Stock Market Swings: A Window of Opportunity for Smart Money

April 10, 2025

Are the Days of Big Drops Over?

Maybe the fat lady hasn’t sung, but she’s warming up. And if you’ve been around the markets long enough, you know she doesn’t sing when you expect her to—she belts it out when you’re either euphoric or asleep at the wheel.

Let’s be clear: you don’t tell the market what to do—you watch her footsteps in the sand, read her breath in the volume, feel her mood in the volatility. You don’t predict; you position. Spot the trend, align your sails, and ride.

?️ Every Crash Whispers a Setup

History doesn’t repeat, but it hums familiar tunes.

? 2000–2002 Dot-Com Crash

A tech bloodbath. But if you watched semiconductors crawl out of the rubble by 2003, you saw the early footprints of NVIDIA, AMD, and biotech. The trend was shifting—macro psychology gave you the setup, the chart gave you the entry.

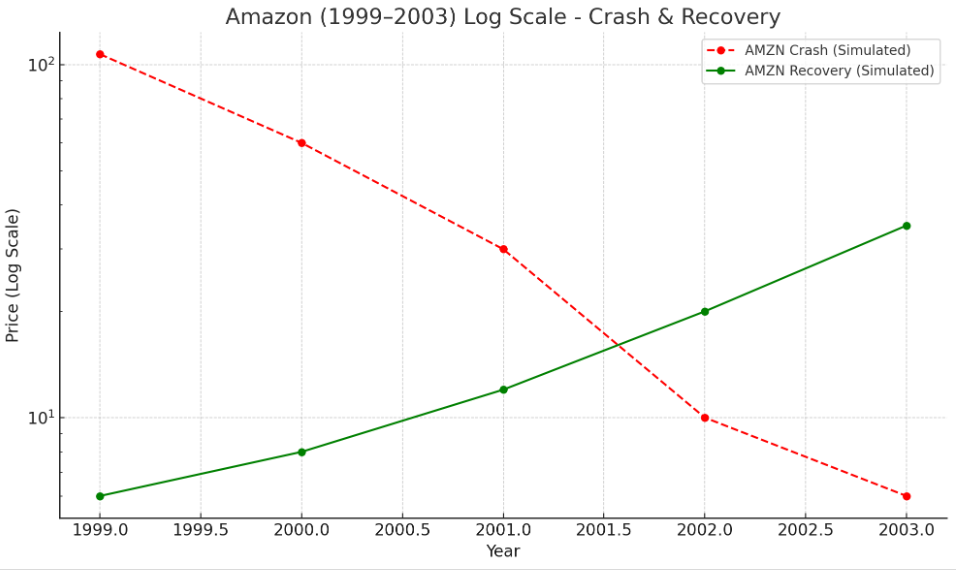

? Amazon (AMZN) 1999–2003 Log Scale

From $107 to under $6—then a stealth reversal. Flatlining RSI, rising OBV, and breakout volume off $10 showed buyers returning before the crowd woke up.

Perfect. Here’s an upgraded, more visually descriptive version for the remaining sections—rich enough that even without charts, the reader sees the setup unfold.

? 2008–2009 Financial Crisis

Not just subprime—it was a collapse in trust. But within the wreckage, patterns spoke louder than panic. Take Citigroup (C): once trading north of $500 (pre-reverse-split), it cratered to under $1 by early 2009.

But zoom in on the price action around February–March 2009.

- Volume exploded while price barely moved lower—classic sign of capitulation.

- MACD crossed above its signal line after months in negative territory.

- RSI formed a bullish divergence—price made lower lows, but RSI made higher lows.

- The 200-day moving average began to flatten for the first time in over a year.

These weren’t bullish headlines. These were behavioral footprints. Funds that missed the bottom only realized it when Citi doubled within weeks—off pennies.

? March 2020 COVID Crash

The fastest 30% drop in S&P history. Limit down after limit down. Oil went negative. Treasuries seized. Even gold dumped.

But the SPX formed a classic V-shaped reversal:

- On March 23, the index tagged ~2190—right as the VIX spiked above 80, echoing 2008 levels.

- That same day, volume surged across the board.

- The SPX printed a bullish engulfing candle on the daily timeframe within days.

- Fed liquidity injections, yes—but it was sentiment exhaustion that really broke the free fall.

You could literally feel the despair peak—and price start to ignore bad news. That’s your tell.

? Bonus: Bitcoin’s COVID Panic Bottom

Bitcoin went from ~$9K to below $4K in a heartbeat. The order books were empty. But then…

- Huge wicks appeared on the 4-hour chart, with 10%+ bounces in hours.

- RSI on the daily chart hit ~15—historically rare territory.

