The Power of the Unconscious Mind in Investing

Feb 27, 2023

Introduction:

In today’s world, emotions and unconscious biases play a significant role in decision-making, including investing. Research has shown that unconscious biases can influence everything from hiring decisions to consumer behaviour, and investing is no exception. As investors, we must understand how these biases can affect our choices and work to overcome them to make informed investment decisions.

This article will explore the impact of unconscious biases and emotions on investment decisions and provide strategies for overcoming them. We will discuss the “herd mentality” and how it can lead to market bubbles and crashes, as well as the role of emotions such as fear and greed in investment decisions. We will also provide practical tips for developing a well-defined investment plan based on sound research and analysis.

By the end of this article, you will better understand how the power of the unconscious mind can impact investment decisions and how to overcome these influences to make informed decisions that align with your financial objectives.

Making: Insights from Research

Research supports the idea that our unconscious mind plays a significant role in decision-making. For example, studies have found that unconscious biases influence everything from hiring decisions to consumer behaviour.

In the context of investing, this means that many investors may be influenced by unconscious biases and habits, leading them to make decisions that are not necessarily in their best interests. For example, some investors may follow the crowd and buy into stocks or investments that have recently performed well without considering whether they are still suitable investments. This behaviour can contribute to market bubbles and crashes as more and more investors pile into overpriced assets.

Research has also found that emotions can significantly affect investing decisions. For example, fear and greed can lead investors to make hasty decisions that are not based on sound logic or analysis. By understanding how our unconscious mind can influence our decisions, we can work to overcome these biases and make more informed investment decisions.

Overcoming Biases and Making Informed Decisions

In today’s world, emotions and unconscious biases play a significant role in decision-making, including investing. It is crucial to understand how these biases can influence our choices so that we can make informed decisions that are in line with our financial goals.

One of the key ways that our unconscious biases can impact investing decisions is through the so-called “herd mentality.” Investors are often influenced by the actions and opinions of others, leading them to follow the crowd and invest in assets that are popular or have recently performed well. This behaviour can result in market bubbles and crashes as more and more investors pour money into overpriced assets.

Additionally, emotions such as fear and greed can also have a profound impact on investment decisions. For instance, fear of missing out on a potential opportunity can lead investors to make hasty decisions, such as investing in a stock that appears to be rising. Conversely, greed can lead investors to hold on to an asset that is no longer a good investment to earn a bigger profit.

To mitigate the impact of unconscious biases and emotions on investment decisions, it is essential to have a well-defined investment plan in place. This plan should be based on sound research and analysis and consider both short-term market fluctuations and long-term investment goals. By approaching investing with a clear head and a rational mindset, investors can minimize the impact of unconscious biases and emotions and make decisions that align with their financial objectives.

While emotions and unconscious biases can play a significant role in investment decision-making, it is possible to overcome these influences through careful planning and analysis. By taking a measured and thoughtful approach to investing, individuals can increase their chances of success and achieve their financial goals.

Conclusion

In conclusion, the unconscious mind profoundly impacts investment decisions, as emotions and unconscious biases play a significant role in shaping our choices. Research has demonstrated that these biases influence various aspects of decision-making, including investing. Understanding how these unconscious biases and emotions can affect investment decisions is crucial for making informed choices that align with our financial objectives.

One of the ways unconscious biases influence investment decisions is through the “herd mentality.” Many investors tend to follow the actions and opinions of others, leading them to invest in assets that are popular or have recently performed well. This behaviour can contribute to market bubbles and crashes as more and more investors pour money into overpriced assets without considering their long-term viability.

Emotions, such as fear and greed, also significantly impact investment decisions. Fear of missing out on opportunities can lead to hasty decisions, while desire can cause investors to hold onto assets that are no longer favourable for profitable returns. These emotional responses often override logical and analytical thinking, potentially leading to poor investment outcomes.

To overcome the influence of unconscious biases and emotions, it is essential to have a well-defined investment plan based on thorough research and analysis. This plan should consider both short-term market fluctuations and long-term investment goals. By approaching investing with a clear and rational mindset, investors can mitigate the impact of unconscious biases and emotions, making decisions that are more objective and aligned with their financial objectives.

