Covid resistance: The masses are about to push back

Covid resistance is about to take hold as in a COVID pushback. It will gain momentum at a dangerously rapid pace.

It is likely to originate from Europe. However, this is not going to be peaceful pushback. Europeans are generally quite friendly. If their general change in attitude is anything to go by. In that case, there is a 78% probability that the resistance will turn highly violent. Please note this is not what we wish for or are hoping for. We examine trends, and the tendency for violence is increasing dramatically in Europe. Market Update Dec 7, 2021

We were wrong. The COVID-19 resistance started in Canada out of all places. It demonstrates a lot because Canadians are usually referred to as Americans without guns. They are peace-loving individuals and the fact they have joined forces to resist mandated vaccines indicates that the Covid resistance movement will continue to gain traction.

Black Swan Events: Navigating Market Uncertainty

The weekly charts are clearly exerting more pressure on the markets than the monthly charts. The MACDs experienced a bearish crossover, and volatility went through the roof. Don’t be perturbed by this development. A bearish crossover in this zone is usually bullish as it occurs in the oversold ranges. The next bullish crossover will probably lead to an even more decisive upward move (usually 2X to 3X stronger). The Dow also trades in the extremely oversold ranges on the weekly charts. Hence, the likely outcome, barring some black swan event is that the markets rally strongly into the new year.

As the Dow closed below 34.8, the short-term trend is neutral, and the Dow could test the 33,6K to 33,9K ranges before surging higher. Our projected targets for the next 24 to 45 trading days are for the Dow to test the 37,2K to 37,8K ranges with a possible overshoot to the 38,4 to 39K ranges. Market Update Dec 7th, 2021

Volatility: A trader’s best friend

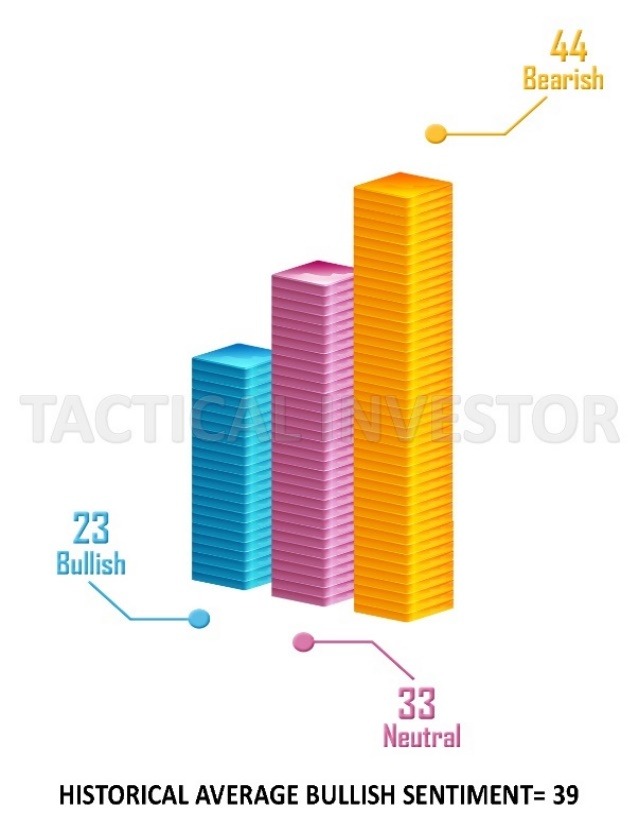

Volatility is rife, and this is clearly evidenced by the rapid swings the anxiety gauge has experienced over the past 2 weeks. The needle has whipsawed once again and is now back in the panic zone, and bullish readings are at multi-month lows. All in all, these developments state the market should be trending higher, and they are.

However, the indices are trending higher while many stocks are taking the chin. A possible repeat of what happened earlier in the year is in play again. A silent correction, where many sectors and top stocks pull back while the indices tread water. However, given the tricky nature of the big players, it is unlikely they will repeat the same manoeuvre so quickly. Hence, there will be some variants if this trick is in play. For example, many top stocks take it to the chin, then they bottom out, and the Dow rapidly sheds 1800 to 3000 points over 6 to 10 days.

