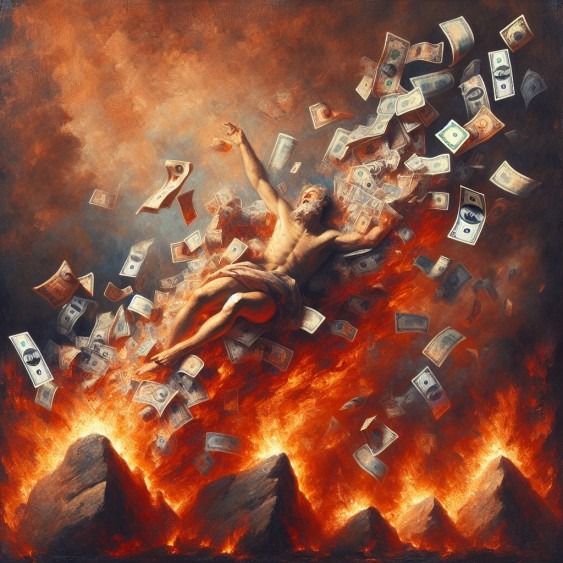

Escalating Currency Wars: The Intensifying Race to the Bottom

Updated Jan 30. 2204

As we navigate through 2024, the global economic landscape teeters on the brink of transformation as the intensifying currency wars signal a race to the bottom. This economic tug-of-war, triggered by nations’ attempts to devalue their currency to boost competitiveness, is escalating at an unprecedented pace. The keyword here is ‘currency wars intensify,’ a phrase that aptly encapsulates the current economic climate.

The central bankers’ strategic manoeuvring in the world markets is worth noting. They’ve adopted a relay approach to quantitative easing: as one nation concludes its easing, another steps up. This financial baton-passing ensures a continuous flow of stimulus, bolstering markets even when the underlying economy shows slight improvement. The tactic was evident when Japan succeeded the USA, launching an even larger and more aggressive package that sent the market to new highs while not significantly boosting the economy. As currency wars intensify, the EU seems poised to be the next in line to pick up the easing baton, likely to announce a sudden intervention when things start to look bleak.

The intensification of currency wars accelerates the race to the bottom, pushing us closer to this destructive cycle’s final, most volatile phase. The Swiss Central Bank’s surprise move indicates growing fatigue among some players in this currency war, a conflict that invariably diminishes the average person’s earnings amidst increasing money supply.

The intensifying currency wars may also see China adopting a strategy akin to Switzerland’s. Despite numerous press stories painting a bleak picture of China’s economic health and prophesying Russia’s demise, these narratives often mask hidden agendas. It’s crucial to remember that the USA’s ascent to the top wasn’t a smooth ride—multiple setbacks, including the Great Depression punctuated it. Therefore, the narrative of China’s boom being over is to be taken with a grain of salt, especially considering the long-term view.

In conclusion, as currency wars intensify, the economic landscape of 2024 will be marked by increasing volatility and strategic maneuvering by central banks. The global economy seems to be in a race to the bottom, with central banks’ quantitative easing measures providing temporary relief to the markets but little to the underlying economies. These intensifying currency wars underscore the need for vigilance and strategic planning in navigating the choppy waters of the global economy.

The Intensifying Currency Wars: Modern-Day Examples and Their Impact

In the complex world of global economics, currency wars are becoming a prominent feature. These wars, characterized by countries battling to lower the value of their money, are intensifying, leading to a race to the bottom. The goal is to increase exports and gain a competitive advantage, but the effects can be far-reaching and often detrimental.

One modern example is the scenario painted by Brazil’s Finance Minister Guido Mantega in 2010. He claimed that an “international currency war” had broken out, with countries worldwide attempting to force down the value of their money to reduce the price of their products sold in foreign markets. While beneficial in the short term for boosting exports, this strategy can lead to unforeseen adverse consequences such as increased protectionism and trade barriers.

Another tactic used in these currency wars is manipulating monetary policy to devalue currency. This can be achieved by reducing interest rates or implementing quantitative easing (QE), where a central bank buys large quantities of bonds or other market assets. While these actions are not as overt as direct currency devaluation, the effects can be the same.

The impact of these currency wars can be significant and far-reaching. For multinational companies, currency wars can raise competition, finance, and valuation issues. For instance, companies like Johnson & Johnson, Merck, P&G, and Colgate-Palmolive have announced significant charges due to currency devaluation decisions in countries like Venezuela.

Moreover, countries can be negatively affected by the “beggar thy neighbour” policies adopted by trading partners that actively devalue their currencies. While beneficial to the country implementing these policies, they can harm the economic interests of their trading partners, leading to a vicious cycle of retaliatory devaluations.

Now let’s walk down memory lane and learn from history, as those who fail to do so are doomed to repeat the mistakes of their forefathers.

We are not stating that it’s time to short the markets or run for the hills, but it is certainly time to keep one’s eyes open. The central bankers have a new theme to keep world markets up. Quantitative easing is called; another will take up the slack as one country eases. When the USA stopped, Japan came to the rescue with an even larger and more aggressive package (about their economy) and so far it has brought almost no economic relief other than a market that is soaring to new highs. The next good chap to pick up the slack will be the EU; expect a sudden announcement from them, when things start to look bleak. The currency race to the bottom is picking up steam; we will soon enter this destructive cycle’s final and most violent/painful phase. Market Update Jan 13, 2015

Surprise moves?

