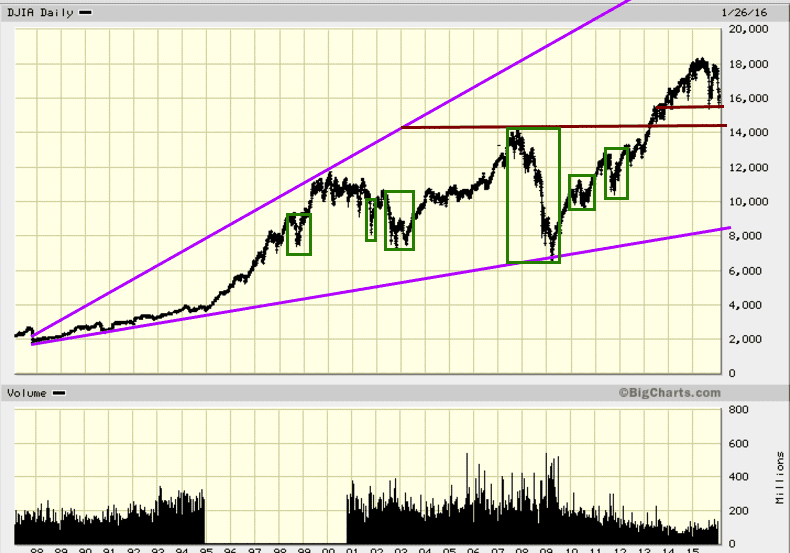

Despite these obstacles, analyzing the long-term Dow chart confirms that each crisis has historically been an investment opportunity. Drawing on Jakob Fugger’s insights, the famed financier of the Renaissance, we see the value in seizing economic opportunities that arise from market fluctuations. Similarly, Montaigne’s reflections teach us the importance of perspective; he urged that wisdom and patience are paramount in times of turmoil. By integrating Fugger’s strategic investment principles with Montaigne’s philosophical steadiness, we can navigate current and future financial storms with informed resilience, transforming challenges into profitable opportunities.

Despite these challenges, if we examine the long-term Dow chart, it becomes evident that every so-called disaster ultimately presented itself as a buying opportunity.

Embrace Every Crash with a Bullish Outlook, Even 1987

We have consistently advocated against buying right at market peaks. Our approach has always considered significant pullback opportunities to initiate new positions. Has the landscape changed significantly since last year? Are we now inclined to align ourselves with the pessimistic crowd? Before addressing that question, let’s delve into volatility.

Last year, we repeatedly highlighted the volatility issue, as our Volatility Indicator had surged into record territory. In early January, we revisited comments we shared with our subscribers in December 2015, listed below.

Our V indicator has surged to yet another high, so extreme volatility is here to stay. In fact, 2016 will probably be remembered as the most volatile year on record.

Volatility is a two-way street; one should expect large price swings on both ends of the scale. Given the run-up the markets have experienced over the past seven years, the current correction, while strong, is nothing to panic over.

Technical Outlook

Panic Equals Opportunity

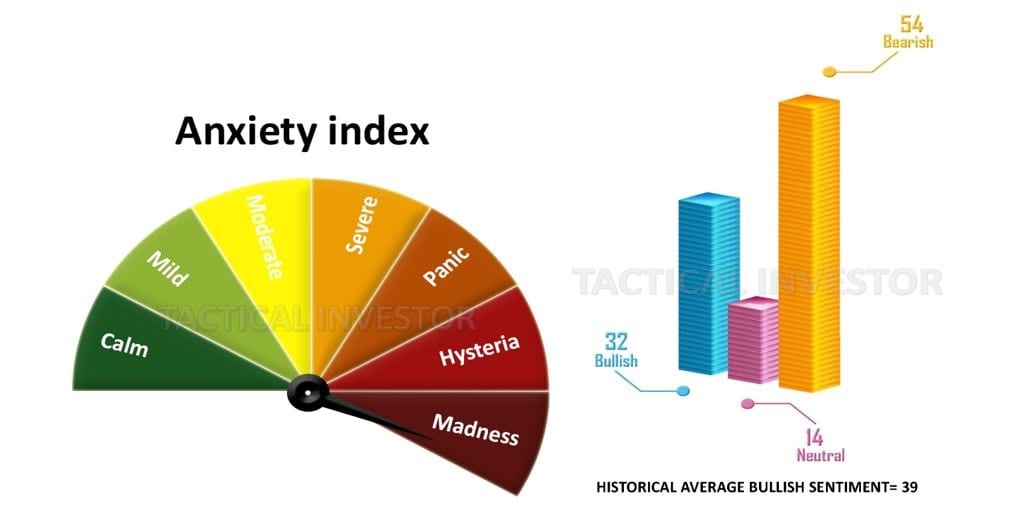

It’s evident that traders are panicking, and short-term market psychology has taken a hit. However, it’s important to distinguish between short-term and long-term perspectives. Last week, we noted that the volume on most down days was considerably lower than on up days. Could this be an indication of intelligent money entering the market? Only time will provide the answer.