Ultimately, while the unconscious mind can significantly impact investment decisions, it is possible to overcome these influences through careful planning, analysis, and self-awareness. By being mindful of our unconscious biases and emotions and employing rational decision-making strategies, individuals can increase their chances of making informed investment decisions that lead to financial success.

FAQ: On The Unconscious mind

Q: What is unconscious bias, and how does it affect investment decisions?

A: Unconscious bias refers to biases that we hold but are not aware of. In the context of investing, unconscious biases can lead investors to make decisions that are not necessarily in their best interests. For example, investors may be influenced by herd mentality, which can cause them to follow the crowd and invest in assets that are popular or have recently performed well. Additionally, emotions such as fear and greed can also affect investment decisions.

Q: How can investors overcome unconscious biases in their decision-making?

A: One way to overcome unconscious biases in investing is to have a well-defined investment plan. This plan should be based on sound research and analysis and consider short-term market fluctuations and long-term investment goals. By approaching investing with a clear head and a rational mindset, investors can minimize the impact of unconscious biases and emotions and make decisions that align with their financial objectives.

Q: What resources can help investors learn more about unconscious bias?

A: Several resources are available for individuals who want to learn more about unconscious bias and how to navigate it. The books “The End of Bias” by Jessica Nordell and “Sway” by Pragya Agarwal explore unconscious biases and hidden prejudices in our daily lives and workplaces and provide strategies for identifying and navigating them. Additionally, the Society for Human Resource Management (SHRM) has published a guide on unconscious bias in the workplace. Blogs such as Brain Pickings and Barking Up The Wrong Tree also offer insights into the role of the unconscious mind in decision-making.

Q: How can investors overcome unconscious biases and make informed decisions?

A: One of the most effective ways to overcome unconscious biases is to have a well-defined investment plan. This plan should be based on sound research and analysis, considering short-term market fluctuations and long-term investment goals.

Investors should also focus on maintaining a rational mindset when making investment decisions. They should avoid getting caught up in the moment’s emotions, such as fear of missing out on a potential opportunity or greed for a more significant profit.

Moreover, investors can seek out diverse opinions and perspectives on investment opportunities. By doing so, they can better understand the potential risks and rewards associated with a particular investment.

It is also essential to recognise the impact of unconscious biases and emotions on investment decisions. By acknowledging these influences, investors can take steps to counteract their effects and make more informed decisions that align with their financial goals.

Q: Are any resources available to help investors better understand unconscious biases and their impact on investment decisions?

A: Many resources are available to help investors understand unconscious biases and their impact on investment decisions. Several books explore unconscious biases and hidden prejudices in our daily lives and workplaces and how to identify and navigate them.

Some of the recommended books on this topic include “The End of Bias” by Jessica Nordell, “Sway” by Pragya Agarwal, and “The Unconscious Mind: How It Controls Your Behaviour” by Maria Popova.

Additionally, The Society for Human Resource Management (SHRM) provides resources on unconscious bias in the workplace. Investors can also explore blogs like Brain Pickings and Barking Up The Wrong Tree, which offer insights into the science behind unconscious biases and how they affect our behaviour.

Other Articles of Interest

Becoming a Better Investor: Key Strategic Moves

Investing in a Bear Market: Ignore the Naysayers

Buy the Dip: Dive into Wealth with this Thrilling Strategy

Resource Wars: Navigating a Shifting Global Landscape

The Prudent Investor: Prioritizing Trends Over Speculation

Optimal Strategies for The Best Stocks To Invest Long Term

Seizing Dominance: The Relentless Rise of Mental Warfare

What is Inflation? Unveiling Effects and Strategies for Mastery

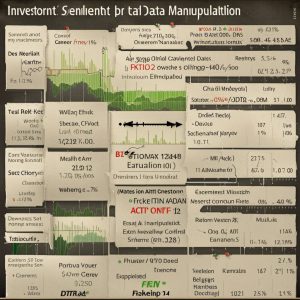

The Cycle of Manipulation in Investments

Investor Sentiment Data Manipulation: Unveiling Intriguing Insights

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Stock Books For Beginners: Investing Beyond the Pages

Psychological Manipulation Techniques: Directed Perception