Define Fiat Money In Economics: Unlocking the Currency Conundrum

Updated June 10, 2023

The Truth About Fiat Money: Empty Promises and Potential Risks for Emerging Markets

When someone asks for a definition of fiat money, it can be explained simply as a currency with no backing other than false assurances or promises from a country to honour its debts. The risk for emerging markets, which heavily depend on short-term foreign capital, is that they might inadvertently drive it away and trigger a resurgence of inflation by excessively injecting newly created money into the system.

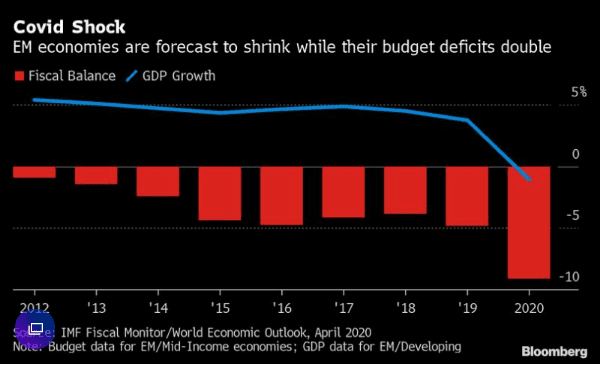

Emerging Economies Grapple with Mounting Outflows and Debt Pressures

In the current year, developing economies have faced significant capital outflows, exceeding those seen during the 2008 financial crisis. Currencies like Brazil’s real and Mexico’s peso have depreciated by over 20%, posing challenges for governments and businesses with dollar-denominated debt. The concern is that these countries may trigger a financial meltdown as they grapple with existing economic downturns. Rising COVID-19 cases and deepening recessions further complicate matters, potentially leading emerging markets to deviate from strict fiscal measures.

However, monetizing budget deficits could result in currency depreciation and worsen the crisis due to their reliance on external and foreign-currency financing. Experts in the field anticipate the possibility of many emerging markets abandoning fiscal constraints. https://yhoo.it/3bURiwM

The rest of the world cannot duplicate America’s deadly ability to create money out of thin air with almost no consequence. Before you start to say, look at how Gold is acting; if one looks at it closely, it has yet to test its old highs. In the interim, the money supply has almost tripled since it topped in 2011. We are hard-money fans, not gold bugs or hard-money fools. The masses have been conned, so the idea that Gold will soar to the moon is plain rubbish. It will trend higher but won’t outpace AI stocks and other sectors.

The Rise of Automation: Deflation and Job Elimination in the Post-Pandemic Era

A significant factor to consider will be deflation, as companies increasingly substitute humans with machines. The impact of the coronavirus pandemic has accelerated the testing of various new technologies, which, once finalized, will permanently eliminate numerous jobs.

The Dark Side of Monetary Policy: Consequences of the Fed’s Money Printing

The Federal Reserve has employed a clever strategy, flooding the markets with money and causing significant damage to various sectors through decreased demand. Influenced players have skillfully used fear, benefiting those who are shrewd and perceptive. However, it’s essential to recognize that not everyone can be a winner in life and investing.

There is a possibility that the Euro may not only reach parity with the dollar but even fall below it, but that is a topic for another discussion. It’s crucial to understand that this abundance of free money comes at a cost: personal freedom. When the printing press goes unchecked, it can lead to the emergence of oppressive forces akin to the Gestapo. Consequently, the United States and other highly regarded retirement destinations may continue to decline in their rankings. Fiat money and freedom are not compatible partners.

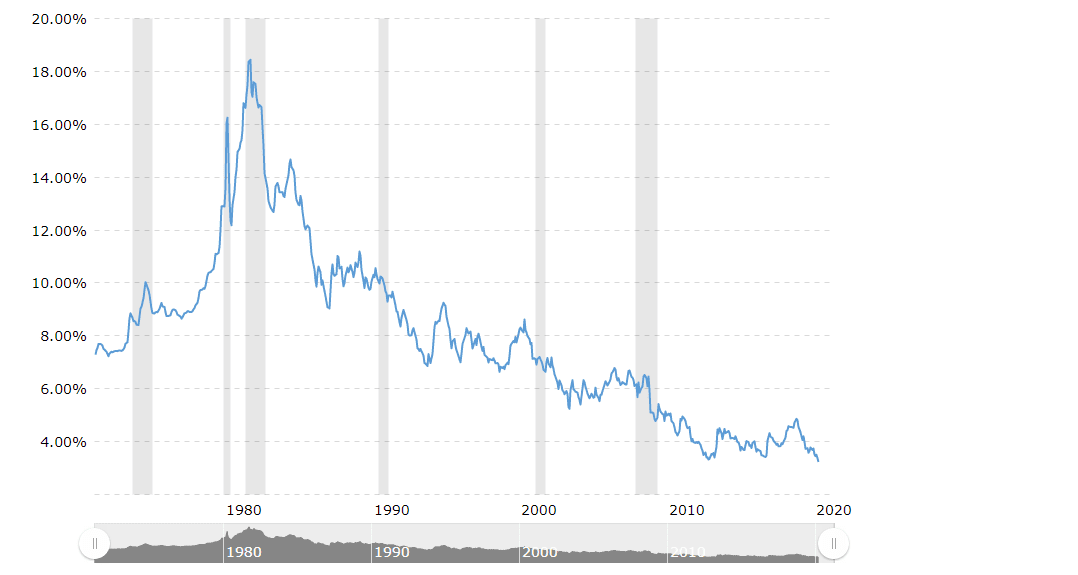

The Upward Trend of Housing Prices and the Role of Ultra-Low-Interest Rates

Paraphrased: This chart provides insight into the long-term upward trend of housing prices, driven by ultra-low interest rates that contribute to the formation of bubbles. Another perspective on defining fiat money is that it is a tool that has played a crucial role in fueling every bubble since the abandonment of the gold standard.

It is the primary reason behind the widening wealth gap, where the rich continue to prosper while the majority experience a decline in financial well-being.

Define Fiat Money In economics conclusion.

In conclusion, the truth about fiat money reveals the inherent risks and empty promises associated with its use, particularly for emerging markets. These economies face the challenge of capital outflows, mounting debt pressures, and the potential for currency devaluation. The Covid-19 pandemic has further exacerbated their economic downturns, leading to a temptation to deviate from fiscal constraints and monetize budgetary deficits. However, this approach can trigger a severe crisis due to their reliance on external financing and foreign currencies.

The ability of certain countries, like the United States, to create money out of thin air without immediate consequences is not easily replicable worldwide. While some argue that gold will soar in value, the reality is that its performance has yet to surpass previous highs, despite the significant increase in the money supply. Furthermore, the rise of automation and job elimination in the post-pandemic era presents challenges, including potential deflationary pressures.

The dark side of monetary policy

As witnessed by the Federal Reserve, money printing has caused significant damage to various sectors by decreasing demand and distorting markets. While some individuals have profited from this strategy, it is essential to recognize that not everyone can be a winner in life and investing. Moreover, the unchecked expansion of the money supply can lead to a loss of personal freedom and the emergence of oppressive forces.

Ultra-low interest rates have contributed to the upward trend of housing prices and the formation of asset bubbles. This trend, coupled with the widening wealth gap, highlights the role of fiat money in exacerbating economic disparities.

In summary, the use of fiat money presents significant challenges and potential risks for emerging markets, impacts personal freedom, and contributes to economic distortions. Understanding these implications is crucial in navigating the complexities of the modern financial system and its dependence on fiat currencies.

Food for thought

According to Mass Psychology, the true purpose of Fiat is to exert control over the masses and prevent them from escaping the 9-5 routine cycle. This is achieved by deliberately devaluing the currency, creating an illusion of stability when things are not okay. Inflation often called a silent killer tax, erodes the value of money over time. One potential solution is to adopt a contrarian perspective and invest in assets that have the potential to outpace currency devaluation. Such assets include the stock market, real estate, and precious metals.

FAQ On Define Fiat Money In Economics

Q: Define Fiat Money In Economics: What does it mean?

A: Fiat money refers to a currency that has no backing other than the promises and assurances made by a country or government. It lacks intrinsic value and relies on trust in the issuing authority.

Q: How does fiat money affect emerging markets?

A: Emerging markets face risks associated with fiat money, mainly when they heavily depend on short-term foreign capital. Excessive injection of newly created money into the system can drive away foreign capital and trigger inflation, adding to the challenges faced by these economies.

Q: What challenges do emerging economies currently face?

A: Developing economies are experiencing significant outflows and currency devaluation. Currencies like Brazil’s real and Mexico’s peso have plummeted, posing challenges for governments and businesses with debt denominated in dollars.

Q: How does the Federal Reserve’s monetary policy impact markets?

A: The Federal Reserve’s strategy of flooding the markets with money can lead to decreased demand and significant damage to various sectors. While some may benefit from fear-driven market movements, not everyone can be a winner in life and investing.

Q: What role does fiat money play in the widening wealth gap?

A: Fiat money has played a significant role in widening the wealth gap. The ability to create money out of thin air and the resulting economic distortions contribute to the prosperity of the rich, while the majority experiences a decline in financial well-being.

Q: How does the rise of automation and job elimination affect the economy?

A: The post-pandemic era has accelerated the adoption of automation, permanently eliminating numerous jobs. This shift towards automation can contribute to deflationary pressures and further economic challenges.

Q: What are the consequences of unchecked money printing?

A: Unchecked money printing can lead to losing personal freedom and the emergence of oppressive forces. The expanding money supply can adversely affect the value of currencies and contribute to economic disparities.

Q: How do ultra-low interest rates impact housing prices?

A: Ultra-low interest rates contribute to the upward trend of housing prices and the formation of Asset bubbles. This trend, combined with the broader wealth gap, underscores the role of fiat money in exacerbating economic inequalities.

Q: What is the overall impact of fiat money on markets and economies?

A: Fiat money poses risks for emerging markets, influences economic disparities, and challenges personal freedoms. Understanding these implications is crucial in navigating the complexities of the financial system and its reliance on fiat currencies.

Originally printed on August 11, 2020, and continuously updated, the latest revision of this information was done on June 10, 2023.

Other Articles of Interest

Student Debt Crisis Solutions: Halting the Madness is Essential

Dogs of the Dow 2023: Howl or Howl Not?

Navigate Student Loans: Discover, Settle, Excel

Early Retirement Extreme Book: Dive into the Facts, Skip the Book

What Is Blue Gas? Unveiling the Energy Mystery

From Student Loans to Financial Freedom: A Post-Graduation Roadmap

How do savings bonds work after 20 years?

In Which Situation Would a Savings Bond Be the Best Investment to Earn Interest?

Mob Rule Meaning: Deciphering for Investing Success

Which Type of Account Offers Tax-Deferred Investing for Retirement?

How much money do i need to invest to make $1000 a month?

How to Start Saving for Retirement at 35 and Ensure a Comfortable Future

Are Doppelgangers Real: Enter the Age of AI Identity Replication

The Best Turkish Food in Istanbul: Exploring Culinary Delights

The Unveiling: Proof Oil Is Not a Fossil Fuel—A Deeper Dive

Deflation Economics: The Art of Twisting Data

BTC vs Gold: The Clear Winner Is …

Russell 2000: Great Buy Signal In the making

Strong Buy Stocks: Focus on The Trend & Not the Fear Factor

Dow Jones Industrial Average Index Set To Defy Naysayers

Smart Money Acting Like Dumb Money

Market Crash 2020 Or Is This A Manufactured Crisis?