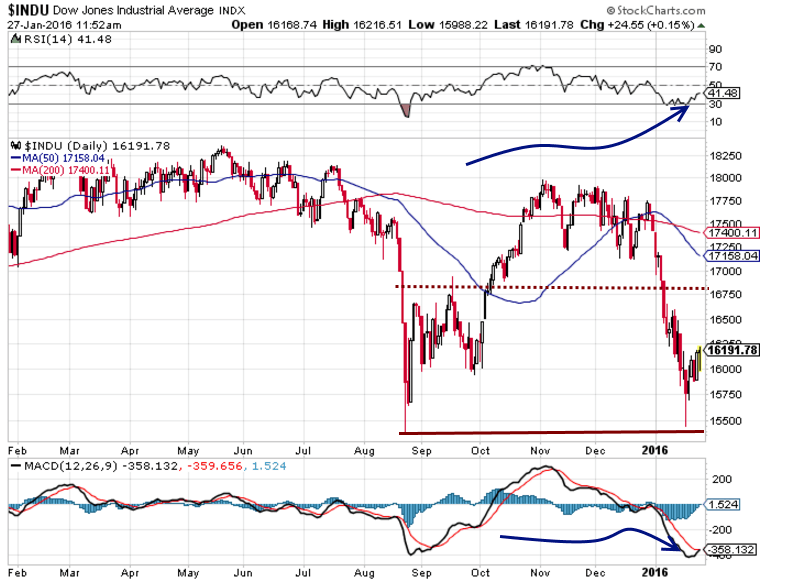

In the short term, the markets find themselves in oversold territory, which opens the door for a potential relief rally at any moment. The MACD and Relative Strength Indicator (RSI) are currently trading in oversold ranges, with the MACDs on the verge of a bullish crossover. Given the magnitude of the correction, there’s a reasonable chance that we haven’t reached the lows yet. The Dow will likely rally in the 16,700-16,900 range before retracing and dipping below current lows. This drop, possibly below the August lows, could shake out the remaining bulls, laying the foundation for a bottom and an upward price movement.

As Seneca once wisely noted, “Fortune is like glass – the brighter the glitter, the more easily broken.” This perspective is crucial in times of market turbulence, where the appearance of a bear market can swiftly shatter. By adhering to this ancient wisdom, investors can see beyond the immediate chaos and recognize the long-term opportunities such disruptions often present.

John Lynch also advises, “Be fearful when others are greedy, and greedy when others are fearful.” Embracing this mindset allows us to capitalize on the panic by meticulously selecting stocks that have been unjustly beaten down. This strategy is not just about survival; it’s about thriving in the aftermath of the panic, leveraging the irrational behaviours of the market to our advantage.

Understanding this can transform market downturns from a source of panic to a source of opportunity. The key is maintaining a calm demeanour, harnessing the collective anxiety to reinforce our investment strategies and preparing for the eventual upswing. As history shows, markets do rebound, and the most strategic investors are best prepared to ride the wave of recovery.

The Coronavirus Pandemic: A Potential Echo of the 1987 Market Crash (April 24, 2020)

Today, the oil market witnessed unprecedented chaos, with the May contract plummeting to negative $40, meaning sellers were essentially paying buyers to take their oil. The explanation behind this turmoil is relatively straightforward. There’s an excessive oil surplus, and the May contract was on the verge of expiration. Additionally, there’s a shortage of storage capacity, prompting May contract holders to offer payments to exit their positions.

Amid this market volatility and the early signs of strength emerging in certain stocks, we are embracing an innovative approach for deploying the initial third of our funds. The first trigger for entering a specific stock will remain consistent: we deploy one-third of our funds when the stock trades within the recommended ranges. The second trigger, however, will be universal. When the Dow trades from 19,950 to 20,400, all pending plays for which we have no existing positions will be activated. Now, traders should place limit orders to initiate classes at the most favourable prices. For instance, if a stock trades between $19.90 and $20.10, you would place a limit buy order within that range to open a position.

Hysteria is the central Theme now.

Instead of fleeing for the hills, compile a list of premier companies and seize the opportunity to invest. This might be the last chance in many years for individuals to amass remarkable wealth. Never follow the silly/stupid crowd; they are destined for loss. Instead, use their behaviour as a contrarian signal, turning their panic into your strategic advantage.

The paranoiac is the exact image of the ruler. The only difference is their position in the world. One might even think the paranoiac is the more impressive of the two because he is sufficient unto himself and cannot be shaken by failure. Elias Canetti

Unconventional Articles Worth Exploring

What Is Contrarian Investing Unleashing Creative Perspectives

ETF Newsletter: Customized Options for Astute Investors

ETF Service Providers: In-House Options for the Tactical Investor

Fearlessly Trade Your Way to Financial Freedom

Dow Jones Industrial Average Stocks Soar Slaughtering the Bears

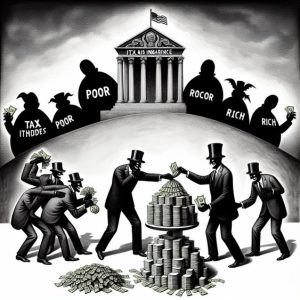

IRS Thieves: Robbing the Poor, Aiding the Rich

Unlocking Radiance: Hemp Benefits for Skin Illumination

Dow 30 Stocks: What Do They Reveal

Stock Market Psychology Cycle: Unveiling Trends and Tactics

Contrarian Thinking: The Power of Challenging the Status Quo

When Is the Stock Market Going to Crash: Anticipating the Unknown

The Israel Iran War: Evaluating the Case Against Military Action

Millennials are killing everything. Are you next?

American retirement just another Pipedream

Oil Supply Outstrips Demand: Oil Headed Lower 2016