Updated Aug 2020

Dow Jones Industrial Index 30K, Yes, But…

We first published this article in July of 2017, and at that point, everyone thought we had lost our mind. We have constantly updated our views over the years and continuously update this article. Needless to say, we were proven right and the naysayers had to crawl into some tight crevice waiting for their next day in the sun.

One group of experts state that the markets are ready to crash (stock Market crash 2018), and another set of experts state the stock market bull 2018 is still very strong. Which group are you supposed to believe? For starters, the naysayers have the odds stacked against them as every so-called stock market crash according to US (Tactical Investor) has proven to be buying opportunity. We view stock market crashes as once in a lifetime buying opportunities and frankly so should every self-respecting long-term investor.

The smart money always swoops in and buys top-quality stocks when there is blood on the streets, and the dumb money sells right at the bottom. Watch this video for it reveals why stock market crashes are buying opportunities. As for Dow Jones Industrial Index 30K, we believe it is a distinct possibility but as stated the market would need to let out a healthy dose of steam first.

Best Strategy; do the opposite of what experts prescribe

Therefore, our advice is that you should never listen to jackasses like Marc Faber who continuously state that the market is going to crash, but instead it ends up going higher. Had you listened to this moron you would have been bankrupted several times over. What is even more disturbing is that stupid stations like CNN continue to host this chap even though is track record is so abysmal, clearly proving that you don’t have to know anything to be labelled a Financial Analyst.

Marc Faber also claims to be a Dr, via a PhD, we assume that PhD is an acronym for permanent head damage as he has not said anything of value regarding this market for decades. Here is a video that shows just how wrong this chap has been. Dow 30K is more likely than a market crash at this point in time.

More Experts & More Nonsense

Another chap though not as bad as Marc Faber is Peter Schiff, he claimed Gold would soar to $5000 and instead it tanked. We, however, predicted that Gold would top in 2011 and it did. We then moved out of Gold into the dollar, and other assets that we believed would fare better. Gold bulls such as Schiff continued to cling to the notion that Gold would soar higher and higher.

Peter has also stated this market is overvalued and should crash, but as we stated he is not on the same level as Marc Faber, who lives in fear and the only way to profit from this Penguins advice is to do exactly the opposite of what he prescribers (generally speaking).

Schillers Take on Dow Jones Industrial Index 30K

Now Schiller, on the other hand, does have a decent track record and in general what he has to say fits along the lines of what we have been stating all along. Here is an excerpt of what he stated recently;

It’s not very often that a Nobel Prize-winning economist who is known for his bearish calls turns extremely bullish. Last week, Professor Robert Shiller of Yale, who called the housing collapse ten years ago, proclaimed that stocks could rise another 50 per cent in the next few years based on his latest research. Meaning Dow 30,000! That got the attention of many folks, especially the Wall Street analysts, many of whom don’t understand this market. Shiller accurately saw the housing bubble and predicted that it would end very badly, as it did. He also co-developed the S&P/Case-Shiller index, which is a benchmark for measuring housing prices around major US cities. What many may not know is that … Full Story

Is Dow Jones Industrial Index 30K A reality or hype

The Dow could trade to 30K, but our goal has never been to focus on absolute targets but the trend. If the trend is up, then every pullback has to be viewed as a buying opportunity and vice versa. Having said that we think the SPX could trade to 3000 plus but only after the market lets out some steam. Every strong bull market has experienced one back-breaking correction, before topping out. The back-breaking stock market correction provides an entry point for a spectacular rally that leads to the feeding frenzy stage. The feeding frenzy stage marks the point at which the masses have finally decided it’s time to join the party.

When the masses jump in a long-term top is usually close at hand. After that, the market can experience a correction ranging from 30%-50% which for most will represent a crash as they purchased at or close to the top. It is too early to talk about this big correction. The trend is up and the markets are strong; Dow 30K is not something that is impossible anymore, but as we stated the markets are extremely overbought and they need to let out a large dose of steam.

New Comments July 31, 2018

Views From Other Analysts on Dow 30K

“The formula for growth is before us and we have turned the corner from an earnings standpoint in the third quarter,” the chief investment officer of Heartland Financial said in an interview with “Power Lunch.” “We are being given a tailwind that, I think, is going to very much help corporate America.”

“You want to bet on the American consumer,” McMillan said. “We’re seeing wage growth continue to rise. We’re seeing job growth doing very well.” Full Story

Massive Corporate Tax Cut Is Very Bullish For Stocks

Most analysts seem to agree that the bull run will continue through 2018 with aid from President Donald Trump’s tax reforms. The controversial rewrite of the US tax code will see corporate tax slashed from 35 per cent down to 21 per cent.

Nigel Green, founder and chief executive of deVere Group said the cuts have a good chance of boosting the American economy and stock market, which in turn could have a positive knock-off effect on global markets.

Mr Silverblatt meanwhile thinks there is enough actually profit behind the rally to avoid the disastrous effects of the 2000s DotCom bubble that was built on a period of extreme and unfounded growth of internet websites.

He said: “Unlike the bull market that ended in 2000, this one has earnings behind it.

“The fundamentals are good. The economy is strong.” Full Story

Trump’s View on Dow 30K

“We broke a very, very big barrier: 25,000,” he said at the White House after the index passed that mark Thursday morning. “So I guess our new number is 30,000.”

Chris Zaccarelli on Dow 30K

“We are going to have a lot more turbulence between now and that next large round number,” he said.