From Lockdowns to Pushback: The Growing Movement Against Covid Restrictions

The second variant is that the pullbacks these stocks are experiencing are a primer of what to expect from the overall markets next year when they are ready to let out some steam. So while the Covid Resistance narrative seems to be dominating the air-waves, in the near distant future, it will be the stock market plunge that will dominate. The current pullback is a precursor of what to expect towards the 4th quarter of this year.

Today’s crowd of investors want more and more. It is never enough, and if the company beats expectations and the results are not beyond fantastic, the company will take a hit. Or if the company even hints those future revenues might slow down a bit after a rapid period of growth, the masses overreact. They act as if the company is about to go bankrupt. Hence it goes without saying that these investors will get hammered over the next 12-24 months. For these spoilt amateur brats that demand more and more, the day of reckoning is close at hand.

The Woke Dilemma: Can’t think nor can they invest

The first place they are likely to get hammered in is the cryptocurrency market. Right now, there is a mountain of resistance in the 60 range (we are using GBTC as a proxy for Bitcoin). Bitcoin will experience another brutal correction. These chaps will then hop into high flyers in the stock market. They will also get creamed there for cycle investing is about to make a massive comeback. Cycle investing is a term that we at TI use to reference stock picking. In other words, stock picking will play a central role next year. Market Update Dec 7, 2021

One will have to purchase the right stock at the right time. Those who jump in and follow the crowd are going to be smashed. After the Covid Crash, following the crowd has worked (to some degree), but the strategy is now falling apart.

Challenging the Mass Mindset: Why Blind Conformity Can Lead to Financial Misstep

The crowd does win some of the time (at least on paper). However, it’s nothing but paper profits until one bank these gains. The majority of the investors in Bitcoin and all other hyper-speculative crypto-currencies will lose all their profits. This will create immense volatility for a while. These guys are used to huge gains; they will jump in and out of stocks in their quest for the next big hit. So next year, TI subscribers must get used to fighting in the trenches. While the crowd runs all over the place, we will be in the enviable position of getting into some top plays at rock-bottom prices.

Overall, we expect above-average levels of volatility and at least two corrections. One will be wild (as in intense), the other softer in nature. Both pullbacks/corrections will likely be more substantial than this market has experienced after COVID.

When one knows how the markets fare over the long term, there is only one course of action. Do not panic and view all panic-based events through a bullish lens. We are in the forever QE era, and in this era, the Fed has only one mantra, Print or kill everyone that resists.

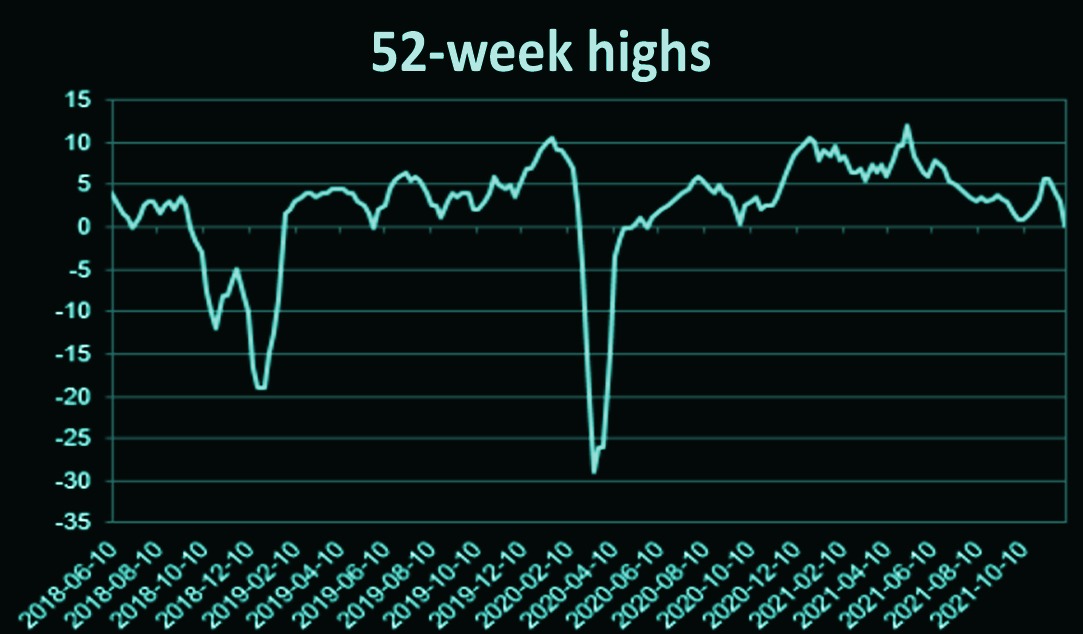

The net number of new 52-week highs is trading at the Zero mark. The markets usually put in a bottom at this juncture, as indicated in the image above. Next year when the markets are expected to let out a lot of steam, we expect this index to be trading in the -15 to -21 ranges before a solid bottom is in place.

Amidst Dark Outlook, A Rally May Be on the Horizon

The outlook is far from rosy currently. However, one must remember how bad things looked when the Markets crashed in 2020. Some of our stocks were down over 50%. At least in the ones where we had only deployed 1/3rd of our funds. However, this provided us with an incredible opportunity to deploy the rest of the funds at a very aggressive pace.

Did things turn around immediately? The answer is no, but we banked massive gains when they did. One can’t bank huge profits every year. Anyone claiming to do this is consuming some strong medicine or lying through their teeth. One should not attempt to lock in huge gains all the time as that is not possible. The idea should be to bank profits consistently. If one is doing this, then one is on the right track. Your portfolio will outperform almost any long-term portfolio in existence in the long run.

Hence the intelligent strategy calls for banking massive gains when the opportunity arises and for banking steady gains after that. One needs to take a long-term look at one’s portfolio and not obsess over it on a short-term basis. If it is trending upwards, you are doing fine, for in between a smooth upward trend, you will experience massive surges. These surges will correspond to events like the COVID crash of 2020, which proved to be a splendid buying opportunity.

There is an excellent chance that the markets might provide Tactical Investors with a similar opportunity next year.

Seeing Through the Fog: Finding Opportunity in Uncertain Times

We have received many emails from subscribers who broke the rules and over-invested in certain stocks or assets. When the going is good, this strategy will appear to work, but it will eviscerate all your hard work and profits when the going gets tough. Never, ever over-invest in any stock unless we issue those instructions. We did this with KEY; instead of deploying 3 lots, we deployed 4. It worked out well, and it worked out well because the risk-to-reward ratio was in our favour. The stock was out of favour, paying a handsome dividend and trading in the insanely oversold ranges on the monthly charts.

PhD equates to Permanent head damage.

From the emails we read so far, most subscribers followed recommendations from friends who had PhDs or were experts in their field. Experts in their field know next to nothing about the stocks in their arena. So, if you are going to rely on a programmer to tell you which is the best Tech stock to get into. You are better off talking to a friendly burro. PHDs predominantly suffer from Permanent head damage. Hence, asking them for financial advice is akin to catching a falling dagger. This futile process is filled with pain and suffering, as for taking advice from friends. If you want to remain friends, don’t do as they do.

Always, and we mean always, remember the following saying

Bulls win some of the time, and bears win some of the time, but pigs always get slaughtered.

In short, the prospects of another super-buying opportunity are above average for 2022. Patience and discipline are needed. Do not overcommit funds to any position. If you are new, then avoid the higher risk plays. In fact, this is something we clearly state in the welcome material. One should only use profits or money they can afford to lose when getting into higher-risk plays.

We are watching what Bitcoin does, for we have a sneaky feeling it will indicate what one should expect from the overall markets Next year.

Random notes on Investing

To achieve success in investing, it is crucial to combine the forces of mass psychology and technical analysis. By comprehending the behaviour of market participants, one can gain valuable insights into the market’s pulse. Identifying trends becomes more manageable once you grasp the significance of crowd behaviour. Additionally, incorporating the principles of market psychology and contrarian investing can enhance your trading skills and benefit from the crowd’s collective wisdom.

Lastly, maintaining a comprehensive trading journal is invaluable for gaining insights into your mindset and devising a robust plan to tackle any challenges.