- On-Balance Volume (OBV) flipped positive days before price action caught up.

- Once BTC reclaimed $6K, it ripped to $10K—while CNBC was still running pandemic death tickers.

It wasn’t just a bounce. It was a regime change—visible in momentum, not the headlines.

? ARKK’s 2022–2023 Death Spiral & Compression

Cathie Wood’s ARKK dropped from ~$160 to ~$30. Brutal.

But if you stare at the 2023 chart:

- The daily candlesticks shrink—volatility collapses.

- Bollinger Bands squeeze tighter than anytime in 3 years.

- Volume dries up, signaling exhaustion.

- Price hovers near a flat 50-day MA.

- No one’s paying attention anymore—that’s the setup.

This is classic spring-loading. Price compresses before it expands—up or down. But silence like this often precedes a scream.

? SMH (Semiconductor ETF) Breakout

While recession was the talk of 2023, semiconductors staged a stealth bull.

- SMH consolidated for over 12 months, moving sideways in a tightening triangle.

- Higher lows formed while the upper resistance line remained firm—classic ascending triangle.

- RSI stayed in the 40–60 zone, a sign of accumulation, not speculation.

- When the breakout came, it came on a 40% increase in volume, and it didn’t look back.

Smart money was already in. The headlines followed.

? Sentiment Is the Trigger. Charts Are the Map.

Even without visuals, here’s how you read the pulse:

- When volume spikes and price flattens, someone’s absorbing.

- When RSI diverges, momentum is lying.

- When price hovers near moving averages in silence, tension builds.

- When retail sentiment hits extremes, institutions often reverse it.

Peaks in greed → Tops.

Panic + flat momentum → Bottoms forming.

? So Are Big Drops Over?

No. Big drops never “end.” They go dormant—like volcanoes.

Notice the rhythm? Each panic was followed by steep climbs—but only for those who entered when everyone else froze.

Big drops are setups for the bold. Not the hopeful. Not the reckless. The ones watching psychology unfold—and charting where emotion and price collide.

So no, it ain’t over. The fat lady’s just backstage, sipping tea. You’ll know when she walks on stage.

Mass Sentiment + Technicals: The Market’s Neural Scan

Forget the earnings. Forget the economic narratives. The market isn’t about facts—it’s about perception of facts, and more precisely, about emotional reaction to perception. Mass sentiment is the nervous system. You’re not tracking reality—you’re tracking how humans malfunction in real time.

This is where most get wrecked. They think the market reflects logic. It doesn’t. It reflects a feedback loop of fear-framed logic, a recursive hall of mirrors where the crowd reacts to what it thinks the crowd thinks. That’s why sentiment indicators are more valuable than GDP prints.

You read:

- Fund flows to catch groupthink in motion.

- VIX spikes and collapses for emotional whiplash.

- Social platforms as digital confessionals where the id leaks out: rage, greed, delusion, hope—all timestamped and algorithmically amplified.

Once you’ve mapped that emotional pressure system, you layer in technicals. But not in the usual indicator-juggling way.

You’re watching volume like it’s breath rate—shallow or spiking.

You use MACD not to follow trend, but to flag when the music’s still playing but the dancers have left.

Fibs mark the haunted zones where past trauma lingers.

And moving averages aren’t lines—they’re tripwires, thresholds where institutional algorithms go from “wait” to “attack.”

This isn’t trading lines. This is emotional surveillance.

Big Drops Don’t Die. They Go Fermenting.

Sharp corrections don’t end. They sink beneath the surface and rot. Later, they explode as something else entirely.

Retail thinks a drop is over when the candle turns green. That’s cute.

The real story happens in the unwind—the slow bleed of liquidity, the creeping withdrawal of confidence, the systemic numbness. It’s not the crash that wrecks people—it’s the post-crash paralysis that eats their capital and conviction in equal measure.

So no, the monster’s not dead. It’s just wearing new clothes: low-volume rallies, hyper-narrow leadership, beta-chasing, fakeouts stacked on fakeouts. You won’t get a “safe signal.” The setups appear when volatility peaks and everyone’s emotional bandwidth is maxed out.

This is where the smart money eats.