Final Comments on Dow Jones Industrial Index 30K

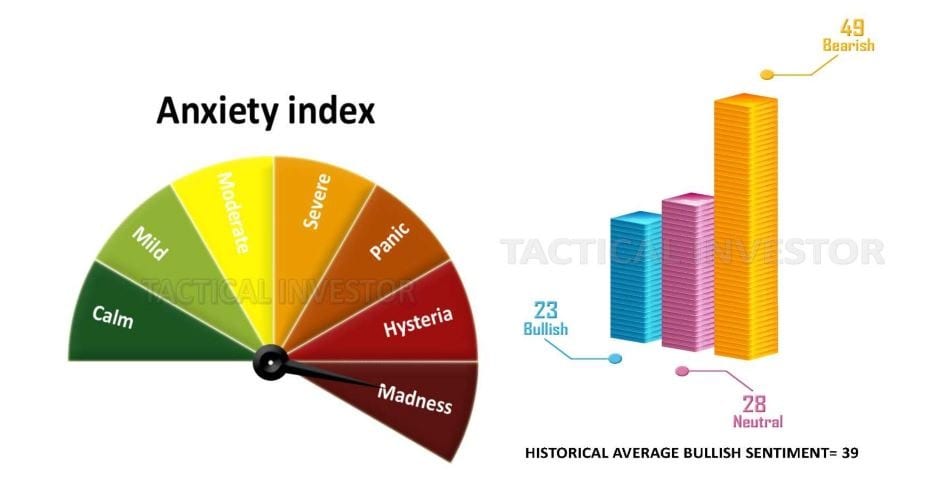

Many analysts seem to agree that Dow 30K is a possibility and for that reason, the upward journey is going to be volatile. As we stated from the onset this market was trading in the very overbought ranges and even though it has let out some steam, ideally our indicators would at least move into the oversold ranges. Currently, they are trading in the neutral ranges, which is a big improvement as they were trading in the insanely overbought ranges in Jan of 2018. The Nasdaq is in a very strong uptrend and that informs us that this Bull is far from over; as it stands the odds are higher that the Nasdaq trades to 10K than they are of the Dow plunging to 5K.

Uncertainty is trending upwards

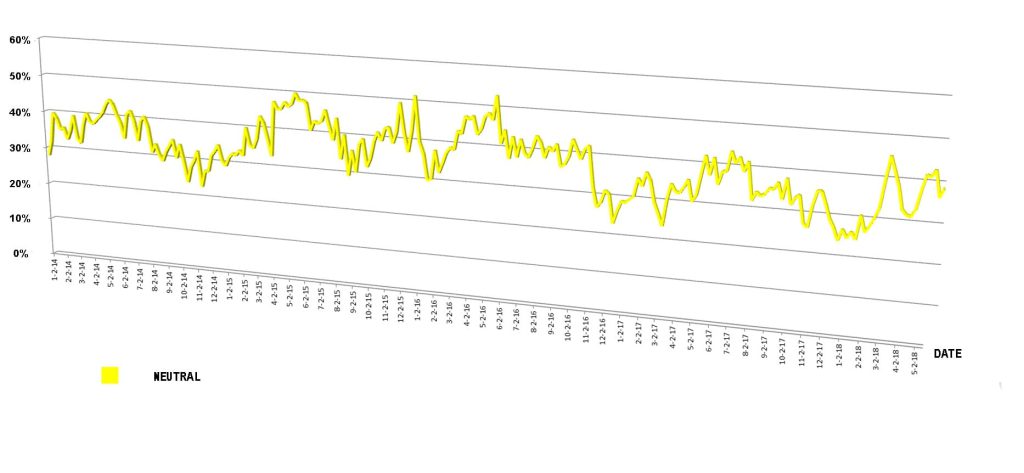

The number of individuals in the neutral camp continues to trend higher and that indicates that uncertainty is rising. The Tactical Investor Views market uncertainty through a bullish lens. Therefore despite increased Market volatility, there is a strong chance that after this consolidation is over, the Dow is like to trade to and possibly past 30K

Dow 30000 Update Aug 2020

The Dow traded roughly to 27,600, coming quite close to the 28,000 targets we suggested, and it did this without closing above 26,100 on a monthly basis. Hence the odds of a decent to sharp pullback rise.

Having said that we need to stop here and discuss a crucial point. Henceforth, the focus should not be on absolute targets as that won’t work. The Fed is directing the markets so while they are likely to let some natural forces control the upward trajectory; they are going to control the downward path. If a market lets out more steam then it should have, it has nothing to do with deteriorating fundamentals or the technical picture. The markets are being pushed lower because the Fed has determined that it is the best course of action.

Therefore, what traders need to understand and come to terms with is that all pullbacks ranging from mild to wild should be embraced. The Fed is playing a dangerous game; dangerous for the crowd, but completely safe for the Fed and its friends and for those that understand the concept of trend investing. Just look how many big players got it completely wrong. To mind comes Buffett. The oracle of Omaha, right now looks like the jackass from Timbuktu, he sold airline stocks right at the bottom, and that’s not his only mistake.

Over the past few years, Buffett has made a massive number of errors. But he is not the only guy. There are a vast number of top hedge fund managers and money managers that would be better of employing a troop of monkeys to do their stock picking. These guys are only as good as you give them credit for, without the credit the masses willing assign to these experts; every expert is nothing but conman waiting to be discovered. Extracted from the June 12, Market Update

Other Stories of Interest

BIIB stock Price: Is it time to buy

Stock Market Forecast for Next 3 months

Next Stock Market Crash Prediction

Dow theory no longer relevant-Better Alternative exists

How to build wealth in 6 steps (March 28)