The surprise move by the Swiss Central Bank indicates that some players are getting tired of this currency war. This war only robs the average person; the harder you work, the less you earn because central bankers want to inflate the money supply. Watch China suddenly come out swinging and pull a move similar to the Swiss. The press is full of stories stating that China is in trouble and that Russia is dead; the sheer volume of these stories is genuinely unbecoming and indicates a hidden agenda. Let us remind everyone that even though the USA has maintained the number one power for so long, the rise was not smooth. We had multiple corrections and failures along the way; the most severe of which was the great depression. So the stories they are pumping about the boom in China being over fall under the category of rubbish when taking the long-term view.

The Intensification of Currency Wars: EU Banks and Quantitative Easing

As the global economic landscape continues to evolve, the European Union’s (EU’s) central banks have joined the fray, embracing the policy of Quantitative Easing (QE). This move aligns with the trend set by the United States and Japan, marking a shift towards a ‘print till you die’ mentality. The old masters of the global economy are uniting in this approach, seemingly overlooking the potential for partnerships with emerging powers. However, as history has shown, fighting against the trend is a futile endeavour. The old masters are set to lose their status, making way for new leaders in the global economy.

Denmark, for instance, is striving to maintain control over its currency amidst the intensifying currency wars. The Euro, Yen, and Dollar are engaged in a fierce race to the bottom, with other currencies like the Canadian, Australian, and British Pound following suit. This ‘inflate or die syndrome’ is becoming a common theme in global economics.

However, countries like Denmark and Switzerland may soon realize the futility of their efforts to weaken their currency by buying dollars. The open market/free trade system, which allows goods from one country to flood another, often to the detriment of local producers and manufacturers, is increasingly being questioned. The destruction caused by free trade or the open market principle is well-documented and serves as a stark reminder of the potential pitfalls of such economic policies.

The EU’s decision to embark on QE is a clear indication of the intensifying currency wars. This move, while aimed at maintaining price stability and preserving the purchasing power of the single currency, also raises concerns about moral hazard. Central banks’ purchases of government securities artificially depress the cost of borrowing, potentially encouraging governments to issue additional debt without fear of increased borrowing costs. This could lead to financial instability and further intensify the currency wars.

Currency Wars Escalate: The Hidden Costs of a ‘Free’ Market

In global finance, ‘free’ often comes with a hefty price tag. True freedom is compromised when nations manipulate their currencies to gain an edge in the relentless currency wars. The current free trade system resembles welcoming an invasive and dangerous alien species into an ecosystem, only to assess the damage after irreversible harm is done. Governments should prioritize protecting their citizens, but modern practices often seem to work against this principle.

After years of dormancy, the currency market has awakened with unprecedented volatility in 2024, reminiscent of the turbulent period in 2011. In the aftermath of the Swiss franc upheaval, Denmark finds itself on the frontline, employing a combination of negative interest rates, market interventions, and halting government bond sales to shield its krone from succumbing to the global currency turmoil. Unfortunately, this script has played out before, and history suggests it rarely concludes favourably.

Denmark’s recent surprise rate cut, charging a 0.5 per cent fee for holding the kroner, reflects the nation’s desperate attempts to weaken its currency. In a span of less than two weeks, the central bank’s third easing, coupled with substantial currency sales, has incurred a considerable cost—estimated at up to 100 billion kroner ($15 billion). The lessons from the Swiss National Bank’s abrupt policy shift are a stark reminder that in financial markets, nothing is truly sacred, and the consequences of currency wars can be unpredictable and scary.

Gold rallying in the face of a stronger dollar?

The currency wars are moving from the covert operations to overt operations; this means currency markets are going to go wild and the most destructive phase of the wars is now about to begin. The definition of the word pain will soon take on a new meaning.

The other surprise move was the fact the Gold continued to rally higher in the face of a very strong dollar. This again signals that big changes are coming and that the dollars days are indeed numbered. For now, the outlook favours a strong dollar, but alliances are already being made that will (not might or May) dethrone the dollars top dog status sooner than later. The war with Russia is nothing, but a currency war in disguise. Russia was and still is one of the prime countries challenging the role of the dollar as the world’s reserve currency. Without this unfair status, the USA would be facing the same situation Greece is facing if not worse.

One can clearly see that Gold has started to show signs of strength this year. It appears to have put in a bottom in 2015. There is strong resistance in the 15.80-16.00 ranges. A monthly close above these levels would indicate that the worst is behind Gold. Consequently, a close weekly close below 12.90 would suggest that Gold bullion is still not out of the woods.

The Race to the Bottom gains steam, as a nation after nations, devalues its currency to gain a competitive edge. As the intent is to gain a competitive edge, the race will not stop until a massive currency crisis unfolds; only then will the race come to a grinding halt.

Tantalising Reads

Top 10 Investment Resources for Novice Investors

Why Mechanical and Technical Analysis Systems Fail

The Limitations of Trend Lines

Portfolio Management Suggestions