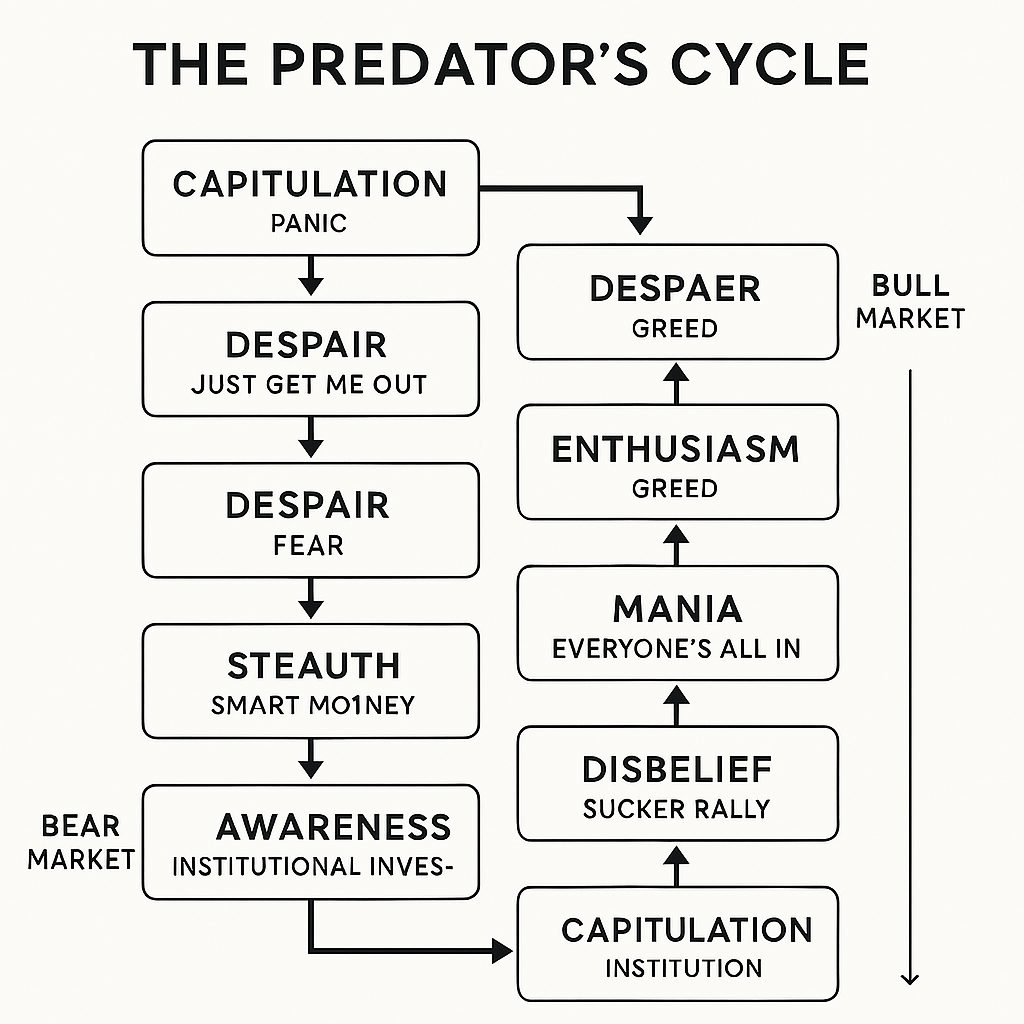

Not because they guess right. But because they move like predators:

- Wait for asymmetry.

- Strike when sentiment detaches from logic.

- Exploit exhaustion, not excitement.

- Trust the chart—but read the crowd beneath it.

The real players aren’t chasing reversals. They’re hunting collective delusion.

The Myth of Stabilization: When Flatlines Lie

Flat periods aren’t safety—they’re suppressed volatility. Think of them as market coma states—neither bullish nor bearish, but psychologically ambiguous, which makes them more dangerous than clean drops.

In these stretches, people get overconfident because nothing’s “happening.” But something always is. Flat action breeds risk through complacency. Indicators soften, narratives reconstitute, and time decay eats away at clarity.

Meanwhile, positioning gets extreme—bulls crowd in because “the worst is over,” and bears overstay because “this is just a pause.” Both sides are wrong because the structure hasn’t resolved. What looks like calm is actually pressure with nowhere to go.

- You watch for coiling patterns.

- You watch breadth divergence—where the index flatlines but internals break down.

- You check options skew—where traders quietly hedge while pretending to be long.

By the time the move starts, the crowd’s misaligned. One side gets wrecked instantly. The other thinks they won until the reversal snaps back.

That’s the magic of flatlines. They lull both predator and prey—and only reward those who know the trap is the setup.

Final Note:

If you’re not reading psychology beneath the data, you’re flying blind. If you’re not watching price behavior with one eye on crowd behavior, you’re not trading—you’re gambling. The market isn’t a puzzle. It’s a behavioral simulation. Every candle is a signal. Every pause is a feint. Every sentiment spike is a countdown.

And no—the fat lady hasn’t sung.

She’s just back in makeup, rehearsing Act II.

The Art of Seeing Differently