Fed Decision Limiting Market Downside Action

The Fed is supporting this market with hot money:

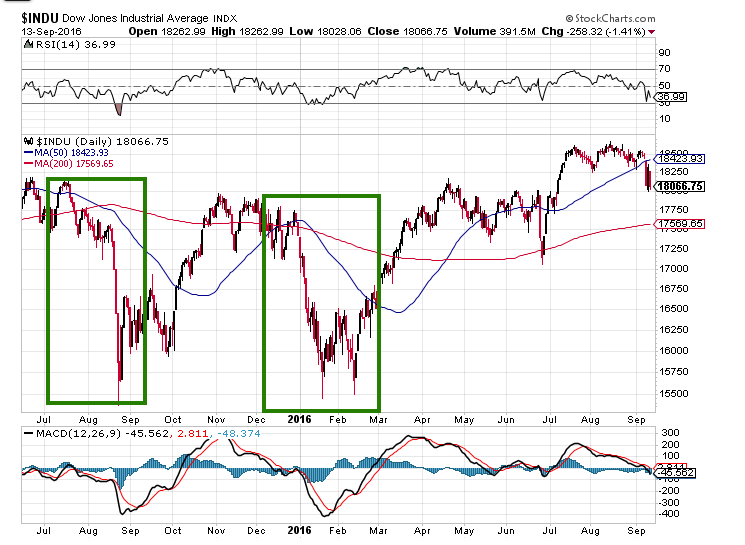

There has been an interesting theme this year; the Fed has gone out of its way to minimise market pullbacks. Additionally, the pattern for the past 24 months has been to allow only one sharp pullback per annum. Take a look at the chart below

2015; the initial wave took place from Aug-Sept; A lower high was put in October, but the pull back from Middle of Sept to Oct was minor.

2016: the main selling wave took place from roughly in Jan 2016. We had a second buying opportunity in Feb, but the overall pullback from early Feb to Middle of Feb was minor in nature. The reaction to Brexit in comparison seems almost a joke; someone intervened to limit the downside action in July of this year. Perhaps the Fed’s are nervous to allow a stronger correction because they assume that the Psyche of the masses would be too weak to deal with one. This could be true as this is the longest period we can remember where the masses have sat on the sidelines.

Even though this bull market is mature it’s not ready to drop dead

This bull market by any standards should be deemed mature and ready to experience a back breaking correction, but no market has ever collapsed without mass participation. Hey, they have to dump the crap on someone, and the big guys do not want to try to trick each other. Killer whales would rather go after smaller prey than fight amongst themselves.

There is also a marked difference between contrarian investing and investing based on the principles of mass psychology. Contrarian shift position once the masses are on board, but we don’t follow that route, we wait for the masses to start frothing before we abandon ship. Mass psychology states that the masses have to be in a state of Euphoria and only after that stage is reached should you abandon the ship. Market Update August 31, 2016

Keep this difference in mind, for contrarians, have been predicting the demise of this market for a very long time, and they are still waiting for their day in the sun. Bubbles only pop, when the masses embrace the market and turn Euphoric. Mass Psychology states that these two ingredients are necessary; they need to embrace the market, and they need to be euphoric.

Volatility readings continue to rise

V readings only edged up 10 points, but they are already so high so 10 points up or down will make no difference; expect volatility to increase and the last three trading days are clear proof of this.

If by some miracle the markets should let out a huge dose of steam, don’t even think of panicking, instead sit down and do something different. Jump up in joy, celebrate, go to a movie, or break open a bottle of wine, do anything but panic. Next get ready to buy. That is what your game plan should be. Drill these words into your mind; the stronger the deviation from the norm, the greater the buying opportunity. Market Update August 31, 2016

Moreover, nothing has changed this week; we still stick to this outlook. The only thing that changed is that the trend strengthened in the face of the recent selloff.

Fed Decision Will Push Markets To New Highs

Negative rates are yet to hit the U.S. some say this won’t happen. Well, let’s see if the U.S will buck the trend forever. It seems highly unlikely as the whole world is gravitating towards negative rates. When negative rates hit the US, you can expect the markets to soar. Market Update August 31, 2016

The U.S will be the last to embrace negative interest rates as they need to foster a sense that our economy is healthy and vibrant. After all, we are still the largest economy on this planet; if the largest economy is sick, then it makes the illusion harder to sell. Corporations will go on debt binge when rates turn negative; their current foray into the debt markets will look like child’s play in the years to come. This bubble could rival that of the tulip mania; at this point, we are not even at the beginning stages of a bubble. The masses will embrace this market and the longer they resist, the higher this market will surge; think of their resistance along the same lines you examine a channel formation. The more extended the channel formation, the stronger the move. In this case, this is a channel formation based on fear; hence the move will be up, and the move will be damn powerful.

The coming bubble could eventually rival the Tulip bubble

This bubble could rival that of the tulip mania; at this point, we are not even at the beginning stages of a bubble. The masses will embrace this market and the longer they resist, the higher this market will surge; think of their resistance along the same lines you examine a channel formation. The more extended the channel formation, the stronger the move. In this case, this is a channel formation based on fear; hence the move will be up, and the move will be damn powerful.

The masses will embrace this market and the longer they resist, the higher this market will surge; think of their resistance along the same lines you examine a channel formation. The more extended the channel formation, the stronger the move. In this case, this is a channel formation based on fear; hence the move will be up, and the move will be damn powerful.

Experiments have shown that fear shuts down one’s ability to view things rationally. Don’t embrace any perspective; understand that it is a perspective and that there always at least three sides to a story; the I like it side, the I hate it side and the I do not care side. Market Update August 31, 2016

There is no need to panic; the markets are letting out a well-deserved dose of steam. We would not be issuing so many plays if we thought this market was going to crash and burn.

Something to keep in Mind

While we examine the markets from several angles, and we keep our eyes open for new developments, the primary driver behind any decision we take is the trend. If the trend is negative, then all the other forces could paint the most bullish of pictures, and we would not pay any attention to them.

The only factor that we would consider on par with the trend are psychological developments and to this day (back testing included) we have never run into a situation where the psychological factors paint an entirely different picture. We are mentioning this because if you find a concept or pattern hard to understand, don’t let it bog you down. The focus should be on the trend, and market sentiment and those two factors are very easy to comprehend.

Other Articles of Interest

Dow theory no longer relevant-Better Alternative exists

BIIB stock Price: Is it time to buy

Stock Market Forecast for Next 3 months

Next Stock Market Crash Prediction