Oil supply outstrips Demand.

Traders and speculators who attempted to predict a bottom for oil prices faced significant losses in 2015, and their situation worsened in 2016. The weekly closing price falling below $32 negated any potential bullish signals that oil may have been attempting to signal in 2015. On the fundamental front, there seems to be no respite in sight. However, Mass Psychology suggests that a potential bottom might be near, given the surge in pessimistic articles and the turmoil within the oil industry.

Fundamentals are pointing to lower prices for Crude in 2016

In 2016, Russia pumped a record-high crude oil production of 534 million tons, marking a 1.4% year-on-year increase in its oil and gas condensate production. Bloomberg observed that Russia’s oil production was on the verge of surpassing its post-Soviet record by the final week of 2015, reaching a remarkable 10.86 million barrels per day. Similarly, instead of reducing production, Saudi Arabia continued to pump oil at near-maximum capacity. Considering the supply side, no positive factors would support a sustainable upward trend for oil prices.

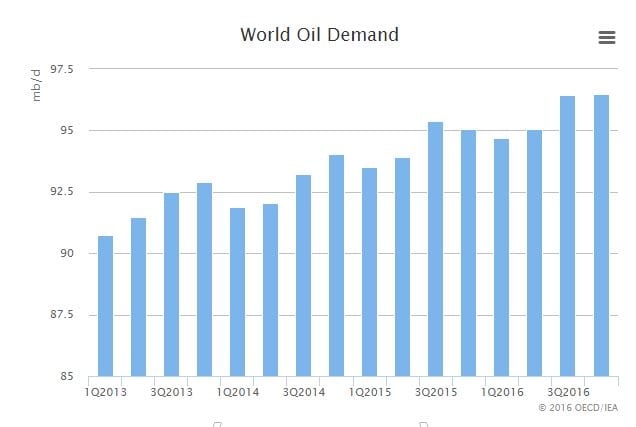

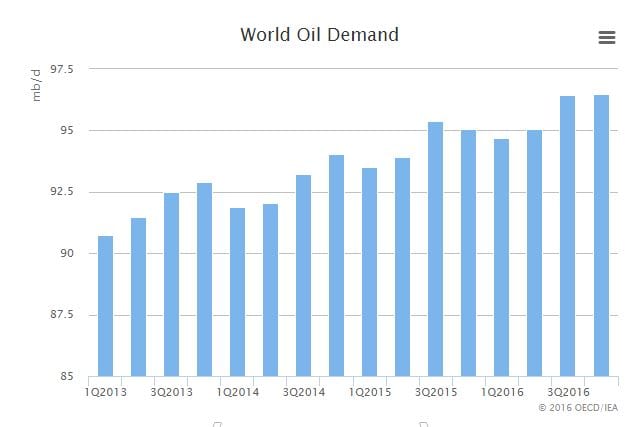

Th IEA states that oil demand for 2016 is expected to remain almost unchanged from 2015. In 2015, it stood at 96.43 million barrels per day (Mb/d); in 2016, it is expected to be 96.49 Mb/d.

The noteworthy aspect is that the IEA (International Energy Agency) anticipates a slight supply decrease from 96.97 million barrels daily to 96.88 million. It’s worth noting that the IEA has a history of significantly missing its predictions. The projections likely do not accurately account for the new supply of Iranian oil expected to enter the market. Russia has straightforwardly declared that they have no intentions of reducing production. They have stated that the only circumstance under which they would halt production is if the price of oil were to plummet to zero. Meanwhile, Saudi Arabia, which played a role in causing this situation, continues to pump oil at full capacity.

Here are key points to remember about the oil market:

1. The oil market experienced a sudden downturn, contradicting predictions from top analysts who foresaw higher prices.

2. Simultaneously, proponents of the Peak Oil theory, who argued that prices could only rise, have gone silent. Instead of oil production peaking, there is currently an abundance of oil available.

3. Just as the oil market collapsed when many expected higher prices, oil is likely to stabilize in 2016, contrary to expectations of a continuous decline.

4. Having breached multiple levels of support, oil will likely need to trade sideways for an extended period before there is any chance of a significant upward breakout.

Here’s the technical outlook for crude oil prices in 2016:

Oil has closed below the significant $30 psychological level weekly. This could potentially drive oil prices all the way down to $20.00. However, it’s more likely that oil will find support in the $23-$25 range. As long as oil doesn’t close below $23.00 on a weekly basis, it will likely start forming a slow bottoming pattern.

For oil to establish this bottom, it mustn’t close below $23 on a weekly basis. Otherwise, the outlook becomes uncertain. Oil will need to create a gradual channel formation, and its price range will be confined to $24.00-$36.00, with the possibility of expanding if there’s a monthly close above $40. If that happens, the trading range could shift to $36.00-$58.00, with a potential overshoot to $65.00.

However, once a bottom is established, it’s important not to expect rapid price increases. Trading will likely remain within a narrow range of $24.00-$36.00 for a considerable period. Only a monthly close above $40 would indicate a shift to a slightly higher trading range of $36.00-$58.00, with the chance of overshooting to $65.00.

It’s worth noting that the turbulence in the oil market is far from over. Conservative investors should exercise caution and wait for a more stable outlook. Many oil companies may face financial difficulties as their debt becomes unmanageable, potentially creating investment opportunities in this sector.

For speculators, particularly those focused on ETFs like UCO, OIL, and USO, it’s advisable to wait until oil reaches at least $25 or lower before considering investments in this sector.

Exceptional Discoveries Await Your Curiosity

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

Copper Stocks: Buy, Flee, or Wait?

Dow 30 Stocks: Spot the Trend and Win Big

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

3D Printing Ideas: Revolutionize Your Imagination

Beetroot Benefits for Male Health: Unlocking Nature’s Vitality

Norse Pagan Religion, from Prayers to Viking-Style Warriors

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Describe Some of the Arguments That Supporters and Opponents of Wealth Tax Make

What is a Limit Order in Stocks: An In-Depth Exploration

Lone Wolf Mentality: The Ultimate Investor’s Edge

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey