A problem clearly stated is a problem half-solved.

Dorothea Brande

Crucial Student Debt Crisis Solutions: Ending the Madness

April 20, 2024

Introduction: Understanding the Complexities of the Student Debt Crisis

The student debt crisis in higher education is a pressing issue that cannot be ignored. It is not simply a matter of financial struggles, but a complex interplay of societal influences, entitlement, and a lack of financial literacy among students and their parents. In recent times, we have seen a shift where certain college students are forsaking the idea of part-time work, instead aiming for elite institutions that come with a hefty price tag. This essay aims to unravel the root causes of this crisis, offer practical solutions, and encourage a shift in mindset to empower students to make wiser financial choices.

Crucial Student Debt Crisis Solutions: Hard Work vs. Entitlement

The dynamic between parents and their children plays a pivotal role in this crisis. In the past, students often chose colleges within their financial means and contributed to their education costs through part-time jobs or with the support of their families. However, today’s generation seems to harbour a sense of entitlement, expecting the finest opportunities without the same level of hard work exhibited by previous generations, such as the Baby Boomers. This ethos of strenuous labour seems to have been replaced by a desire for instant gratification and a reluctance to embrace financial responsibility.

“Should no interventions address this predicament, the ensuing generations will persist in pursuing amplified privileges while expending diminished effort. Inevitably, the toll of these indulgences will be borne by others—higher taxes and increased financial burdens for diligent contributors to society.”

The Root Cause: Lack of Financial Awareness and Misguided Choices

The core of the student debt crisis lies in a lack of financial awareness and unwise decision-making. This is evident in the growing trend of students turning to “sugar daddy” websites to fund their college education. Over 350,000 students are registered on these platforms, opting for prestigious colleges and impractical degrees that do not lead to well-paying jobs. This phenomenon reflects a disconnect between educational choices and financial realities.

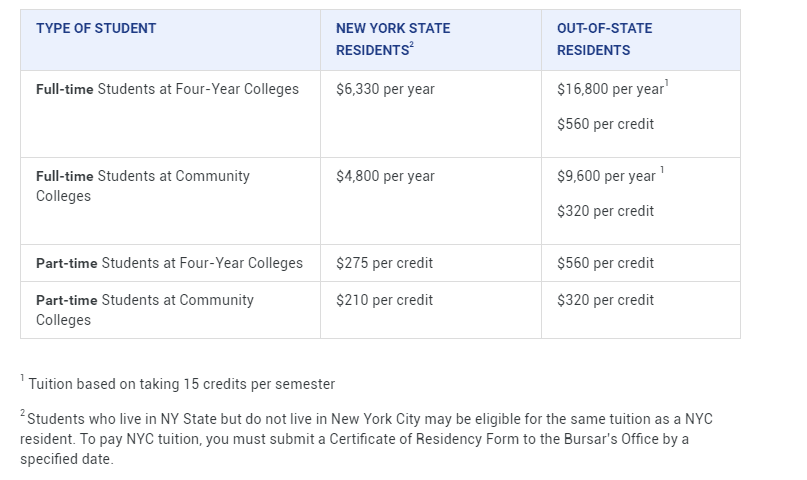

A simple yet effective solution is to encourage students to work part-time and contribute to their education costs. For example, residents of New York can attend CUNY (City University of New York) for approximately $6,330 per year, or SUNY (State University of New York) for $6,500. With a part-time job, students can easily cover these expenses and gain financial independence.

Source www2.cuny.edu/

Encouraging Financial Responsibility and Planning

Initiating financial responsibility early on is key. Students should be guided to understand the importance of earning their room and board, managing their finances, and planning for the future. This includes introducing the concept of investing a portion of their earnings in the stock or real estate market, with parental matching incentives similar to 401k plans. By comprehending the value of hard-earned money and the impact of inflation, students can make more informed decisions and break free from the cycle of debt.

The Role of Mismanagement and Entitlement

The student debt crisis is also a crisis of mismanagement and entitlement. Gullible parents often enable their children’s extravagant choices, leading to a sense of being “chosen ones.” However, the solution is straightforward: live within your means, work hard, and spend less. It is essential to instil a sense of financial responsibility and appreciation for the value of money.

Unraveling the Crisis: Further Dimensions and Remedies

Countless students find themselves entangled in debt due to a lack of awareness and misguided decisions. The allure of prestigious institutions and societal expectations often cloud their judgment, leading to financially unsustainable choices. This problem is exacerbated by a culture that encourages exceeding one’s financial means.

To address this, financial literacy should be integrated into high school curricula. Students need to be equipped with the knowledge to make informed decisions about their education and lifestyle choices. Additionally, they should be directed towards more affordable educational pathways, such as community colleges, online courses, or state universities. Scholarships, grants, and work-study programs can also provide significant financial relief.

Conclusion: A Holistic Approach to Addressing the Student Debt Crisis

In conclusion, the student debt crisis demands a holistic shift in mindset. It requires young people to embrace financial responsibility, make prudent decisions, and resist instant gratification. Parents, educators, and society at large must prioritize financial literacy to guide the next generation towards a more sustainable future.

By exploring alternative educational avenues, promoting financial literacy, and fostering a culture of hard work and financial prudence, we can collectively carve a path towards a brighter future where the weight of unnecessary debt is lifted and enlightened choices define success.

Anytime you think that the problem is out there, that thought in itself may be the problem. If it is out there, then you have no control, and you have to wait until it changes. Anonymous

Food For The Mind

How to Start Saving: Effective Strategies to Achieve Your Savings Goals

And how much did it cost for a Baby Boomer to go to SUNY in 1961? Next to nothing, because public universities were free or fully funded. Cooper Union in NYC went from being a totally free university in 2014, to a costly institution now. That’s just two years ago. It’s called the commodification of education, the inevitable result of capitalism. Why don’t you try doing some actual research and journalism next time, yes?

There’s also criminal for-profit colleges teaming up with government to prey on unwary students with promises of high-tech careers and a glamorous curriculum where the golden carriage turns into a pumpkin after all the papers have been signed.

There *IS* a problem with the student loan bubble an a lot of people are legally profiting from this currently legal government endorsed crime.

Considerations:

1. Consider your first 2 years at a junior college

2. Consider an in-state college (as the author has stated)

3. Consider a quality school but not an A-list school

4. Consider a program paid for by the military

5. Consider doing the work in HS to earn full academic scholarship

Just to name a few.

I lost about 30 IQ points reading that. Wow, that was an was an intensely misinformed rant. Maybe the blogger should plot a graph of how education costs have been inflated over the past 30 years. Or perhaps the shady practices of the for profit diploma mills that feed off the loan subsidies. Really don’t know where to start correcting this mess, other than “GET OFF MY LAWN”